- Bitcoin’s recent price drop has led to significant market liquidations.

- Poor performance by Hong Kong and US spot ETFs underlines the market struggle.

Like Bitcoin [BTC] continued to struggle under significant market pressure and fell below the $58,000 mark. Analysts are now predicting a substantial price correction of 30-40% in the current market cycle.

This potential decline could cause the leading cryptocurrency to adjust to values not seen since previous bullish runs, which could trigger concerns and anticipatory strategies among investors.

Bitcoin is dangling near $55K

Bitcoin’s recent market behavior has not been particularly favorable, with a 10% decline over the past week bringing its trading price dangerously close to $55,000.

According to analyst Scott Melker, Bitcoin has breached critical support levels that now act as resistance, potentially leading to further declines. He warned,

“Nothing but air until about $52,000 on the card.”

This suggested that Bitcoin could enter a freefall if it fails to maintain current support levels.

The technical perspective also offers bleak prospects.

Melker pointed out that the Relative Strength Index (RSI), usually a reliable indicator of when an asset is oversold and likely to recover, has not yet reached oversold territory.

This deviation indicates a lack of strong buying interest and supports the thesis of further price declines.

This condition is reflected in the broader price trends observed on the charts, where Bitcoin shows a pattern of lower highs and lower lows, indicating continued bearish momentum.

According to Melker, the continued decline is only a fraction of what is to come.

“This is still ONLY a 23% correction, very shallow for a bull market and consistent with other corrections during this run. We have yet to see a 30-40% pullback like those of the past during this bull market.”

Broader market implications

In addition to the immediate price action, broader market indicators reveal underlying challenges.

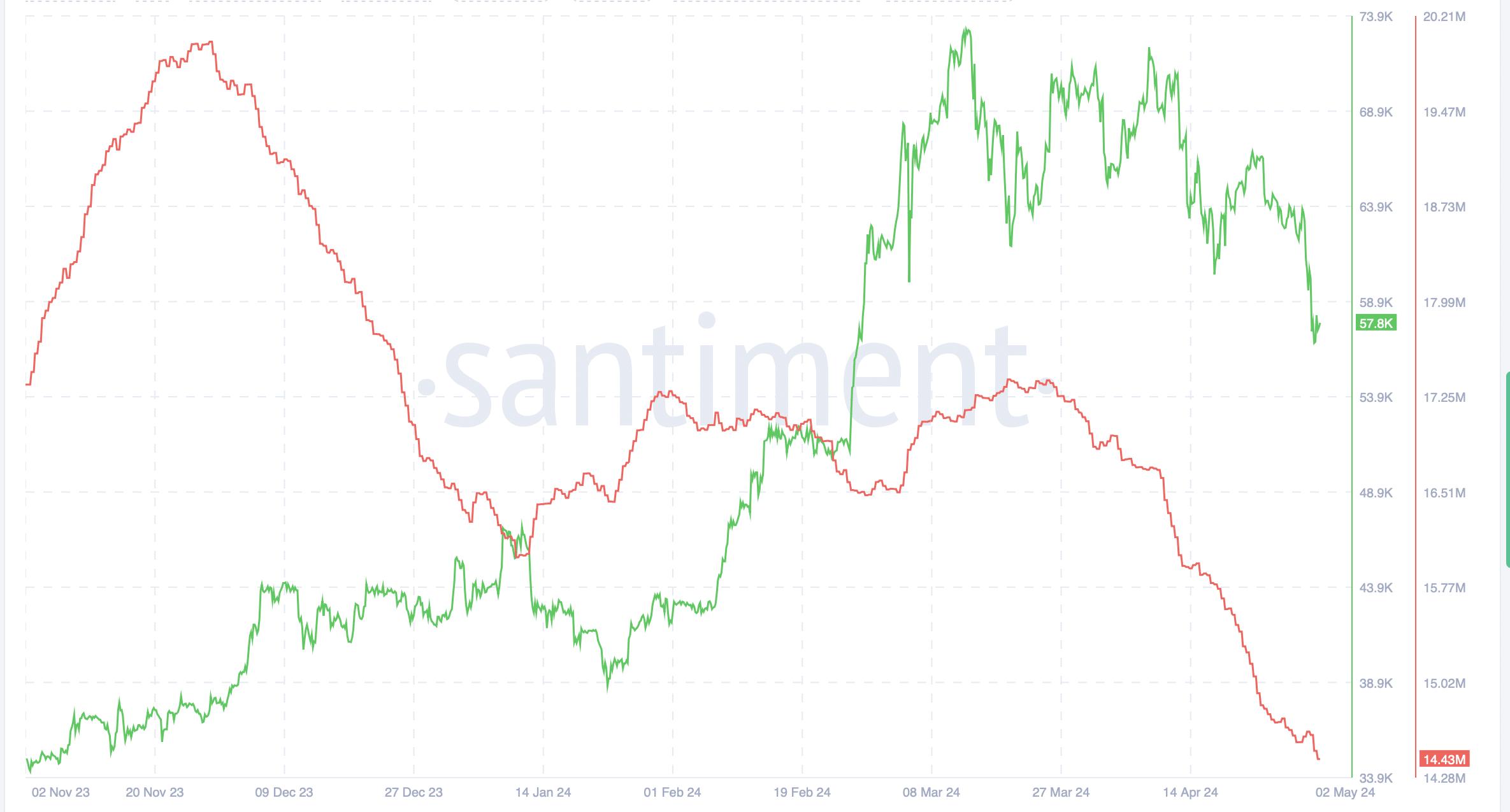

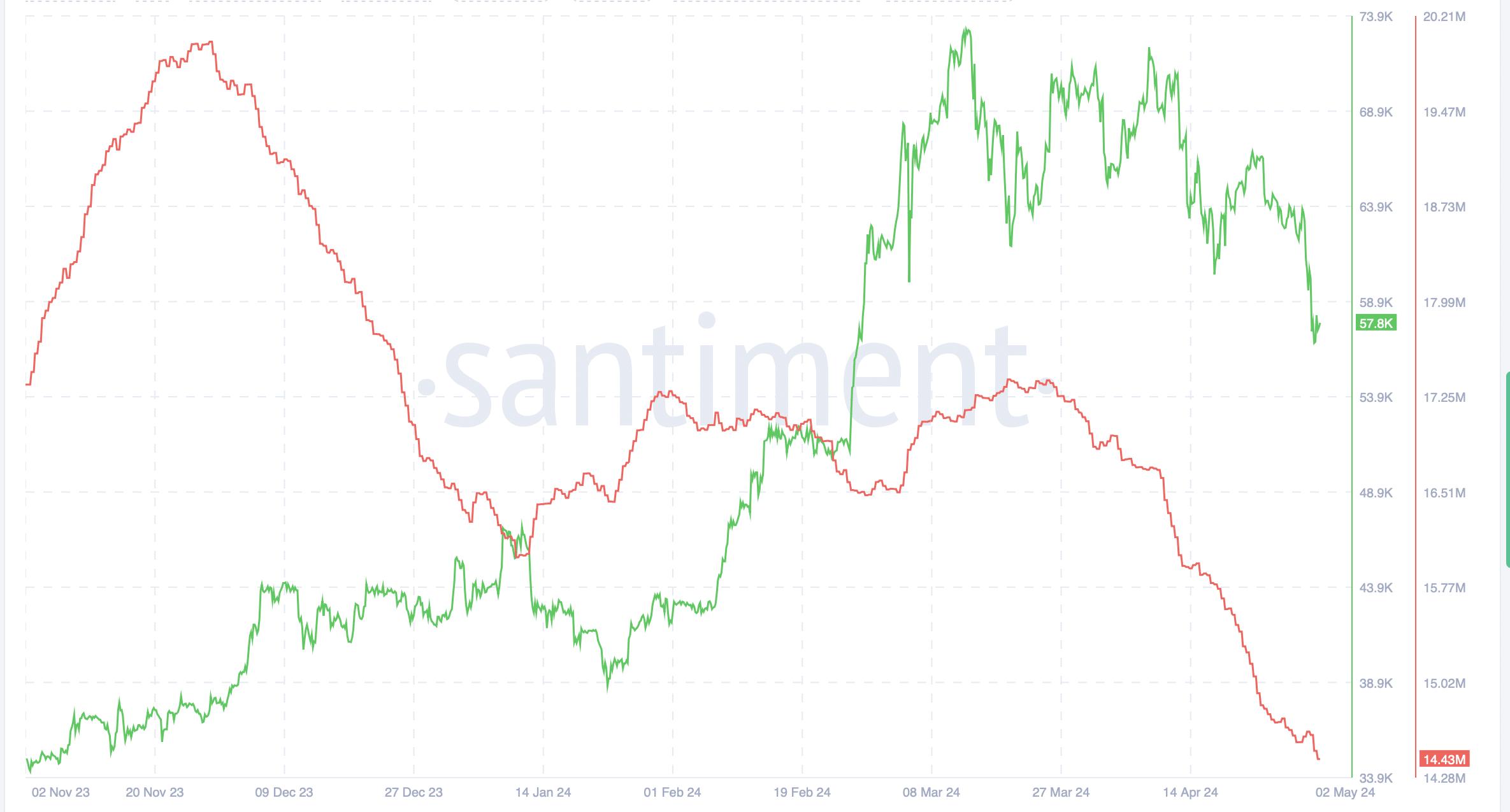

Facts from blockchain analytics firm Santiment showed a significant drop in Bitcoin’s daily active addresses.

It dropped from over 17 million in March to around 14.7 million on May 1, indicating declining user activity and interest.

Source: Santiment

The social dominance echoed this sentiment, with a decline of 20%.

Source: Santiment

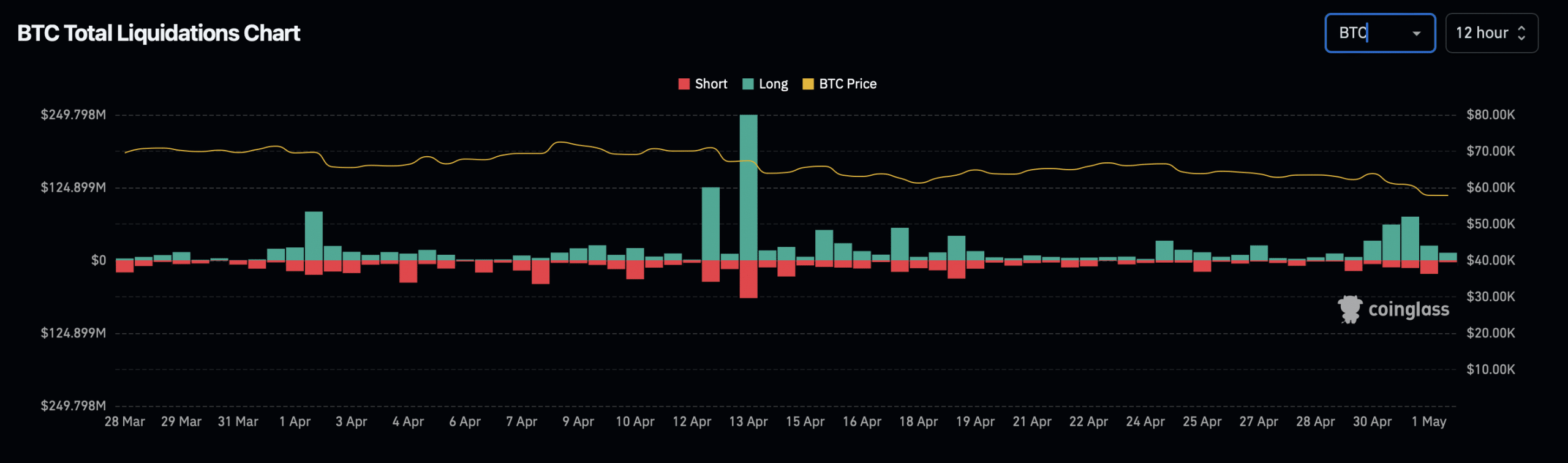

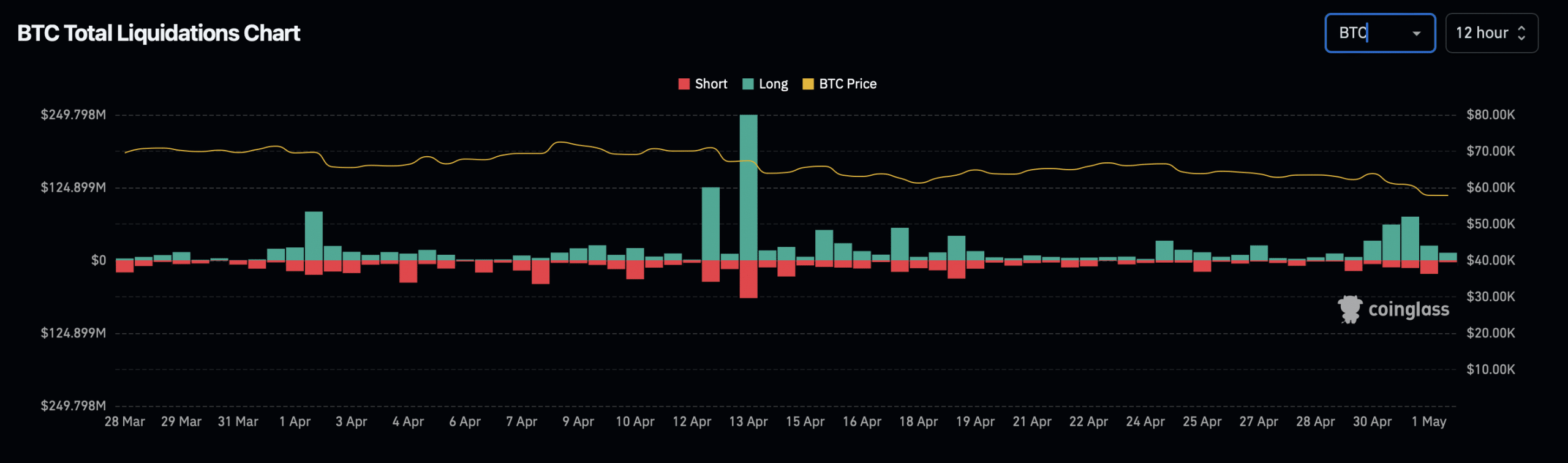

The decline in Bitcoin’s value has not only dampened the aforementioned market figures, but has also led to widespread liquidations, impacting countless traders.

According to Mint glassIn the last 24 hours alone, approximately 60,795 traders were liquidated, totaling $205.12 million.

Source: Coinglass

At the same time, like reported by AMBCryptothe disappointing debut of Hong Kong’s newly listed spot ETFs has only exacerbated the situation.

These ETFs had a trading volume of just $11 million on their first day, which is in stark contrast to the much higher figures achieved by the US-based spot ETFs when they launched in January.

Additionally, US spot ETFs have experienced significant outflows, with $161 million withdrawn on Tuesday alone, marking the fifth consecutive day of outflows, as analyzed by AMBCrypto using SoSo Value data.

Read Bitcoin’s [BTC] Price forecast 2024-2025

Furthermore, expectations that the US Federal Reserve will maintain stable interest rates at the upcoming FOMC meeting – due to higher-than-expected inflation – has led traders to withdraw from riskier investments.

This put even more pressure on the already tense market.