Bitcoin continues to capture the attention of investors and analysts with its price changes and big moves. Recently traded on $65,715Bitcoin’s small gain of almost one percent over the past 24 hours has led to some cautious optimism among crypto fans around the world. This newfound confidence is reinforced by large whale activity and positive long-term forecasts from top analysts.

Related reading

Major investor buys $395 million worth of Bitcoin

A well-known crypto whale has made headlines by purchasing 6,070 BTC, worth approximately $395 million. This is the whale’s first major purchase in more than 18 months. Known for his smart trading moves, this investor previously bought 41,000 BTC during the 2022 market dip at an average price of $19,000 per BTC.

In a brilliant move, during the market boom in 2023 and 2024, the whale sold 37,000 BTC at an average price of $46,800, generating a massive $1.74 billion in proceeds and a profit of over $1 billion. This latest purchase shows the whale’s renewed confidence in Bitcoin’s future, hinting at major price moves ahead.

Analysts predict that Bitcoin could reach $100,000

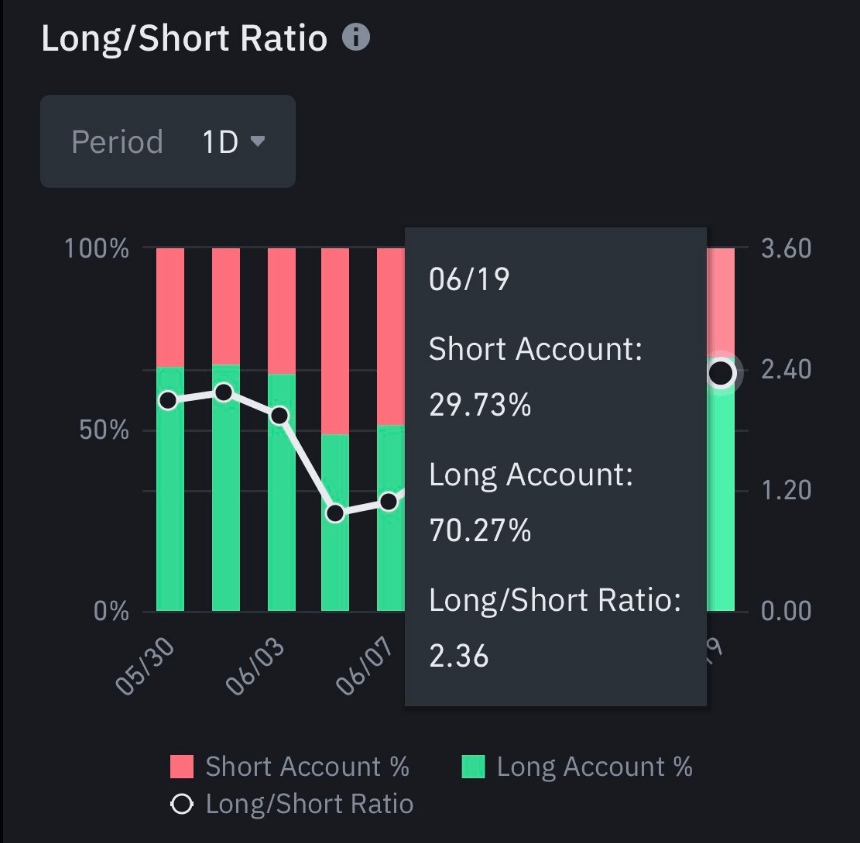

Top crypto analysts are very optimistic about Bitcoin’s future, with some predicting that it could happen $100,000. Ali Martinez, a respected crypto expert, points out that more than 70% of all open Bitcoin positions on Binance are bullish.

70.27% of all accounts in @binance with an open #Bitcoin position goes long! pic.twitter.com/PiGZp0rP58

— Ali (@ali_charts) June 19, 2024

Another analyst who goes by the name Jelle notes that Bitcoin has recently reached key support levels such as the 100-day Exponential Moving Average (EMA) and the bottom of an ascending triangle pattern.

Jelle believes that a rebound from these levels could push Bitcoin to $72,000 soon, paving the way for a potential surge to $100,000 in the long term. These predictions are consistent with a broader bullish view, as many believe Bitcoin’s current price represents a good buying opportunity.

More bullish signs on the horizon

Bitcoin’s recent price movement isn’t just attracting individual investors. More large institutional investors are showing interest, indicating growing confidence in Bitcoin’s value. Major investments from public figures and companies indicate broader acceptance and integration of Bitcoin into the mainstream financial world.

Related reading

Meanwhile, the Bitcoin price forecast for July is bullish, indicating a potential increase of 30% to more than $85,000, according to crypto price tracker CoinCodex. This is despite the fact that current technical indicators are bearish. This indicates a possible discrepancy between market sentiment and price action.

The Fear & Greed Index of 60 further emphasizes this dissonance. Although the price has seen almost half of bullish days (47%) over the past month with relatively low volatility (2.29%), the underlying technical data may indicate a different story. It will be interesting to see if the predicted price increase materializes or if the bearish undercurrents prevail.

Investors are closely watching Bitcoin’s price movements, looking for opportunities that could signal new highs. While the path to $100,000 is fraught with uncertainty, strategic insights from market veterans and increasing institutional interest provide a solid foundation for Bitcoin’s long-term potential.

Featured image from Pexels, chart from TradingView