- Bitcoin’s fall below $59,000 has led to significant market liquidations, particularly affecting altcoins.

- Analysts advise caution and suggest a pause in altcoin accumulation due to current market uncertainties and weak signals.

In a dramatic 24-hour period, the global cryptocurrency market witnessed a sharp decline of 4.7%, driven by a significant decline in the price of Bitcoin. [BTC] price, which fell below the critical level of $59,000.

This decline has rippled through the market and has serious consequences for altcoins.

As Bitcoin struggles to maintain its position, the altcoin sector experienced a significant reduction in market capitalization from $1.03 trillion at the start of this month to just $953 billion at the time of writing.

Bitcoin’s recent drop below $59,000 marks a critical moment in the cryptocurrency market, reflecting broader uncertainty and causing widespread sell-offs.

The downtrend has cast doubt on the continued health of the bull market, with Bitcoin testing support levels multiple times – an indicator of potential market weakness.

On Crypto Banter’s ‘The Ran Show’, Analysts marked Bitcoin’s precarious position at the bottom of its trading range, suggesting that repeated tests of these levels could signal an impending market shift.

Stay away from altcoins

During these tumultuous market conditions, experts advise traders to exercise caution, especially with altcoins.

Recent patterns and market data indicate a cooling off period for altcoins, which have been significantly affected by Bitcoin’s prolonged price adjustments.

The Crypto Banter analyst noted that while altcoins typically experience periods of recovery, current market conditions are not favorable for an immediate recovery.

Use pendulum [PENDLE] For example, the analyst revealed that the altcoin has experienced a notable decline not due to protocol issues, but due to external market pressures, illustrating the volatile nature of altcoin investments in uncertain times.

The analyst’s advice is to focus on robust on-chain data and not be influenced by volatile social media trends.

The Crypto Banter analyst also mentioned FTX’s recent move, which could potentially return more money to users than was initially lost, indicating a positive turn in market liquidity that could support the recovery.

Comparing Bitcoin’s market capitalization growth with that of major financial institutions and traditional assets like gold, the analyst strengthened Bitcoin’s long-term value proposition despite its short-term volatility.

Solana: A case study in volatility

While the analyst recommends caution with altcoins, it makes sense to investigate Solana [SOL]the third largest altcoin on the market, as a specific example of the impact of the market decline on altcoins.

Solana has been hit hard; In the last 24 hours alone, SOL’s share price has fallen 7.3% and stood at $134.83 at the time of writing. This downturn followed a brief rise excitement about potential ETFs.

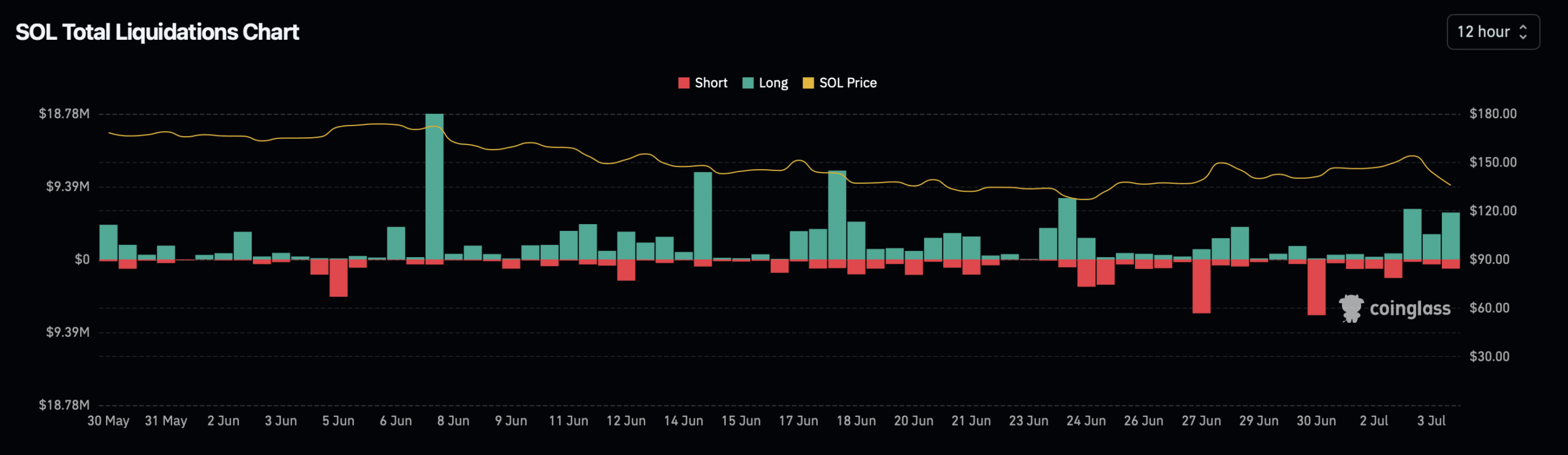

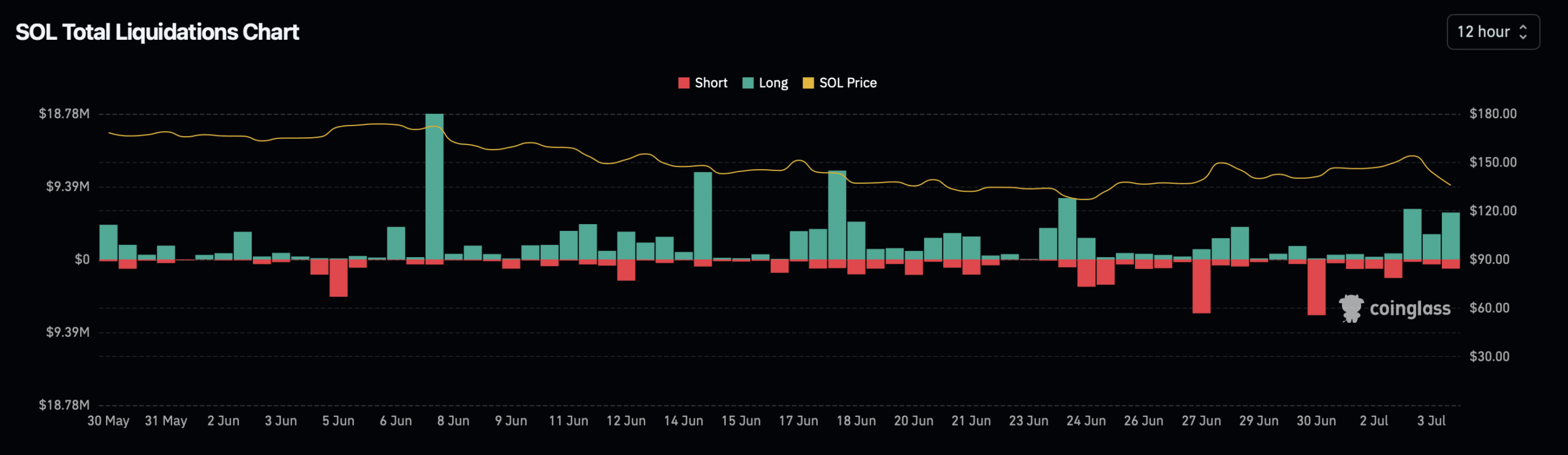

This decline in Solana’s value has had a significant effect on traders. According to Mint glassOver the past day, 106,449 traders have faced liquidations totaling $289.26 million.

Of this, Solana-related liquidations amounted to approximately $12.55 million, primarily from long positions. Specifically, Solana’s long liquidations totaled $10.76 million, compared to $1.80 million from short positions.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024-25

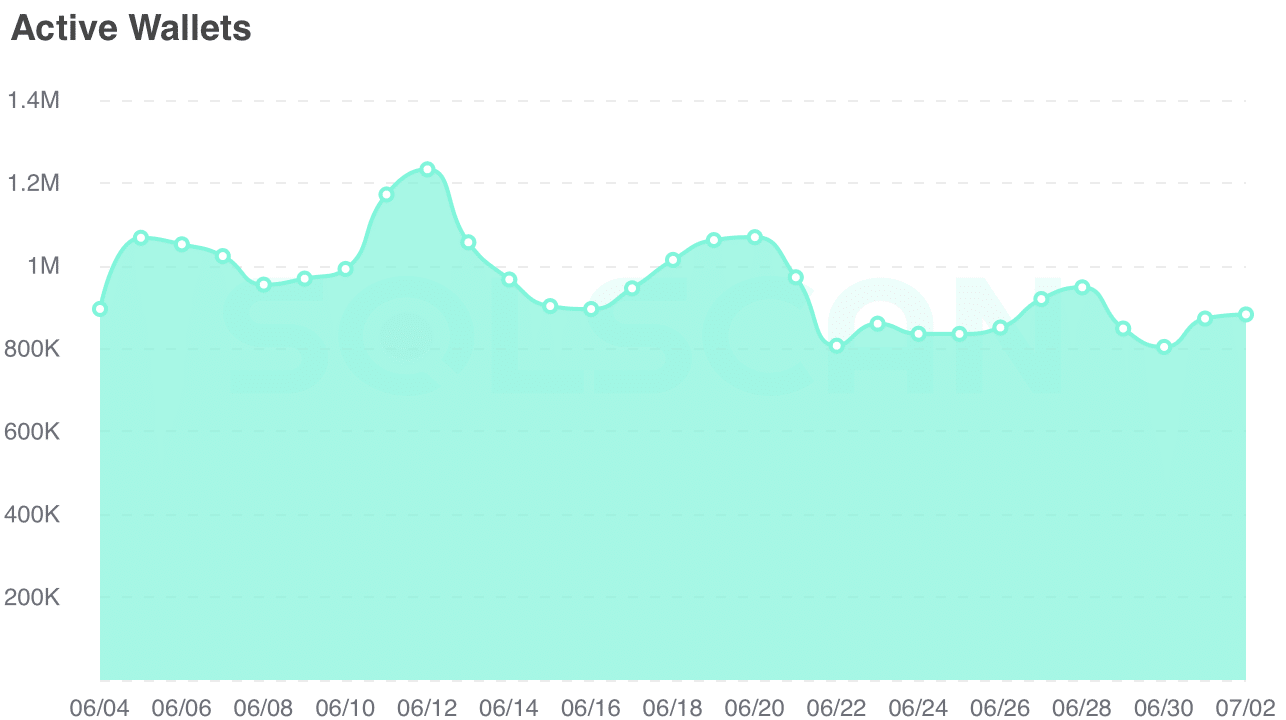

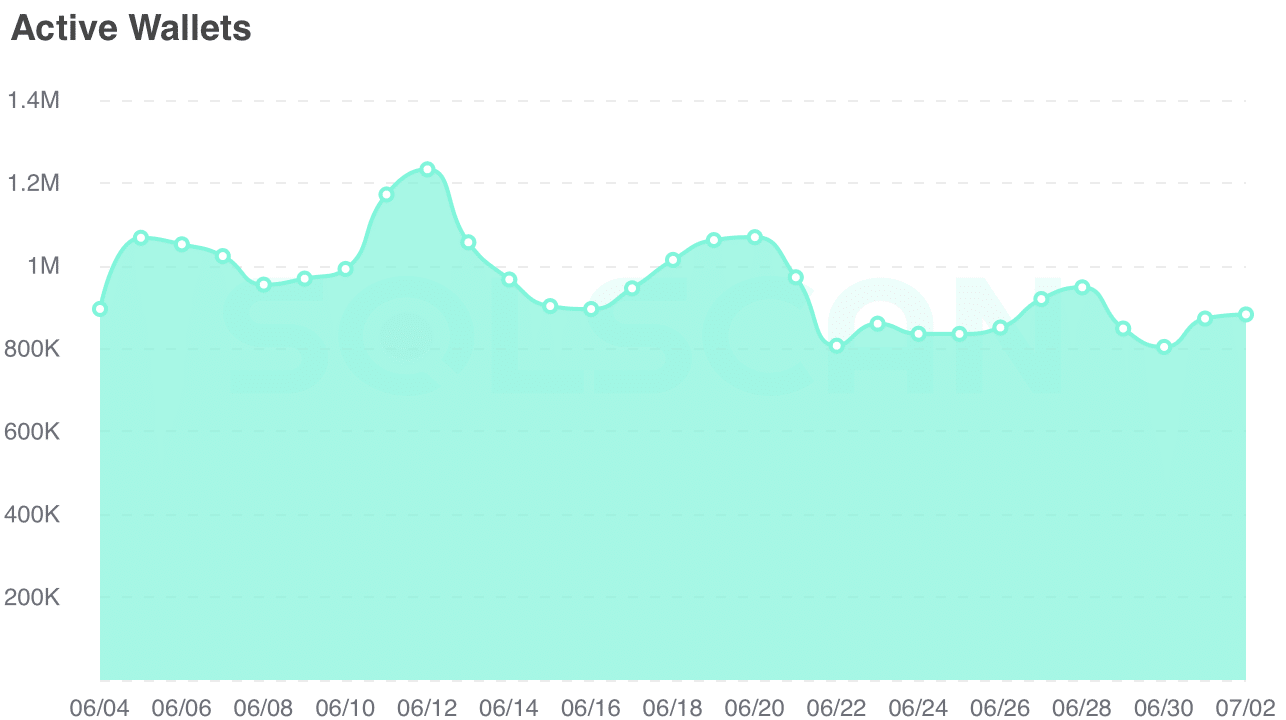

The downturn appears to have consequences for Solana’s activities in the chain. AMBCrypto’s look on Solscan indicated a clear decrease in the number of active addresses.

From over 1.2 million addresses last month, the number has fallen to 882,000 at the time of writing, indicating declining user engagement amid current market conditions.

Source: Solscan