- BTC’s recent rally could stall amid mounting selling pressure, according to Coinbase analysts

- Analysts from QCP Capital and Coinbase predicted a breakthrough in the fourth quarter of 2024

On Friday, Bitcoin [BTC] climbed higher on the charts, reaching a monthly high of $67.3k, despite a general collapse in US stocks.

However, Coinbase analysts have a word of caution. According to them, the recent gains could attract gains and “limit price movement to the upside.”

In fact part of the exchange’s weekly market commentary read,

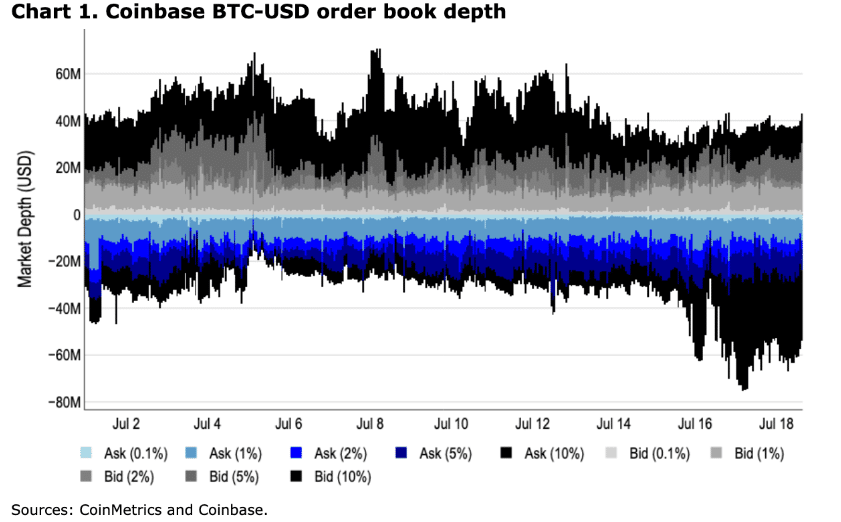

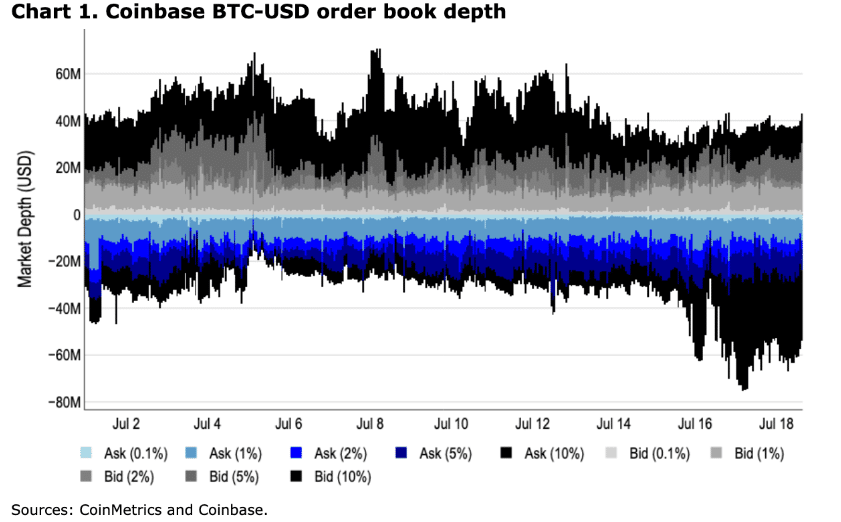

“We have seen an increase in the number of total sales orders placed within 5-10% of the mid price. “That suggests we may see some profit-taking at current levels and/or a greater willingness from market participants to sell at price increases.”

Source: Coinbase market depth

For perspective, market depth follows the number of sell (ask) and buy (bid) orders. Positive values in USD indicate buy orders, while negative values follow sell orders.

The attached Coinbase chart revealed a significant drop in market depth between July 16 and 18, with increasing inquiries (sell orders). In the short term, this could put more downward pressure on the cryptocurrency’s price.

More Bitcoin sales volumes

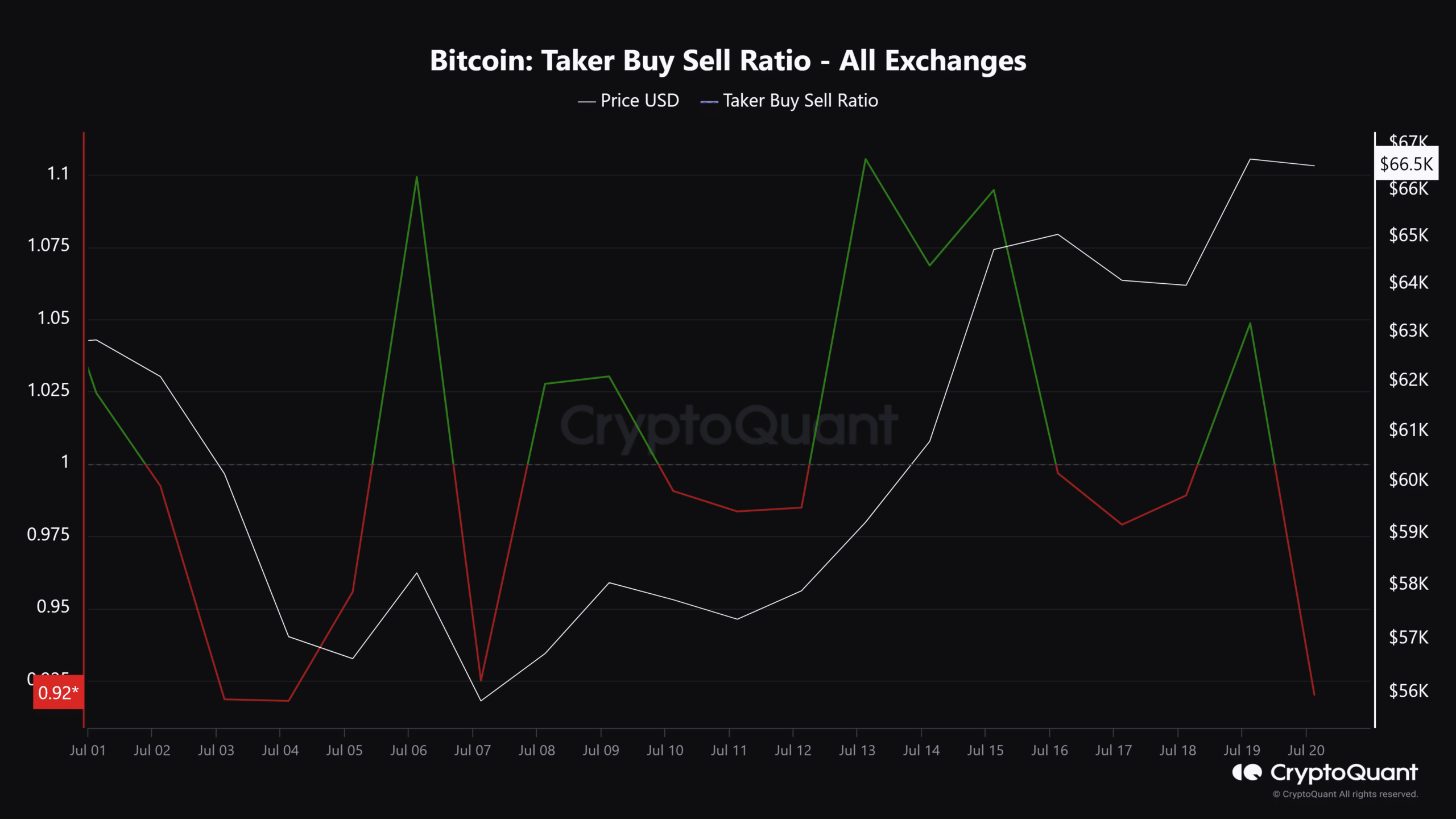

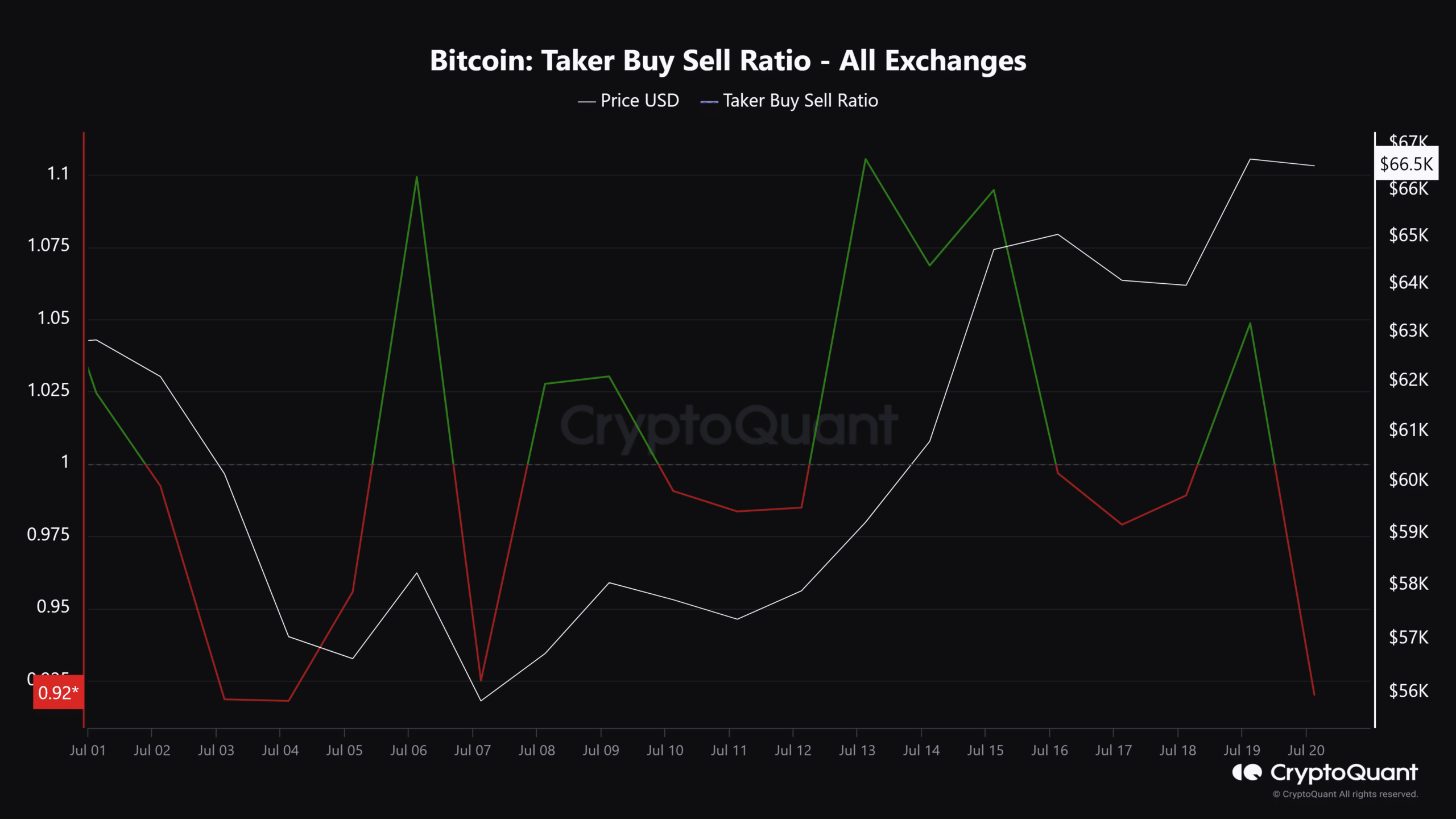

The above trend was also observed on most exchanges, especially on the derivatives side. For example, according to CryptoQuant data, selling volumes eclipsed buying volumes on Saturday, as evidenced by the declining Taker Buy Sell Ratio.

Source: CryptoQuant

This measure, which divides buying volumes by selling volumes, was indicating bearish sentiment at the time of writing, after dipping below 1 on the charts.

Meanwhile, Coinbase analysts believe that the likely profit-taking during the recent rally fits well with the choppy trading forecasts for the third quarter of 2024. However, they also believe that a rally in the fourth quarter of 2024 is still feasible.

This prediction is also consistent with that of QCP Capital’s analysts. In a Friday note to the Telegram community, QCP Capital analysts said noted,

“While the spot here could vary in the short term, especially with dealers waiting a very long time for the July 26 67k Strike, the market is certainly betting big on a breakout ahead of the US elections.”

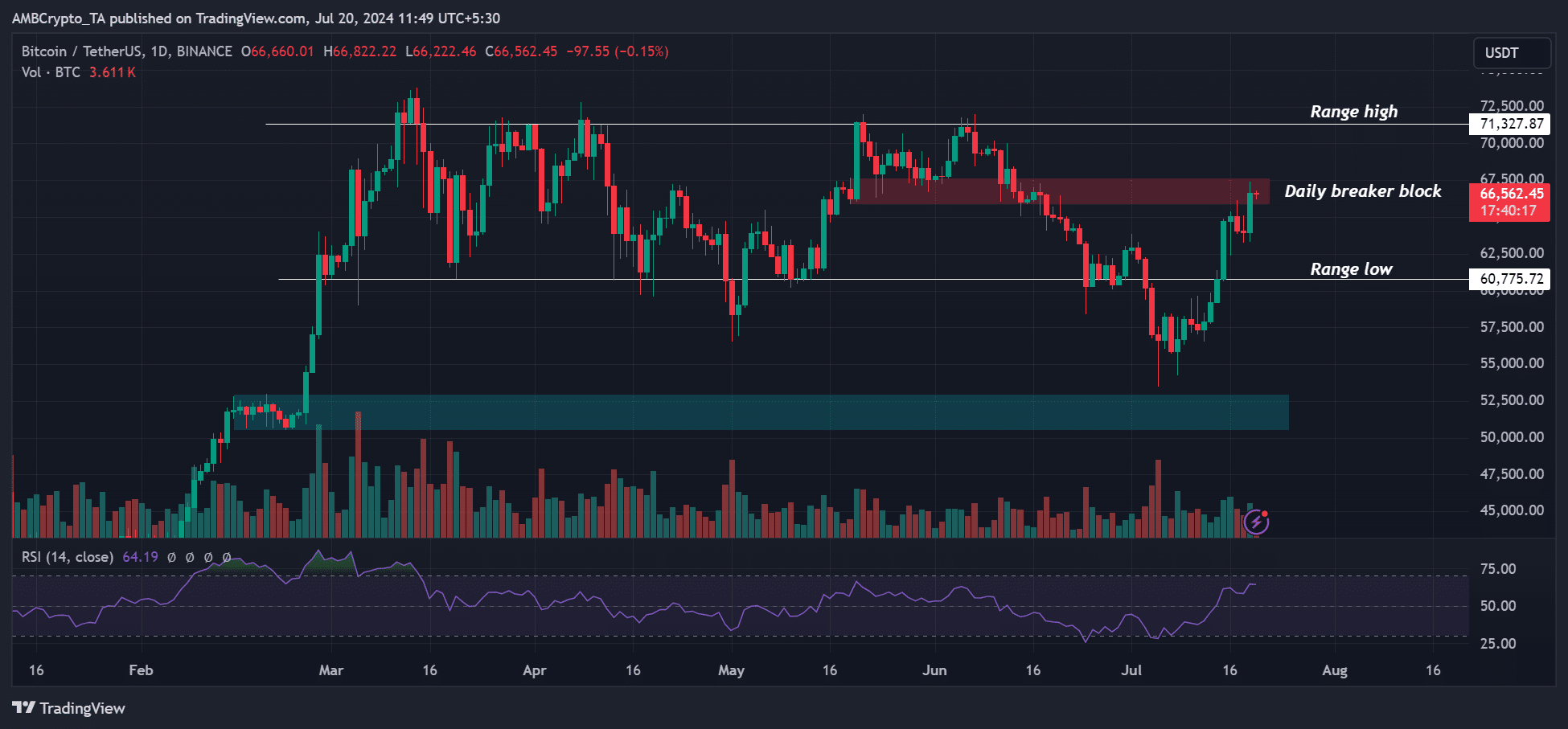

On the price front, the cryptocurrency had yet to break above the hurdle and daily breaker block, highlighted in red, near $67.5k at the time of writing.

If the bulls clear this hurdle, a quick retest of the range highs at $71k would be likely.

Source: BTC/USDT, TradingView