- Analysts predict that the necessary $50,000 BTC support will hold.

- Increased wallet activity on Bitcoin indicates long-term bullish sentiment.

The idea that Bitcoin [BTC] has reached its lowest point has not been confirmed. For a true bottom, the price must revisit the support level several times.

Prices usually don’t bottom out and stay there; they often form a double bottom, make a higher low or move sideways to build up.

If the $50,000-$52,000 level were maintained, the price would have revisited this 95% of the time, as we see now. If this level is not the lowest level, the price will drop on this new visit.

However, if this is the bottom, the price should return to this level with a slow pullback.

To have confidence in the market’s next move, price must build support. Traders and investors can now use dollar-cost averaging or invest when the price confirms this support.

Source: TradingView

Mayer Multiple is at its lowest level since 2022

The Mayer Multiple measures the current price of Bitcoin against its 200-day moving average. This 200-day average is a well-known indicator for determining whether the market is generally rising or falling.

Currently, the Mayer Multiple is at its lowest level since the 2022 bear market bottom. If you think Bitcoin’s price will rise over the next six to twelve months, now is a good time to buy. This period offers the opportunity to invest at lower prices.

Source: Glassnode

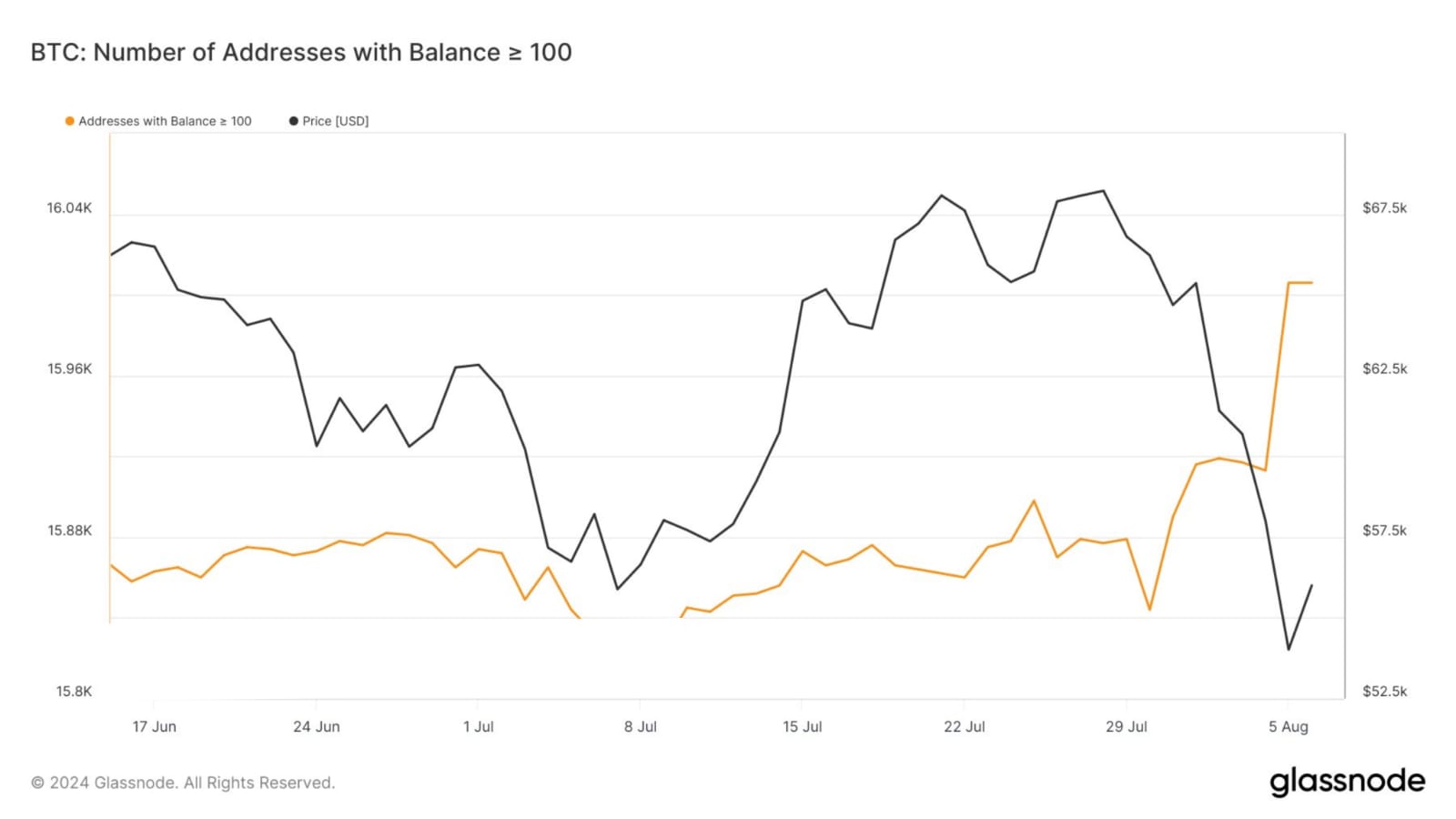

Whales buy more BTC during the dip

The number of Bitcoin addresses holding more than 100 BTC increased from 15,913 to 16,006 during the recent market dip, showing that large investors were buying more Bitcoin.

Former MicroStrategy CEO Michael Saylor, a major Bitcoin holder, has announced that he owns over a billion dollars worth of Bitcoin. Data from Glassnode shows that this metric reached its highest point in 2024.

Source: Glassnode

Is your portfolio green? Check out the BTC profit calculator

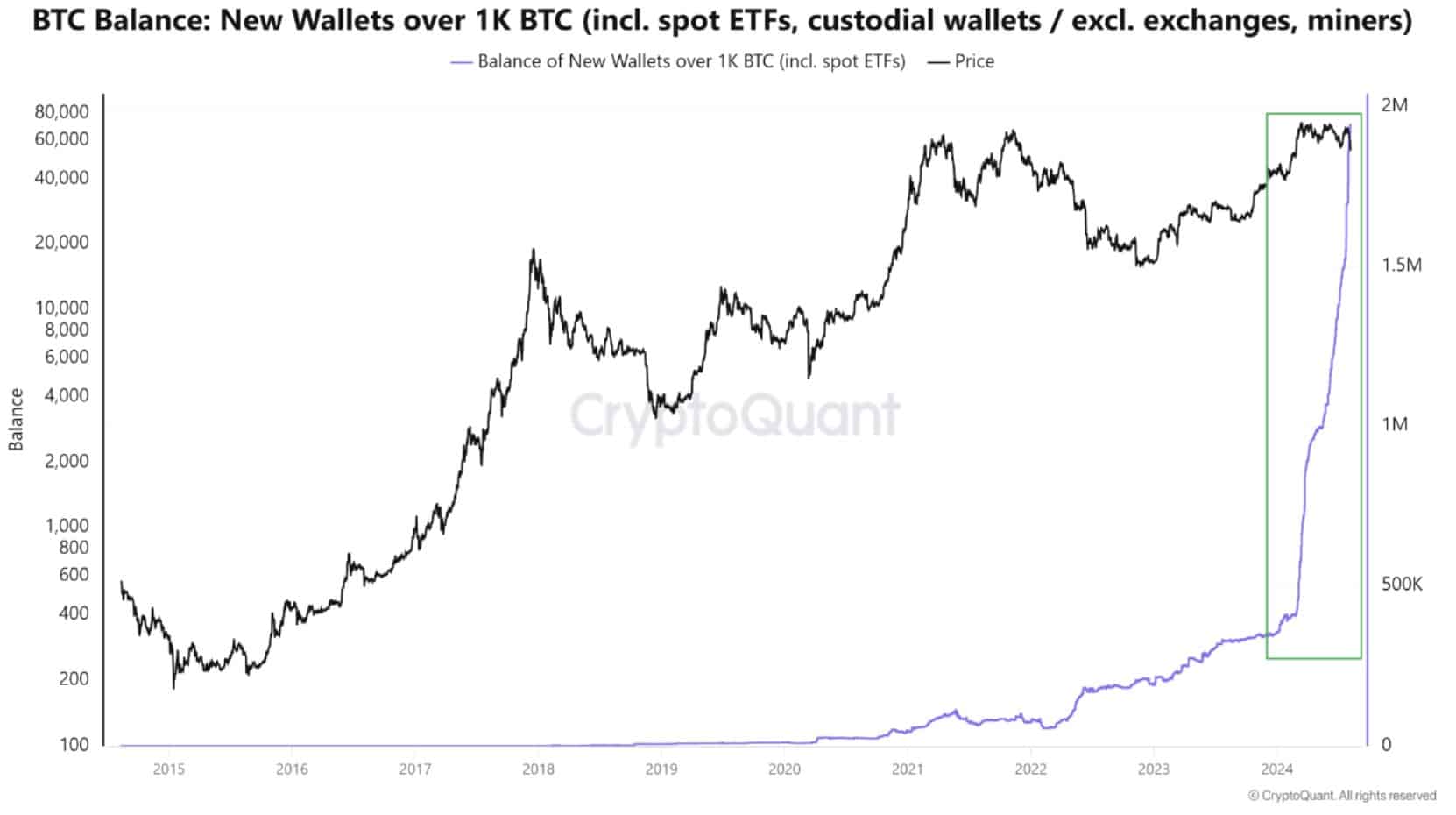

Data from CryptoQuant shows that since the launch of the Spot Bitcoin ETF, the number of new Bitcoin wallets holding more than 1,000 BTC has risen to an all-time high.

This increase indicates that large, smart investors are buying more Bitcoin, while smaller investors and traders are panic-selling.

Source: CryptoQuant