- Traders are not allowed to buy FOMO in buying XRP after the interruption of the six -week trend line resistance.

- The possibility of a short squeeze meant that traders could look for opportunities to have XRP too short after a small bouncing.

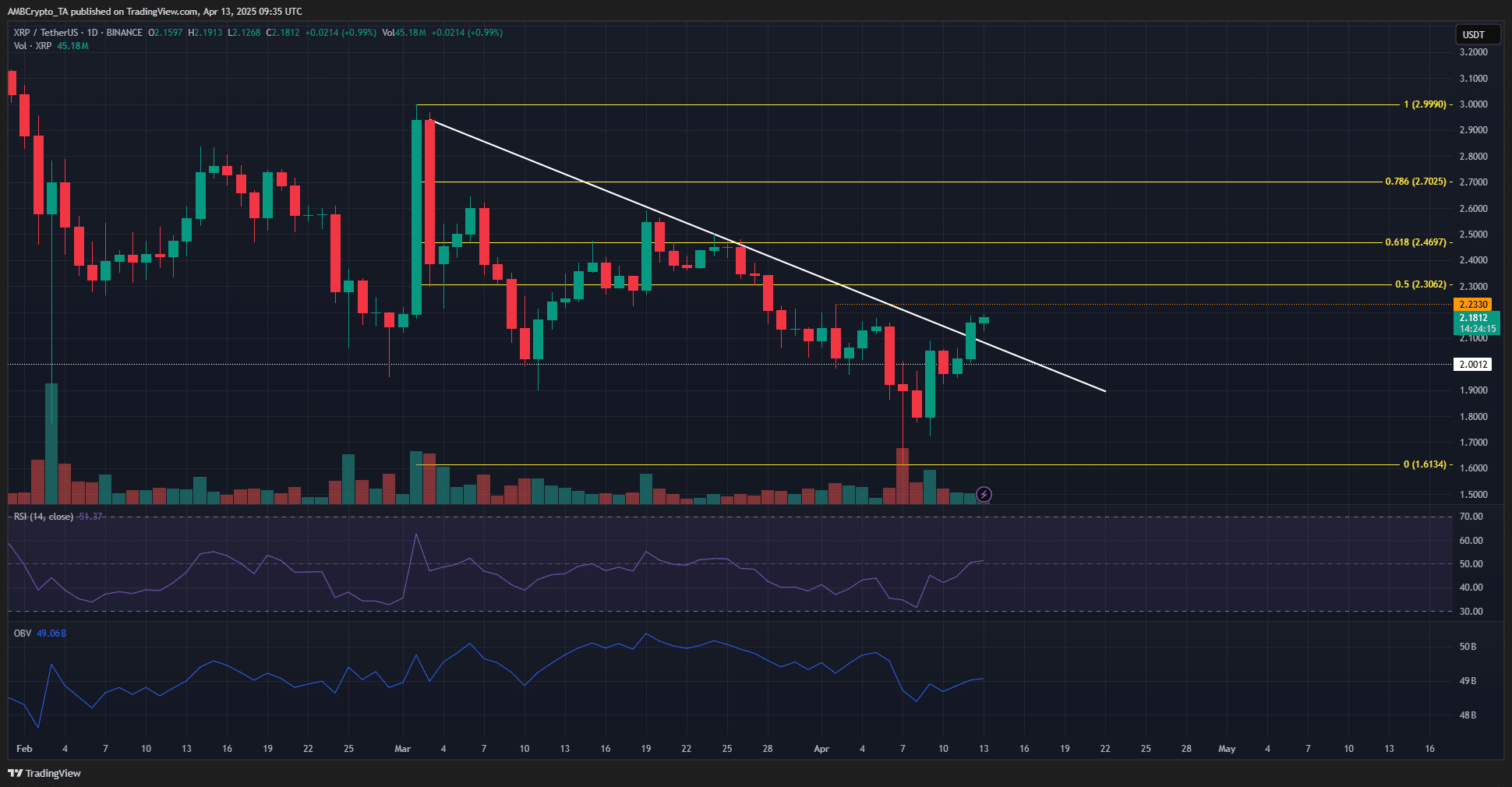

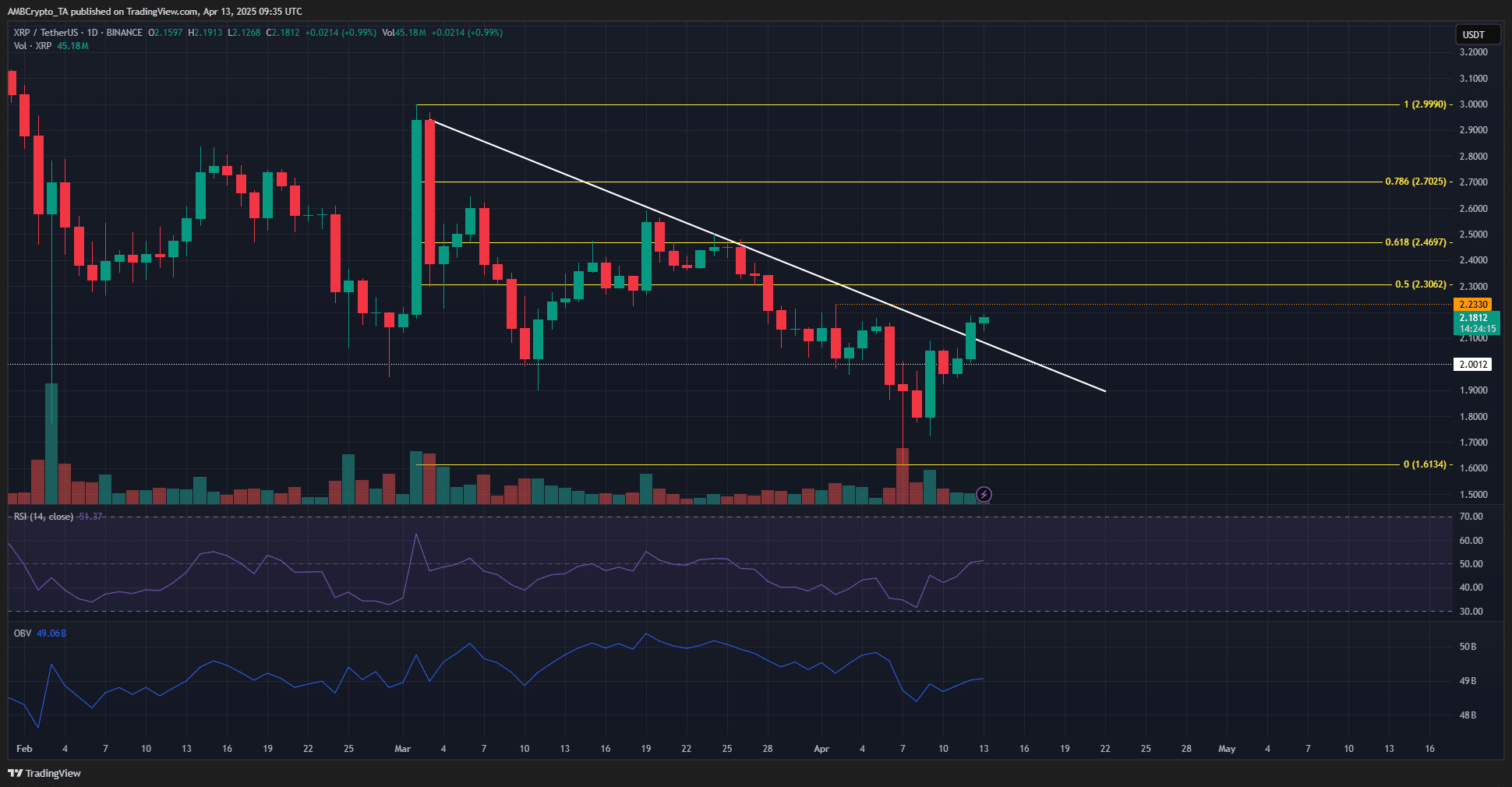

Ripple [XRP] Saw an outbreak beyond the falling trendline resistance that has been in the game since the beginning of March.

Although this outbreak, combined with turning the psychological $ 2 level to support, encouraging, it was not the end of the downward trend.

An earlier analysis underlined a structure of liquidity around $ 1.95. A deeper price decrease to $ 1.2 was expected, but the liquidity overhead attracted prices higher. This trend will probably continue in the short term.

Investors and traders can prepare to sell XRP at these levels

Source: XRP/USDT on TradingView

The price diagram on the daily period showed a bearish structure in the game. The lower high at $ 2.23 was not yet violated, although the trendline resistance was broken. That is why the Bearish front views must be kept by traders.

The RSI was 54 and showed a bullish momentum shift. This was an early sign of a reversal, but it was overshadowed by the finding of the OBV. The volume indicator was in a downward trend next to the price.

Until it can set a new higher high to signal a steady demand, investors and traders must be careful to take bullish positions. The Fibonacci racement levels showed that $ 2.46 and $ 2.7 formidable resistance levels were beyond the local resistance at $ 2.23.

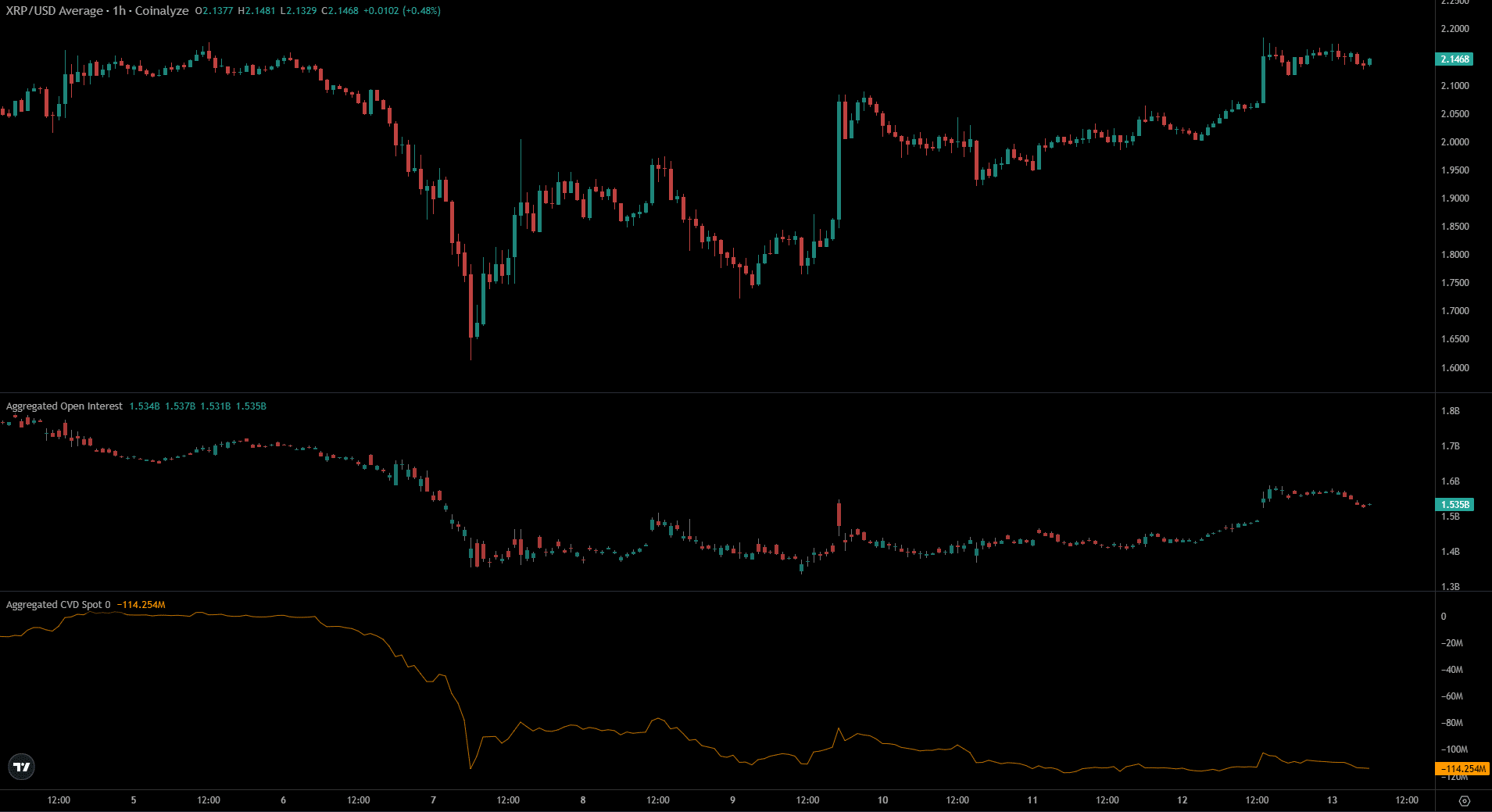

The open interest (OI) behind XRP has increased over the past 24 hours because the price at the time of the press increased 6%. This increase in OI was not accompanied by an increase in spot CVD.

This indicated a lack of purchasing pressure on the spot markets. That is why it was more likely that the recent rally was powered by derivatives and could falter quickly.

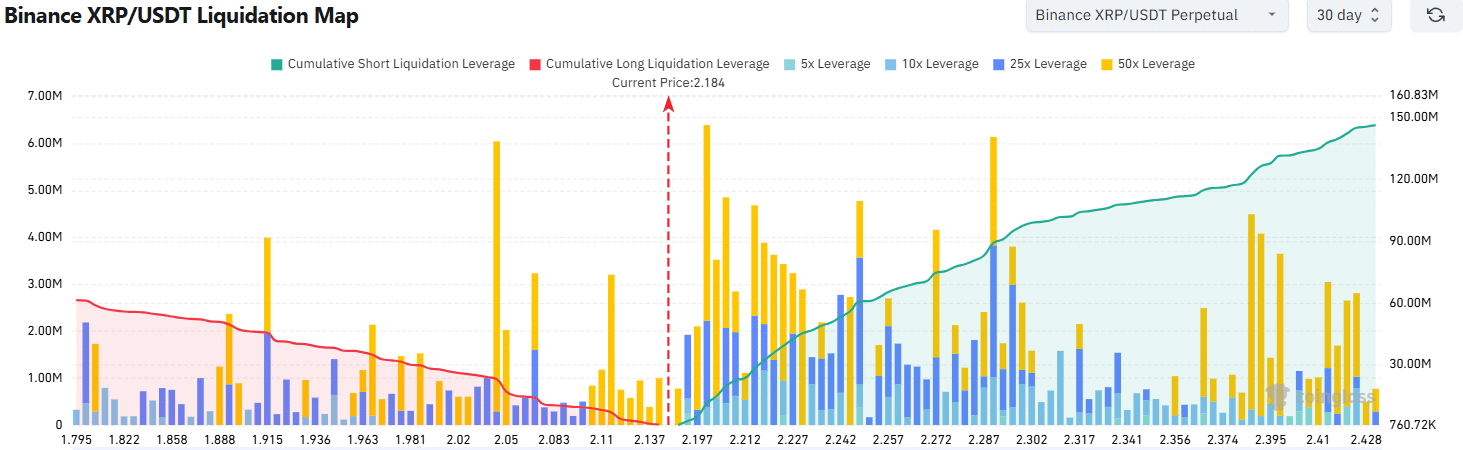

The Liquidation Heat Map strengthened this image. It showed a cluster of high leverage liquidations just above the XRP market price, which extends to $ 2.25.

The increased cumulative leverage meant that short -term sellers could be hunted for a bears in the short term.

This short squeeze could yield a short -term surcharge and also give traders the opportunity to fail.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer