On-chain data shows a Bitcoin metric is approaching a crucial retest that could make or break a rally. Will the bulls come out on top?

Bitcoin Short-Term Holder Realized Profit/Loss Ratio Approaching Level 1

This is evident from data from the on-chain analytics company Glasnode, a successful retest here would be constructive for the price of the asset. The indicator that matters here is the “realized profit/loss ratio,” which measures the ratio of gains to losses that Bitcoin investors across the network are currently realizing.

The metric works by going through the on-chain history of each coin sold to see at what price it was last acquired. If this previous price for a coin was lower than the BTC value at which it is now being sold/moved, then selling the coin would bring some profit.

The opposite case would of course imply that loss realization occurs with the movement of the coin. The metric takes the sum of all such profits and losses harvested in the market and finds the ratio between them.

When the value of this ratio is greater than 1, it means that the market as a whole is currently making some gains. On the other hand, values below this threshold imply that losses are currently more dominant in the industry.

In the context of the current discussion, it is not actually the realized profit/loss ratio for the entire market that is the measure of focus, but the version specific to the “short-term holders” (STHs).

The STHs are one of the two largest groups in the Bitcoin market and include all investors who held their coins less than 155 days ago.

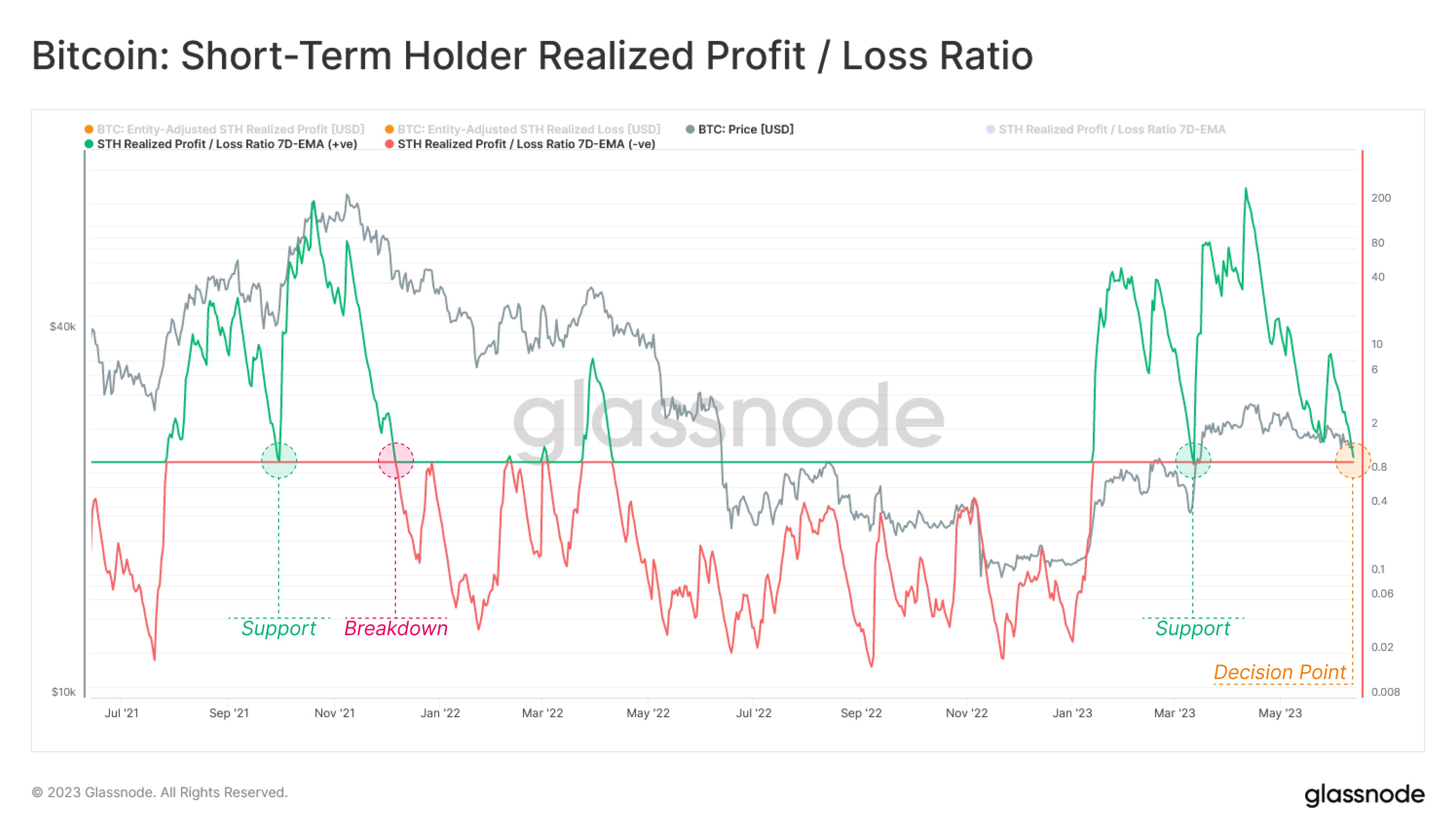

Here is a chart showing the trend in the 7-day exponential moving average (EMA) BTC STH realized profit/loss ratio over the past few years:

The value of the metric seems to have been going down in recent days | Source: Glassnode on Twitter

As shown in the chart above, the 7-day EMA Bitcoin STH realized profit/loss ratio has been above 1 for the past few months, suggesting that profit realization has been the dominant factor.

This makes sense, of course, since the rally happened during this period, which would have made these investors a lot of profit. However, lately, the statistic has been falling as the price has seen a decline.

From the chart, it can be seen that the indicator is now moving closer to the 1 mark. The 1 line has historically held tremendous significance for the market, as it serves as the point where the STHs just break even on their sales.

During bearish periods, this line has usually resisted the price of Bitcoin, while during bullish regimes it has switched to a support point. The reason behind this interesting pattern lies in the fact that investors view their break-even mark very differently between the two types of markets.

In a bearish environment, investors see the break-even mark as an ideal starting point because that way they can at least avoid taking losses. So there is a lot of selling at the level, leading to price resistance. Similarly, the investors view the level as a profitable buying opportunity during rallies, so they participate in some buying.

Clearly, if the current rally is to have any chance of success, this Level 1 retest must be successful. However, if a breakdown occurs here, a bearish regime could return for Bitcoin.

BTC price

At the time of writing, Bitcoin is trading around $26,000, up 1% over the past week.

BTC has been moving sideways | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Glassnode.com