- Dogecoin approached the key resistance at $0.115, indicating a possible bullish breakout.

- Bullish liquidation trends and strong open interest indicate increasing trader confidence.

Dogecoin [DOGE] has gained attention with large transactions, indicating growing interest from institutional players and whales. At the time of writing, DOGE was trading at $0.1091, showing a decline of 0.56%.

However, this price action raised an important question: Is DOGE preparing for a breakout, or will it remain within its current range? Several factors provide insight into where Dogecoin could go.

Can DOGE hold out?

Dogecoin price fluctuated between crucial support at $0.108 and resistance at $0.115. Therefore, breaking through these levels could set the tone for the next step.

If DOGE breaks above $0.115, a bullish trend could ensue, creating more upside momentum.

However, if the price fails to hold support, it could test the USD 0.100 level. Consequently, the coming days will be critical in determining whether Dogecoin can break free from this range.

Source: TradingView

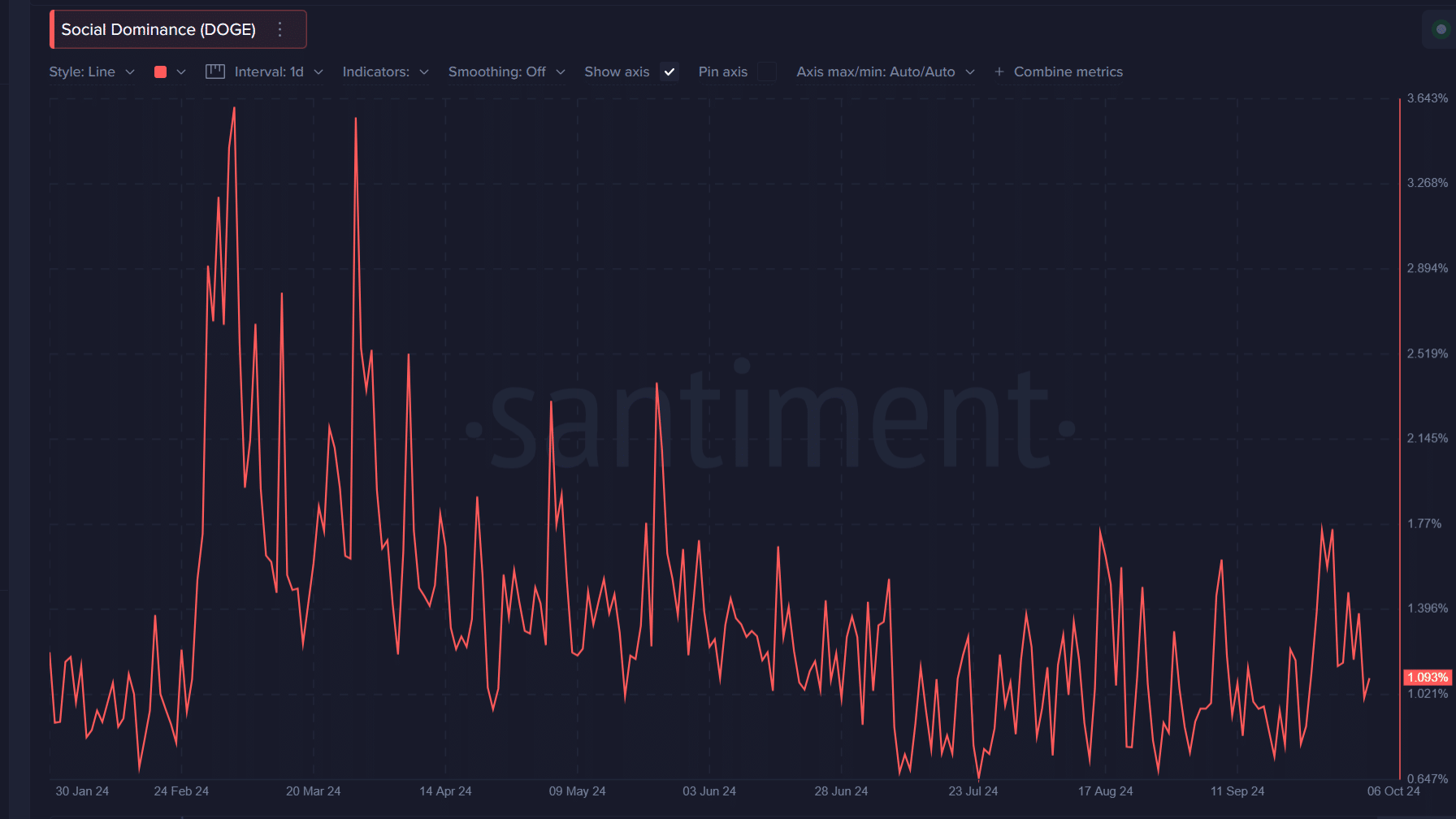

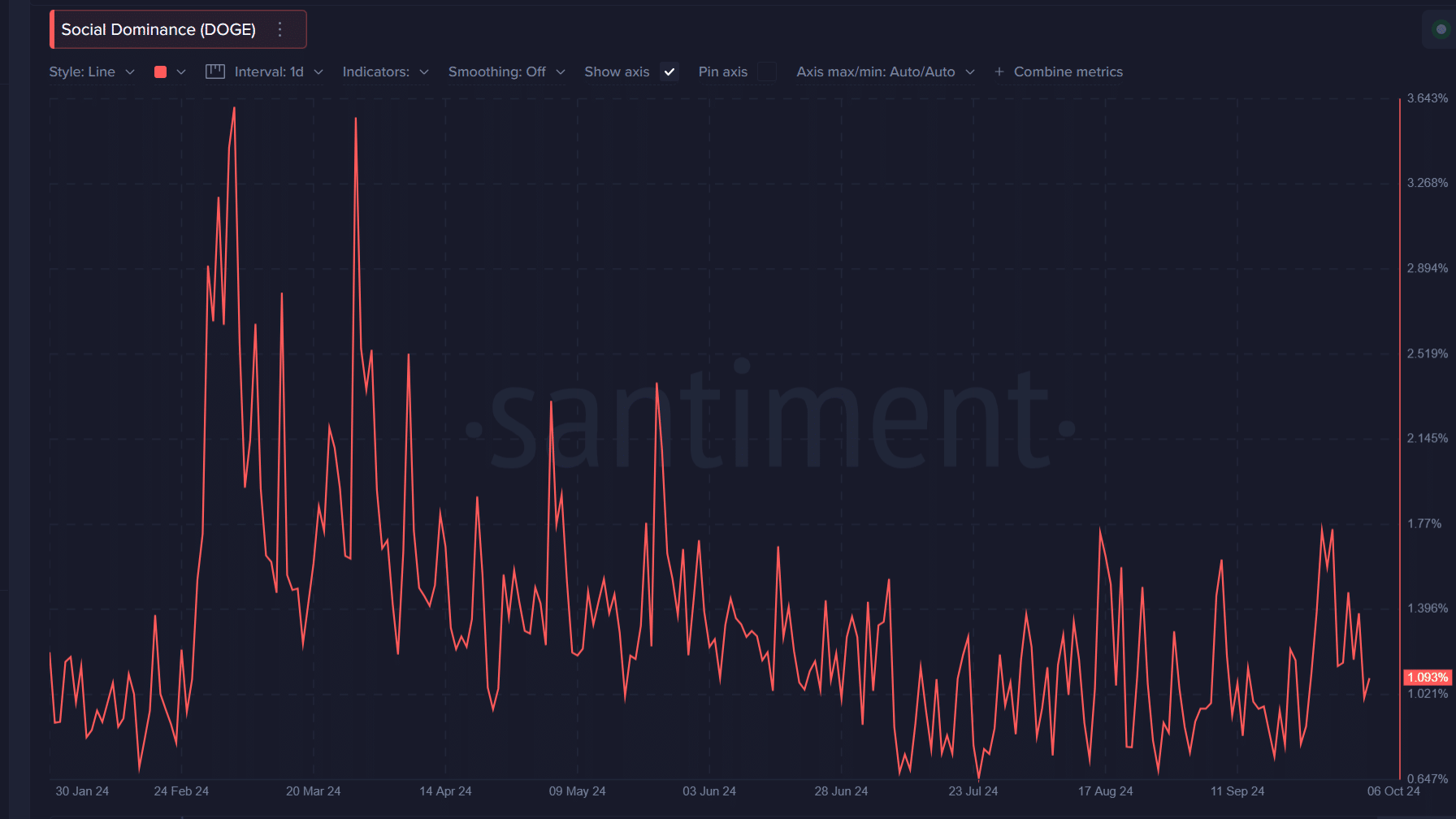

Dogecoin Social Dominance: Is the Hype Real?

The social dominance for Dogecoin stood at 1.09% at the time of writing, reflecting its strong presence in the crypto community. This engagement is essential for memecoins, as social buzz often drives market activity.

Therefore, increasing social dominance could lead to renewed purchasing interest.

However, if social media conversations subside, it could dampen enthusiasm and delay any potential rally. Therefore, maintaining or increasing social presence is crucial for Dogecoin’s price action.

Source: Santiment

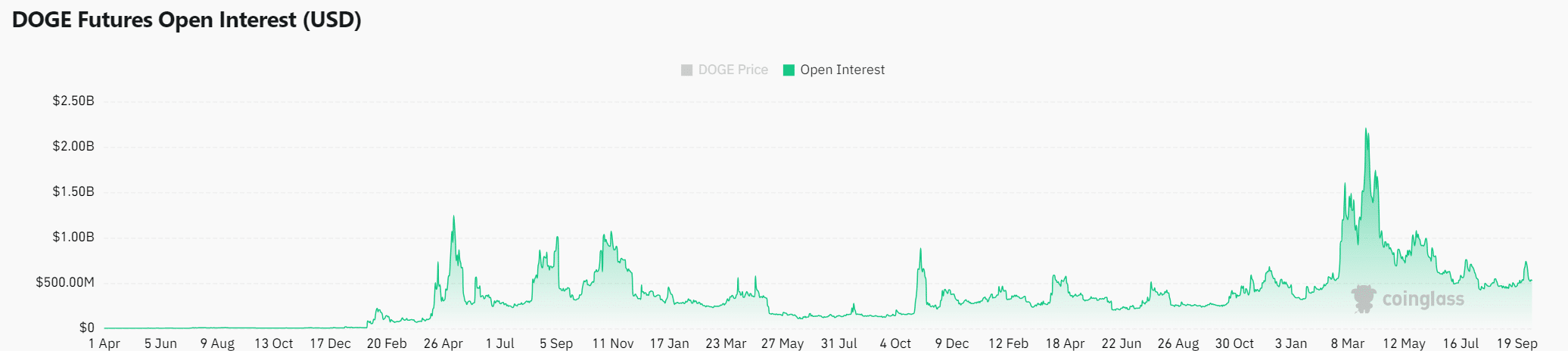

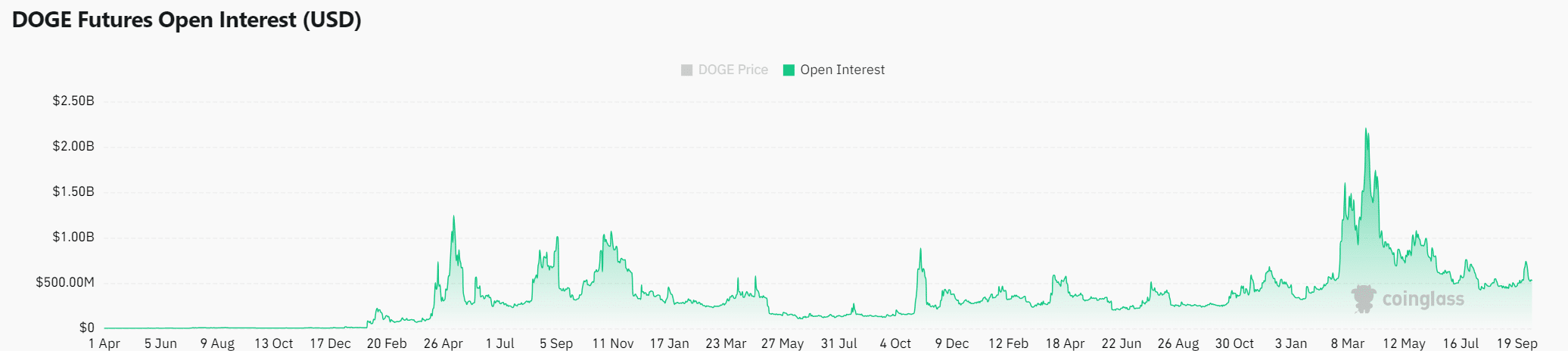

Open interest: what do traders indicate?

Open interest in Dogecoin at the time of writing was $520.69 million, down slightly by 1.73%. This dip indicated that some traders were being cautious and taking profits.

However, the generally high level of Open Interest suggested that there was still significant market activity and that a price move could be in the works.

If open interest rises again, it will likely be a sign of renewed confidence and increased volatility, which could push DOGE higher.

Source: Coinglass

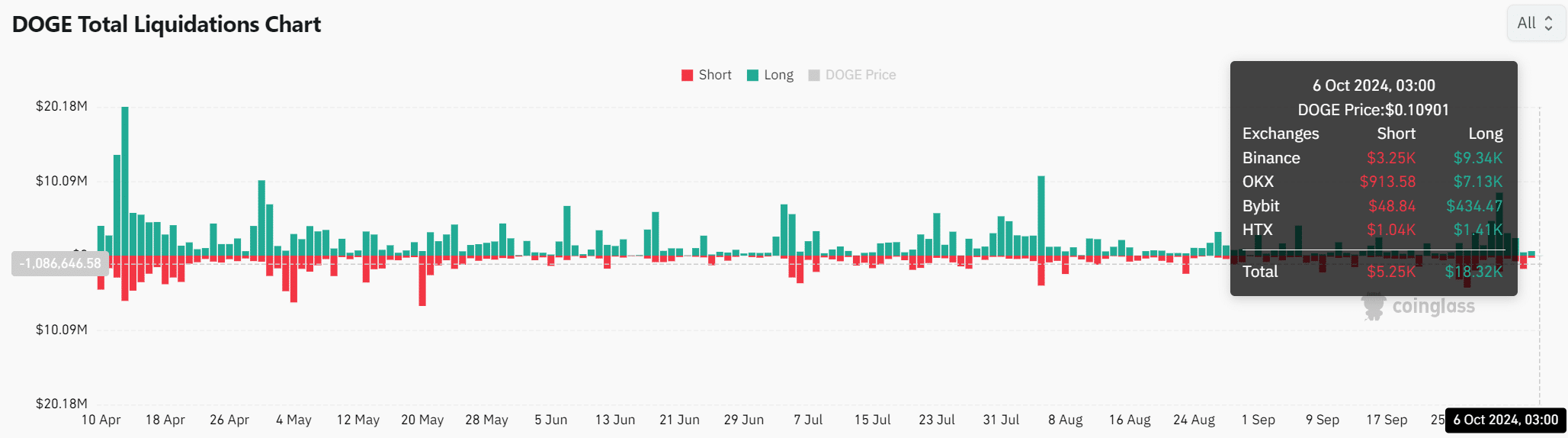

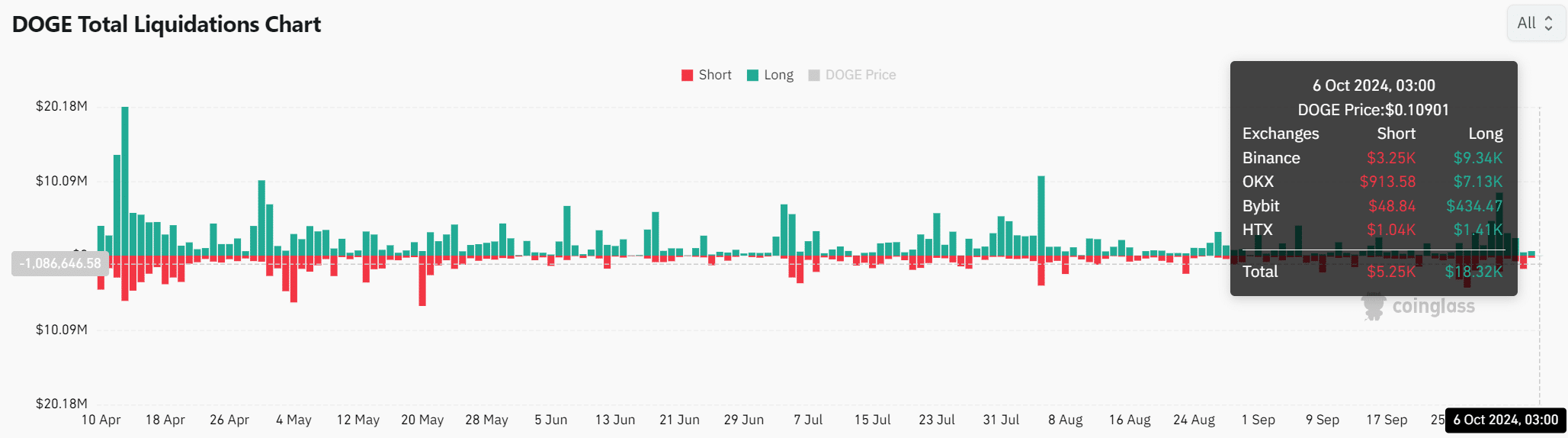

Liquidation details

Dogecoin liquidation data revealed $5.25K in short liquidations versus $18.32K in long liquidations. This imbalance suggested that bullish traders were holding firm, while fewer short sellers were confident of a downtrend.

This could increase upward pressure on DOGE, pushing the price towards a possible breakout.

Source: Coinglass

Read Dogecoins [DOGE] Price forecast 2024–2025

Will Dogecoin Break Out?

Based on current metrics, Dogecoin appeared to be building the momentum needed for a breakout. If the price can break the resistance at $0.115 and hold the support, a rally is very likely.

All indicators point to an impending move, making the coming days crucial for DOGE’s future trajectory.