The recent recovery of the cryptomarkt faded on Friday, as a sharp sale, knew almost all weekly profit. Investors were careful in the midst of concern about President Trump’s upcoming rates before 2 April, along with stronger than expected core PCE data. With Bitcoin confronted with increasing sales pressure under $ 85,000, it is on its way for the worst quarter since 2018, so that analysts can speculate or the Mars could end below the critical level of $ 80,000.

Bitcoin to make the worst Q1 since 2018

The price of Bitcoin has fallen sharply in recent hours. According to Coinglass data, almost $ 90.56 million were liquidated in BTC positions, including $ 79.3 million from buyers and around $ 11.25 million from sellers.

Bitcoin has been on the right track because of the worst Q1 performance since 2018. Data Coinglass Indicates that Bitcoin fell around 11.86% in Q1 2025, slightly worse than the loss of 10.83% in Q1 2020, although far from the drastic decrease of 49.7% seen in Q1 2018.

The open interest of Bitcoin has fallen by around 4.5% in the last 24 hours and is getting closer to a low of around $ 54 billion. The decrease in open interest indicates the falling trading activity at BTC traders, which can lead to reduced volatility and more cautious market behavior in the short term.

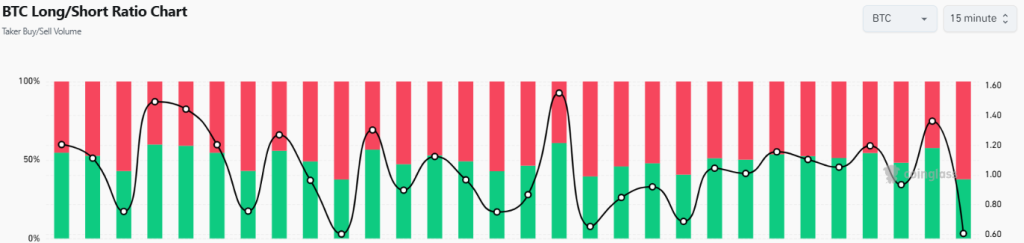

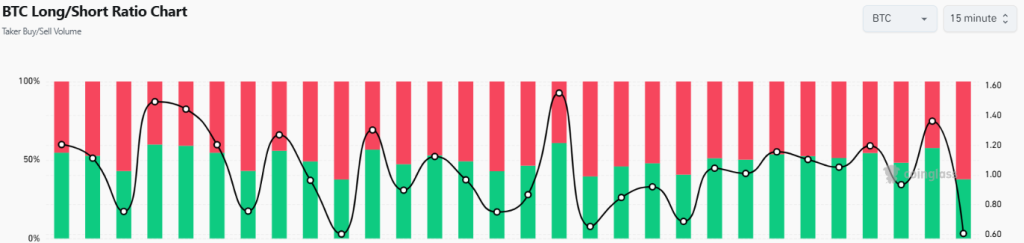

Moreover, the long/short ratio has experienced a noticeable decline, which is currently 0.6051. This metric reveals that about 62.3% of traders now bet on a further price decrease for Bitcoin, while only about 38% is hopeful about a potential rebound. In general, these figures point to an increasing bearish sentiment among traders.

Read also: Bitcoin ETF Inflow Streak breaks after a 10-day rise

Add to Beerarish sentiment, Bitcoin ETFs experienced remarkable outskirts, so that BTC possibly pushed closer to the level of $ 80k. The FBTC Fund of Fidelity alone saw $ 93.16 million out on Friday, ending a 10-day line in the influx-the longest this year. In particular, FBTC had only received $ 97.14 million in inflow the previous day, according to Sosovalue. The trade volume in all American Bitcoin ETFs rose slightly on Friday, a total of around $ 2.22 billion.

What is the next step for BTC price?

Bitcoin recently experienced an increased sales pressure, which reduced the price under important support levels from Fibonacci and reached a low point of approximately $ 81,644. Bitcoin is currently acting near $ 82,289, about 1.7% falling in the last 24 hours.

Sellers actively keep the crucial resistance to $ 85,000, so the price is not back. Nevertheless, buyers remain determined and they seem prepared for a new push to reclaim this important level.

If buyers succeed in regaining the level of $ 85,000, the market sentiment can shift positively, so that the road may be released for further upward momentum against the next major resistance near $ 90,000.

However, if buyers are not successful in overcoming this critical barrier, Bitcoin can be confronted with an increased sales pressure, so that the price may be towed to the support zone between $ 80,000 and $ 78,000.