After a price drop of 6%, XLM, the native token of Stellar, started on the way to the next support level. From today, April 9, 2025, the market seems to continue its downward trend because the rate war between the United States and other countries does not show any signs of end.

XLM -Price promotion and its most important levels

The XLM price prediction has become an important topic of discussion in the midst of the Bearish market sentiment. According to the technical analysis of experts, it has been actively moving in a falling wig pattern on the daily period. With the recent price fall, XLM has not succeeded in retaining its most important support level of $ 0.23 and is now going to the lower limit of the pattern.

Historically, this level of support has followed up as a zone for price outlets or rebounds. After he did not retain this level, XLM was able to fall by 16% and reach the next level of support at $ 0.19 in the coming days.

XLM price forecast

This continuous fall in price has expressed concern about whether it will come to an end or whether it could be actively reversing with upward boost.

The daily graph indicates a strong possibility that the active level of $ 0.19 could reach. However, this could be the point where XLM experiences a price reverse. However, if the downward momentum continues, the price of the asset could, however, fall by another 25%, which makes it possible to reach $ 0.14.

Current price momentum

At the time of the press, XLM acts nearly $ 0.22 and has registered a price fall of more than 6% in the last 24 hours. In the same period, trade volume fell by 50%, indicating lower participation of traders and investors compared to the previous day.

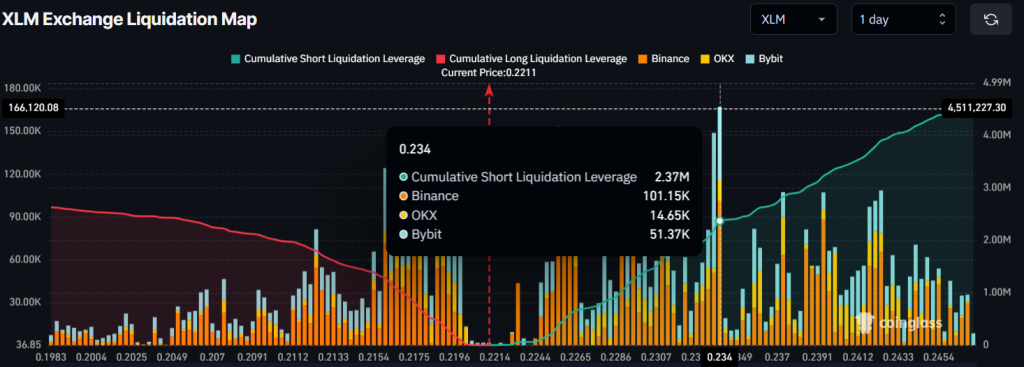

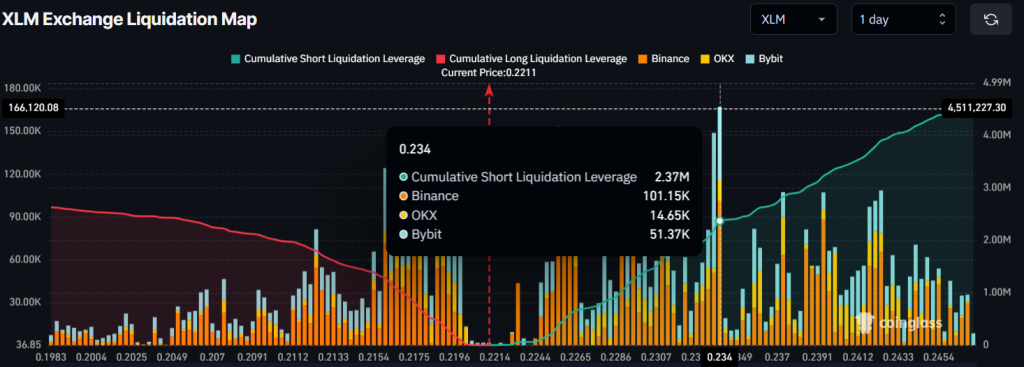

$ 2.37 million in Beerarish bet

In addition to the Bearish price action, traders also seem to follow the total market sentiment, because many are strongly betting on the disadvantage.

Data from the on-chain analysis company Coinglass It appears that traders are currently used too much at the level of $ 0.212 at the bottom, with $ 1.80 million in long positions. On the other hand, the level of $ 0.234 is another over-livered zone at the top, with $ 2.37 million in short positions opened by traders.

This metric clearly reflects the bearish statue of the traders of XLM, who could actively push it lower in the coming days.