- WLD is up 7.83% in the past day.

- Market indicators suggested that increased whale accumulation supported Worldcoin’s upward trend.

Over the past week, Worldcoin [WLD] has seen a strong revival. During this period, the altcoin has risen from a low of $1.8 to a high of $2.8.

At the time of writing, Worldcoin was trading as high as $2,637. This marked a 26.20% increase in the weekly charts.

Likewise, this bullish trend has continued on the daily charts, with an increase of 7.83%. During the same period, trading volume increased by 145.90% to $705.1 million.

The recent price pump raises questions about what is driving it and whether Worldcoin can sustain the uptrend.

What’s Driving Worldcoin’s Uptrend?

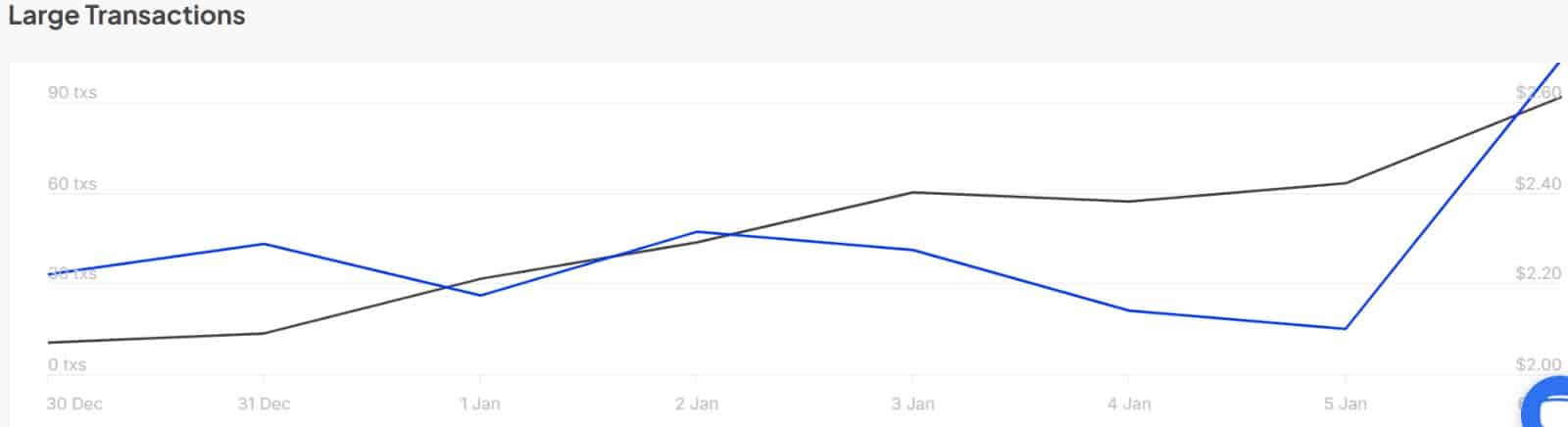

According to AMBCrypto’s analysis, one of the factors currently driving Worldcoin is increased whale activity. Based on data from IntoTheBlock, whale activity has increased by a whopping 593.3% in the past day.

Source: IntoTheBlock

This is reflected in an increasing number of large transactions, which have increased from 15 to 104. When whale activity increases, it can indicate selling or even accumulation.

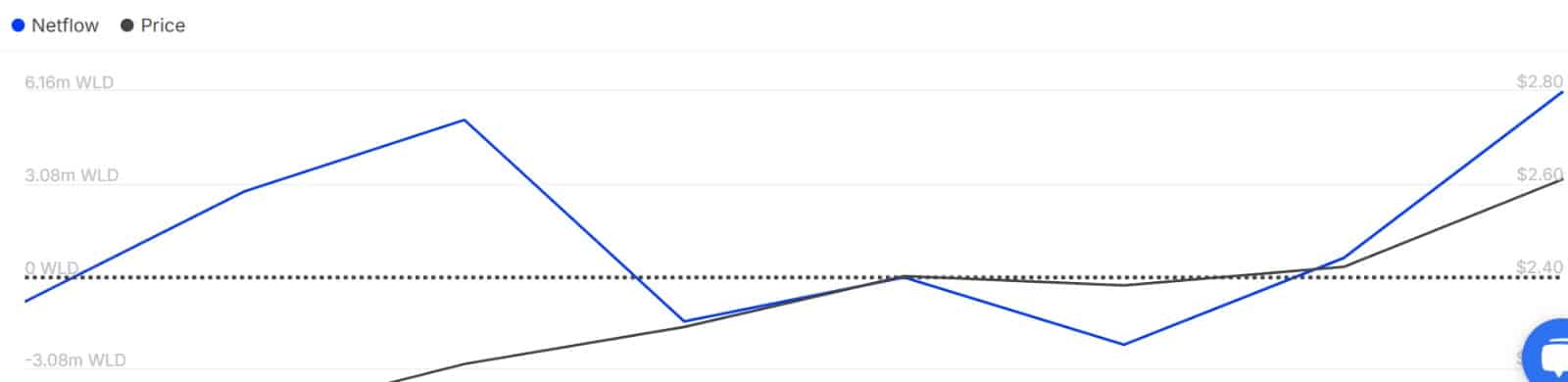

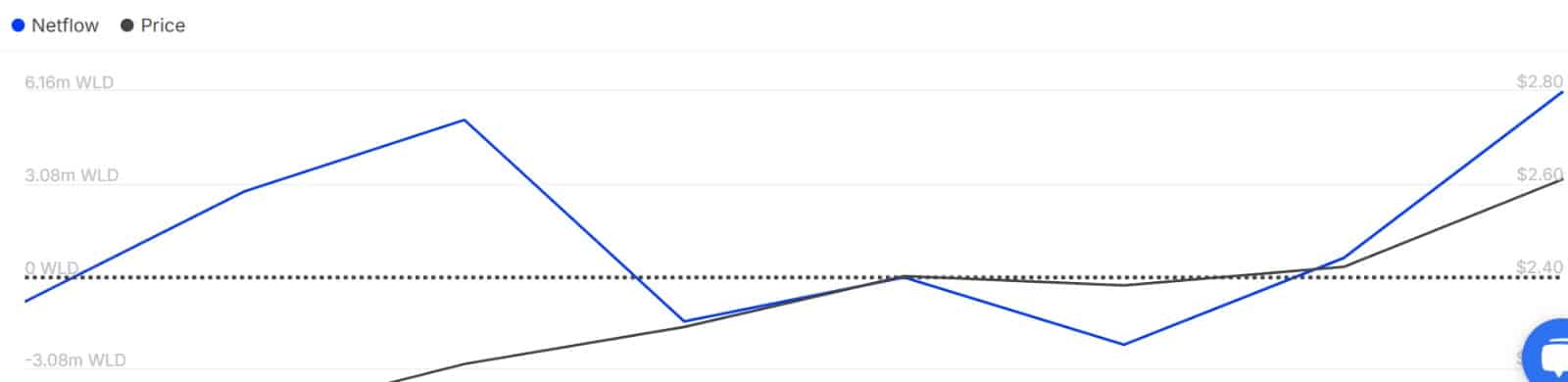

Since this is followed by a spike in net flows from large holders, this implies that whales are actively purchasing WLD.

Source: IntoTheBlock

As such, the net flow of large investors has increased from 603.68,000 to 6.16 million in the past day. This shows that there is more capital inflow from whales into the assets than there is capital outflow.

Now that whales are turning to buying WLD, it suggests they are bullish and expect WLD to make more profits.

Can WLD keep these profits?

In particular, the increased accumulation of whales indicates positive feelings. As such, prevailing market conditions position WLD for more gains on its price charts.

Source: TradingView

For example, Worldcoin’s Stoch has made a bullish crossover in the past day. This shows that the altcoin is experiencing strong upward momentum.

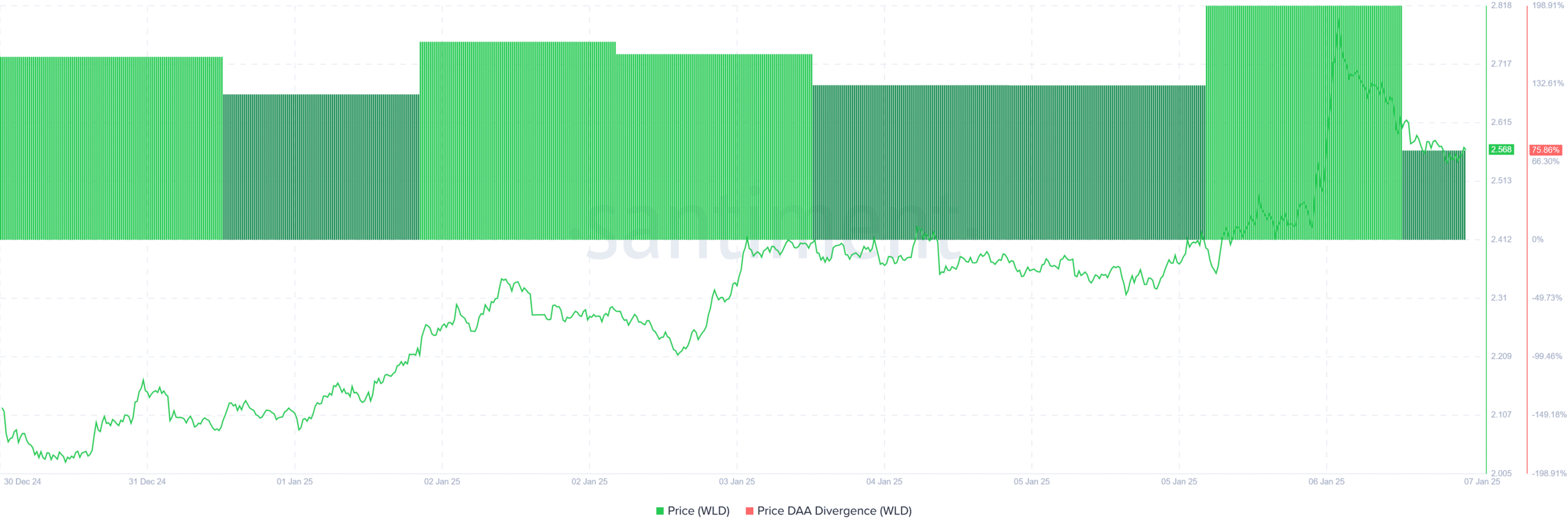

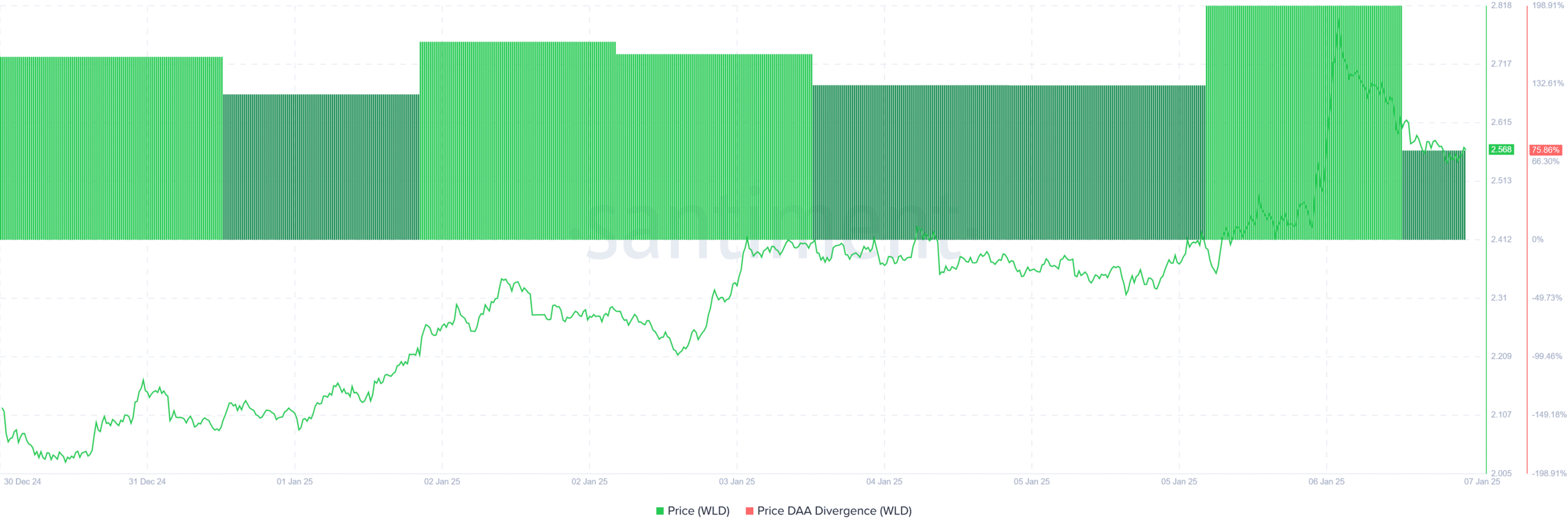

Source: Santiment

Moreover, Worldcoin’s price-DAA divergence has remained positive over the past seven days. This positive divergence indicates that the altcoin’s fundamentals are strengthening, with a rising number of active users and greater network adoption.

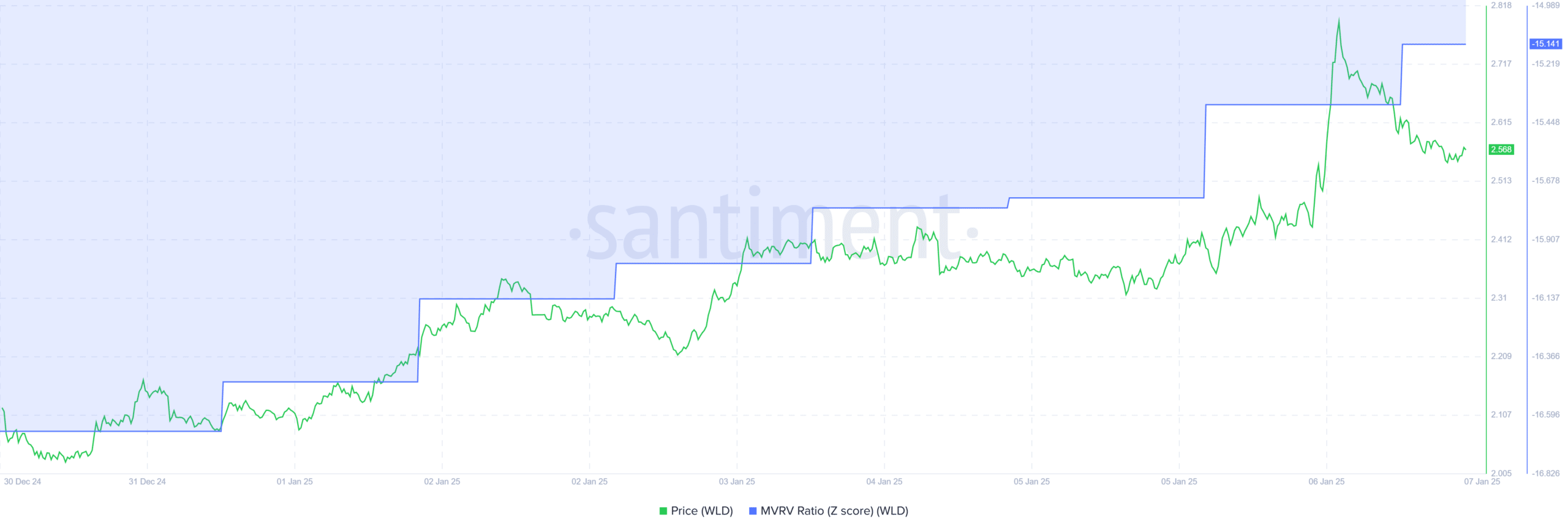

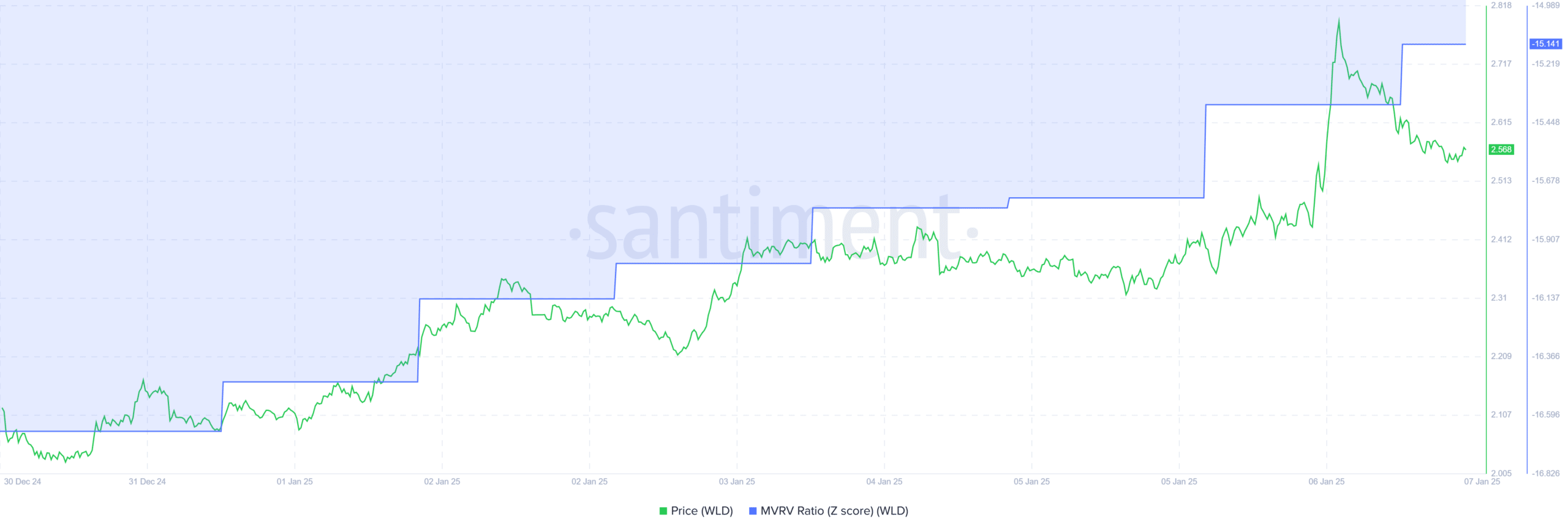

Source: Santiment

Currently, the altcoin’s MVRV ratio is in the negative zone of -15. This suggests that WLD is still undervalued, with many holders incurring losses.

Historically, a negative MVRV ratio provides a buying opportunity, allowing investors to acquire the asset at lower prices.

Typically, prices tend to recover from these levels as buyers enter the market, causing prices to rise due to increased demand.

Realistic or not, here is the WLD market cap in terms of BTC

In short, Worldcoin enjoys positive sentiments from retailers and whales. With market conditions being bullish, the altcoin is positioned for further gains.

If this trend continues, WLD could claw back $3 and attempt $3.2, facing multiple rejections. Conversely, a trend reversal could lead to a drop to $2.3.