- BTC has recovered $100,000, albeit briefly, after cooler-than-expected inflation data

- XRP regained its 7-year high while ONDO faced a $2.4 billion token unlock push.

On Wednesday, Bitcoin [BTC] bounced back and retested $100,000 after cooler-than-expected US inflation data, sending the entire market higher. Inflation data, the CPI (Consumer Price Index), came in at 3.2% on an annualized basis (year-on-year), versus the 3.3% that economists had forecast.

Source: Coinmarketcap

This dampened inflation fears and the prospects for Fed rate cuts, which had previously sent markets plunging and dragged BTC below $90,000.

However, it’s worth pointing out that markets still estimate a 97% chance of a ‘unchangedFed rate at next meeting in late January.

AI Agents Lead the Recovery, XRP Hits a New High

After BTC’s rally, Solana [SOL] and ether [ETH] recorded a gain of 14% and 12% respectively. The AI agent sector saw a bigger rally, however, with Virtuals Protocol [VIRTUAL] and Aixbt [AIXBT] book profits of 25% and 35% respectively.

Other tokens with the AI agent story, such as Fartcoin and Cookie, also posted double-digit gains. Some agent tokens even made triple-digit gains in one day.

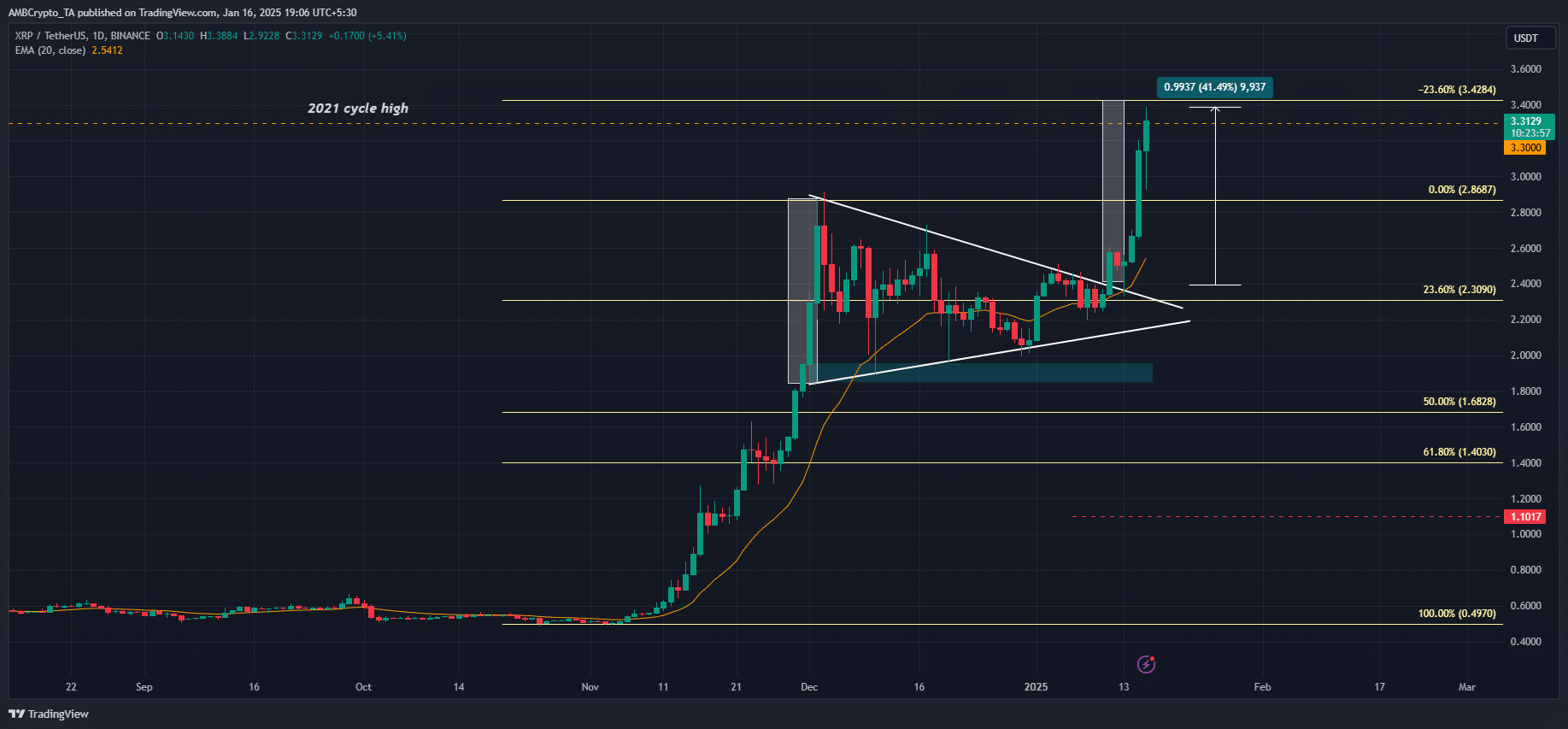

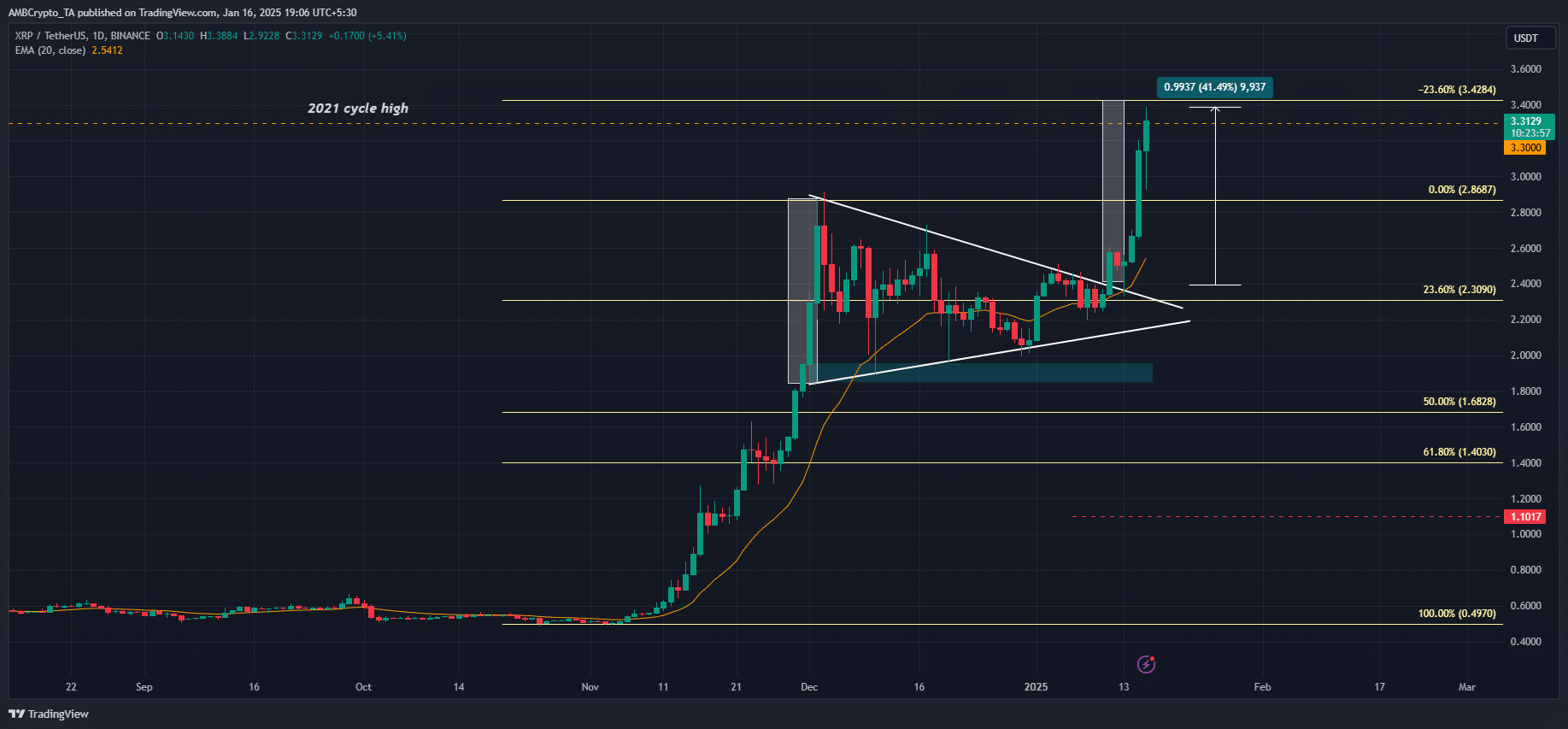

However, the main highlight of the market was XRP. At the time of writing, the altcoin reached a high of $3.38, surpassing the 2021 cycle high. This performance effectively extended breakout gains to +40%, with the altcoin remaining unaffected by legal developments as the SEC appealed Ripple Labs.

Source: XRP/USDT, TradingView

The agency is unhappy with the ruling of US District Judge Analisa Torres, who classified XRP as a non-security risk and reduced the $2 billion fine for Ripple Labs to $125 million.

Despite speculation that the agency would not appeal the case, it did so. Ripple’s leadership irritateswho called the measure a waste of taxpayer money. However, there are reports that the new Trump administration could “freeze” a number of crypto lawsuits, including Ripple’s case.

Finally, the RWA (real-asset tokenization) market leader, Ondo [ONDO]will unlock nearly 800 million tokens (worth $2.4 billion) on January 18.

This will translate to 134% of its market capitalization and could expose the token to significant volatility and selling pressure. Despite a broader market recovery at the time of writing, the altcoin is already down 42%. At $1.2, it has yet to recover from the December sell-off.

After all, next week is the D-day of Donald Trump’s presidential inauguration, and a new chapter for crypto will be heralded.

As the market shifts focus to this historic event, trading firm QCP Capital noticed increased interest from options traders in the $100,000-$110,000 price targets. The company declared,

“On the options front, BTC JAN calls dominated the market yesterday as traders took an increasingly bullish stance and snapped up contracts with strikes ranging from $100,000 to $110,000. This is a promising sign as we enter March, which currently has the highest concentration of open interest at the $120,000 strike.”