- Cardano will likely fall towards $0.3 in the near term to gather liquidity.

- The MDIA’s downtrend could be a strong signal for bulls to re-enter.

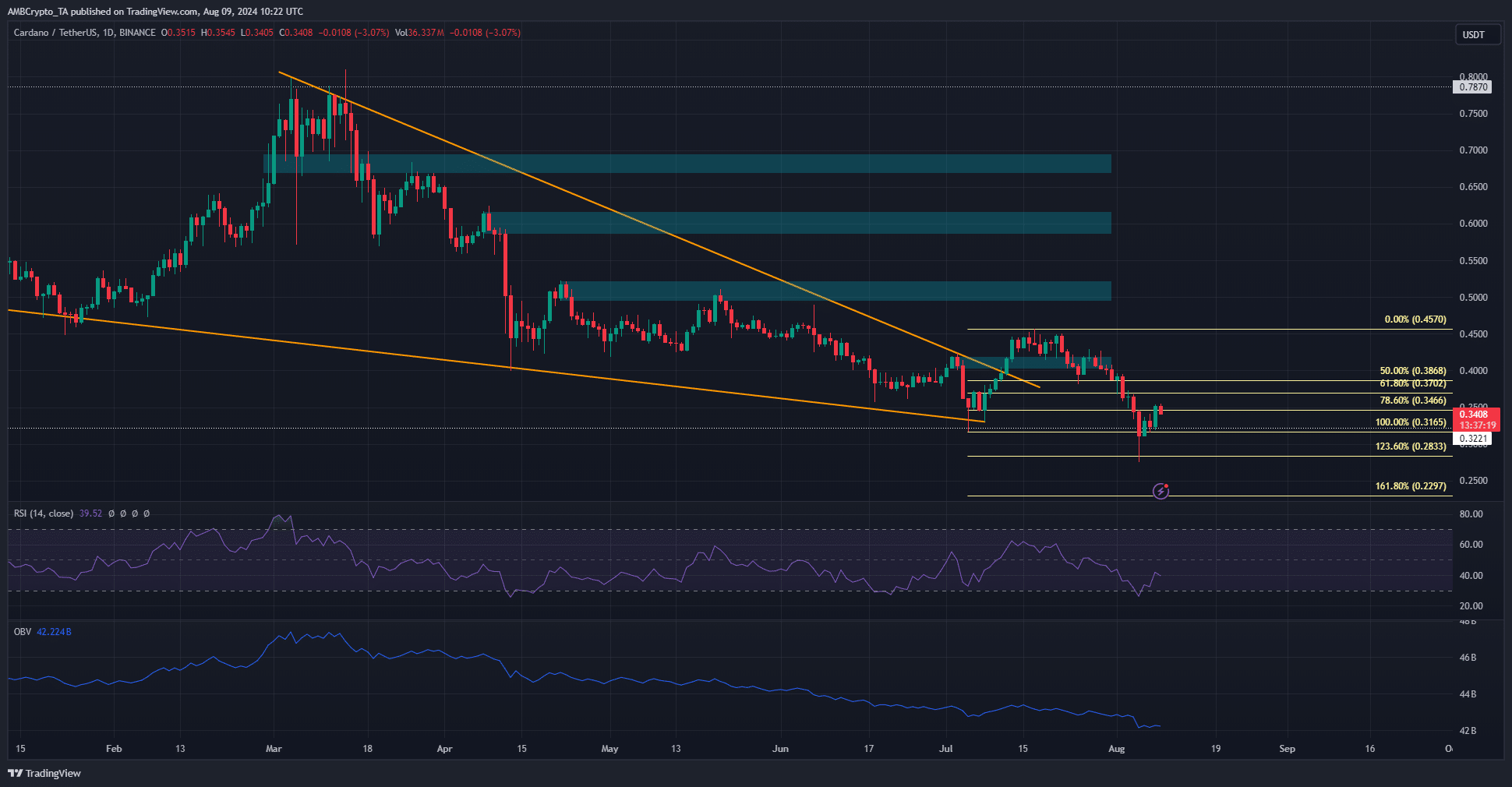

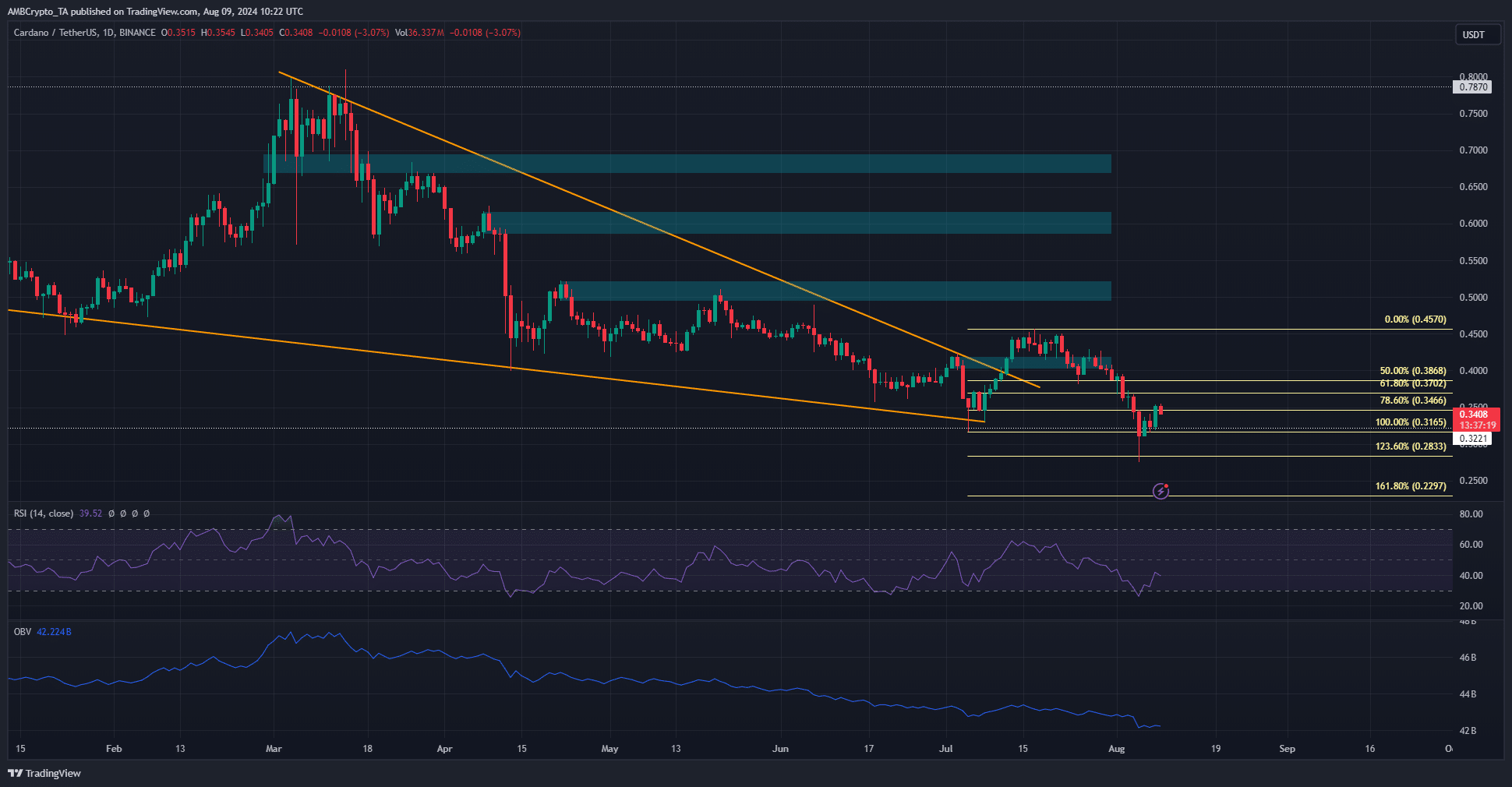

Cardano [ADA] saw a breakout past the falling wedge formation in mid-July, but its progress was halted before the uptrend was well established.

If that wasn’t daunting enough, Bitcoin [BTC] Sell-off and market-wide panic earlier this week caused the ADA to fall to $0.275.

Source: ADA/USDT on TradingView

Data showed that assets have been quite volatile in recent weeks. The other stats were mixed, but favored the bears more than the bulls. Despite the price drop, sentiment on social media remained strong.

Is ADA a good investment?

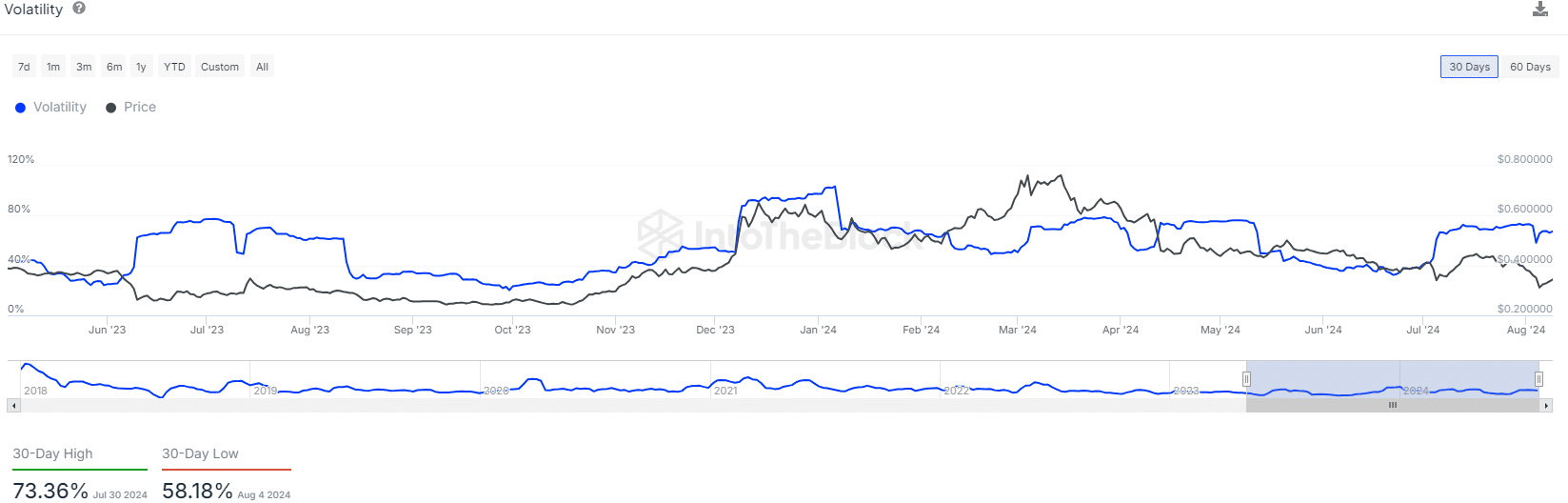

The 30-day variations in Cardano volatility showed large price swings in July. Due to the continued price decline in the first week of August, this measure fell to a low of 58.18%.

Ideally, long-term investors want to see low volatility over an extended period of time, indicating steady, sustained accumulation.

AMBCrypto looked at another metric, the beta coefficient, and compared Cardano’s volatility to Bitcoin’s. It showed a value of 0.86 at the time of writing, which means that the price movements are less volatile.

It also showed that ADA is likely to be favored by more conservative investors.

More aggressive investors would likely seek higher returns and be willing to tolerate the higher volatility of the chosen asset relative to BTC.

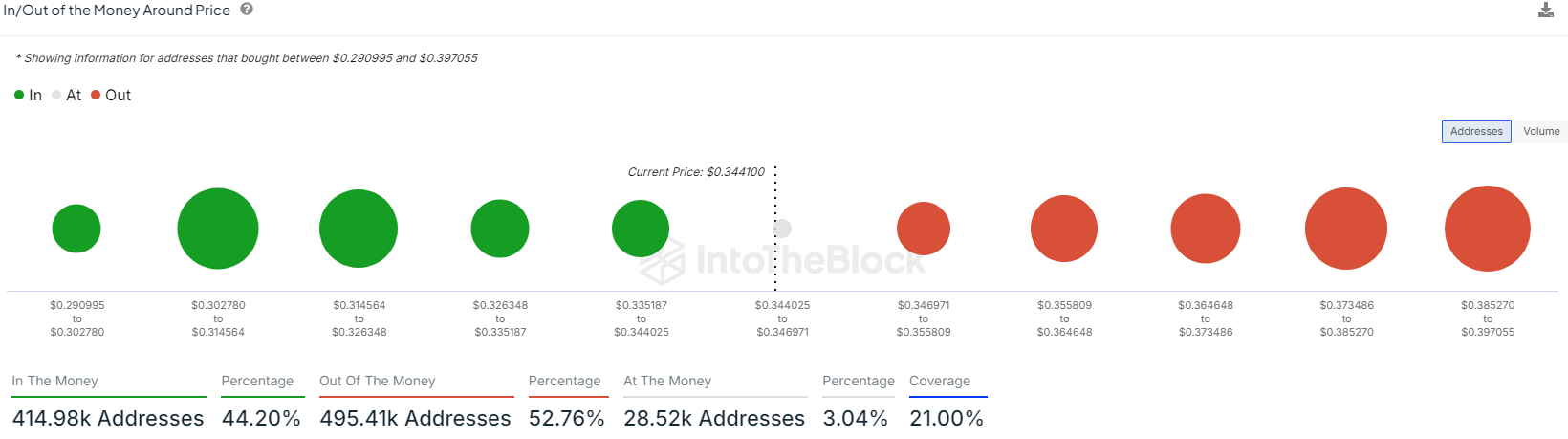

The $0.3-$0.326 was highlighted as the largest support zone around the price. This region coincided with the July lows, but was breached on Monday.

Gather more clues to the next price trend

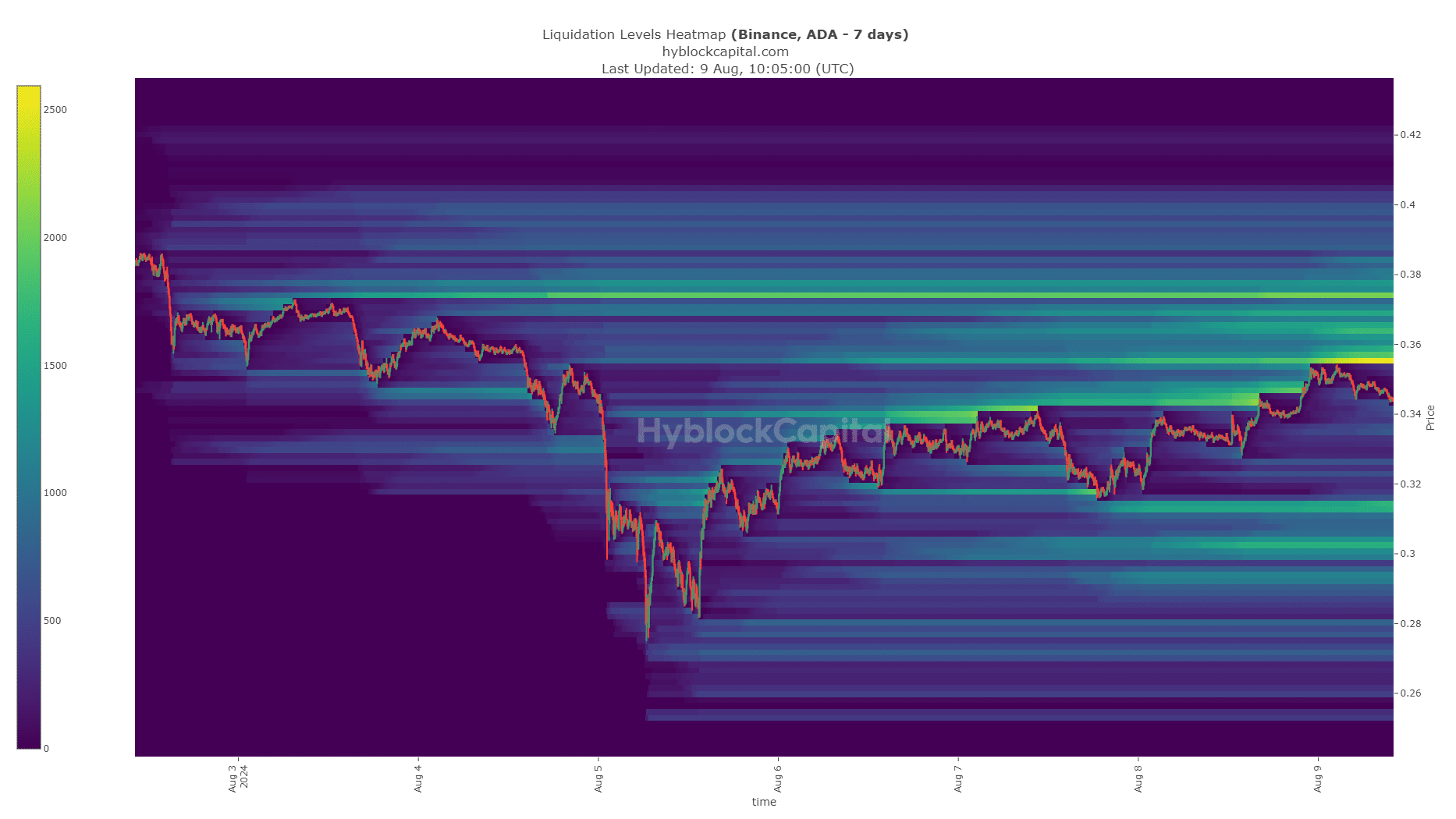

The seven-day lookback period showed that the $0.3-$0.314 zone had a cluster of liquidation levels that could influence a reversal.

However, due to the recent crash, there wasn’t enough time to build a large amount of liquidity, which would be an obvious target with a higher time frame.

It supports the technical findings and the money in/out data.

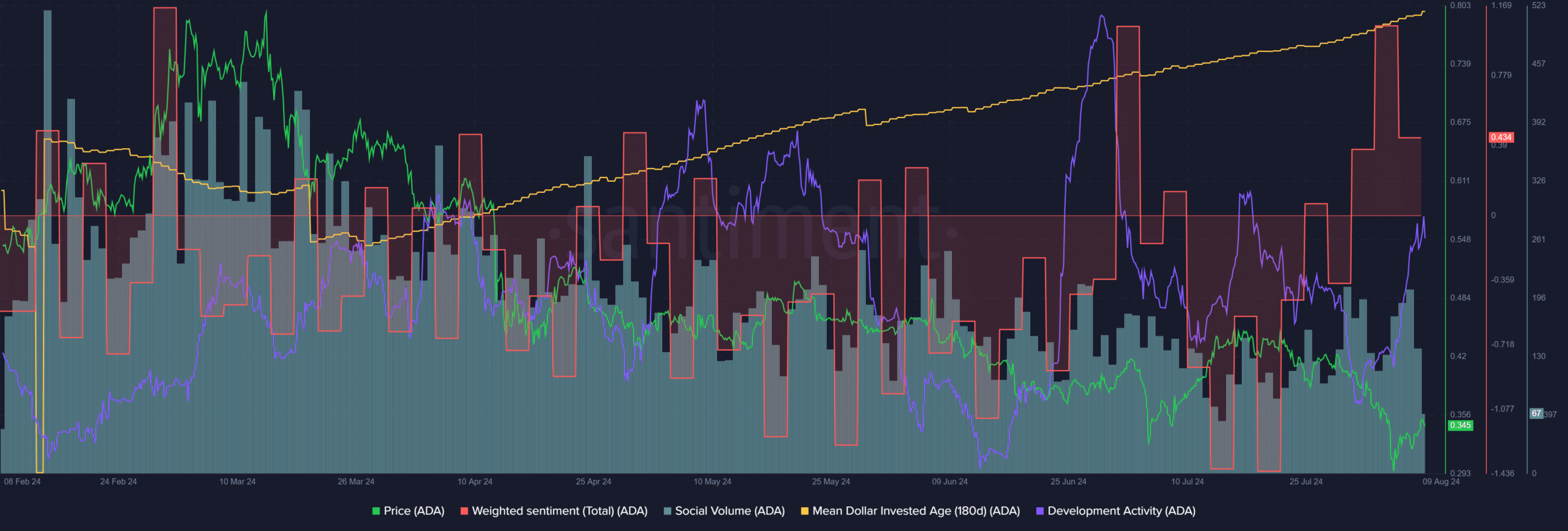

Weighted sentiment was positive, a surprising development after the price crash below $0.3. It suggested that panic has not gripped investors.

Development activity was similar to previous months, another inspiring sight for long-term owners.

Read Cardanos [ADA] Price forecast 2024-25

Yet the average age invested in dollars continued to rise. The 180-day MDIA has moved higher since March and is near October 2023 levels. It signaled stagnation and a lack of new capital flowing in.

If the metric starts trending down, it would be a strong sign that ADA is poised for a sustained rally.