- The price of Worldcoin tokens and network activity showed a downward trend.

- The NVT showed that the token could be overvalued despite the heavy losses.

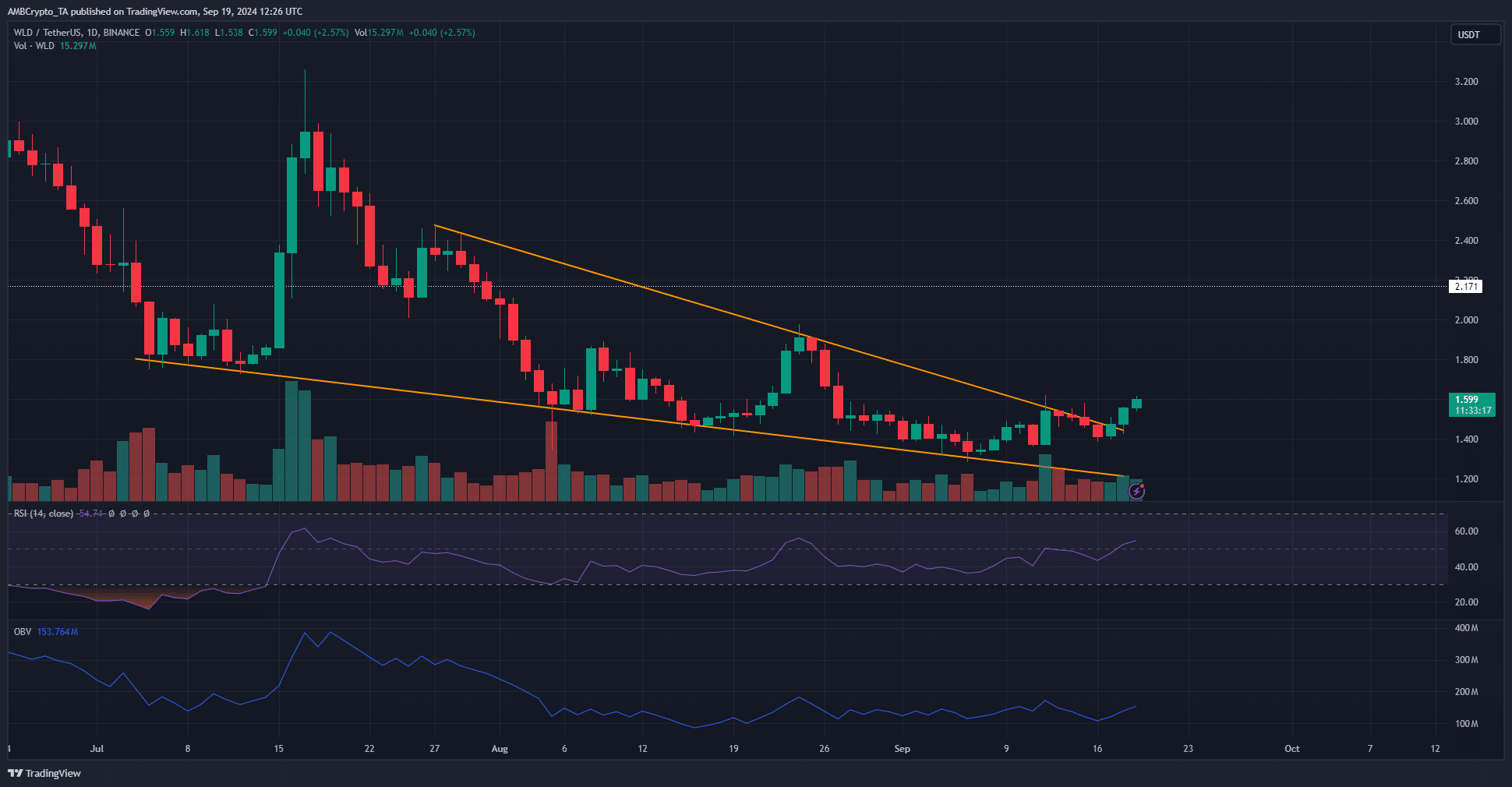

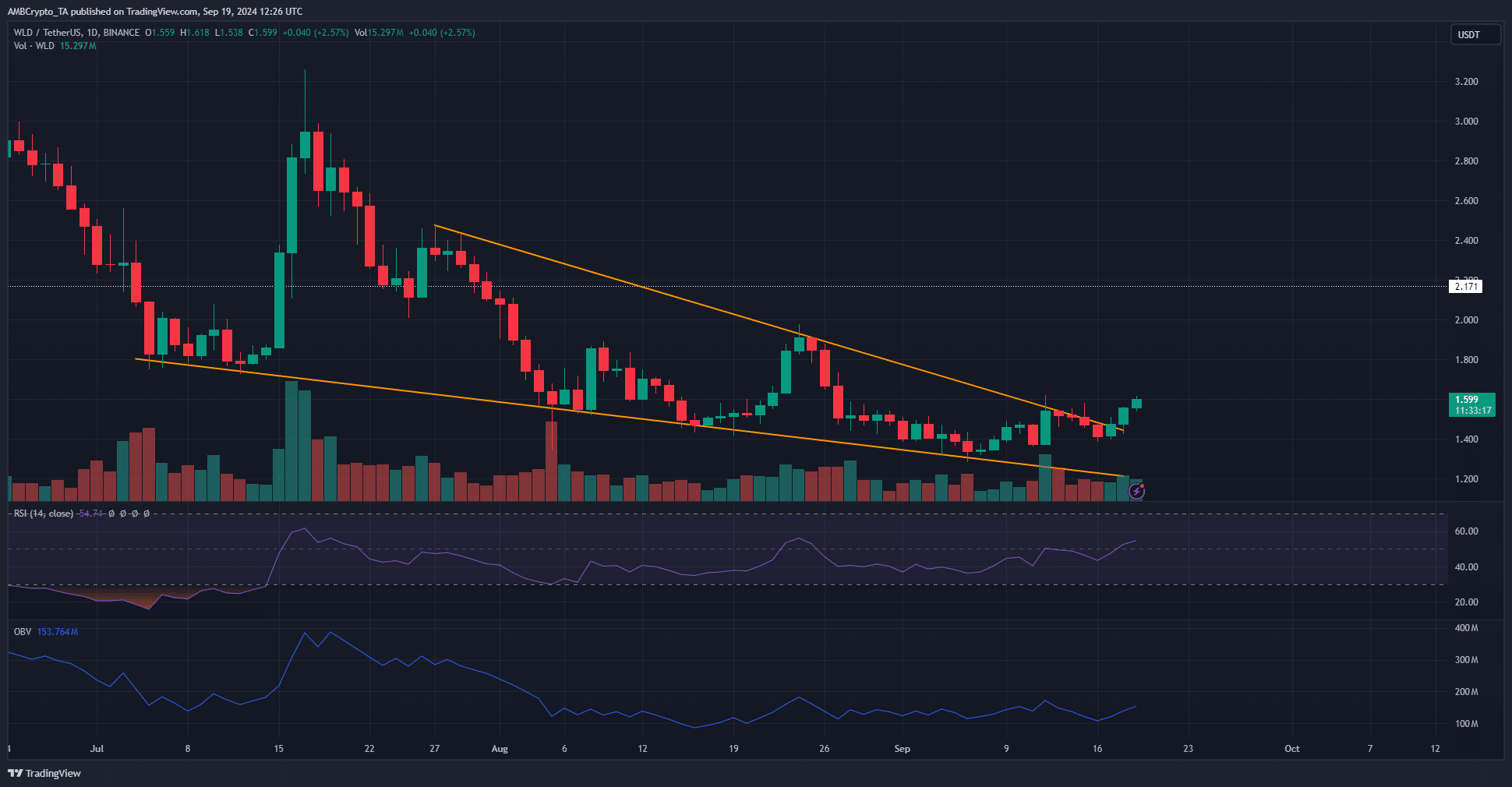

World currency [WLD] is up 14.32% over the past two trading days, but was still in a long-term downward trend. Bitcoin [BTC] has also been in a slow downward trend in recent months, but is only 13.5% lower than at the beginning of April.

Source: WLD/USDT on TradingView

In contrast, the WLD has fallen 80.51% since April 1. The $2.17 level, which had marked the 2024 low before the February rally, was comfortably beaten in July.

A falling wedge pattern appeared to be forming, but the bullish promise was not high as the pattern had not been filled.

WLD is overvalued

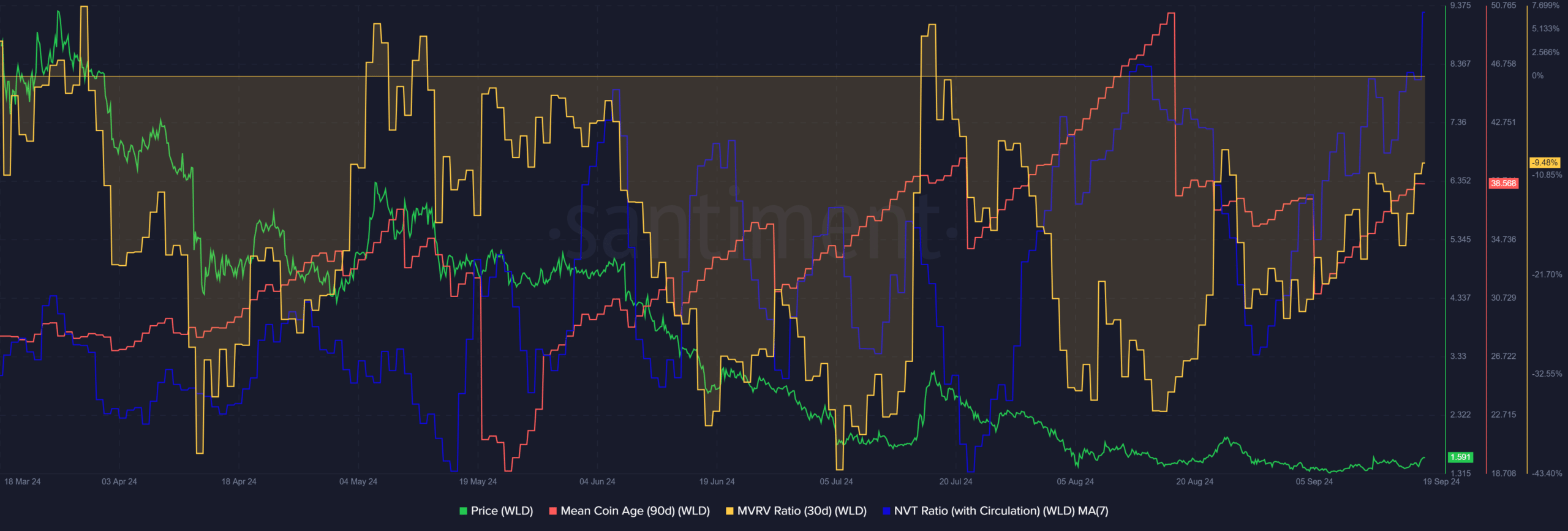

To understand whether Worldcoin investors can be hopeful of a recovery, AMBCrypto took a closer look at the on-chain metrics. The combination of the average coin age and the MVRV ratio provided a short-term buy signal.

The upward trend in the average coin age indicated accumulation, while the 30-day MVRV in negative territory showed that short-term holders were at a loss. However, this signal should be treated with caution.

Such a buy signal occurred in early July and early August, but the downtrend on the higher time frame continued to play a role. The bulls were too weak to make a significant rally higher.

The Network Value to Transactions (NVT) ratio based on circulation showed the metric at a six-month high.

Such high values indicate that the market value of the network is high compared to the amount traded, which means that the WLD token is overvalued.

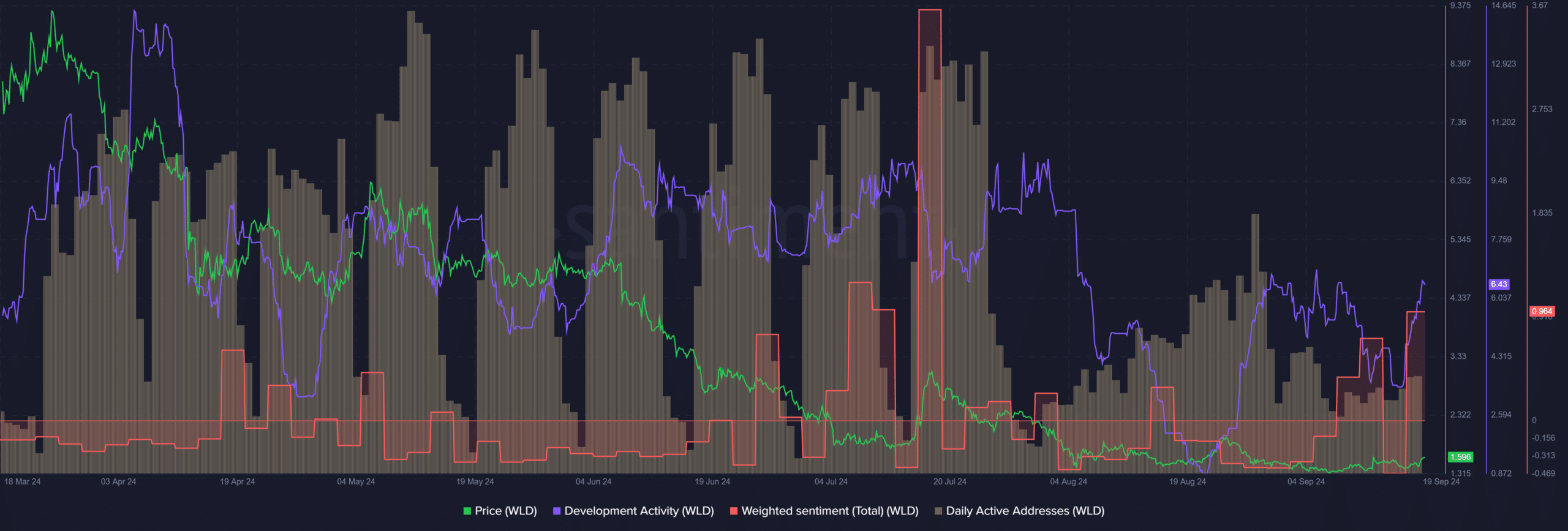

Network activity is also decreasing

From April to July, the daily active addresses metric showed similar peaks during weekdays, consistently declining during weekends.

Read Worldcoins [WLD] Price forecast 2024-25

The steady activity at that time dropped dramatically in early August and found it difficult to recover.

During that time, development activity also took a hit, but returned to near July highs. However, the decline in activity should be a concern for long-term investors.