- SushiSwap’s TVL has risen significantly over the past week.

- Activity on the protocol continued to decline as prices witnessed a correction.

The DeFi sector has experienced a downturn in recent months. With Uniswap’s dominance in the DEX sector, there was limited room for other DEX platforms to expand. Nevertheless, recent data indicated that SushiSwap [SUSHI] has made progress and shown growth despite the prevailing market downturn.

Is your wallet green? Check out the SUSHI Profit Calculator

Growing despite all odds

According to data from digital asset firm ASXN, SushiSwap’s TVL grew 32.94% over the past week, reaching $21.3 million at the time of writing.

Notable changes in TVL and fees earned over the past week:@own layer TVL grew by 182.33%. They reopened the LSTs deposits for re-withdrawal yesterday.@GMX_IO TVL grew 63.02% and reached $34.7 million.@sushiwap TVL grew 32.94% and reached $21.3 million. pic.twitter.com/rsDAGtwSma

— ASXN (@asxn_r) August 23, 2023

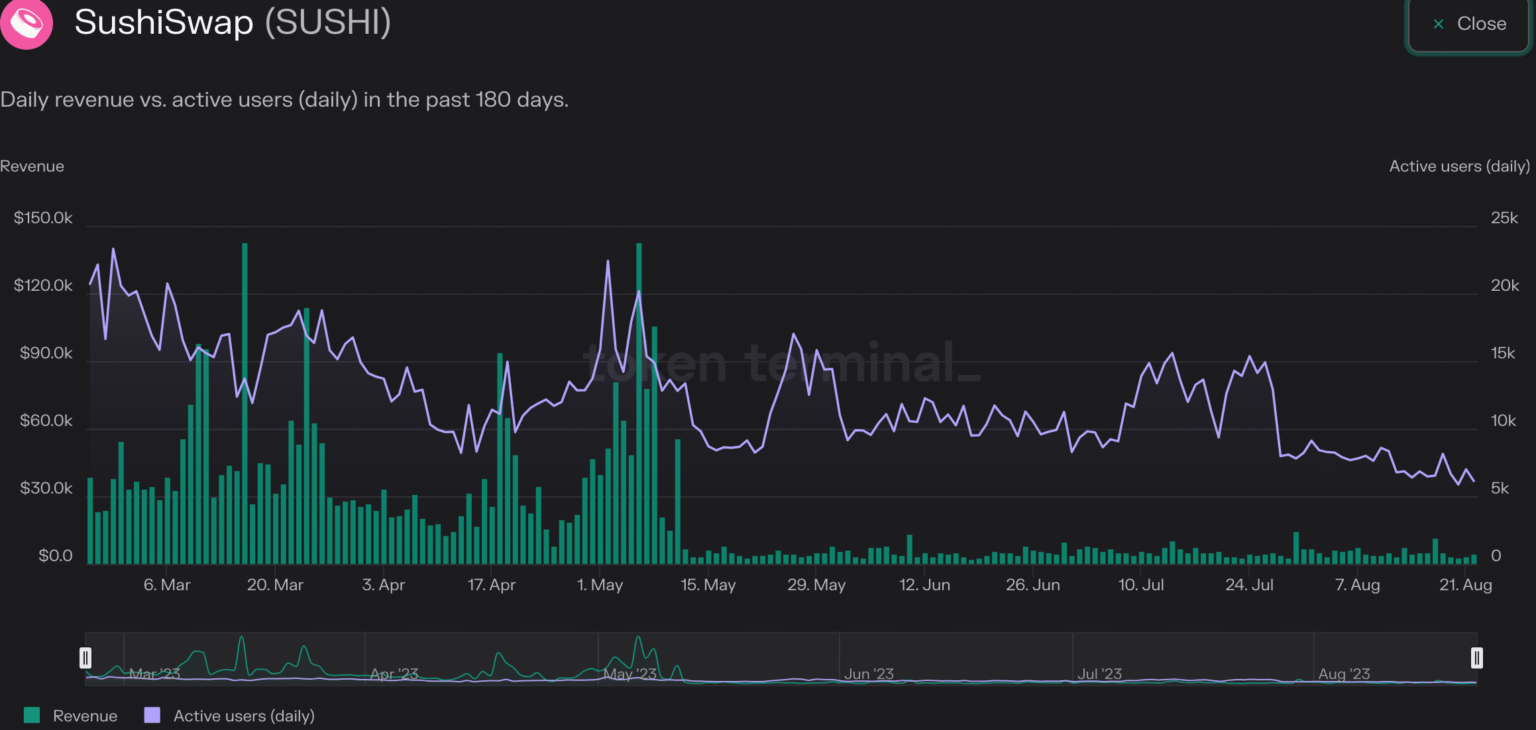

Despite the rising TVL, revenue from the protocol continued to decline. Data from Token Terminal shows that SushiSwap’s revenues are down 7.4% over the past month. One reason for the drop in turnover is said to be the declining activity on the SushiSwap network.

In the past month, activity on SushiSwap is down 60%. This sharp decline in activity could hinder SushiSwap’s growth potential going forward.

Source: token terminal

What’s going on in terms of governance?

Despite the ups and downs of the protocol’s performance, the board took an active role in making efforts to improve the protocol’s condition.

Recently, a proposal was passed by Sushi’s government regarding adding liquidity to one of its pools. DWF Labs, a global digital asset marketplace maker, proposed a collaboration to improve the V3 liquidity and trading depth of SUSHI tokens.

The partnership included providing at least $1.6 million in additional liquidity to pairs such as WETH/USDT, WETH/USDC, LDO/WETH and more. DWF Labs is committed to growing market share: 3% in three months, 6% in six months and 10% in nine months.

SUSHI support on exchanges such as Binance and OKX with deep market action was also part of the plan. SUSHI also planned to lend 2 million tokens over 24 months, with a 5% annualized return paid to Sushi Treasury.

DWF Labs has a European call option with strike prices based on the spot price increase of SUSHI. The proposal was passed with over 99.85% of the vote.

Source: snapshot

Realistic or not, here is SUSHI’s market cap in terms of BTC

Whales get hungry for SUSHI

Although much progress has been made by the SushiSwap protocol in administrative terms, the price of SUSHI continued to fall. At the time of writing, SUSHI was trading at $0.5901.

Despite the drop in prices, interest in whales in SUSHI continued to grow. The rising optimism of major investors could provide long-term momentum for SUSHI holders.

Source: Sentiment