- The NFT market experienced a sharp decline, with the Bored Ape Yacht Club (BAYC) NFTs experiencing a historic price decline.

- ApeCoin is affected as whale price and interest starts to decline.

Over the past few months, the NFT market has witnessed a gradual decline in interest and engagement. This downturn has been particularly noticeable in recent weeks as the decline in interest within the NFT sector has intensified, impacting several facets of the NFT space.

Realistic or not, here is APE’s market cap in terms of BTC

Declining health

According to ASXN data, a clear example of this market shift is the rock bottom price of Bored Ape Yacht Club (BAYC) NFTs. This bottom price has experienced a sharp drop, reaching a historically low value of 23 ETH. As a result, a significant number (more than 108) of the BAYC NFTs were at risk of liquidation.

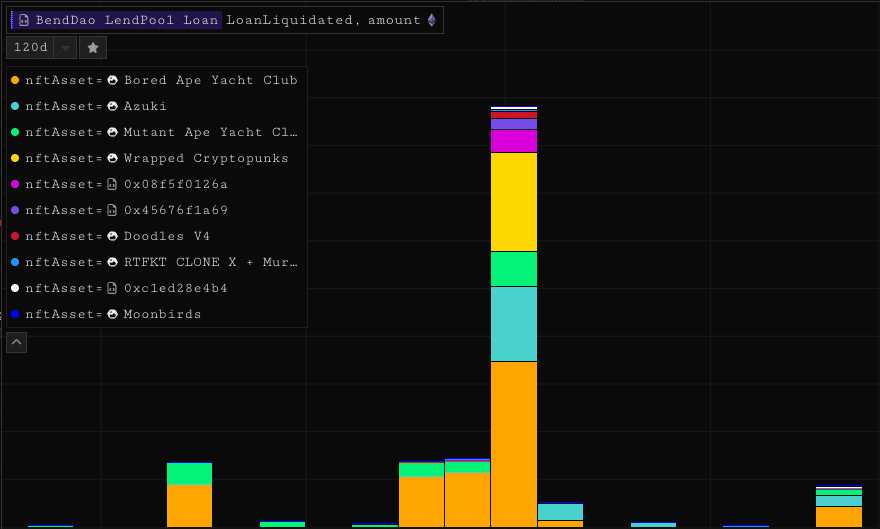

If we dig deeper, it is noteworthy that BendDAO, which actively contributes to the BAYC ecosystem, had 32 BAYCs with a health factor equal to or lower than 1.1. This figure includes 8 NFTs that have an even lower health factor of 1.05 or less.

BendDAO uses a method that calculates floor prices based on a time-weighted average, positioning the BAYC floor price at 25.02 ETH.

Source: ASXN

In comparison, taking into account the other platforms, Blur and Opensea, we find their respective floor prices at 23.1 and 23.49 ETH. In an interesting parallel, ParaSpace, yet another marketplace, also struggled with challenges.

Here, an additional 76 BAYC NFTs faced potential liquidation risks, 18 of which had a health factor of less than 1.05. Meanwhile, the remaining 58 NFTs showed a health factor of less than 1.1. Adding to the complexity, six BAYCs are currently up for auction. This marked a turbulent time for this segment of the NFT market.

State of the market

Moreover, the waves of this trend were felt across the spectrum of NFT marketplaces. Yuga Labs NFTs had once been a major contributor to market volume. The total fees paid to OpenSea over time underscored this, with Yuga Labs taking on three of the top four projects, totaling more than $100 million.

Despite this significant contribution, the total percentage of total sales attributed to Yuga Labs was approximately 15%. Year to date, Yuga Labs still ranks as one of the top contributors, albeit with significantly lower numbers as market volumes have seemingly migrated to other platforms such as Blur.

Source: NFTstats.eth

Around monkeys

Given this dynamic, it is plausible to speculate on the possible ramifications of Yuga Labs’ fall on ApeCoin. This token, which is intrinsically linked to Yuga Labs, experienced a significant drop in value.

Is your wallet green? Check out ApeCoin’s Profit Calculator

At the time of writing, ApeCoin was trading at $1.51, reflecting a significant drop over the past week.

Adding to the complexity, larger investor sentiment turned bearish this period. In addition, a reduction in the number of token holders was observed. The combination of these factors could significantly affect the price of APE.

Source: Sentiment