- Solana’s trading volume has fallen sharply over the past seven days.

- A key technical indicator pointed to a soon price drop.

Solana [SOL] has witnessed a slight correction in the last 24 hours, just like several other cryptos. However, a recent analysis has shown that it is crucial for the token to stick within a certain range to maintain its price.

Will SOL be able to do that, or could SOL lose market cap by the end of 2024?

Solana’s Crucial Level!

After a weekly price increase of almost 5%, the value of the token has fallen over the past 24 hours. At the time of writing, SOL was trading at $193 with a market cap of over $92 billion.

Ali Martinez, a popular crypto analyst, posted one tweet shows an interesting development. Martinez said it is crucial that the token keeps its price within the $190-$180 range.

IIn case of a decline below that level, the token could witness a further price drop, which could leave many investors in losses.

AMBCrypto then checked Solana’s on-chain data to find out if SOL falls within this range in the near term.

What’s going on with SOL?

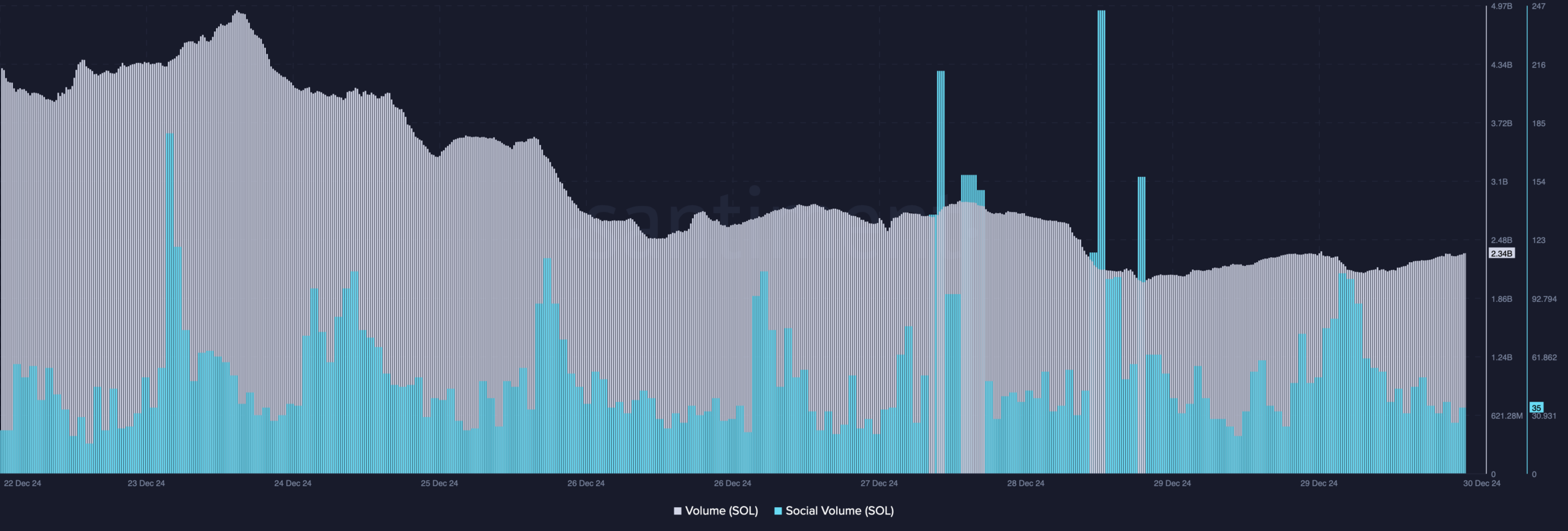

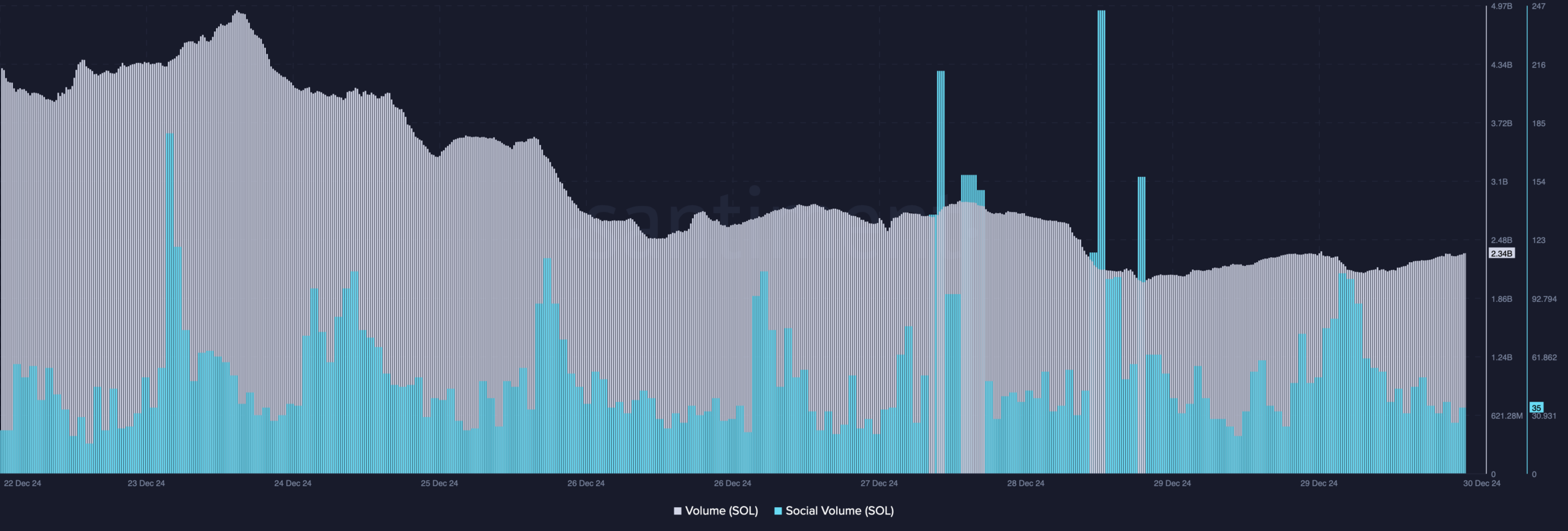

According to our analysis of Santiment’s data, SOL’s price could continue to decline as trading volume fell over the past week. A drop in the statistic indicates a continued bearish trend.

Nevertheless, Solana’s social volume remained high, reflecting the token’s popularity in the crypto market.

Source: Santiment

Despite the declining volume, SOLs remained Long/short ratio registered an increase. This meant that there were more long positions in the market than short positions, which could be considered a bullish update.

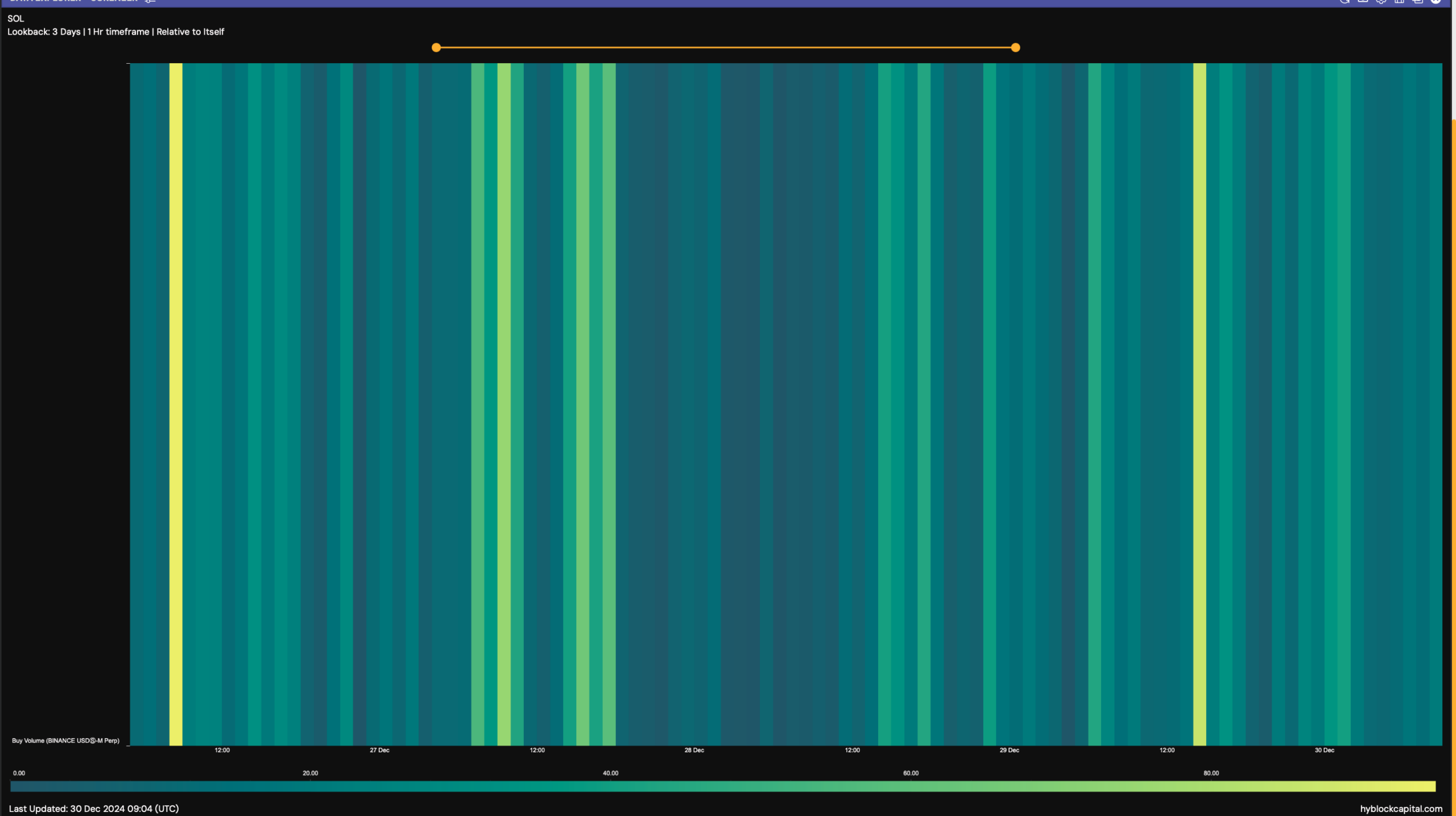

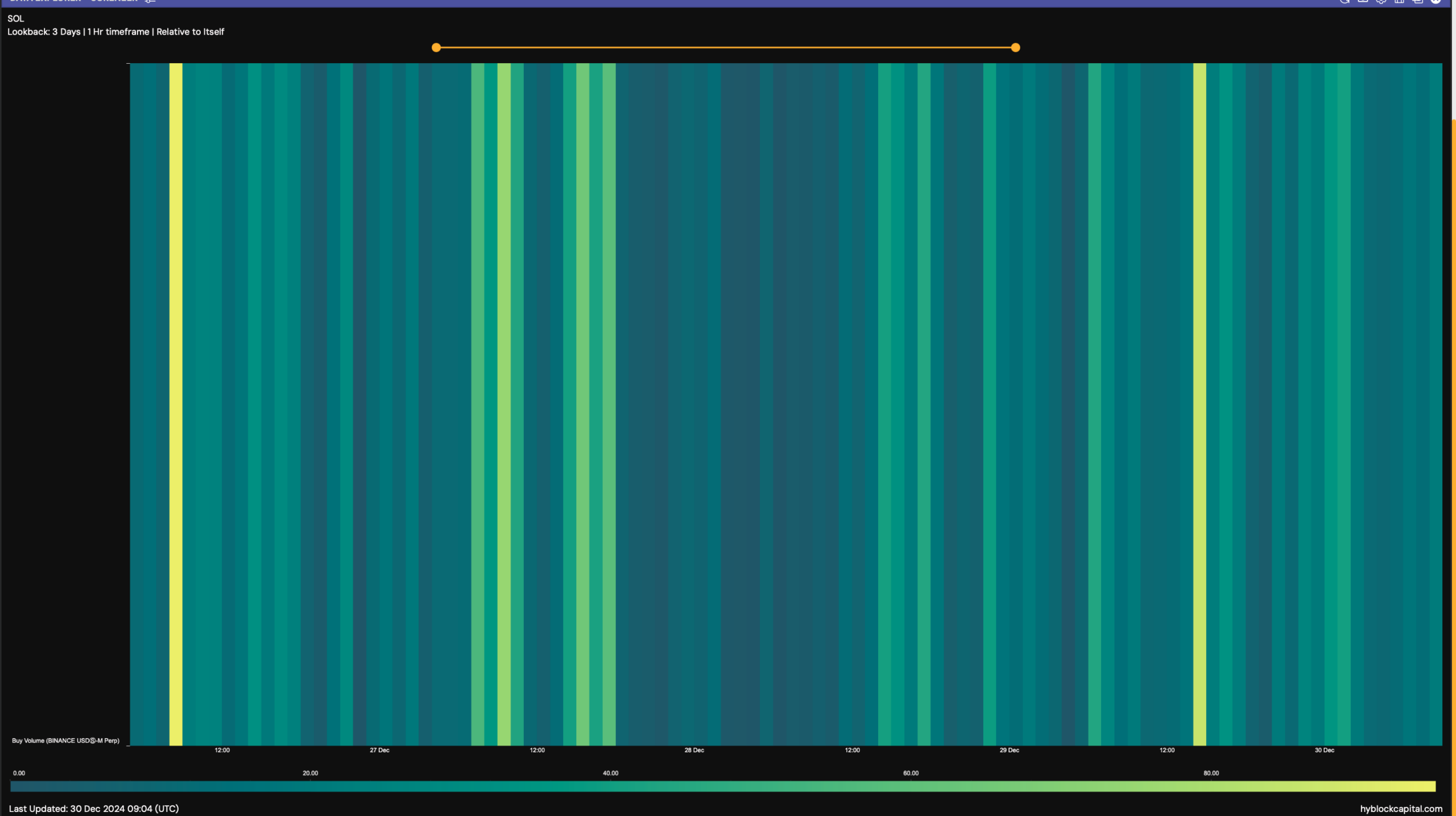

AMBCrypto’s analysis of Hyblock Capital’s data revealed yet another bullish metric, suggesting Solana could now move below the critical trading range.

TThe buying volume of the token reached 86 on December 29. A value closer to 100 indicates that buying pressure is high, which positively affects the price of an asset.

Source: Hyblock Capital

The fact that buying pressure on Solana increased was further proven by a technical indicator. The token’s Relative Strength Index (RSI) recorded a slight increase, indicating an increase in buying activity.

However, the Chaikin Money Flow (CMF) has fallen in the recent past – signaling a decline in buying activity.

Read Solanas [SOL] Price prediction 2025–2026

Whether this will lead to Solana’s price falling below $180 in the coming days is a question that can only be answered.

Source: TradingView