- Bitcoin may be on the cusp of a massive capital surge as the countdown to Trump’s return to the White House enters its final two weeks.

- The next step is critical, so traders must be prepared to play their cards right.

Bitcoin [BTC] has remained stable around $98,000 for two days in a row.

After a week of bullish trends driven by the ‘New Year’ hype, market makers are preparing for possible shifts. These shifts are tied to Donald Trump’s inauguration, which is just two weeks away.

Altcoins are also not standing still. AIOZ is up 20% in the last 24 hours, indicating that capital isn’t just stuck with Bitcoin – it’s flowing across the market.

As excitement builds, could this momentum finally push BTC past the six-figure mark? All signs point to an intriguing two weeks.

The clock is ticking

In the fourth quarter of last year, Trump’s influence helped Bitcoin flirt with the $100,000 mark. However, broader market forces quickly intervened to cool the rally. This highlights a crucial truth: Even strong catalysts cannot avoid the unpredictable impact of larger economic trends.

During this period, Bitcoin’s foreign exchange reserves rose 1.7% in just a week, reaching 2.43 million BTC – the biggest increase in more than three months.

However, the story quickly turned around. Bitcoin reserves have now fallen to a new four-year low of 2.30 million BTC, indicating more Bitcoin is being taken off the exchanges.

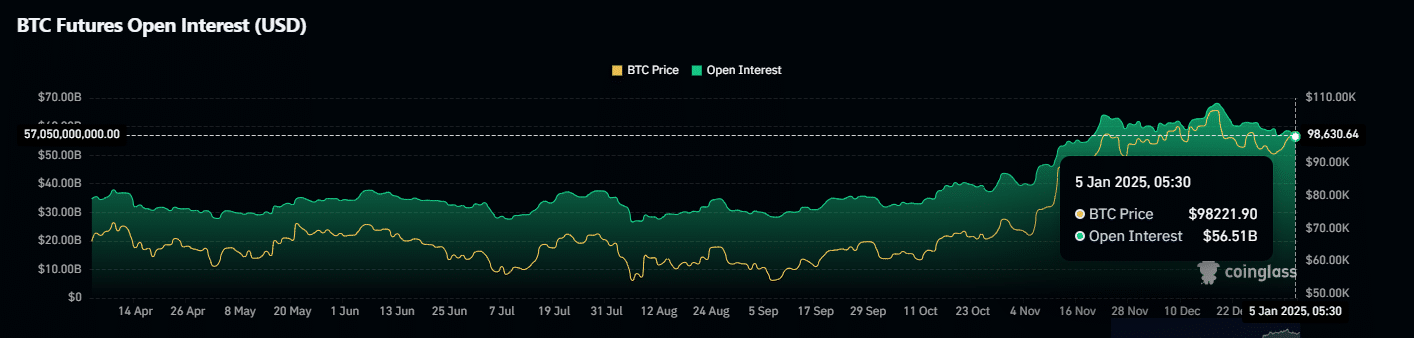

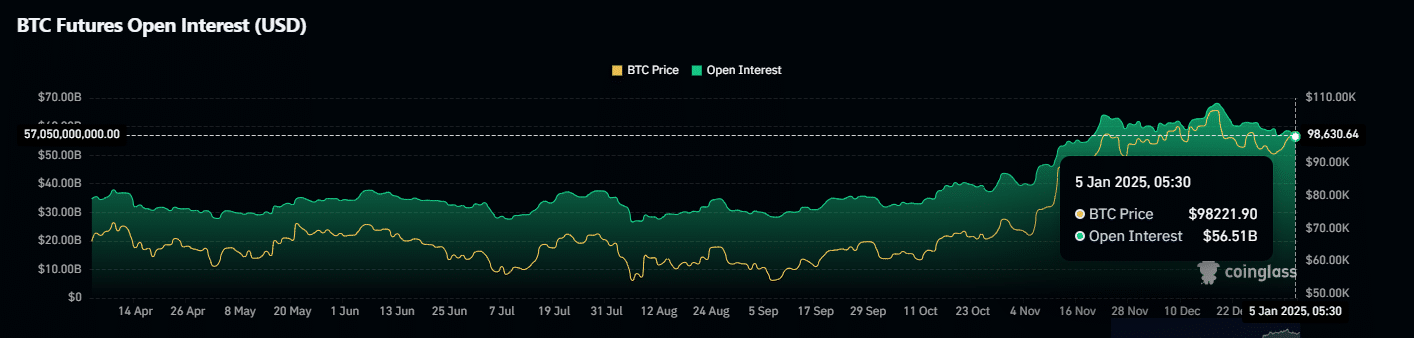

Nevertheless, activity remains moderate. Futures Open Interest (OI) is less than $60 billion, compared to $70 billion when BTC reached $108,000. It is notable that trading volumes have also fallen by 6%.

Source: Coinglass

With Trump’s inauguration just two weeks away, a rise in both metrics could be the catalyst Bitcoin needs to break six figures — and possibly reach a new all-time high.

But weak demand at these levels could flip the script, leading to a sharp pullback instead. The stakes are high.

Bitcoin investors are bracing themselves for a test of patience

As Bitcoin approaches the $100,000 mark, the “risk factor” is becoming more and more powerful in the market.

Retail investors, who make up 88% of Bitcoin networkfeel the pressure. Fears of a possible crash are high, and if Bitcoin fails to establish $100,000 as a solid support level, we could see some hesitation in capital inflows.

Trump’s return to the White House could be the perfect catalyst. His influence could be exactly what Bitcoin needs to stay strong and avoid falling back into the $97,000 – $99,000 price range.

Read Bitcoin [BTC] Price forecast 2025-2026

Meanwhile, the altcoin market is not far behind. Ethereum[ETH] is showing signs of weakness, with options volume down 50% and $7 million in long positions squeezed out. The market is waiting for a clear recovery.

The coming weeks will test your patience. The buzz around Trump’s inauguration could lead to a buying frenzy, but without stronger accumulation of both Bitcoin and altcoins, even Trump’s return might not be enough.

Keep a close eye on the volume indicators. If buying rates pick up significantly, we could see the market breakout.