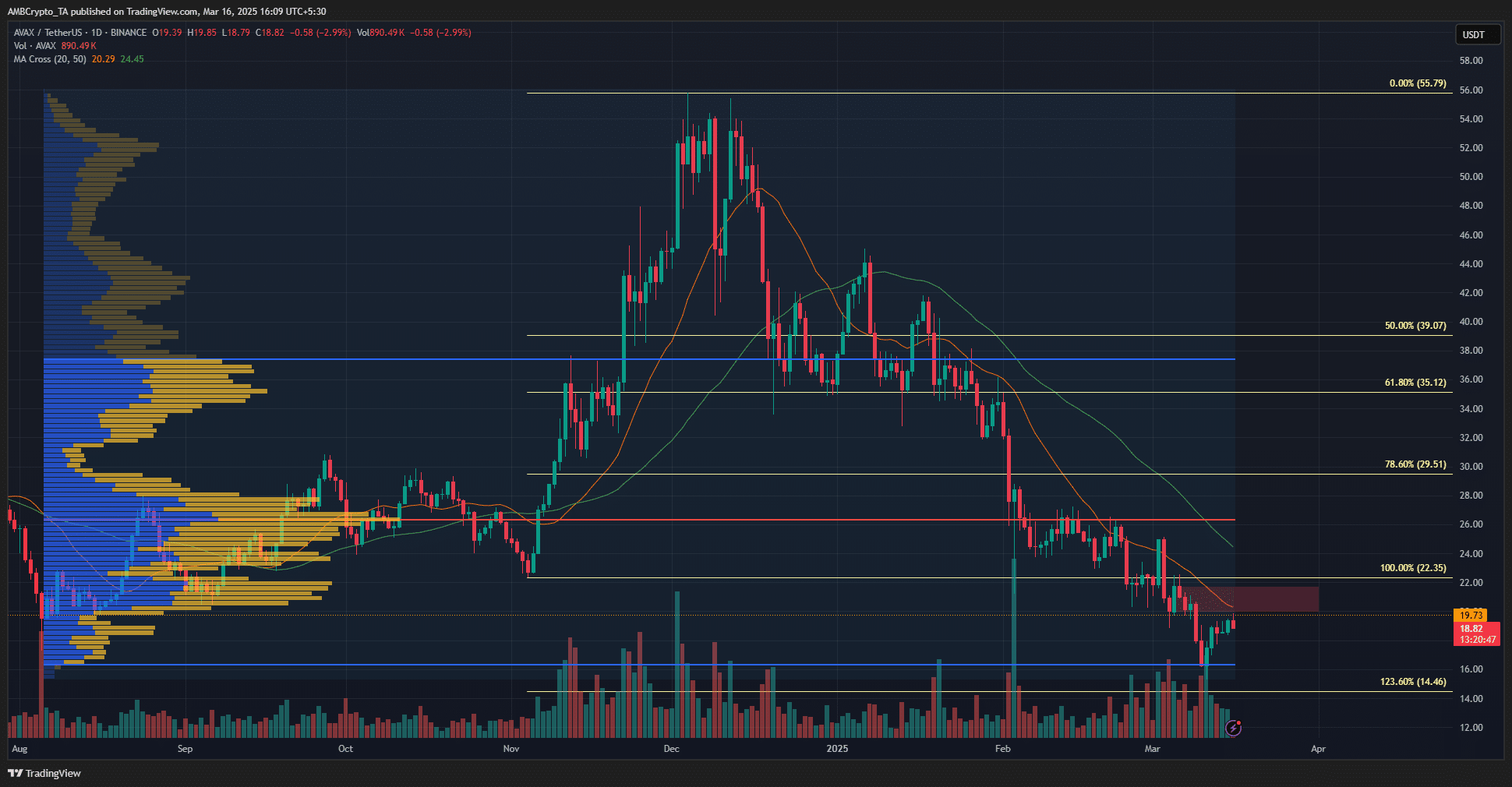

- Technical analysis showed several reasons why the $ 20 area was a formidable resistance zone for Avax Bulls.

- A small price bounce was possible, but a bearish would probably start quickly.

Early March, avalanche [AVAX] It was predicted that it would see a price of 10%, but the downward trend would be expected, and this had happened.

Later a price decrease up to $ 14 was expected in an analysis and Avax dropped to $ 15.2 a week later.

The Bearish -by -views remained in place. The question was not strong enough to take avalanche from his downward trend and strong resistance zones were over the head.

Swing traders may want to look for short entries or stay offside in the coming days.

Avalanche set to preserve Beerarish process

Source: Avax/USDT on TradingView

The November rally was completely withdrawn by 24 February. Since then, Avalanche has another 14% on the price chart.

The trade volume has also been relatively high during the decrease, which emphasizes intense sales pressure.

The progressive averages of 20 and 50 periods showed a steadily downward momentum. The 20 DMA also acted as dynamic resistance at the price in the past two weeks. At the time of printing, the 20 DMA was at $ 20.29.

The area of $ 20- $ 21.7 was a resistance zone because it was a bearish order block. Every Avax price aid would probably be checked by the sellers.

In addition, the fixed range of the volume profile of the range showed that the $ 20.5- $ 22.1 area was a high-volume junction, which strengthened the strength of the resistance.

The tool was deported from the lows from August to Verse Tijd and marked the checkpoint at $ 26.36.

The daily market structure was Beerarish and the recent lower high was set at $ 24.95. A daily session close to this level is required to shift the bullishs structure. At the time of the press, such a movement seemed unlikely.

The Fibonacci retracement and expansion levels showed that the extension level of 23.6% at $ 14.46 was the next target.

Swing traders can try to sell a price for short-term price to $ 21 and target this level as a profit motive. The bearish idea would become invalid if the price could climb above $ 22.15.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer

![Will avalanche [AVAX] Crash deeper? Why $ 14.5 support is the new target of Bears](https://bitcoinplatform.com/wp-content/uploads/2025/03/Avalanche-Featured-1-1000x600.webp)