- The institutional property of Ethereum ETF rose from 4.5% to 14.5% in Q4 of 2024

- Grayscale has searched the SECs noden for his ETH ETF strike -function

Institutional acceptance of Ethereum ETFs increased in Q4 of 2024, in contrast to the Bearish sentiment under the retail trade. In fact ACcording to Juan Leon, Senior Investment Strategist at BitWise, Reden Institutional Own of ETFs by approximately 10% from 4.8% to 14.5%.

She noted”

“Institutional ownership of ETH ETFs rose from 4.8% in Q3 to 14.5% in Q4. The settings come for ETH. “

A huge adoption -uptick

Here another remarkable trend is the relatively higher acceptance percentage of ETFs, compared to BTC ETFs, in the same period. This, despite the fact that Bitcoin maintains overall dominance in all sectors of the market.

According to Leon, the institutional adoption for Bitcoin ETFs was 21.5% in Q4 2024, compared to 22.3% in Q3.

The report came from the last 13F archives at the SEC, which are made quarter and offer a look at bids by top managers with more than $ 100 million in AUM (assets under management).

Especially Fintel facts It revealed that BlackRock’s Eth Trust, Ethha, was dominated by Goldman Sachs, Millennium Management and Brevan Howard Capital. The top three companies had $ 235 million, $ 105 million and $ 94 million in ETHA shares.

Leon added that an increase in institutional ownership marks the next phase in adoption.

“I think this indicates the introduction of the next phase of institutional accumulation: large institutions such as sovereign power funds and pension funds.”

Another potential bullish update for the products is the urge to ETF deployment. The Crypto Task Force recently met Jito Labs and Crypto VC Multicoin Capital on the issue. The move is generally considered to be positive for likely ETF strike characteristics. Grayscale has in fact submitted a recent sec application For an ETF strike function for its US spot ETF product.

Respond to the developments, Nate Geraci of the ETF store stated That ETF move is a ‘matter of time’.

“Instead of just saying” no “, SEC actually takes on constructive conversations. Encouraging. Imo, deploying in ETH ETFs is just a matter of time.”

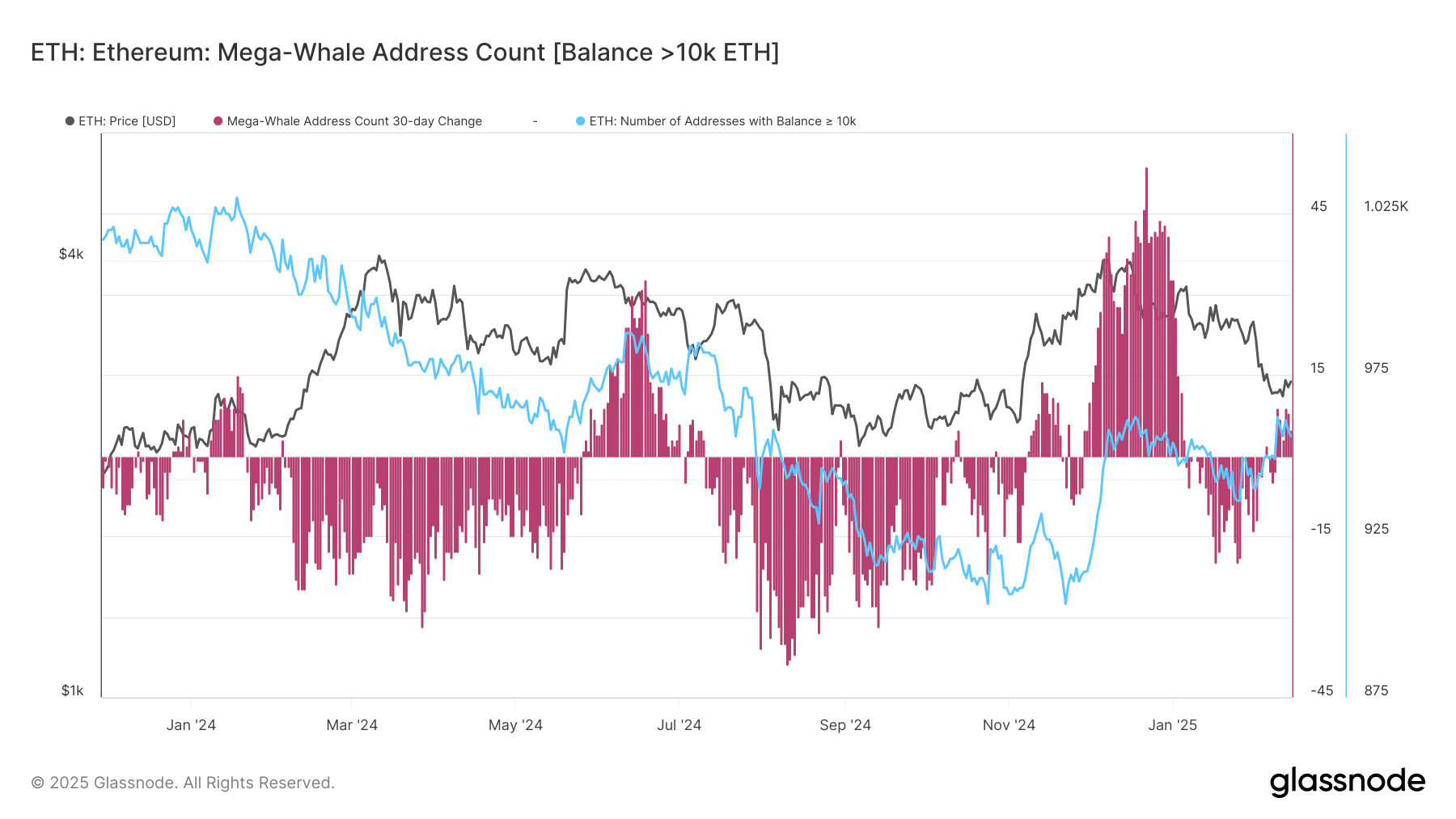

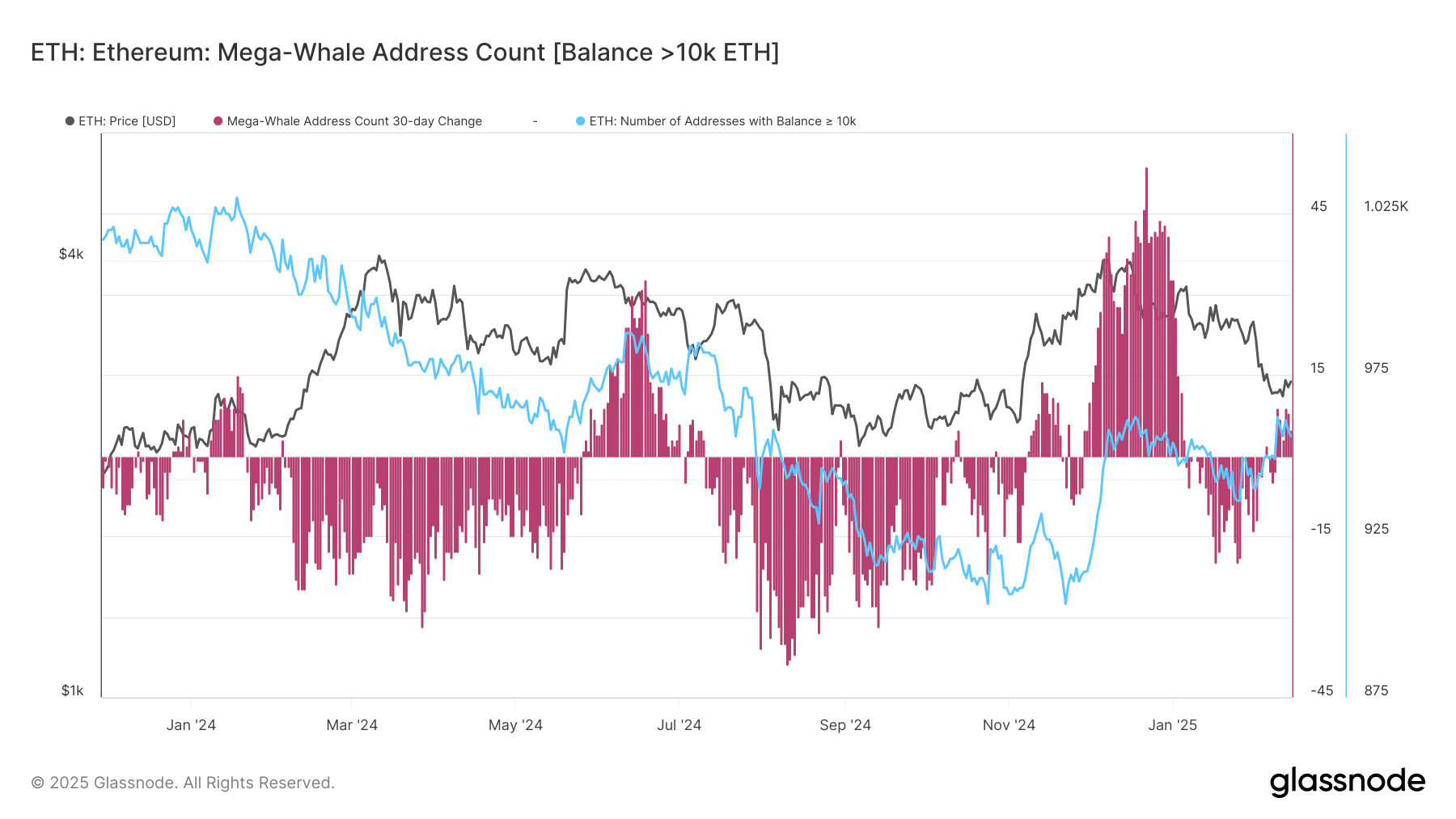

That said, the 30-day Mega-Wal address results (with more than 10k ETH) became positive again in February. The number of addresses with more than 10k ETH has also risen to 956 from 936 so far.

Source: Glassnode

On the contrary, the price of ETH has remained damped despite the institutional adoption flow. At the time of writing, the Altcoin was appreciated at $ 2.7k and 34% was compared to its peak of $ 4.1k.