- An increase in foreign exchange withdrawals and a negative MVRV ratio indicated a potential UNI rally.

- The project’s TVL increased, indicating that traders had recovered from the previous FUD.

If we can believe the recent action of a whale: Uniswap [UNI] There could be a big rally in the coming weeks. According to Spot On Chain, a whale withdrew his UNI holdings from Binance for the first time.

The total number of tokens was 121,871, worth $954,000. Withdrawing the tokens from the exchange implied that the participant has no intention of selling anytime soon.

Before the price action, this was a bullish signal. A few weeks ago, UNI was subjected to a massive nosedive after the US SEC publicly revealed that it might sue Uniswap Labs, the company behind the token’s development.

This news caused fear, uncertainty and doubt (FUD) around the token. In addition, UNI’s price fell to $5.86.

However, in the past seven days, the value of the cryptocurrency has increased by 8.31% as it changed hands to $7.81.

DeFi’s time to shine?

But another thing AMBCrypto noticed was that the whale also removed its Compound [COMP] tokens from Binance [BNB].

A scenario like this suggests that it could be possible that DeFi tokens, and not just UNI, could jump.

Unlike the last bull market, DeFi was not one of the biggest stories this cycle. Instead, meme coins, Real World Assets (RWAs), and AI tokens dominate.

Will the recent development change the state of affairs? Well, we checked the possibility by looking at the sentiment surrounding UNI.

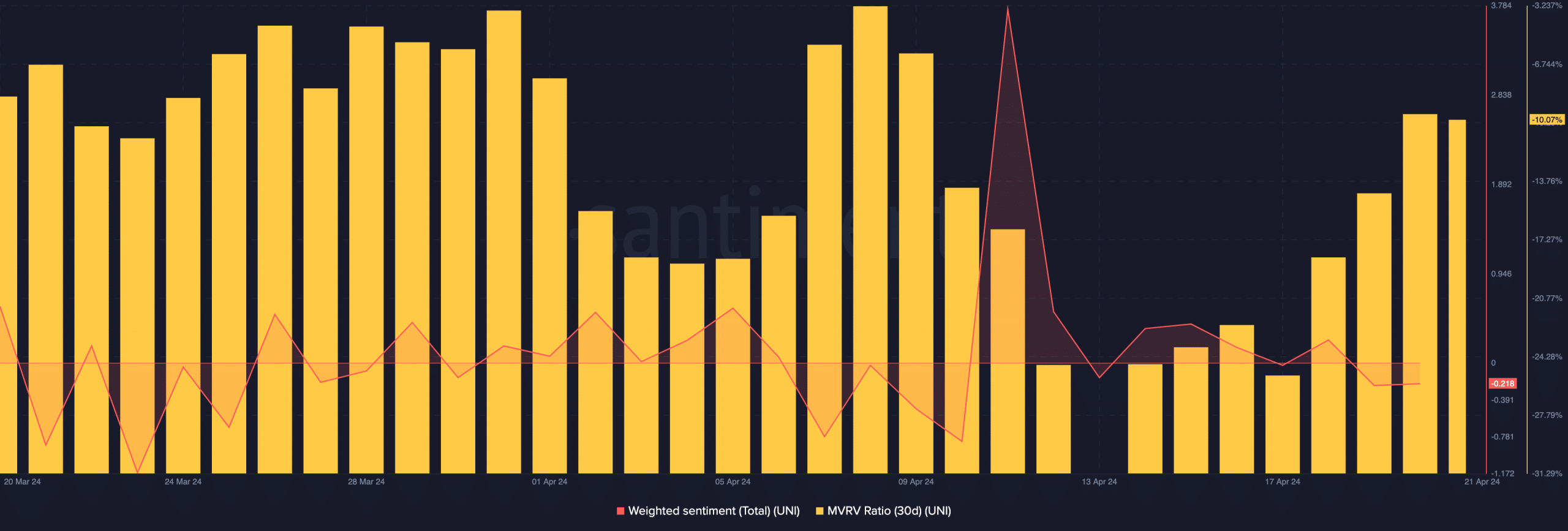

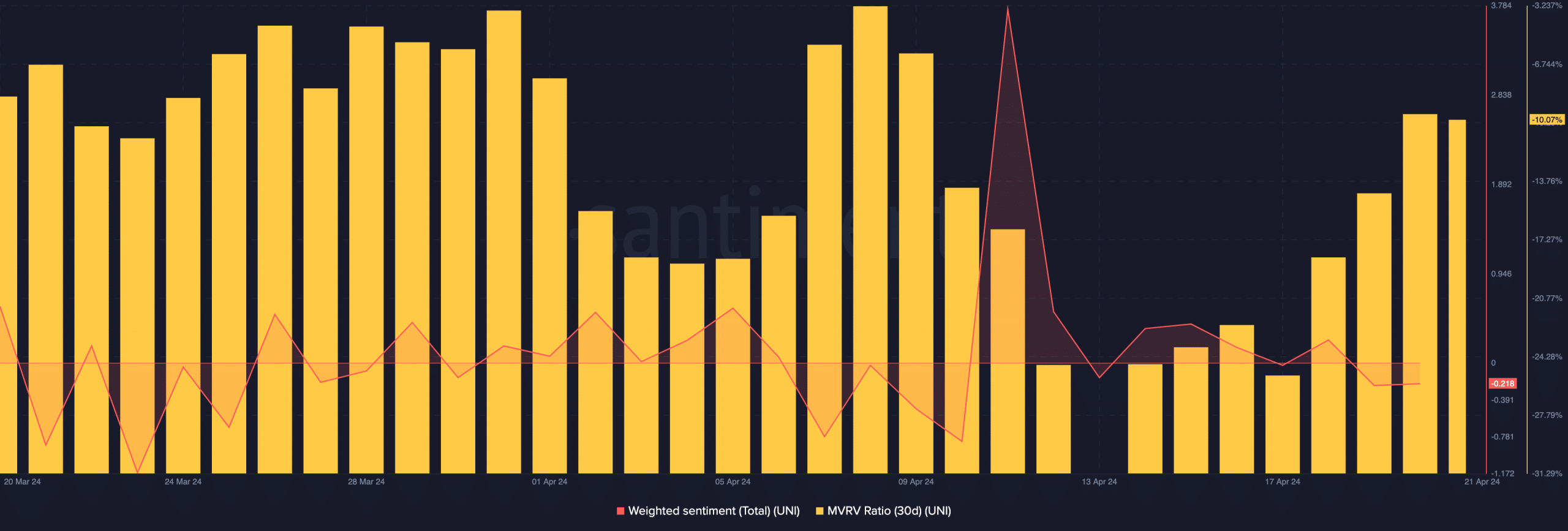

At the time of writing, this was the case with Uniswap’s Weighted Sentiment dropped to the negative zone. This decline implied that most comments about the project were more somber than enthusiastic.

Typically, the state of the benchmark would imply that UNI may not have any demand. But a look at the ratio between market value and realized value (MVRV) suggested otherwise.

Source: Santiment

At the time of writing, the 30-day MVRV ratio was -10.01%. This means that if every UNI holder sold at press time, the average return would be a 10% loss.

UNI regains confidence

But that’s not something most holders would do. As such, a buying opportunity may exist between $6.50 and $8. If buying pressure increases, UNI’s price could recover to double-digit numbers.

Additionally, an upcoming altcoin season could also help prices, as targets between $15 and $20 could be possible.

AMBCrypto obtained further evidence that Uniswap was recovering from the FUD of its Total Value Locked (TVL).

Realistic or not: here is UNI’s market cap in BTC terms

According to DeFiLlama, the TVL did increased by 138% in the past 30 days. This increase was a sign that participants perceived the protocol as reliable.

Source: Santiment

Therefore, the value of the assets deployed and locked up increased. Should this TVL continue to rise towards 2021 levels, as has been evident in recent weeks, UNI’s price could also be close to its all-time high.

![Will Uniswap [UNI] be a dark horse after Bitcoin’s halving?](https://bitcoinplatform.com/wp-content/uploads/2024/04/uniswap-news-after-bitcoin-halving-1000x600.webp)