- The FOMC meeting, in combination with the post of Donald Trump, hinted in a potential end of QT in April.

- Positive sentiment was further fed by important statistics and remarkable figures such as Brad Garlinghouse that tackles the crypto -top.

The crypto -markets responded positively to the expectations of reduced monetary system rates for the medium term. FOMC comments were less strict than expected, and increasing activity in conventional financial markets fed optimism.

Nevertheless, the rates remained unchanged, without a clear indication of possible reductions.

Jerome Powell, chairman of the Federal Reserve, emphasized that high interest rates are essential to combat inflation. He reduced economic growth projections, which suggests that improved market conditions.

However, he attributed economic challenges to aggressive policy that was implemented during the government of President Donald Trump.

Arthur Hayes, Co-founder of BitMex, noted on x (Formerly Twitter), which Powell had achieved his objectives that led to an expected end of quantitative tightening on 1 April.

Hayes said that the true bullish shift would probably come from a SLR exemption or the return of quantitative relaxation (QE) measures.

This was supported by a post by Trump on Truth Social reading;

“The Fed would be much better off, because American rates are switching their way to the economy (ease!).

Hayes saw $ 77k as the possible soil for Bitcoin, but predicted that shares could decrease further before it reached Powell’s desired, so investors had to remain flexible with sufficient funds.

Market expectations were influenced by predictions of rising inflation rates. It was expected that extensive high rates would have bearish effects.

Analyst Benjamin Cowen confirmed on X That quantitative tightening (QT) was underway. He explained in response to Hayes;

“QT is not” actually over “on April 1. They still have $ 35 billion/MO off the effects covered by mortgage. They have just delayed QT delayed from $ 60 billion/MO to $ 40 billion/MO”

Crypto and Blockchain Business Investments

News from a crypto summit with Trump, Michael Saylor, co-founder of strategy, and Brad Garlinghouse, the CEO of Ripple Labs fed recent market profits.

The top emphasizes crypto and institutional adoption. Bullish Sentiment grew after Trump media executives Renaus Tactical, with the aim of collecting $ 179 million via a special acquisition company (SPAC) for blockchain investments.

Increasing the organizational interest in crypto continues to increase trust in the sector. Expectations of more crypto-friendly government policy have also contributed to the market profits.

Short liquidations, sentiment and ETF flows

Supplementary, Crypto -markets that were won as the demand for short positions decreased and massive short closures meant that the resolution of bearish bets.

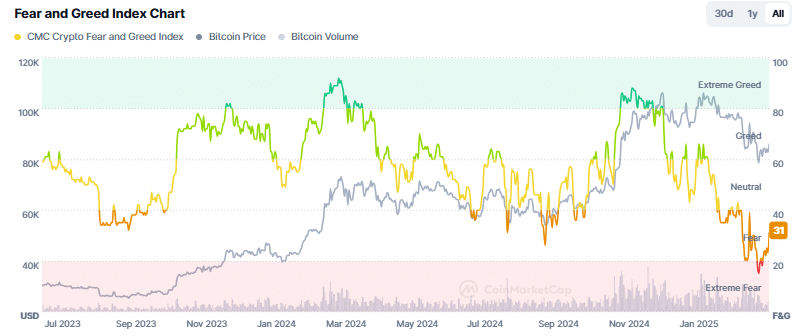

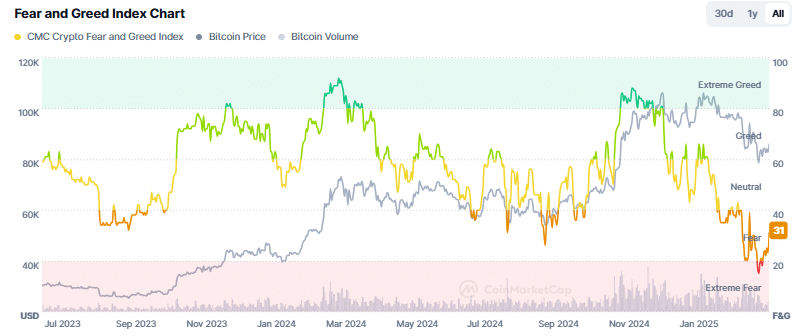

At the time of writing, the Crypto fear and greed index reached 31 points of its previous level of 15 during the past week, indicating escalating trader positive and the development of bullish market sentiment.

Source: Coinmarketcap

Bitcoin Spot ETFs saw an inflow of $ 11,7984 million, which reflects greater demand. Ethereum, on the other hand [ETH] Spot ETFs registered their eleventh consecutive day, a total of $ 11,7459 million.

With Bitcoin that led the crypto markets, this trend meant a strong bullish sentiment.