- XRP Holds Against a Deeper Pullback Backed by Strong Whale Support.

- This resilience suggests that the current correction is part of a “healthy” retracement.

Ripple [XRP] is at a crucial crossroads as 2024 draws to a close. With the altcoin market poised to follow Bitcoin’s momentum and break new psychological barriers in 2025, now may be the time to take action if you’re “long” XRP and want it to overtake its rivals – just like the whales do.

Since the beginning of December, major ““unknown wallets” holding significant amounts of XRP have either emptied their positions or aggressively added more.

This back and forth has already had a noticeable impact on the price of XRP – leaving it in a state of limbo as it braces for its next big move – both up and down.

XRP has strong support

Ten days ago, XRP came close to crossing the critical psychological threshold of $3, fueled by an impressive 19% surge in one day. However, as of now, XRP is trading at $2.30.

This dip is part of a broader trend, as many cryptocurrencies are in the red and investors weigh their options: should they trim their holdings or take advantage of the lower prices to buy more?

Wrinkle is no exception. The one-day price chart shows that bulls are working hard to fend off a deeper pullback, while bears remain steadfast. For HODLers, the continued support of whales provides a much-needed sense of security.

This support creates a strong foundation for XRP to recover when the market turns bullish again.

And when will that happen? It is likely related to the performance of Bitcoin, the coin with a trillion dollar market cap, or the upcoming FOMC meeting, where investors bet on an interest rate cut of 25 basis points.

Either way, this strong foundation could be exactly what XRP needs to set its sights on the $3 milestone in the near term. The fact that large wallets are accumulate XRP adds weight to this trend, but will it be enough to push XRP over the edge?

The recent correction is likely related to external factors

Under the top There are ten altcoins, two of which have been hit hardest by the current market volatility: XRP and Cardano [ADA].

What’s fascinating is the strikingly similar price pattern they share. Both coins benefited from the ‘Trump pump’ and broke psychological barriers with triple-digit monthly gains.

But such rapid growth comes with greater risk, and both coins are now more vulnerable to sharp corrections as the market adjusts.

In fact, XRP and ADA have seen some of the steepest declines in the past 24 hours – each down more than 3%.

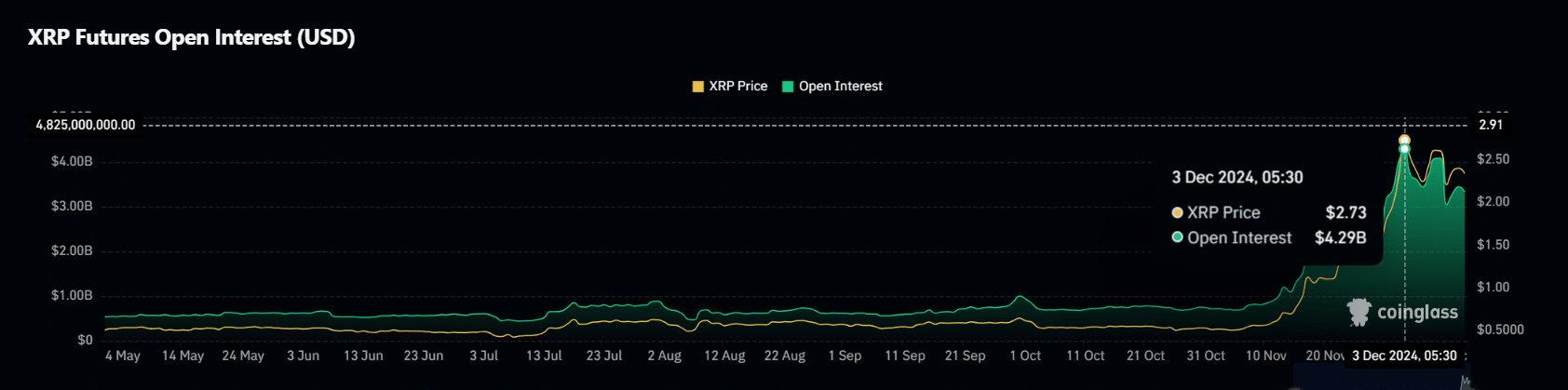

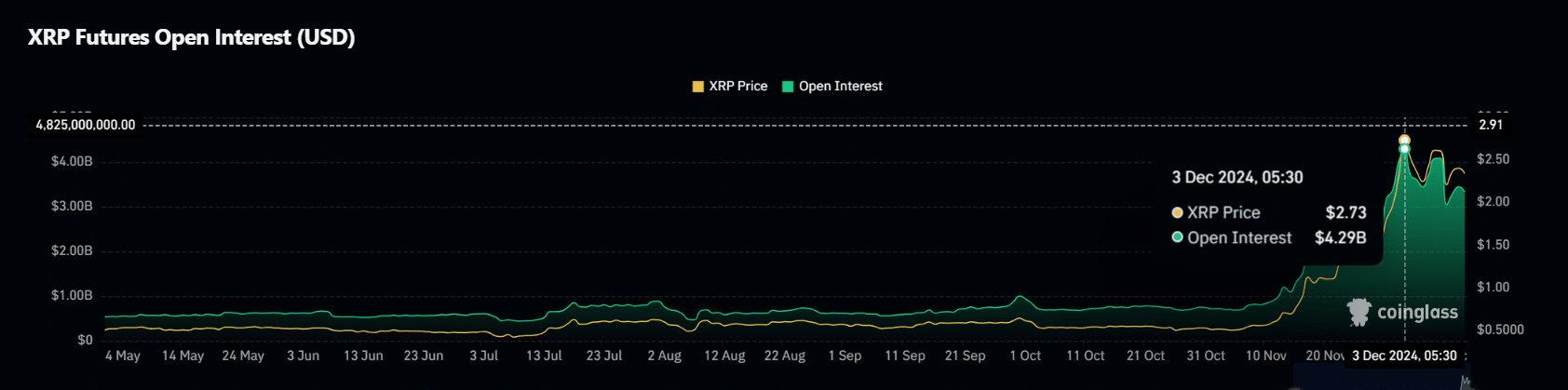

This suggests that the story is far from over and that a strong recovery is still underway – despite some bumps in the derivatives market, especially as Open Interest (OI) shows some volatility.

Source: Coinglass

OI rose to an all-time high of $4.29 billion just ten days ago, matching XRP’s peak of nearly $2.90 for the day.

Many investors went long and bet on a breakout of $3. However, with that breakout failing to materialize, OI has since fallen to $3.33 billion, leading to about $6 million in long-term liquidations – up 1% from the day before.

Read XRP’s 2024-2025 Price Prediction

But here’s where things get interesting: a resurgence in shorting could lead to a big squeeze, especially with whale support and bullish on-chain activity behind XRP.

That said, your patience will likely be tested unless Bitcoin breaks through key resistance levels or a broader macroeconomic trend takes shape.

Until then, consolidation, with strong support, seems the most likely path for XRP.