Hannah Phung, lead analyst at the on-chain analytics platform SpotOnChain, recently gave her thoughts on the impact Bitcoin Halving could have on the price of the flagship crypto. This adds to the ongoing debate over whether or not the Halving event could cause this The price of Bitcoin will rise to $100,000.

Bitcoin’s price increase may not come immediately

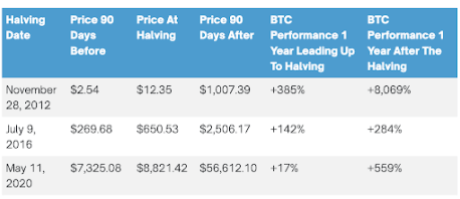

Phung mentioned during a interview with BeInCrypto shows that the price of Bitcoin tends to increase about 6 to 12 months after the date Halving and not immediately. This is evident from the previous halving events, such as Bitcoin’s significant price gains came about a year after the halving took place. After the first halving on November 28, 2021, Bitcoin experienced a price increase of more than 8,000% a year after the event.

Source: Milk Road

Meanwhile, BTC saw a price increase of 284% and 559% one year after the second and third halving events, which occurred on July 9, 2016 and May 11, 2020, respectively. Phung further noted that Bitcoin’s price gains come from the decline in its price The supply of Bitcoin minerswhich helps increase scarcity and drives up its price, especially when demand is stable.

NewsBTC was published in February reported that the demand for Bitcoin far exceeded the supply of the miners. This led several crypto analysts to make bullish predictions that Bitcoin’s price could rise exponentially if miner rewards are further halved later this month. One of those analysts was MacronautBTC, who raised the possibility of Bitcoin rising to $237,000.

This Bitcoin halving could be different

Even though it is known that the crypto market will follow suit historical patternsPhung emphasized that the market can also be unpredictable, raising the possibility that this halving will be different from previous halvings. Moreover, this cycle has already proven to be different, considering that Bitcoin reached a point for the first time new all-time high (ATH) before the halving.

Furthermore, the analyst acknowledged that the Bitcoin market is “much larger and more established compared to previous halvings.” However, Phung still expects a price increase after the halving, although she admitted that the exact timing is uncertain, meaning it could be sooner or even later than normal.

Crypto analyst Rekt Capital also echoed a similar sentiment about how things could be different this cycle when he shared his analysis of the five phases of the Bitcoin halving. He specifically stated that the reaccumulation phase “may not last very long before continuing uptrend,” as this is the first time the reaccumulation range will be around a new ATH.

Market sentiment could determine Bitcoin’s price after the halving

Phung also elaborated on how market sentiment post-halving could provide insight into Bitcoin’s future trajectory. She predicts that crypto investors will likely be bullish once the halving occurs given the event’s significance for Bitcoin supply.

However, once the excitement about the halving subsides, various metrics such as price charts, trading volume, social media discussions, and on-chain data such as active addresses or exchange offerwill need to be analyzed to determine if investors are still bullish.

Meanwhile, Phung suggested that the price surge that occurs immediately after Bitcoin’s halving may not be short-lived this time as more institutional investors are now involved and have helped create a ‘more mature market’.

BTC price rises to $70,700 | Source: BTCUSD on Tradingview.com

Featured image from Bitcoin News, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.