- The resilience of XRP and the strong DIP-BUY question to a hint to the long-term outbreak potential.

- Can bulls with momentum structure push past the resistance?

Ripple’s [XRP] Third dip up to $ 1,9925 last week, followed by an increase of 7.40%, shows classic dip-buying in action. Acting at $ 2,3855, a MacD bullish crossover strengthened the upward trend, with $ 2.60 resistance in sight.

In the meantime, XRP/BTC approached at the beginning of March levels, without signs of overload.

While the resilience of XRP indicates strength in the long term, the short-term volatility remains because taking profit and risk-off sentiment can shake weak hands. An increase in Changes suggests an increased sales pressure.

If this trend continues, a retracement may be needed before the next leg up, especially with Bitcoin that is still under pressure in the short term. This makes a different market -wide correction probably.

XRP has strong basic principles in the midst of a weak spot to ask the question

XRP/BTC shows strength, better than other high caps in Dip-Buying. However, Ripple is still moving together with Bitcoin, and is not yet setting up as a completely independent active.

While the basic principles of XRP remain strong – with Add whales 150 million XRP in the past two days and investors who are re -assigned funds from BTC to XRP – the sales orders on the eternal market are rising.

Of weaknessActive addresses at their lowest since December, and increasing retail distribution, another long squeeze could challenge whale efforts. In that case, breaking $ 2.60 resistance will not be easy.

Source: TradingView (XRP/USDT)

Short orders dominated on Binance. Whales bought the $ 1.99 dip and activated a short squeeze that pushed the prices higher. A similar step could happen again, given on Whale accumulation.

However, if Bitcoin cannot break $ 85k and another sale hits, the short of short holders can press long holders, causing the momentum to turn over. Ambcrypto breaks the chances of this playback.

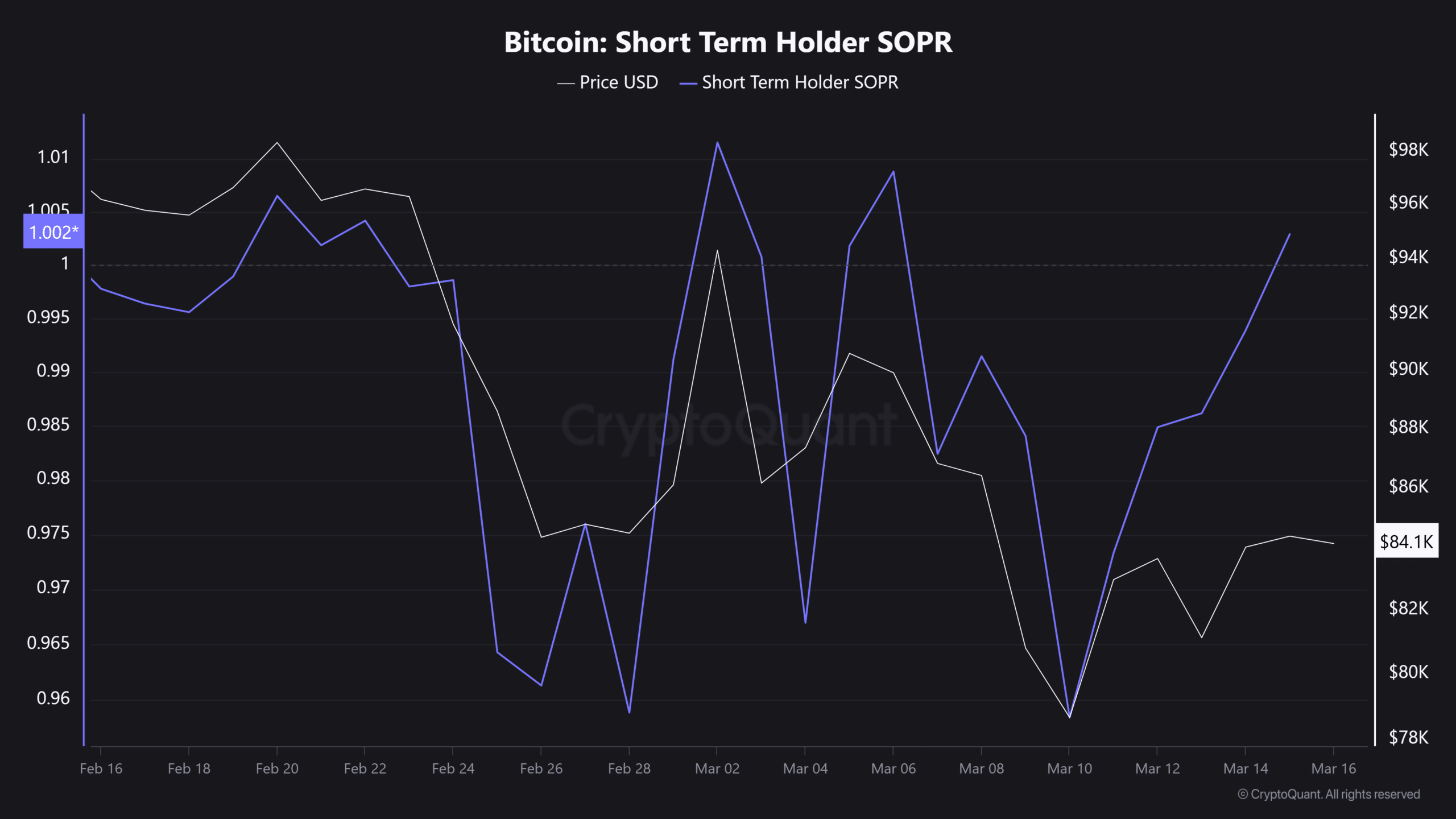

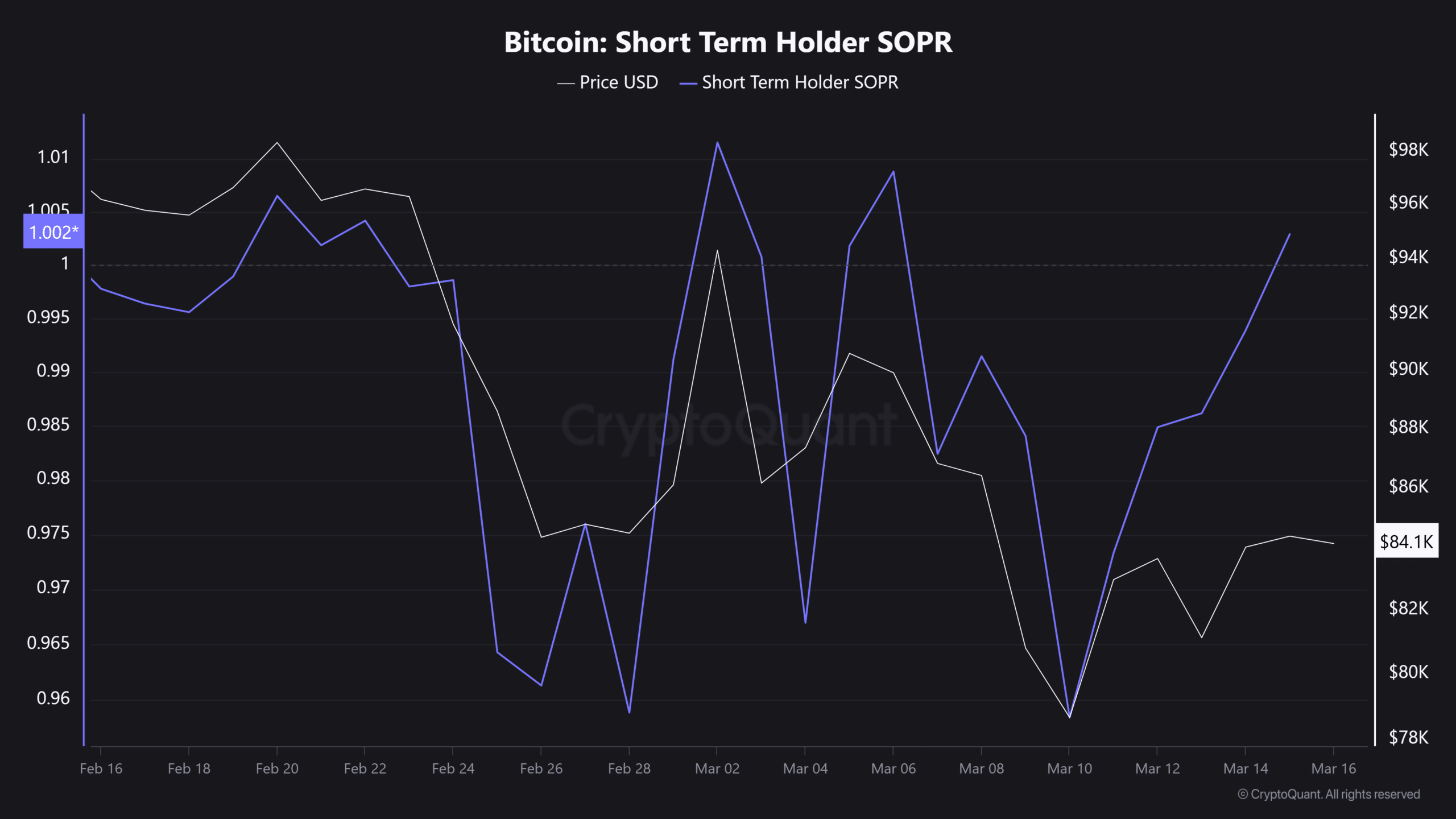

Source: Cryptuquant

Navigating Volatility: where XRP is standing

On his 1D graph, the price of XRP closely Bitcoin follows. Two dips up to $ 1.99 in three weeks corresponded to BTC that dropped below $ 80k.

The recovery of XRP has been stronger than that of BTC, who draws investor’s interest, but if Bitcoin drops again, the first could still visit the most important support levels.

The risk remains high, because large BTC interests are still underwater and the demand for important accumulation zones remains weak.

While the short-term holder SOPR 1 Returned when BTC bounced from $ 81k to $ 84k, the low demand could make it difficult to absorb this sell-side liquidity.

Source: Cryptuquant

With Bitcoin -contronted resistance, XRP can return to $ 2.26 in the short term. However, if BTC falls below $ 80k, a retest of $ 2 or lower is possible-one chance of short sellers can benefit from.

Despite strong basic principles, XRP remains susceptible to market -wide volatility, making a break above $ 2.60 resistance challenging, unless Bitcoin recovers important resistance levels and recovers broader risky appetite.