- Celsius executed massive ETH transactions in the wake of the bankruptcy proceedings.

- Gas consumption on the network fell, but NFT activity remained high.

The latest data insights from LookonChain, an on-chain analytics provider, revealed massive transactions within the Celsius wallet in the past 10 hours.

Specifically, a deposit of 13,000 Ethereum [ETH]worth $30.34 million, was carried out on Coinbase, in addition to another transaction that deposited 2,200 ETH, for a total of $5.13 million, to FalconX.

Turn up the heat

For context, Celsius Networks is a cryptocurrency lending platform that is undergoing bankruptcy proceedings. This is why the asset has transferred a significant portion of its Ethereum holdings to various exchanges.

This process of withdrawing ETH and moving it to exchanges is a strategic move that aligns with the platform’s recovery efforts during the ongoing bankruptcy proceedings.

The #Celsius wallet deposited 13K $ETH($30.34 million). #Coinbase and 2,200 $ETH($5.13 million). #FalconX again in the last 10 hours.

Currently there are 2 staking portfolios #Celsius still owns 557,081 $ETH($1.3 billion).

Address:https://t.co/3gGOucC9gYhttps://t.co/zodN4gzVHKhttps://t.co/Jjt9fCN2Ej pic.twitter.com/E9DIZ9KDAH

— Lookonchain (@lookonchain) January 23, 2024

According to the most recent data available, two Celsius-affiliated staking wallets held a significant amount of Ethereum.

The total holdings within these staking wallets at the time of writing amounted to 557,081 ETH, equivalent to an estimated value of $1.3 billion.

ETH sees red

The amount of ETH Celsius holds can affect market sentiment, and their sudden moves can cause FUD around ETH.

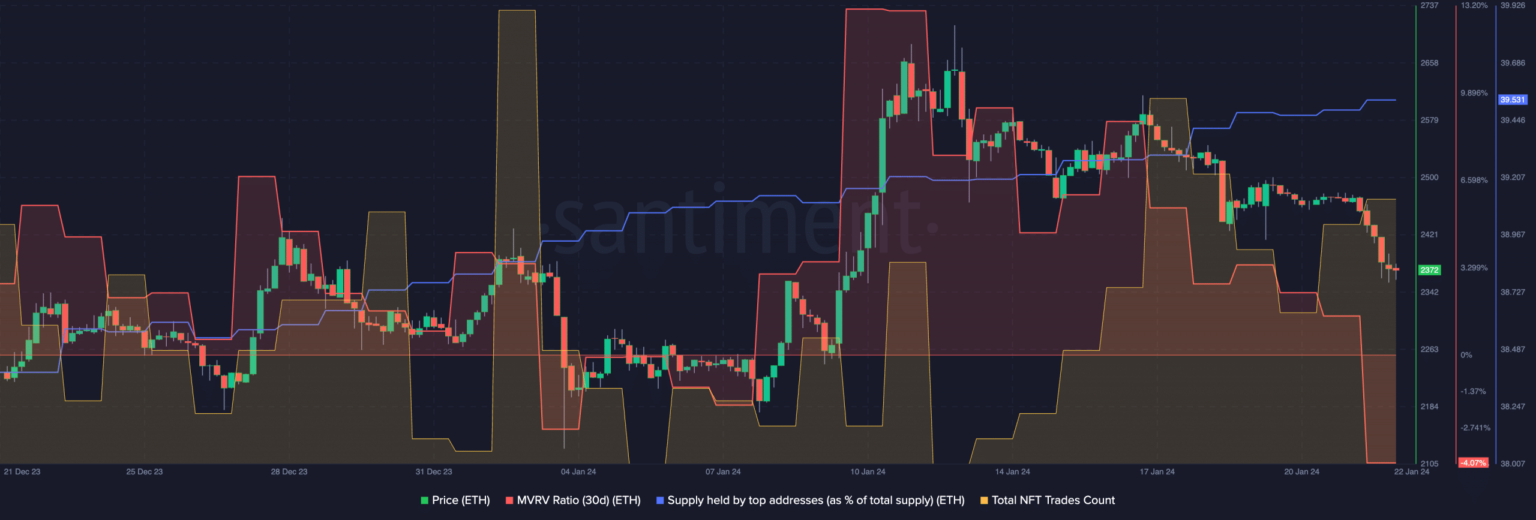

At the time of writing, the king of altcoins was trading at $2,229.54, with its price down 6.46% over the past 24 hours. The MVRV ratio also fell during this period, indicating that many holders posted losses.

This could be a positive development for ETH, as there was no incentive for these addresses to sell their assets.

Furthermore, the concentration of ETH in the hands of whales remained high despite Celsius depositing their ETH on exchanges. The increasing interest from whales could help move the price of ETH in a positive direction.

Source: Santiment

Despite these factors, the number of short positions in ETH had increased. According to Coinglass data, the number of short positions against ETH has increased to 53.12% in recent days.

Source: Coinglass

Is your portfolio green? Check out the ETH profit calculator

State of the network

Regarding the state of the network, it was seen that gas consumption on the Ethereum network had plummeted. This meant that overall activity on the network had decreased.

However, overall NFT transactions on the Ethereum network continued to rise, indicating that there is hope that interest in Ethereum will rejuvenate in the future.

Source: Santiment