- Solana’s trading volume and weighted sentiment have declined in recent days.

- SOL could rebound if the price drops to $144.

Solana [SOL] The bulls have managed to maintain their lead over the market over the past week. Thanks to that, the token is approaching a crucial level. A breakout above that could further push the token’s price higher in the coming days or weeks.

Solana approaches a resistance

CoinMarketCaps facts revealed that Solana is up more than 7% in the past seven days. At the time of writing, it was trading at $147.28. In the meantime, Ali, a popular crypto analyst, posted tweet highlighting the fact that SOL was approaching a crucial resistance.

According to the tweet, it was important for Solana to get above the $154 resistance as a rejection at that marl could push the token lower. To be precise, a failed test could push Solana back to $85, which could be disastrous for several investors.

Source:

Apart from this, AMBCrypto’s look at Coinglass’ facts also revealed a bearish statistic. Our findings suggested that Solana’s long/short ratio declined.

Whenever the measure falls, it indicates that there were more short positions in the market than long positions, which can be inferred as a bearish signal.

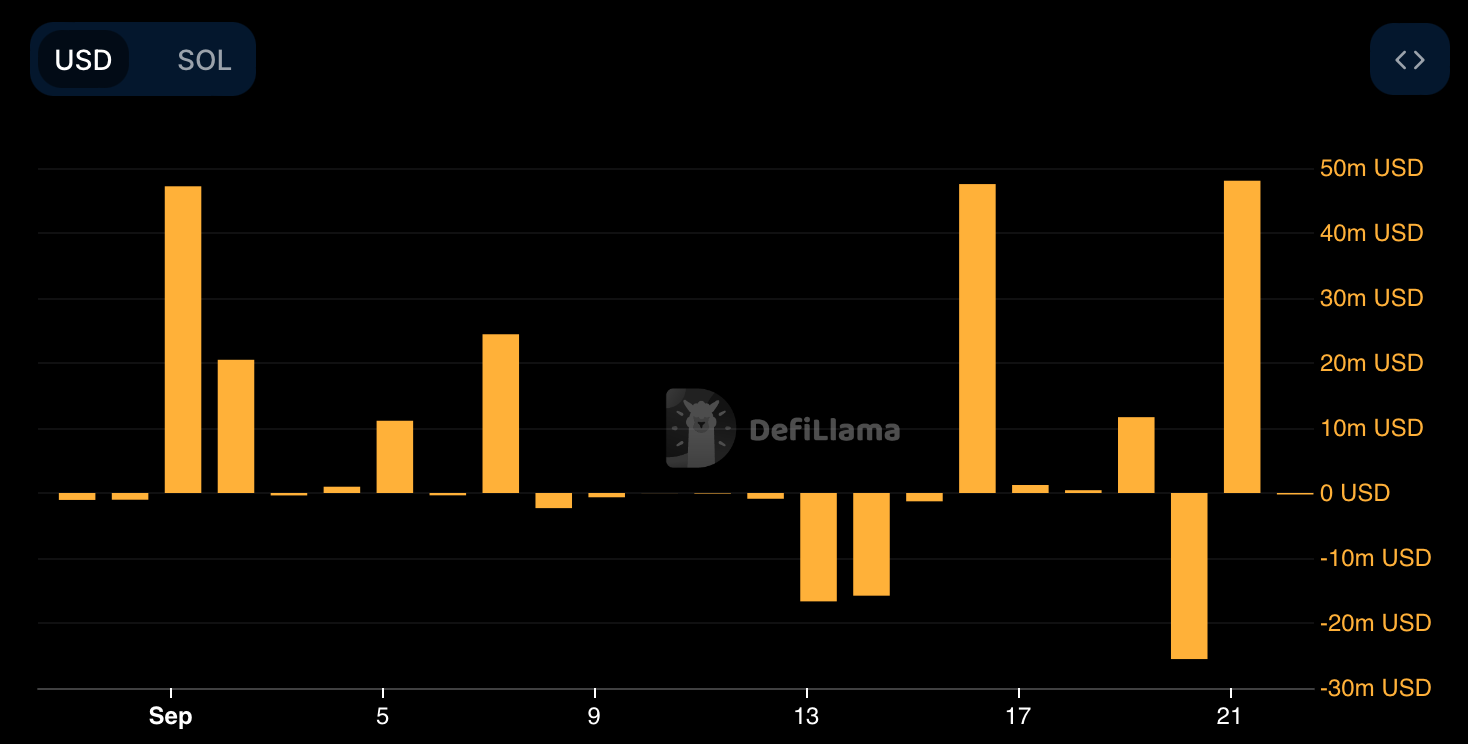

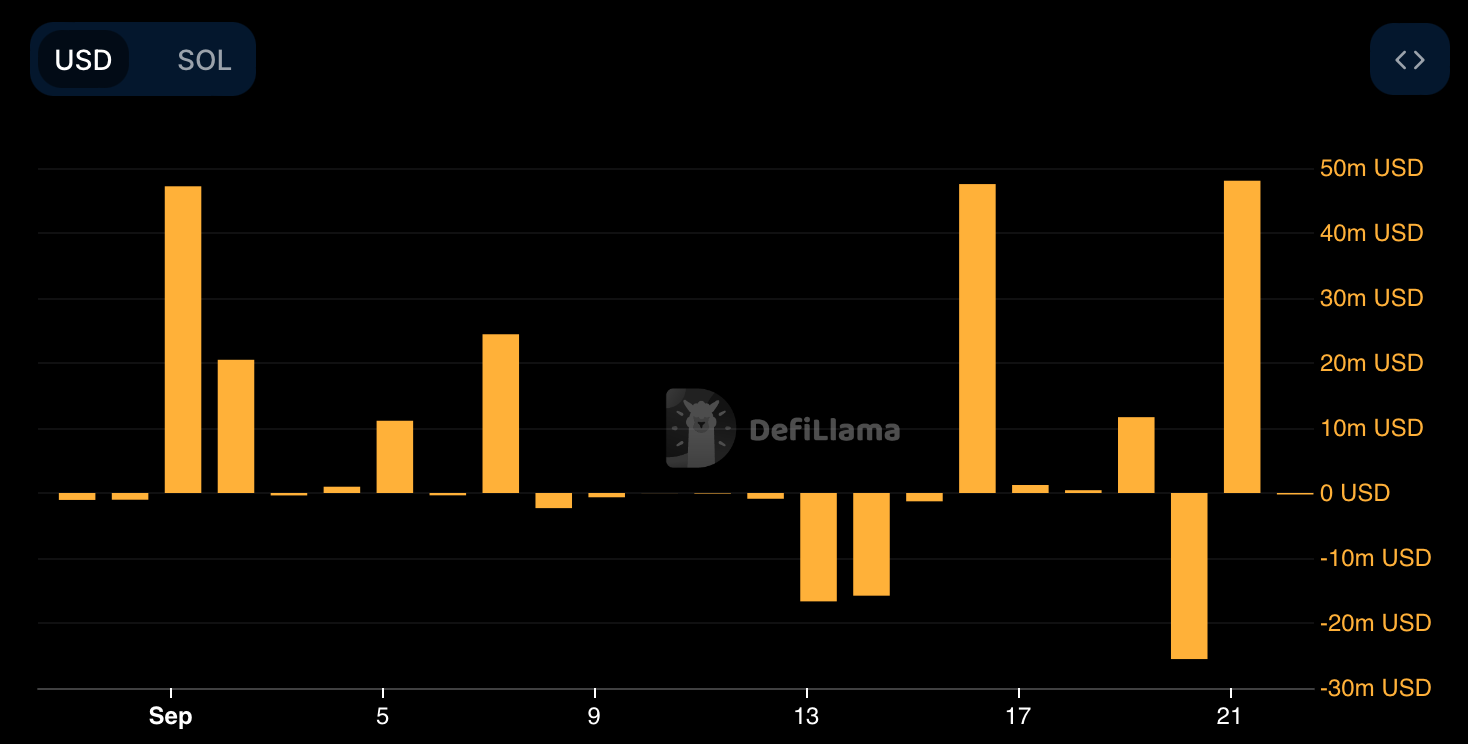

Moreover, SOL’s net flow also turned positive. This clearly suggested that selling pressure on the token was increasing. To be precise, Solana’s inflows amounted to $48 million as of September 21, 2024.

An increase in selling pressure indicates that the chance of a price correction is high.

Source: DefiLlama

AMBCryoto then reviewed the token’s daily chart. Our analysis showed that the Solana’s Chaikin Money Flow (CMF) recorded a decline. This indicated a price correction. However, the MACD was bullish as it showed a buyer’s advantage in the market.

Source: TradingView

Read Solanas [SOL] Price prediction 2024–2025

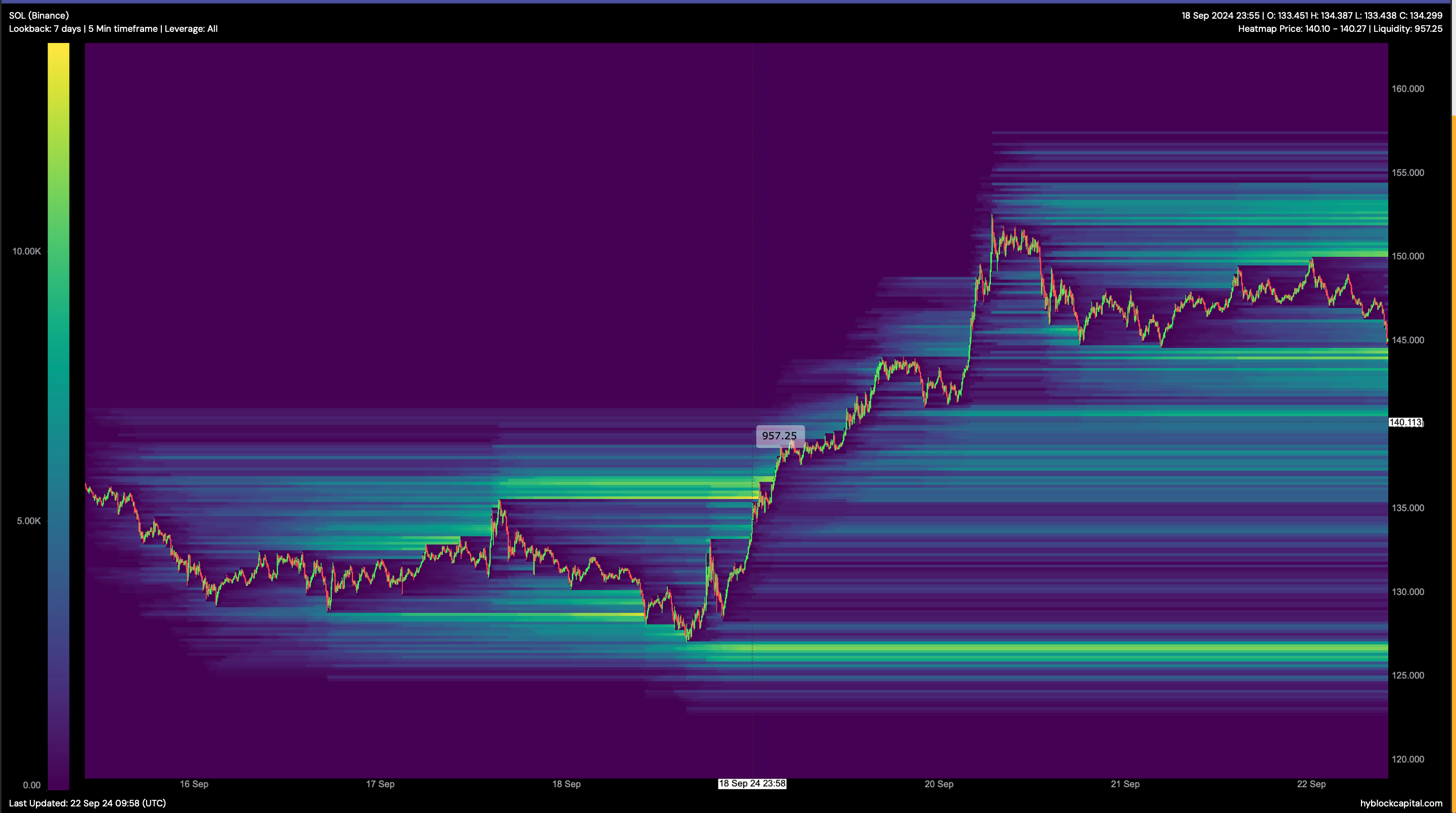

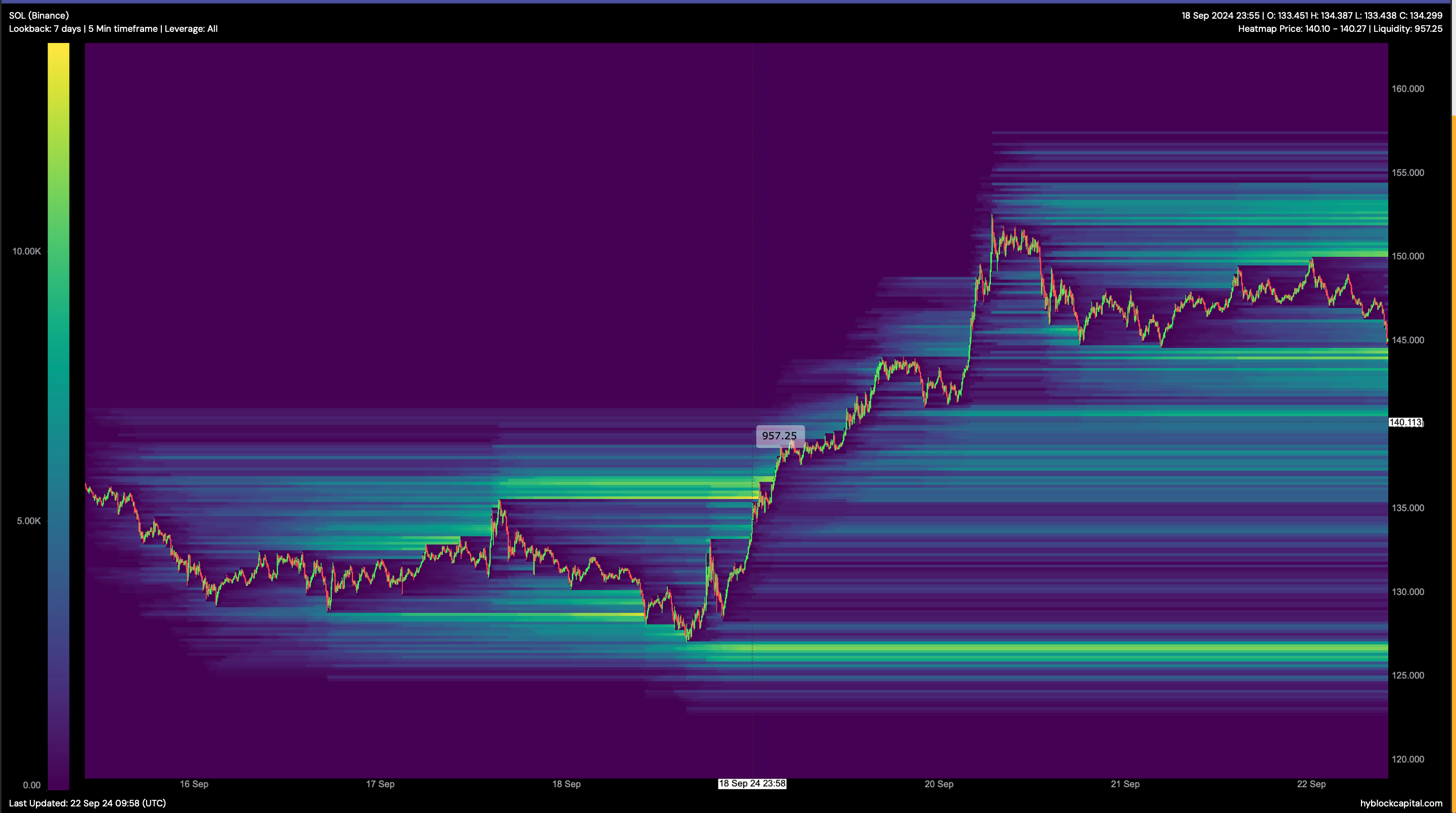

According to Hyblock data, if the downturn continues, SOL has a strong support at $144. From there, the token can rebound. If that happens, SOL could reach $150 before targeting $1564.

Source: Hyblock Capital