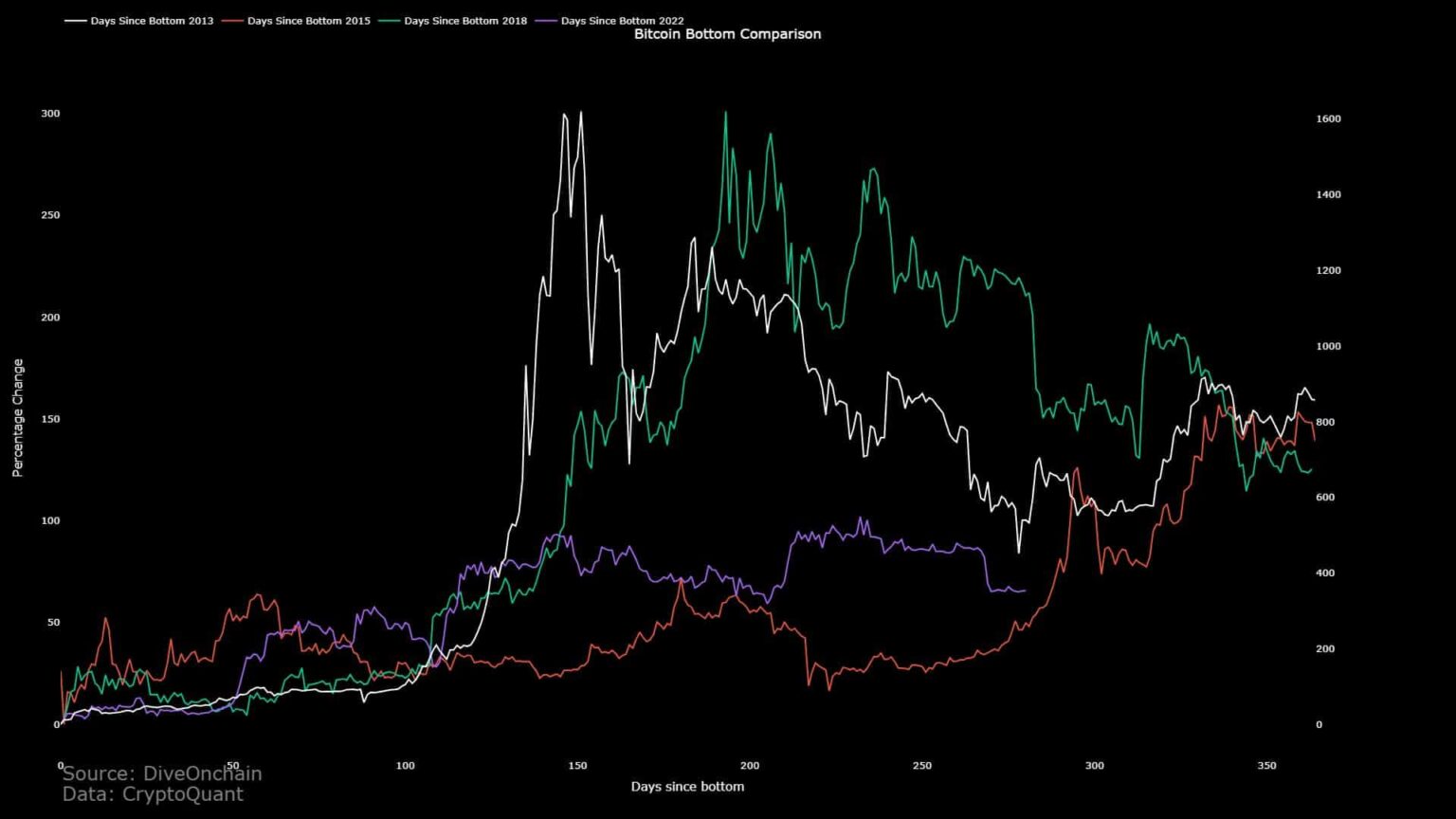

- The price movement of BTC at the time of publication was very similar to its trajectory in 2016 and 2020.

- Nearly 75% of the supply was held by diamonds, similar to the 2016 and 2020 cycles.

The month of August may be drawing to a close, but not before we witness the elusive volatility making a comeback in the crypto markets. After a mid-month freefall, Bitcoin [BTC] pumped up earlier this week amid growing anticipation surrounding its spot exchange-traded fund (ETF) filings.

Is your wallet green? Check out the BTC Profit Calculator

Maximalists believed that this optimism would keep the king coin in good condition, leading to the most important halving eventthat’s about eight months away.

Will history repeat itself?

This quadrennial event halves miners’ block rewards, eliminating the number of tokens in circulation. Historically, these events have preceded bull markets, raising hopes for a 2021-like scenario next year.

In addition, the ongoing trends also showed some resemblance to previous pre-halving periods.

According to CryptoQuant analyst YES MaartunBTC’s price movement at the time of publication was very similar to its trajectory in 2016 and 2020. Maartun predicted that relative stability would continue until the halving.

Source: CryptoQuant

Aside from the price action, the long-term owner (LTH) accumulation activity was also like history repeating itself. Nearly 75% of the supply was held by these diamond hands, similar to the 2016 and 2020 cycles.

Source: CryptoQuant

In addition, Bitcoin’s hash rate, i.e. the computational power required to create blocks on the network, has steadily increased over the years.

Since their total earnings from each block would drop from 6.25 to 3.125, miners would be tempted to use most of their resources to reap the higher rewards until the halving. This, in turn, could boost the hash rate even further.

Source: CryptoQuant

Is the HODLing mentality here to stay?

After noticing the above patterns, a fascinating new finding came to light. Since the last halving in May 2020, Bitcoin supply on the exchanges has undergone a trend reversal. As HODLing sentiment gained more money, LTH users began withdrawing their coins in favor of self-custody.

How much is 1.10.100 BTC worth today?

Therefore, it would be interesting to see how this trend will shape us after the next halving. Will LTH sell off much of their holdings in the event of a bull market, or will they continue to store BTC as a safe haven?

At the time of writing, BTC was priced at $27,254, according to data from Santiment. The positively weighted sentiment underlined the bullish mood among market participants.

Source: Sentiment