- Dogwifhat has been trading in a declining channel since late May.

- If the memecoin bulls fail to defend the support level, its value could fall further.

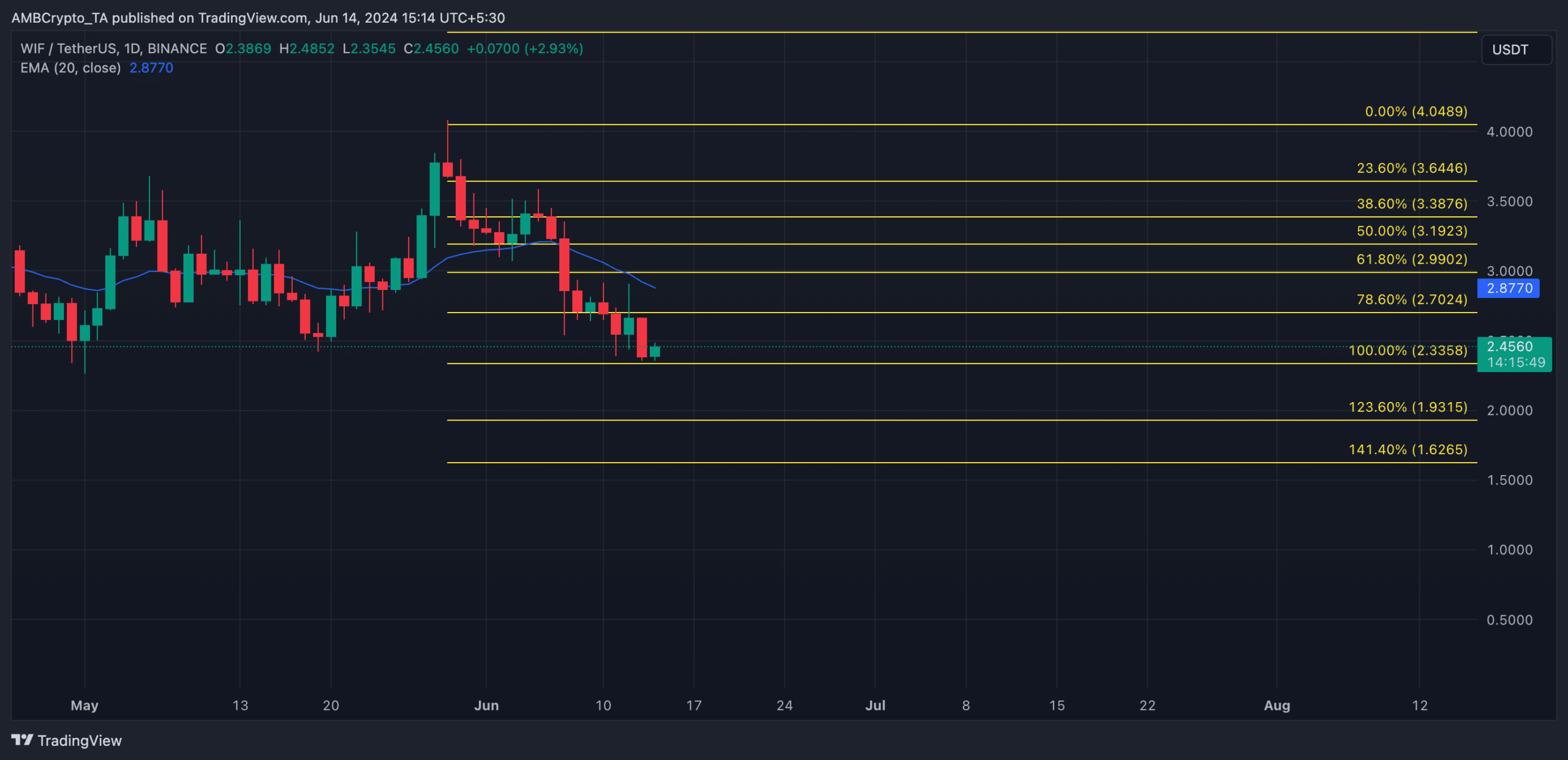

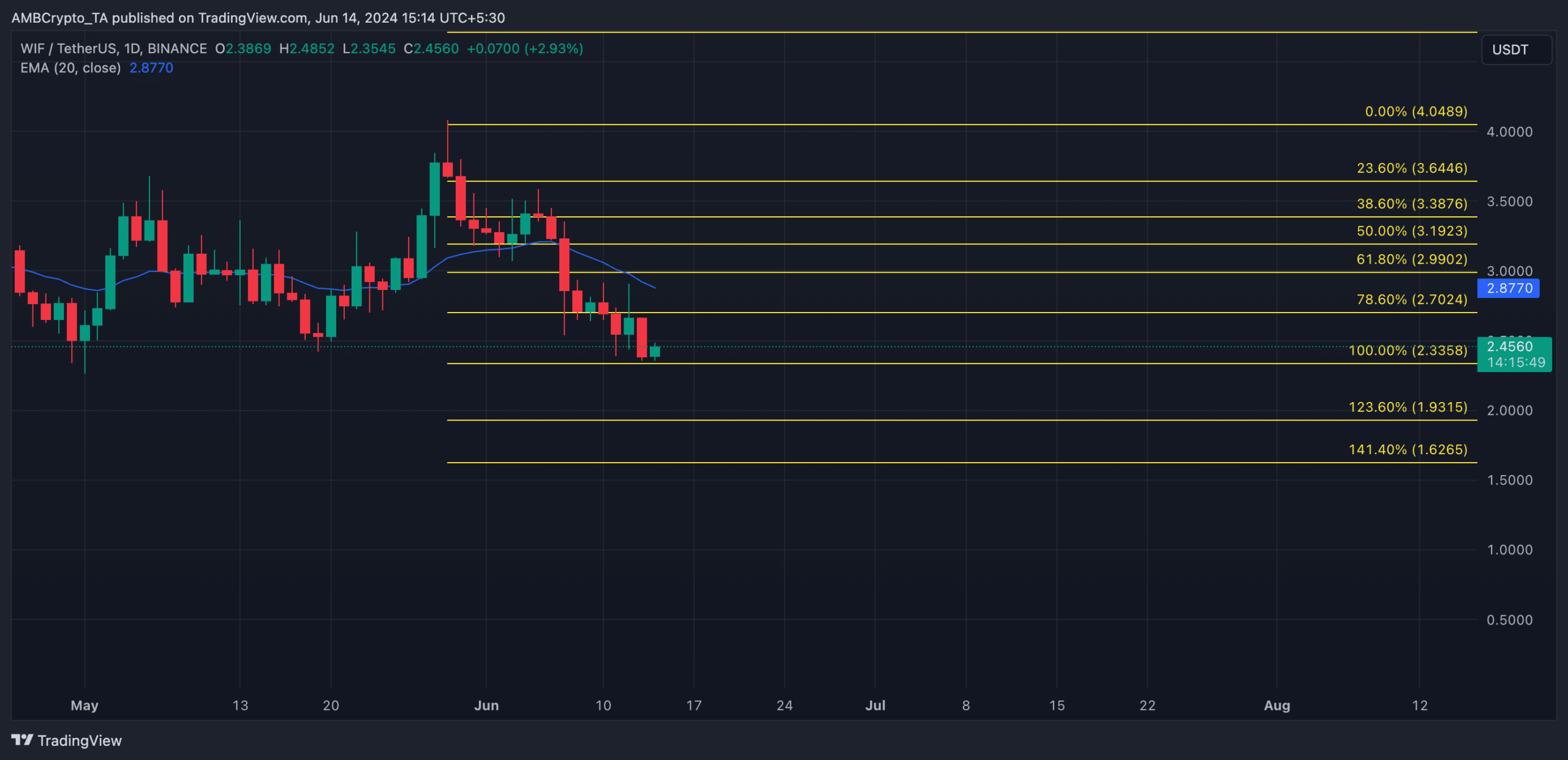

Dog hat [WIF] may be ready for a rebound if it falls to the bottom line of its descending channel.

The popular dog-themed meme coin has been on a downward trend since May 29, after closing at $3.67. Trading hands at $2.44 at the time of writing, WIF’s price has fallen 34% since then.

The bulls and bears have to get it out

When a descending channel forms, it is a bearish sign indicating continued selling pressure.

The upper line of this channel acts as resistance, while the lower line represents support. For WIF, it has encountered resistance at $4.10 and found support at the $2.08 price level.

When the price of an asset falls to the lower line of the descending channel, it approaches a level where it previously found support, and the bulls may intervene to defend this level.

If the bulls are successful and the support level holds, the asset’s price may bounce back to the upper line at resistance. However, if the support line is broken, it indicates a continuation of the bearish trend, leading to a further decline in the value of an asset.

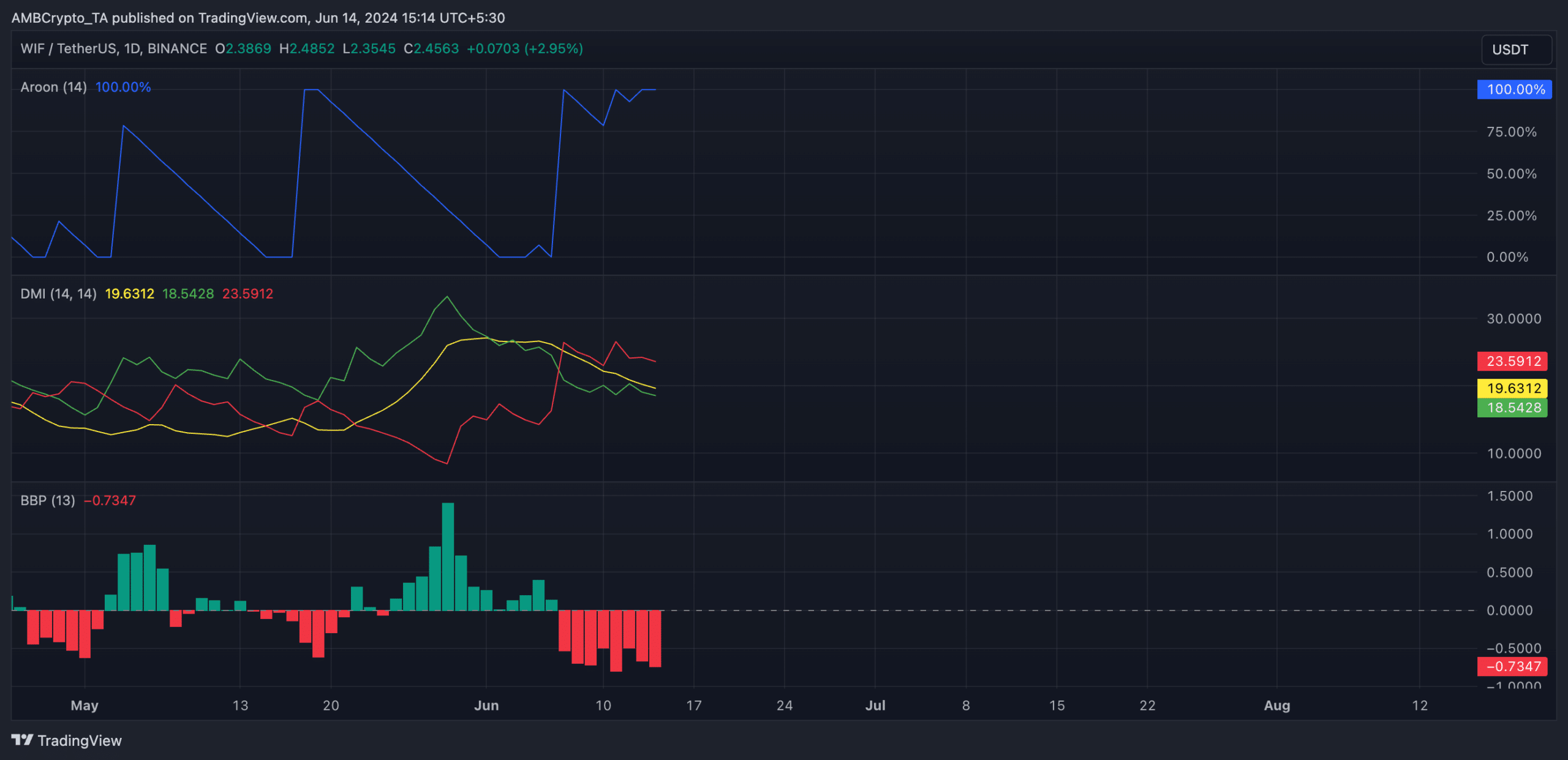

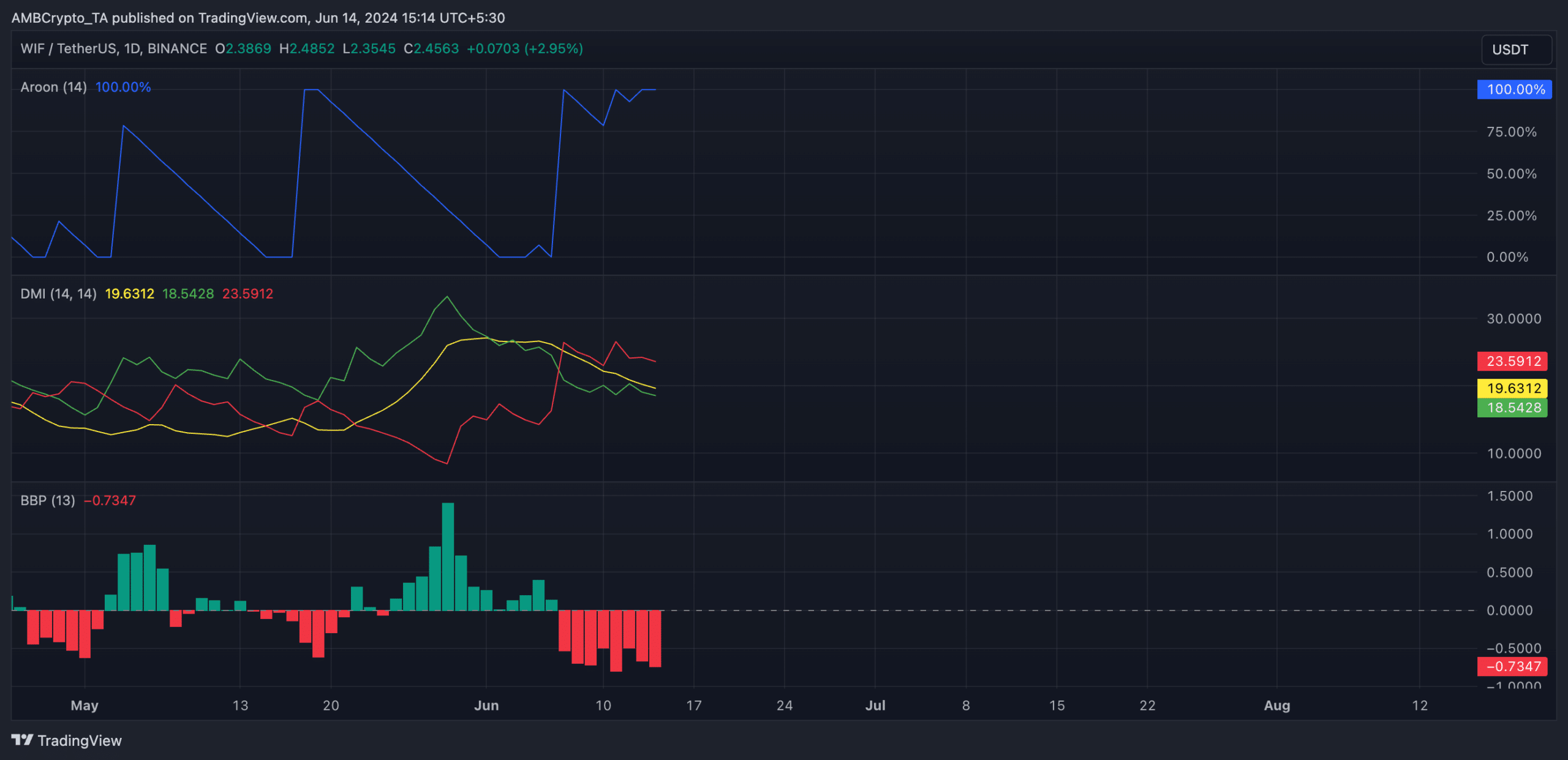

The WIF market has a significant bearish presence. For example, measurements of the Directional Movement Index (DMI) showed that the positive directional index (green) was below the negative index (red).

This confirmed that selling pressure was greater than buying activity among the meme coin holders.

Furthermore, WIF’s Elder-Ray Index has returned only negative readings since June 7. At the time of writing, the value of the indicator was -0.75.

This indicator measures the relationship between the strength of WIF buyers and sellers in the market. When the value is negative, bear power dominates the market.

WIF’s Aroon Down Line was 100%, confirming the strength of the current downtrend. The Aroon indicator identifies an asset’s trend strength and potential reversal points in its price movement.

When an asset’s Aroon Down line is close to 100, it indicates that the downtrend is strong and that the most recent low was reached relatively recently.

Source: TradingView

Read dogwifhat’s [WIF] Price forecast 2024-25

If this downtrend continues, WIF could break the support to trade at $1.93.

Source: TradingView

However, if the bulls successfully defend the support level and WIF witnesses a recovery, the price could rise towards USD 2.70.