- XRP fell to $0.40 and was down 12.24% in 24 hours.

- Ripple’s lawsuit with the SEC remains pivotal, with the potential outcomes significantly impacting XRP’s future market performance.

The crypto market has suffered significant declines in recent days, with the global market capitalization falling by more than 7%.

This downturn has had a significant impact on XRP, which saw a sharp drop in value.

At the time of writing, XRP was trading at $0.400692, with a 24-hour trading volume of $2,099,990,889. The token is down 12.24% over the past 24 hours, reflecting the broader market trend.

XRP press time CoinMarketCap the ranking was #7, with a live market cap of $22,327,796,369.

XRP: price predictions

On July 3, when XRP was valued around $0.46, analyst EGRAG CRYPTO said noted that the token was approaching a crucial resistance level, specifically the Fibonacci 1,618 level.

The analyst suggested:

“If history repeats itself halfway through, we will aim for $27.”

However, this optimistic forecast contrasted with the current downward trend observed in the market.

Source: EGRAG CRYPTO/X

A major factor that has influenced the future price of XRP is the ongoing lawsuit between Ripple and the US Securities and Exchange Commission (SEC).

The legal dispute began in December 2020, with allegations that Ripple and some of its executives had made an unregistered security offering by selling XRP tokens.

The outcome of this case will have a substantial impact on the market performance of XRP. A favorable resolution for Ripple could potentially lead to a rally in the price of XRP.

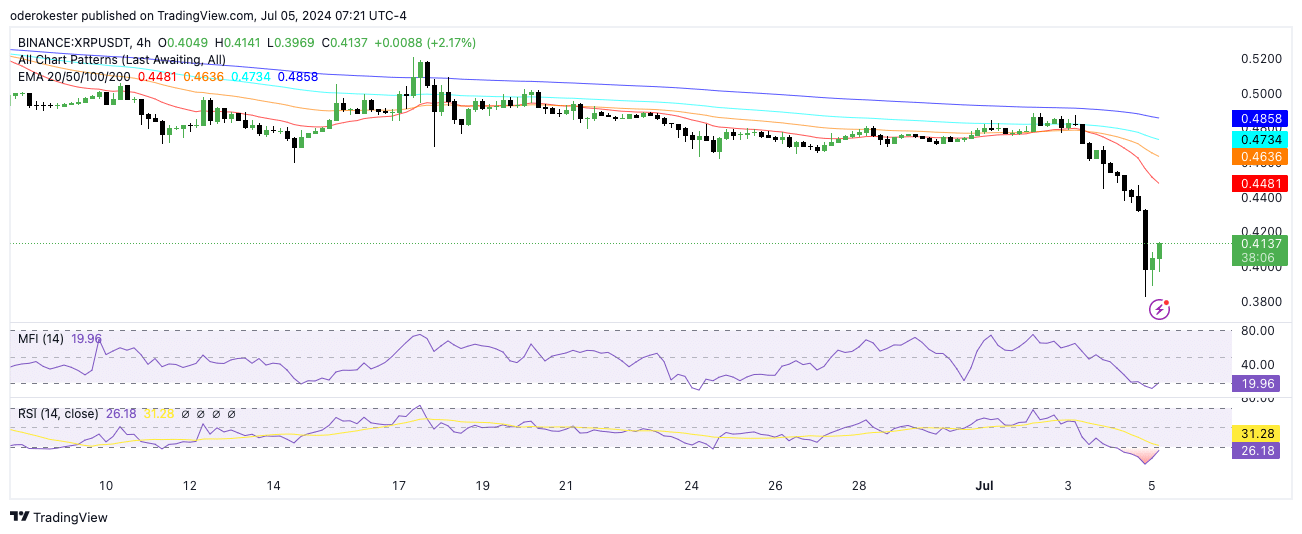

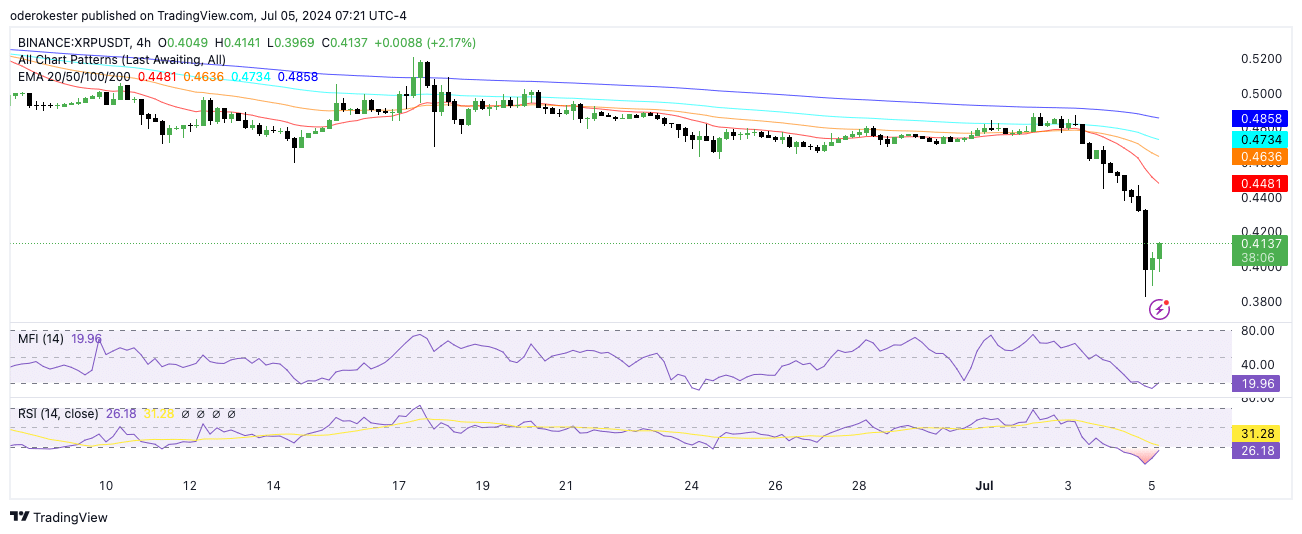

Technical analysis

Indicators such as the Moving Average Convergence Divergence (MACD) showed bearish momentum, while the Money Flow Index (MFI) and Relative Strength Index (RSI) were in oversold territory at 16.83 and 17.98 respectively.

This suggested a potential for a short-term recovery.

Is your portfolio green? Check out the XRP profit calculator

However, the price remained below the major exponential moving averages (20, 50, 100 and 200 EMA), which could continue to exert bearish pressure unless a substantial reversal occurs.

Source: TradingView

According to XRPSCANTransaction volume increased noticeably in late June and early July 2024. However, a slight increase in payment activity was also observed in these months, indicating renewed user engagement.