- Market sentiment around Solana turned bearish in recent days.

- But there was a chance that the sell signal would be canceled out.

Solanas [SOL] price volatility has fallen over the past week as both the daily and weekly charts have been inactive.

But if we consider the latest data, a sell signal appeared on the chart of SOL, which could lead to a price drop in the coming days. Let’s see what’s going on.

Solana slows down a gear

According to CoinMarketCap’s factsThe price of SOL is down only 1% over the past seven days.

At the time of writing, SOL was trading at $142.28 with a market cap of over $66 billion, making it the fifth largest crypto.

In the meantime, Ali, a popular crypto analyst, recently posted tweet points to a crucial development. According to the tweet, a sell signal flashed on Solana’s 4-hour chart.

When a sell signal appears, it indicates that there are chances of a price correction.

Therefore, AMBCrypto planned to take a closer look at the state of the token to see if the statistics also indicated a price drop.

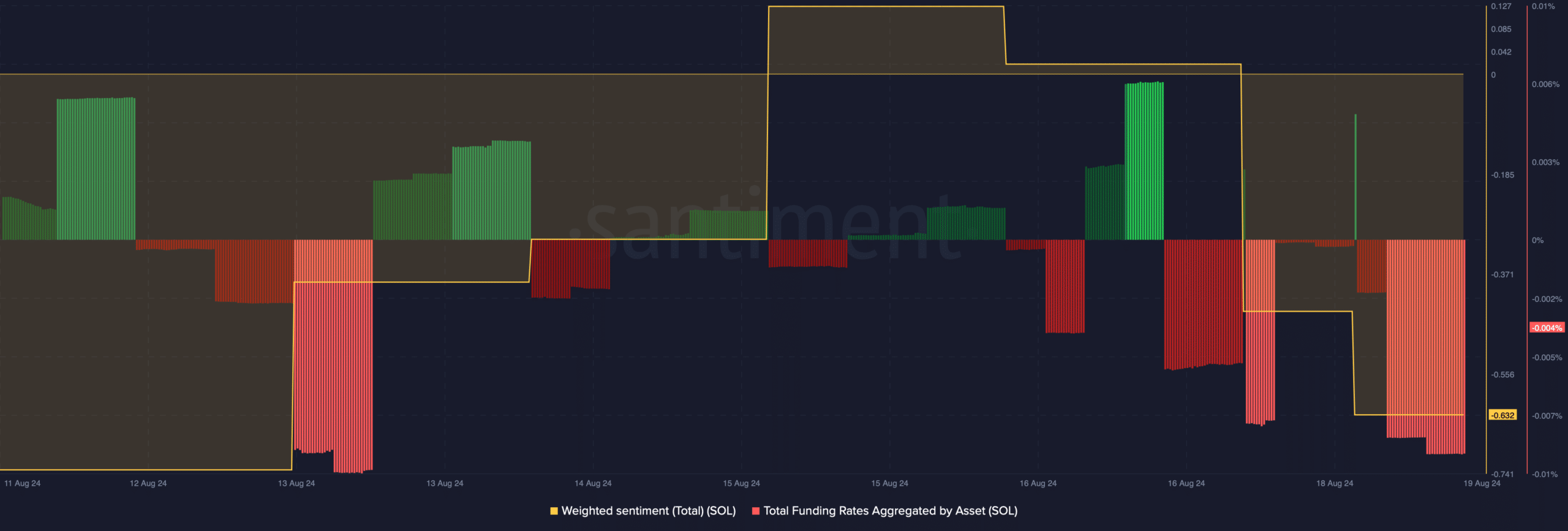

According to our analysis of Santiment’s data, SOL’s weighted sentiment fell sharply, meaning bearish sentiment around it increased.

According to Coinglass’ factsThe long/short ratio also showed a sharp decline. This meant that there were more short positions in the market than long positions, which was bearish.

Source: Santiment

Nevertheless, not everything seemed bearish as Solana’s funding rate fell. In general, prices tend to move in the opposite direction to the financing rate.

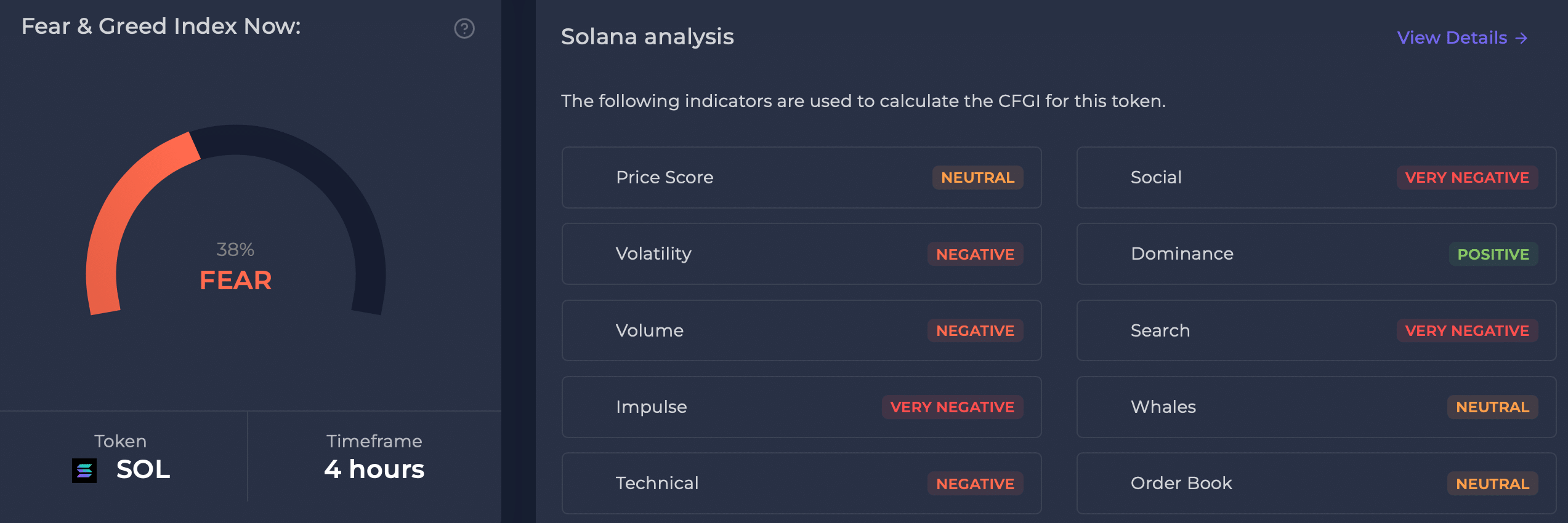

Furthermore, SOL’s Fear and Greed Index was at 38% at the time of writing, meaning the market was in a “fear phase.”

The index reaching this level indicates the possibility of a price increase. AMBCrypto had previously reported that selling pressure on Solana was low, which can be interpreted as a bullish signal.

Source: CFGI.io

Solana’s upcoming goals

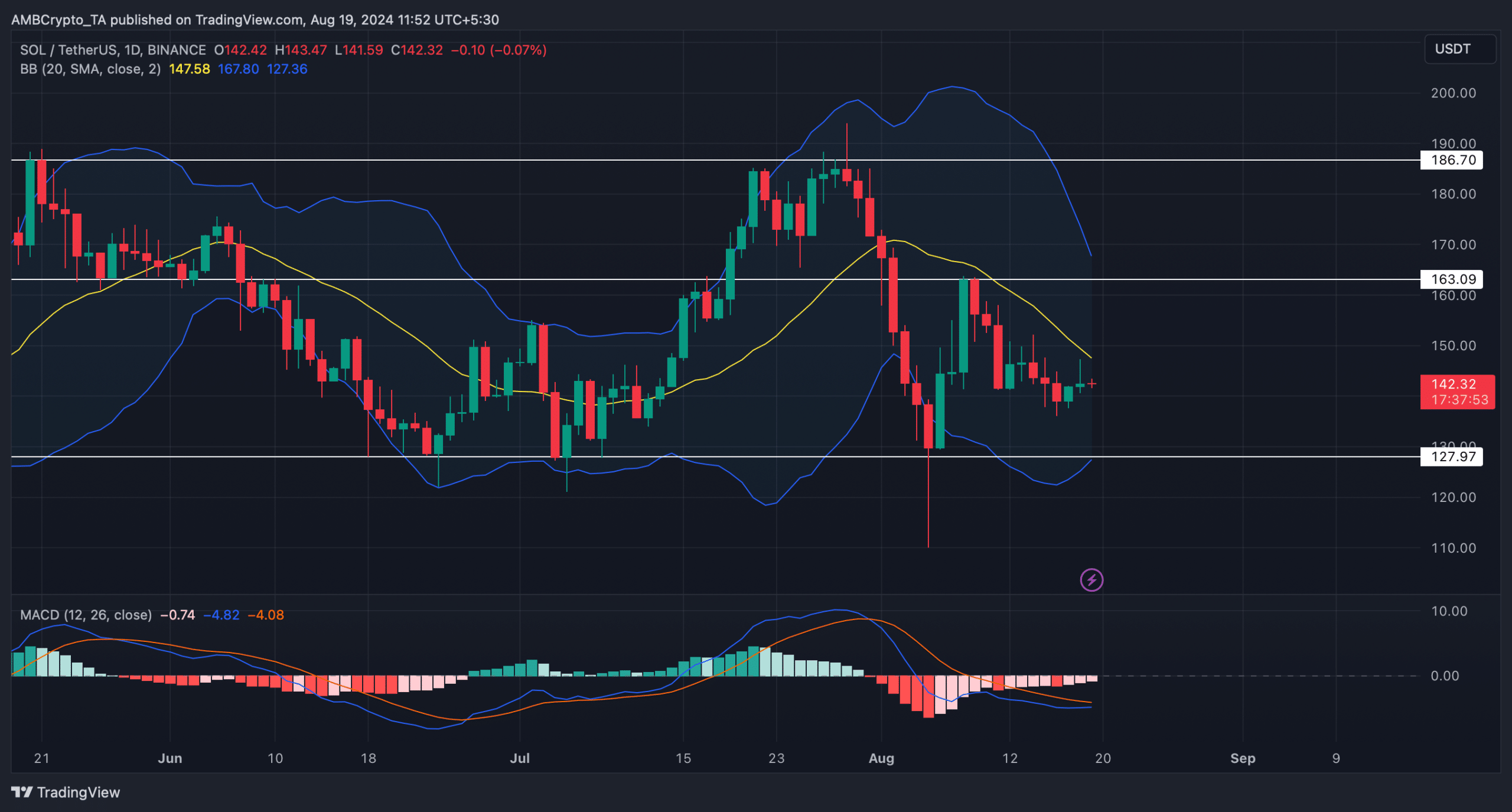

AMBCrypto then looked at Solana’s daily chart to find out what market indicators were suggesting. The Bollinger Bands revealed that SOL was testing its 20-day simple moving average (SMA).

Read Solanas [SOL] Price prediction 2024-25

The MACD showed the chances of a bullish crossover. If that happens, SOL could successfully move above its 20-day SMA.

This could allow SOL to target $163 before moving towards $186. However, if SOL takes a step further as suggested by the sell signal, investors could witness a drop in the token towards its support near the $129 range.

Source: TradingView