- Solana’s revenues did not increase despite low network congestion

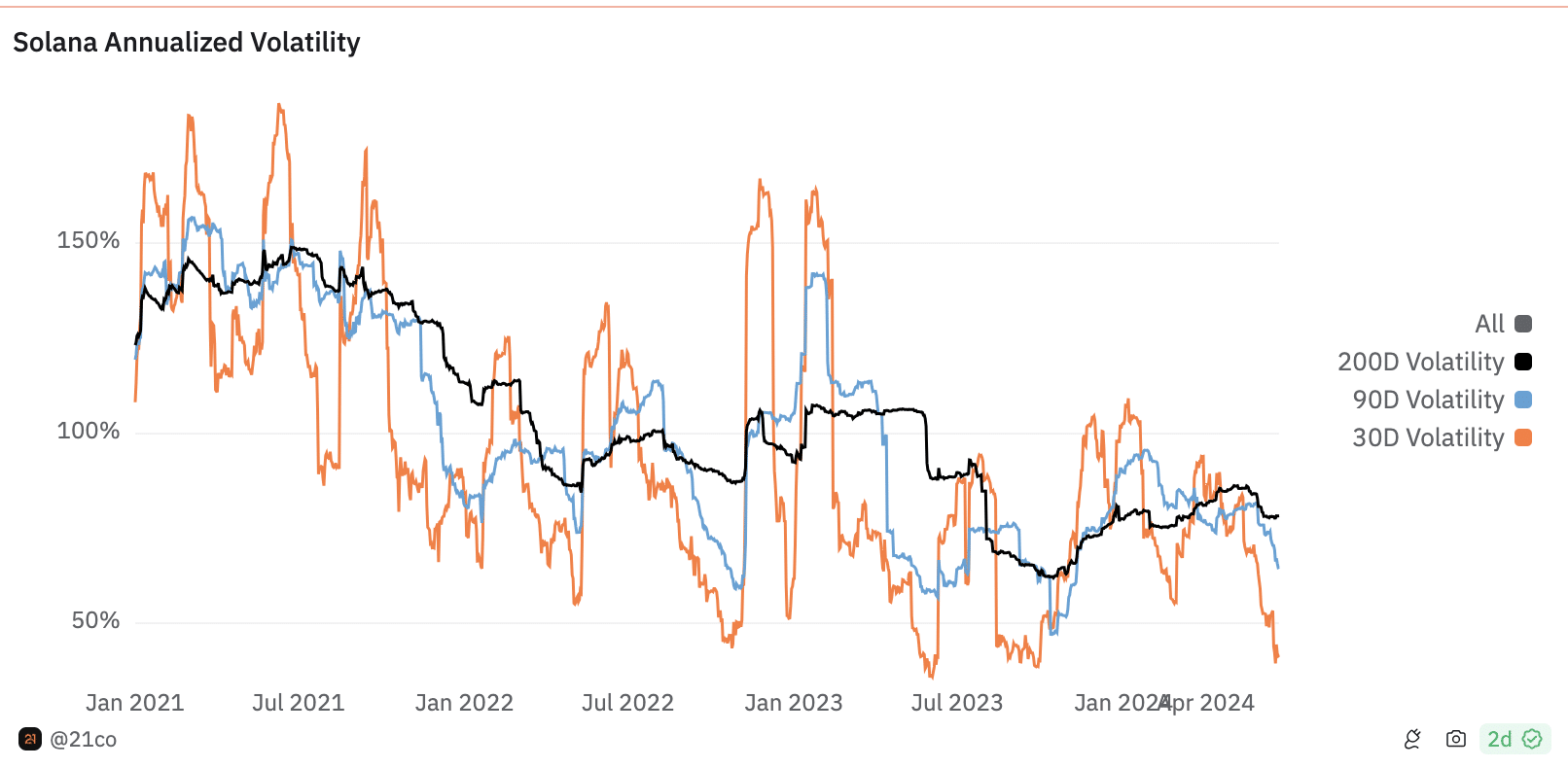

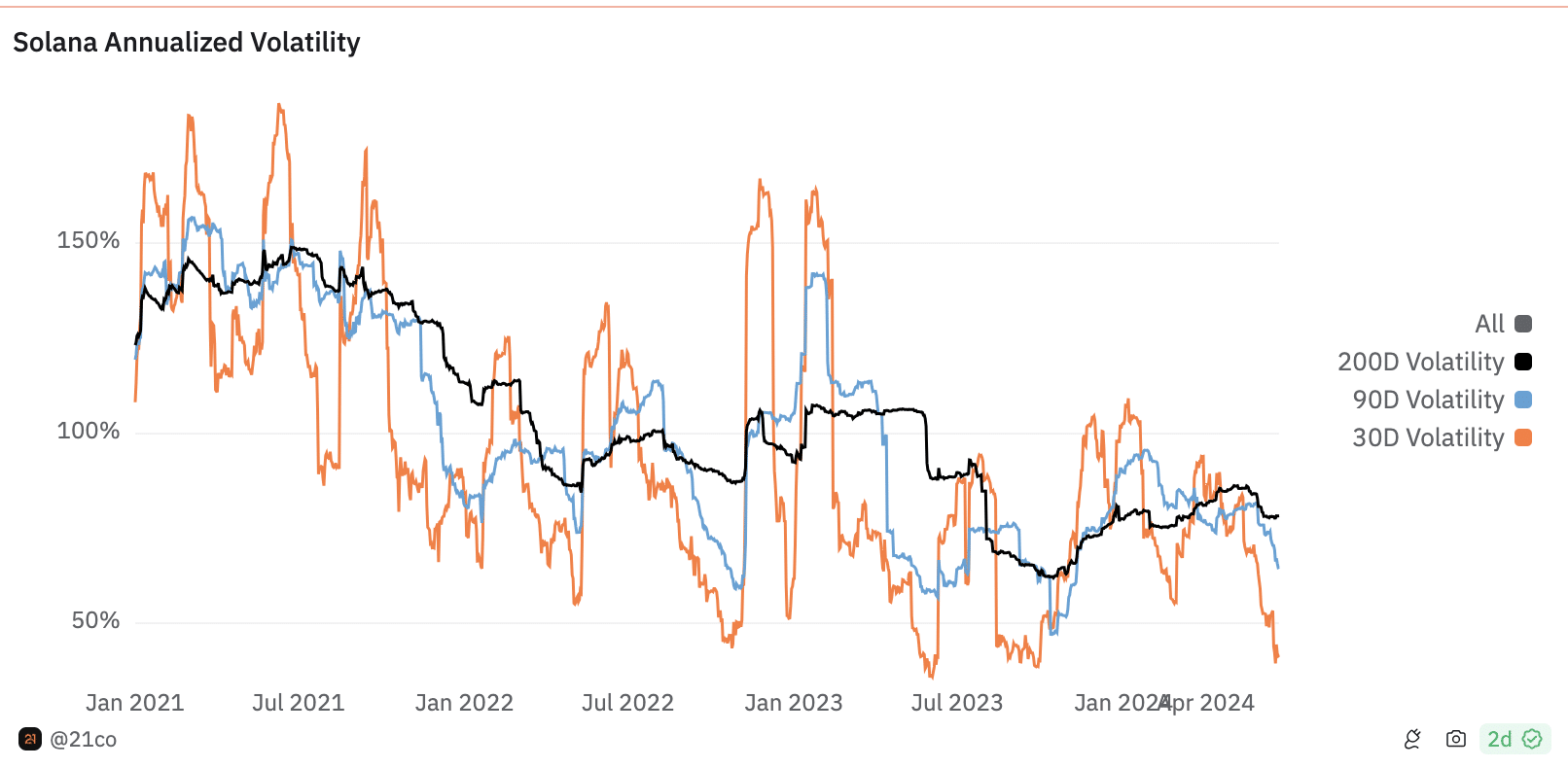

- Volatility around SOL decreased, indicating that a breakout was not close.

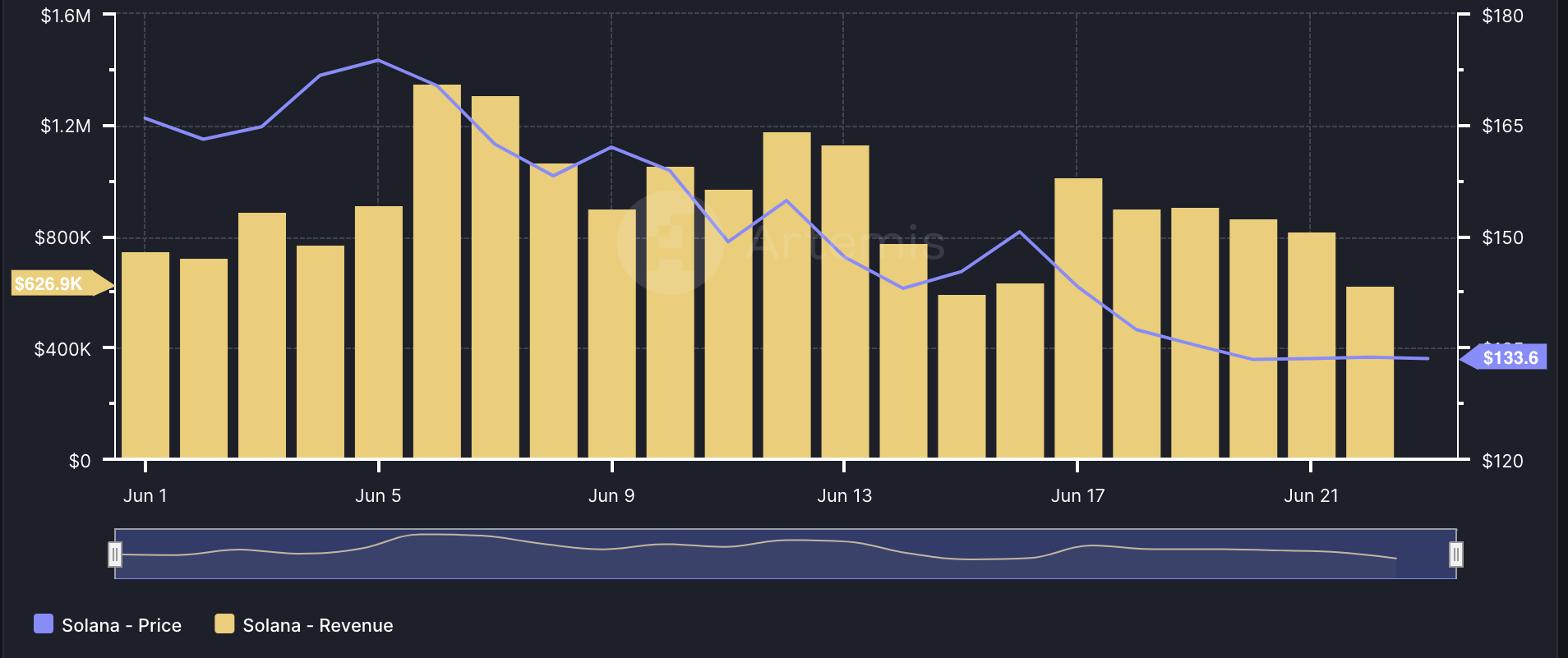

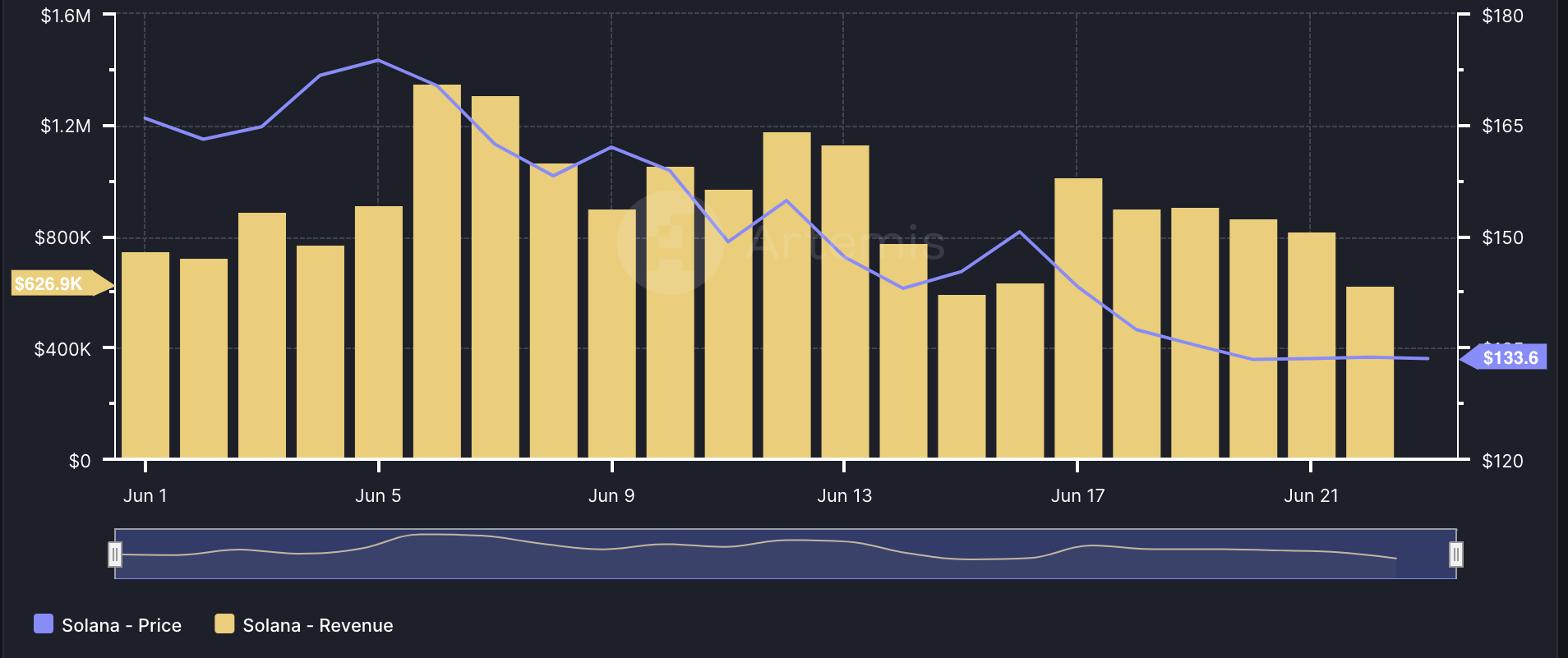

The Solana [SOL] blockchain took a hit on June 23, when sales hit their lowest point in the past seven days. At the time of writing, the project is gain amounted to $626,900.

The value was an indication of the economic value of Solana. The sales drop to one Solana upgrade that happened a few days ago.

On June 10, AMBCrypto reported how the project asked validators to upgrade to a new node.

The idea behind the development was to solve the congestion problems that the blockchain has been facing for some time.

As a result, fees were no longer unusually high and Solana appeared to have maintained its high throughput of 2,000 to 3,000 transactions per second (TPS).

Source: Artemis

Success is not final for Solana

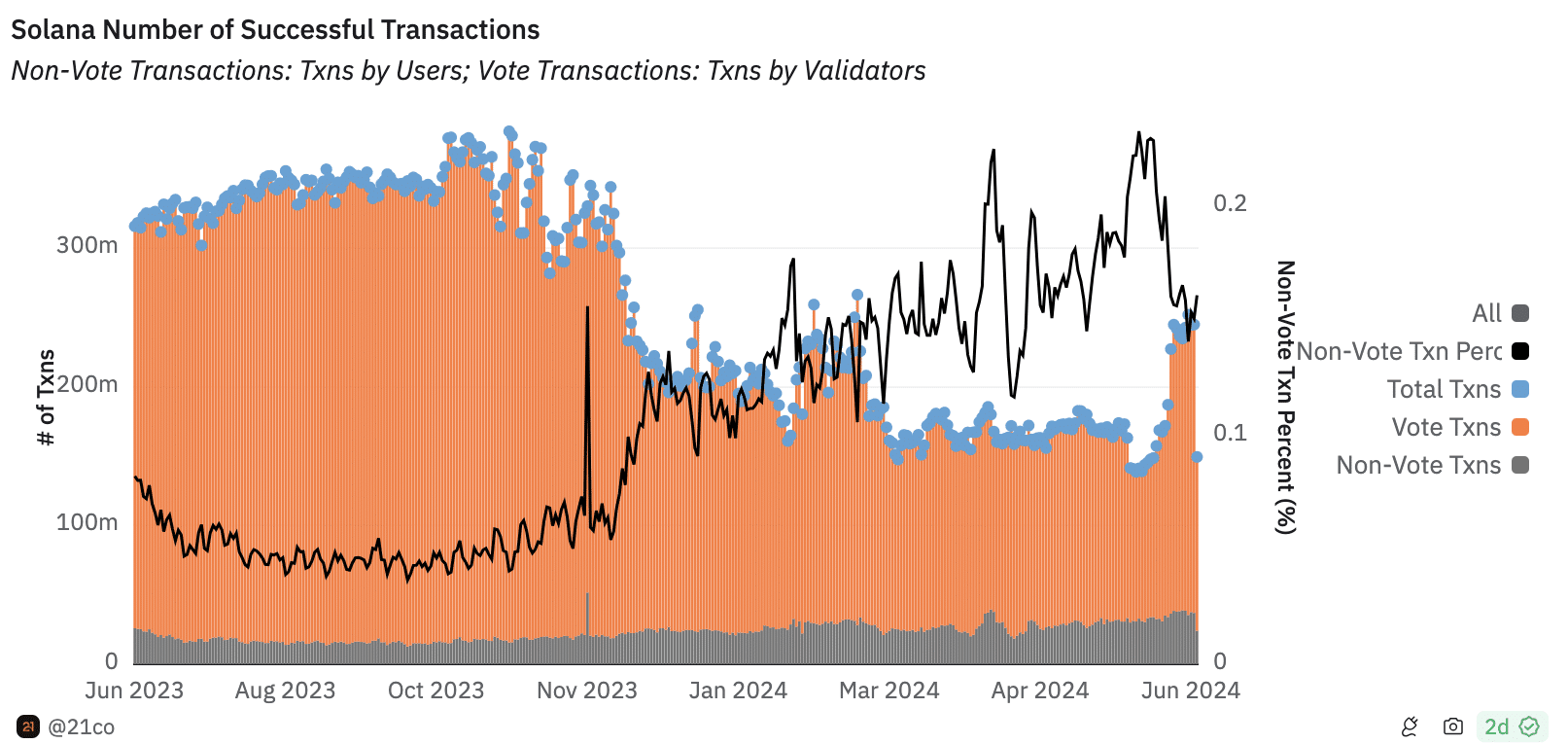

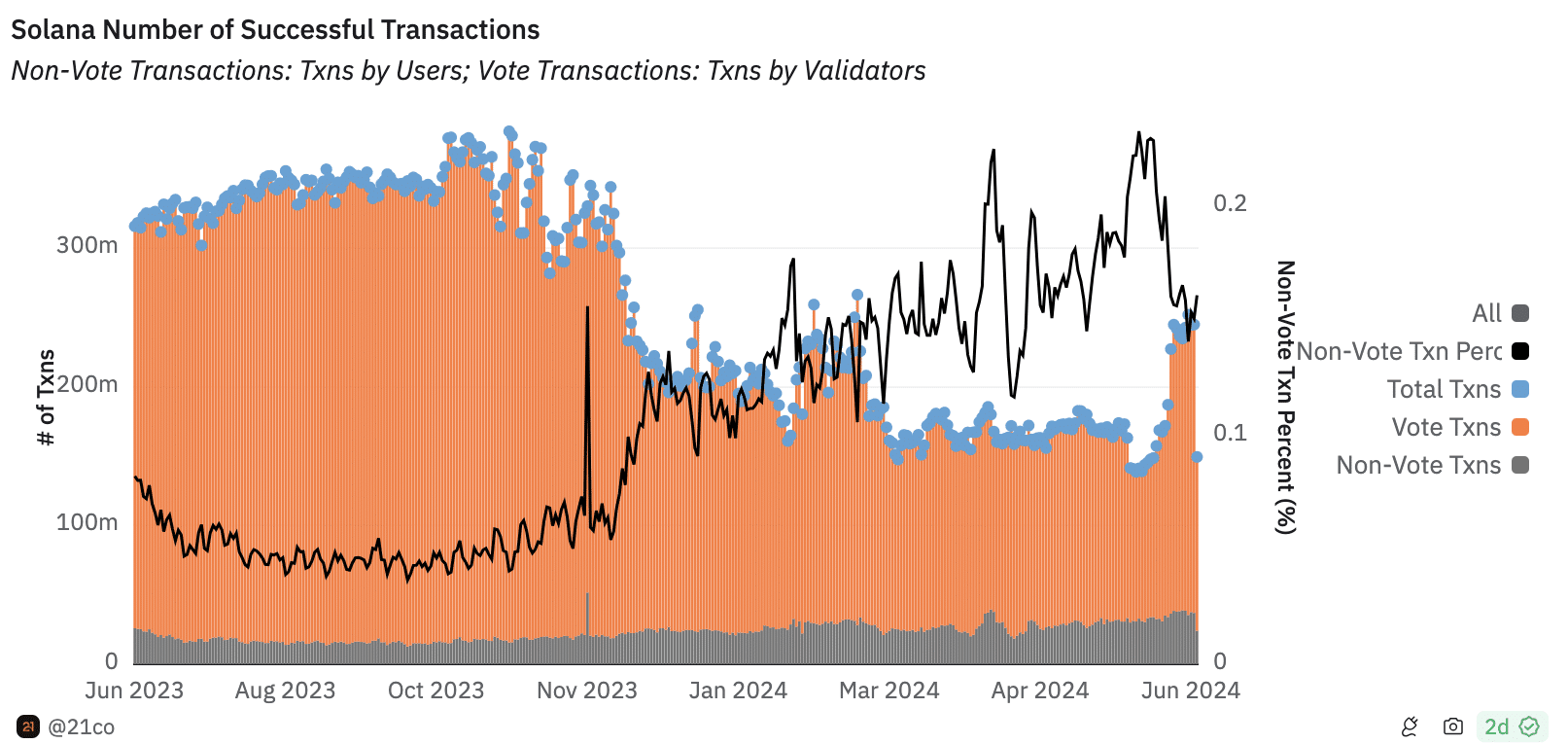

The proof of this is reflected in the number of successful transactions. According to Dune, the number of voting transactions was 206.94 million. On the other hand, non-voting transactions amounted to 37.57 million.

A non-voting transaction occurs when market participants transfer SOL between Solana accounts or smart contracts. A voting transaction is a transaction submitted by validators on the blockchain.

Therefore, the increase implied that most transactions extended compared to the period when approximately 75% of non-voting transactions failed.

Source: Dune

Moreover, this development could affect SOL’s price forecast. At the time of writing, the token’s price was $133.71. As SOL attempted to jump to $140 on June 22, bears disrupted the effort.

However, it may be challenging for the token to reach a higher price in the short term. This was due to year-on-year volatility.

SOL to continue the sideways movement

Volatility shows how quickly prices can move. If the volatility level is high, it means that the price can jump to an extremely high level within a short period of time.

However, the low volatility implies something else. For Solana, 200-day annualized volatility was 77.80%. In the past 90 days it was 66.30%.

But at the time of writing it had dropped to 39.60%, Dune data showed. The decline in this measure implies that SOL could continue to fluctuate within a tight range in the coming days.

Source: Dune

Should this condition remain the same, the value of the cryptocurrency could fluctuate between $130 and $140.

Moreover, the Relative Strength Index (RSI) showed bearish momentum. The RSI uses the speed and magnitude of price changes to indicate the price momentum of a cryptocurrency.

Values above 70 indicate an asset is overbought, while values below 30 indicate it is oversold. At the time of writing, the RSI on the SOL/USD chart dropped to 45.00.

Read Solana’s [SOL] Price forecast 2024-2025

The downtrend of the indicator showed that the momentum was bearish.

Source: Santiment

So SOL’s price forecast could go down in the short term. However, an invalidation could occur if prices start to rise in the broader market.