- Nearly $3 billion in BTC and ETH options are expiring as traders brace for high volatility and major price action.

- Market makers are repositioning amid a lull in holiday trading as $98K BTC and $3,700 ETH levels dominate attention.

Bitcoin [BTC] And Ethereum [ETH] options contracts worth $3 billion were set to expire on December 13. These expirations often lead to increased market activity, with traders keeping a close eye on potential price movements.

At the time of writing, Bitcoin was priced $100,073while Ethereum was trading on $3,881.12according to data from Coingecko.

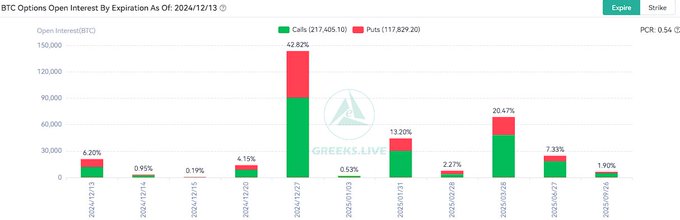

Bitcoin options worth $2.1 billion are nearing expiration

Bitcoin has $2.1 billion worth of options contracts expiring. The put-call ratio is 0.83, which indicates that there are more calls (bullish bets) than puts (bearish bets).

The maximum pain point – the price point at which most options will expire worthless – is $98,000.

Source:

With Bitcoin’s market cap at $1.98 trillion and a circulating supply of 20 million coins, traders are keeping an eye on its next steps.

The 24-hour trading volume for BTC has reached $94.48 billion, indicating increased activity as the expiration date approaches.

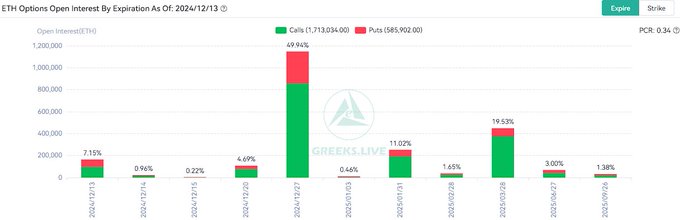

Ethereum options see $640 million expiration

Ethereum has $640 million worth of options expiring, with a put-call ratio of 0.68, showing even stronger bullish sentiment than Bitcoin. The maximum pain point for ETH is $3,700, a crucial level that traders are closely watching.

Source:

Ethereum’s trading volume over the past 24 hours is $44.47 billion, with a market cap of $467.65 billion and a circulating supply of 120 million ETH.

Although ETH has seen a slight price decline of 0.63% over the past 24 hours, its week-on-week performance remains flat, reflecting a wait-and-see attitude among traders.

Market makers are repositioning as liquidity diminishes

According to Greeks.livemarket makers are shifting their positions during this period of expirations, which coincides with reduced trading volumes during the holiday season.

Analysts have noted rising implied volatility (IV), indicating markets are preparing for sharper price movements. “Lower liquidity during the holidays often increases market volatility,” Greeks.live analysts said.

They also highlighted the growing correlation between crypto prices and the US stock markets, suggesting that stock price movements could influence cryptocurrency movements.

Economic data adds additional complexity

The expiration of these options comes after a week of economic developments in the US in November inflation rose to 2.7%, with a core CPI of 0.3%, pointing to persistent inflation concerns.

Read Bitcoin’s [BTC] Price forecast 2024-25

While a rate cut by the Federal Reserve is expected, concerns remain about whether inflation will slow the easing.

These factors, combined with billions in crypto options expiring, could lead to increased market activity.