- Have sold long -term holders as Bitcoin consolidated in the charts

- Bitcoin -derivative volume increased by 74%, which is careful optimism

The recent Bitcoin meeting beyond $ 109,000 has recently been delayed, with the cryptocurrency now consolidating just above $ 100,000. In reality, Bitcoin (BTC) acted at $ 104,982 at the time of the press, with 2.18% in the last 24 hours and last week by 3.58%.

The trade volume of 24 hours was $ 104.8 billion, while the market capitalization was according to $ 2.08 trillion, according to Coingecko -Data.

Long -term holders see the sales activity

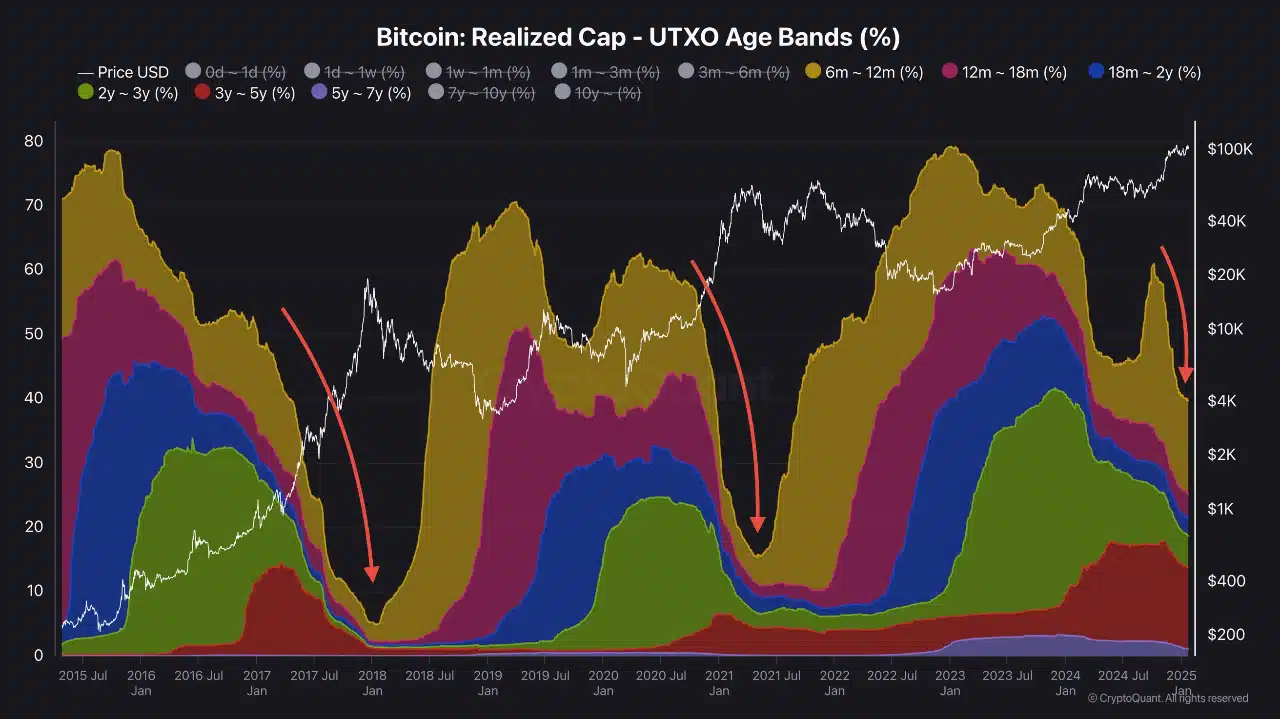

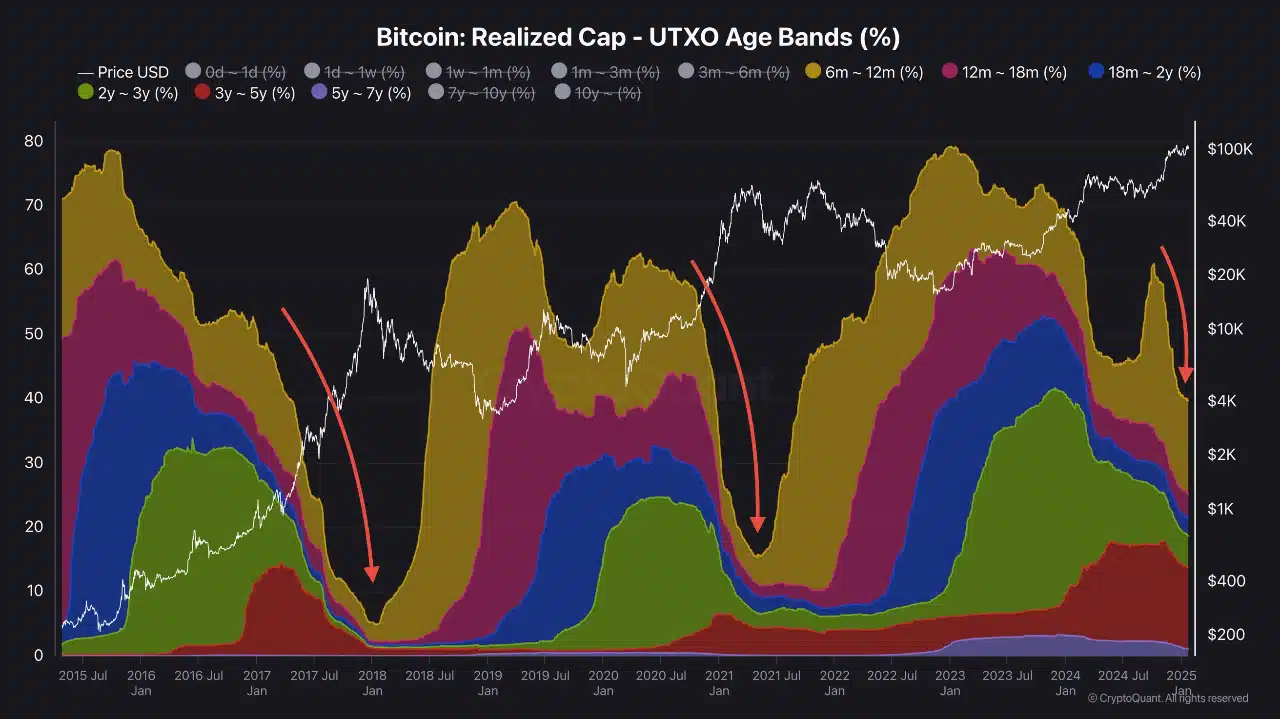

Bitcoin holders in the long term have started sales after months of holding the correction period from March 2024, according to the SOPR data (issued output profit ratio). During this period, these holders have abandoned the sale and collected Bitcoin.

However, as the price increased by $ 100,000, long-term holders resume the sales and behavior that was previously seen during the Bull market of 2021.

Source: Cryptuquant

Source: Cryptoquant

Short -term holders, on the other hand, continue to make a profit more often. SOPR data for short-term holders revealed various cases in which the ratio exceeded more than 1.02 exceeding a sign of profitable sale.

However, Sopral values above 1.06, often seen during the peaks of the market cycle, have not yet appeared. This means that there is still room for extra price growth before the profit peak in the short term.

Despite the sales activity, Utxo data emphasized that holders still retain considerable companies in the long term. This seemed to support the idea that the current cycle has not yet ended.

Source: Cryptuquant

Source: Cryptuquant

$ 97,530 identified as a crucial support level

According to the latest Crypto analyst Ali’s newest tweet”

“The most important support level to pay attention to Bitcoin is $ 97,530. Holding above this level is crucial for maintaining the current Bullish Momentum. ”

Recent data of Glass node Confirmed that this price point matches high activity levels, making it a crucial zone for price stability. If Bitcoin loses the $ 97,530 level, it can go back to $ 93,856 or $ 90,000. Especially since these are areas of strong historical activity.

Moreover, resistance is expected near $ 100,967 – $ 105,118, because many holders can take a profit in this reach.

Trade and derivative activity shows the market caution

According to CoinglassBitcoin’s trade volume rose by 73.27% to $ 172.56 billion, with open interest by 1.19% to $ 68.52 billion. Option trade also saw a larger activity, with a volume of 74.28% to $ 6.61 billion and the open interest rises by 3.95% to $ 40.62 billion.

In the meantime, the financing percentages have fallen steadily, with the OI-weighted financing percentage at 0.0038% on January 24, 2025.

This hinted with reduced leverage in the derivatives market, which reflects a careful sentiment among traders.

Hashrate shows persistent power

Finally, Bitcoin’s hashrate Was at 746.7 EH/s at the time of the press, which is a reflection of a consistent growth of network security and miners’ activity.

Although not at all of his all time, this increased level showed strong mineral trust and persistent investments in mining infrastructure, in line with Bitcoin’s press price of $ 104,994.

Source: Cryptuquant

While Bitcoin consolidates, traders and investors must keep a close eye on the most important levels to determine the next step in the current market cycle.