- There is a risk that DOT could fall to or below the historic low of $2.00 if it fails to hold the support level at $4.001.

- A noticeable lack of interest from retail investors signals a potential decline for DOT.

This past year Polkadot’s [DOT] Market performance was noticeably weak and substantially underperformed, with a 3.36% decline wiping out most of the gains for spot holders.

This downward trend was consistent in both daily and weekly time frames.

Further analysis conducted by AMBCrypto suggested that DOT holders may need to brace for losses if the crucial support level does not hold.

Will big support help DOT?

At the time of writing, DOT was trading actively at $4,125, declining towards the $4,001 support level.

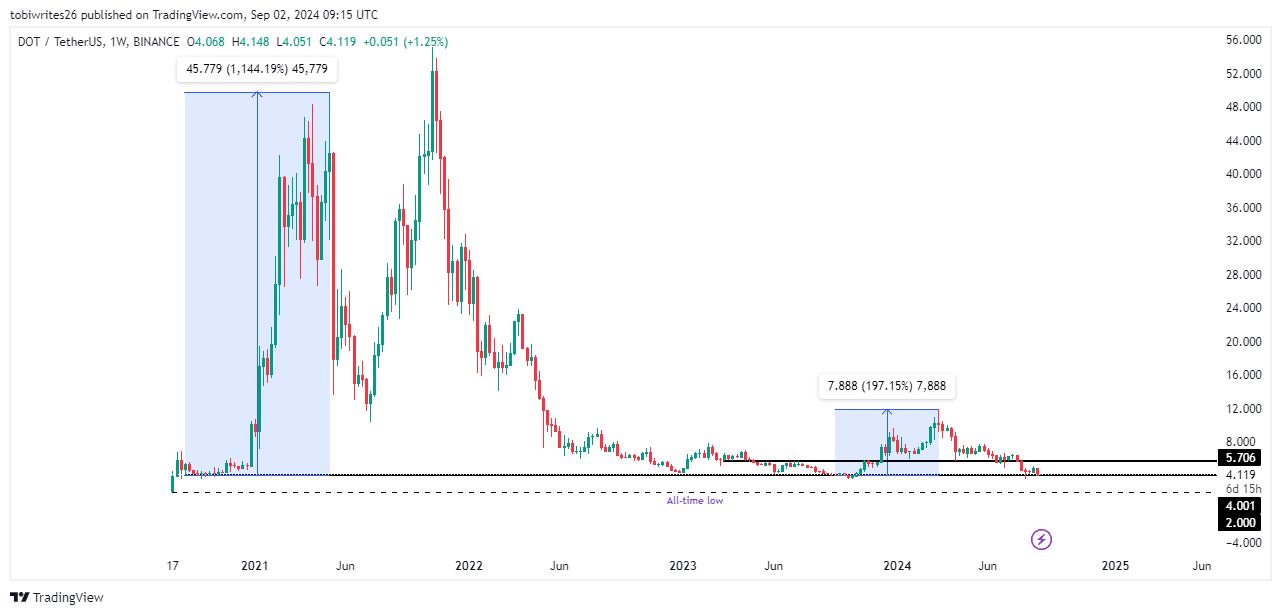

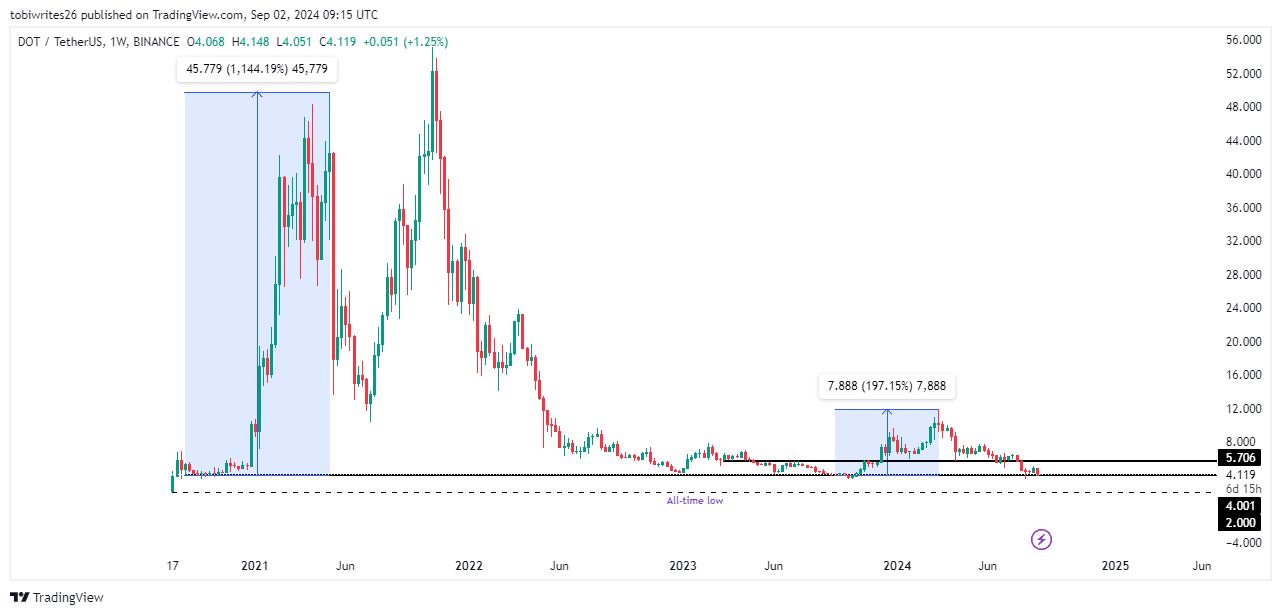

This level of support has previously led to two major rallies for DOT. However, the buying pressure that catalyzed these increases appears to be easing.

When the price initially reached this support level, it rose by an impressive 1144.19%. During the second approach, the increase was more modest: 197.15%.

Source: trading view

If market patterns hold and DOT reaches this support level again, it could potentially move back towards the resistance at $5,706 where it could face selling pressure.

Further analysis by AMBCrypto suggests that the support at $4,001 is likely to fail as selling pressure from retailers increases.

Retailers withdraw support for a DOT rally

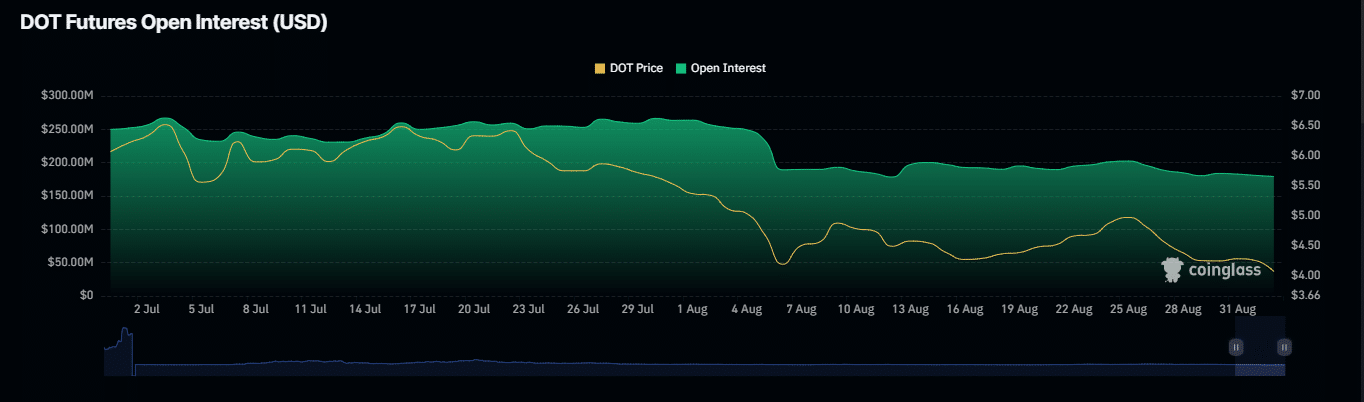

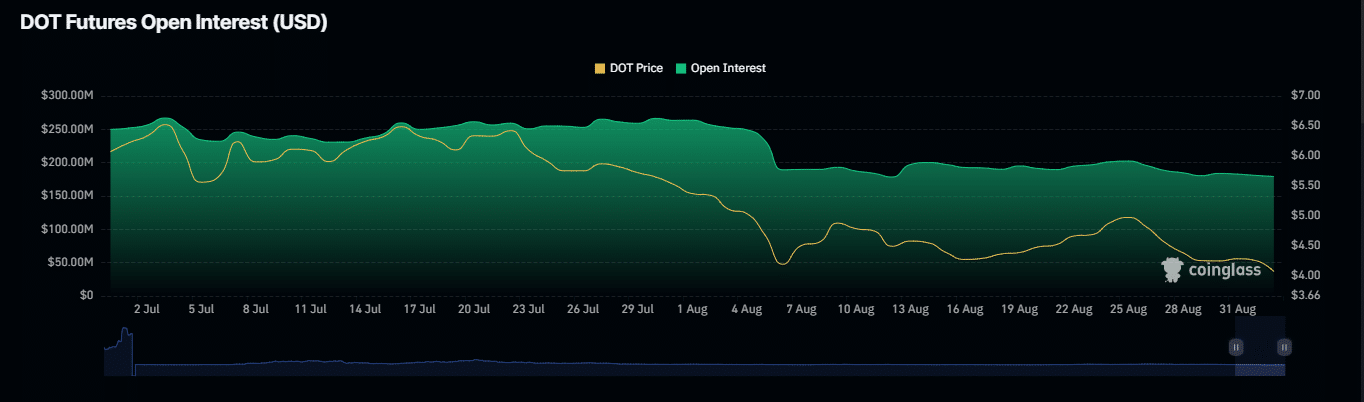

Open Interest (OI), a key indicator of liquidity and market activity, indicated waning enthusiasm for DOT.

According to CoinglassDOT’s OI has plummeted since August 25, from $202.30 million to $178.9 million. This decline indicated that retail interest in maintaining DOT prices was faltering.

Source: Coinglass

Further insights from Coinglass, as analyzed by AMBCrypto, showed that long traders have faced significant liquidations. Specifically, $339.93k worth of long positions have been eliminated from the market.

This pattern suggested that traders who were optimistic about DOT prices pushing higher were unable to withstand the prevailing selling pressure.

If this selling pressure among retailers continues to increase, there is a real risk that DOT could break below the critical support level at $4,001 and possibly fall towards $2.00.

Indicators point to further declines

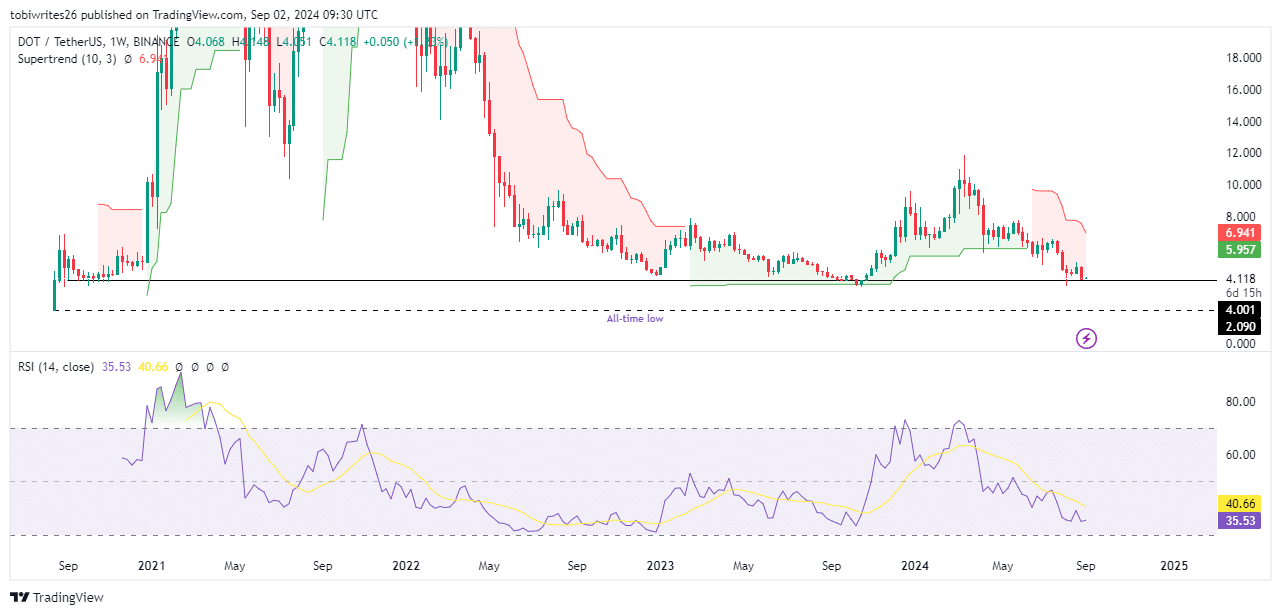

Further analysis, using the Super Trend and Relative Strength Index (RSI), indicated a likely decline in the DOT price.

The Super Trend is a trend following indicator that combines price movement data with the average true range to determine the direction of the market.

It currently signals a downtrend for DOT as the price remains below the indicator line, indicating bearish conditions.

Source: TradingView

Read Polkadots [DOT] Price forecast 2024–2025

Meanwhile, the RSI, which measures the speed and change of price movements, also predicted a decline. With an RSI value of 35.52 and a downward trend, intensified selling pressure could push the price of DOT even lower.

These combined indicators point to a possible continuation of the current selling trend, pushing the price towards $2,000 and below.