- Mount Gox has started repaying creditors who suffered losses when the mountain collapsed in 2014

- Ethereum fell to an intraday low of $2,825 and looked on track for four consecutive daily red candles, at the time of writing

Bitcoin, the world’s largest cryptocurrency, crashed to its lowest level since February earlier today as the market reacted to news of activity around a Mt Gox-linked wallet. In fact, the magnitude of the crash was so great that BTC fell below $55,000 on the price charts, a drop of more than 9% on the weekly charts.

However, it was not the only one: Ethereum took over the lead from BTC. It also recorded worse losses, with ETH falling below $3,000 and hitting an intraday low of $2,820.

Whale activity also contributed to the losses

Ethereum’s free fall also seems to have happened worsened by whales selling significant amounts of Ethereum (ETH) to pay back debts on their sunk bets.

In fact, on-chain data source LookOnChain found that ETH price drops created liquidation risks for Ethereum whales craving ETH through Aave and Compound. For example, the tool tracked an address that sold 26,600 ETH to pay off a debt on Aave in no time. after on X.

Liquidations

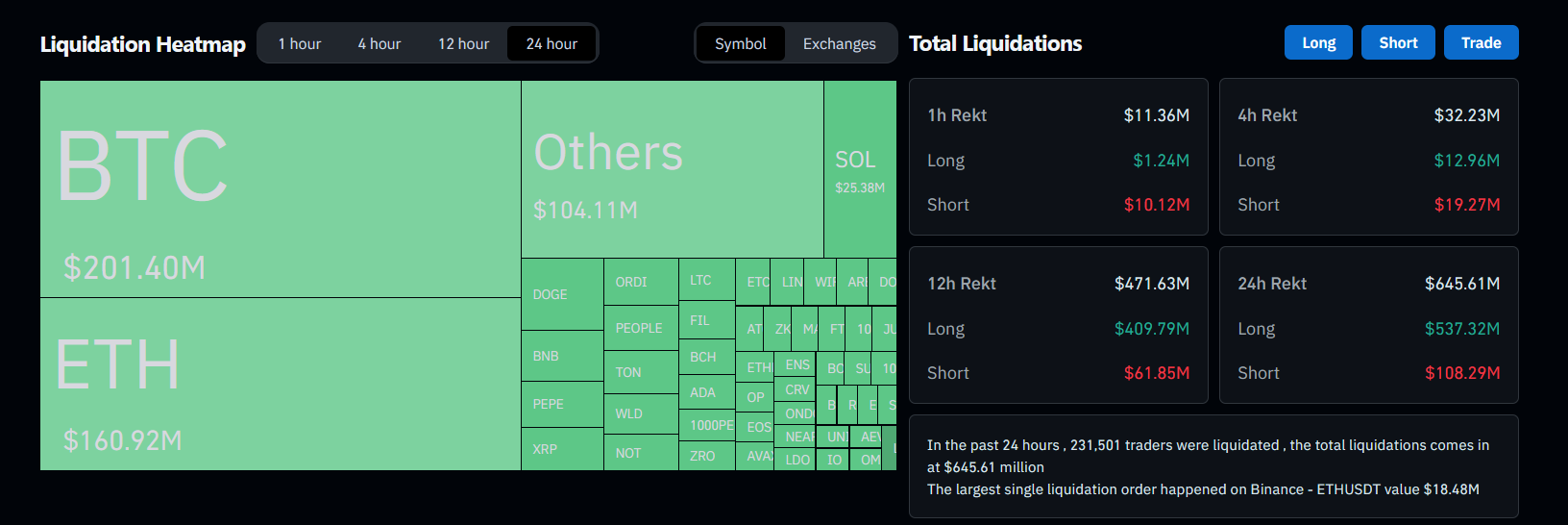

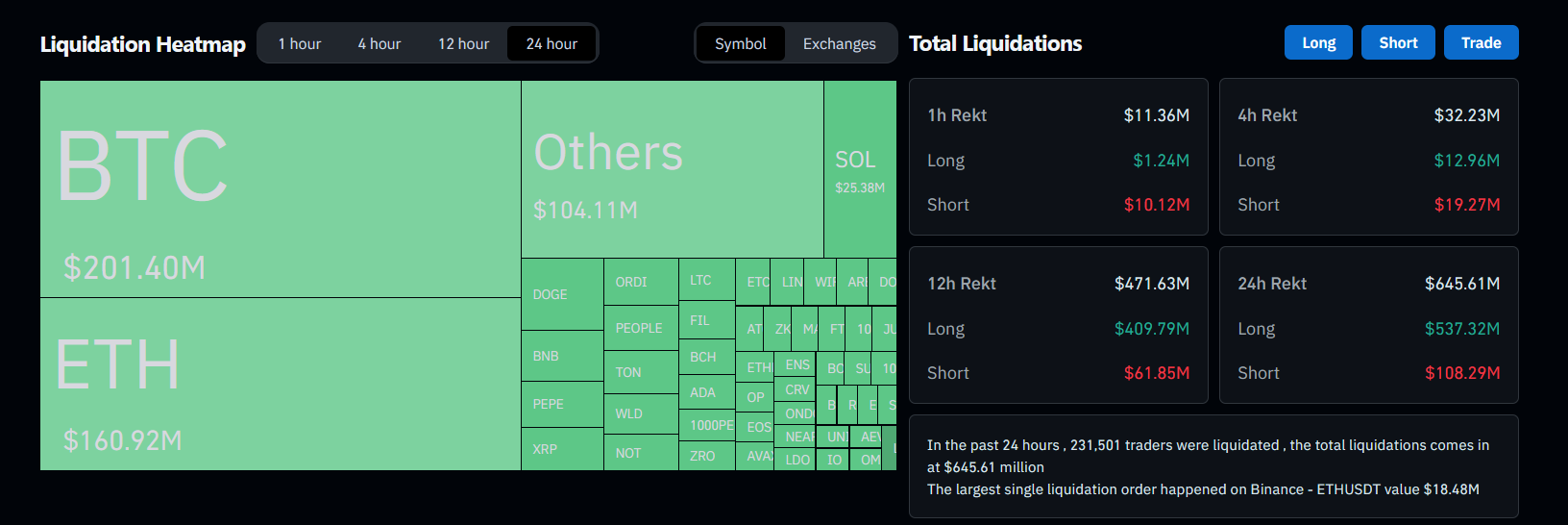

As expected, Friday’s market carnage resulted in nearly $650 million worth of cryptos, including $537 million in bullish bets, being liquidated in just 24 hours.

Source: Coinglass

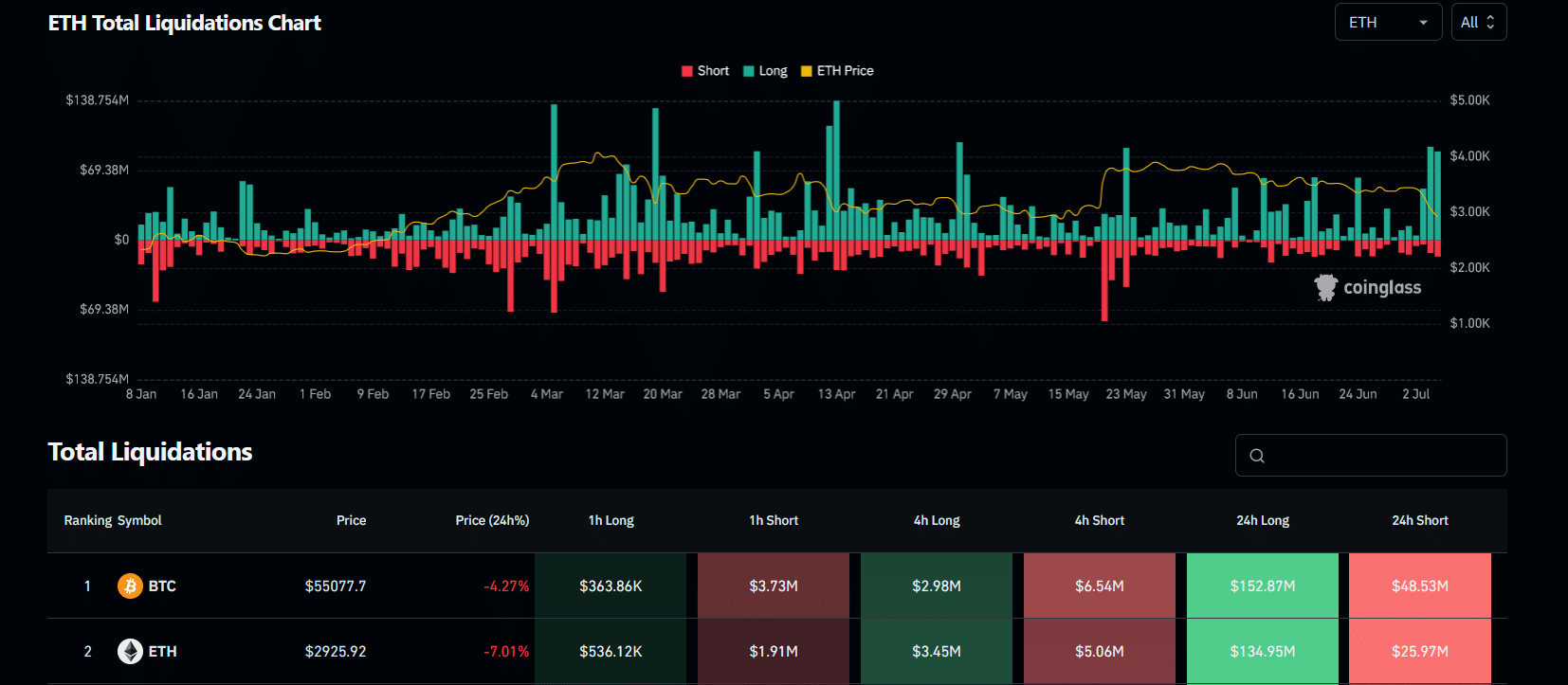

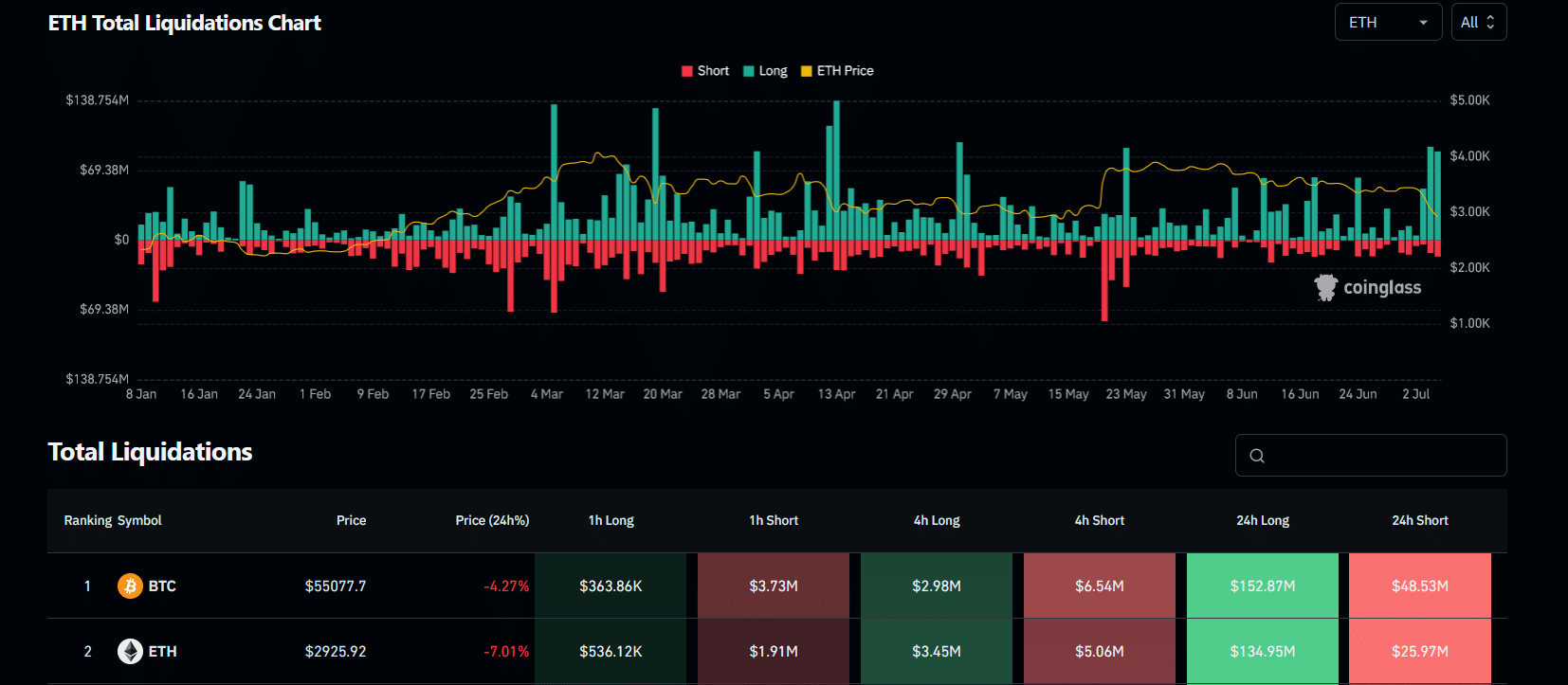

More than $130 million worth of ETH long positions were forcibly closed in the 24 hours, which also led to press time.

Source: Coinglass

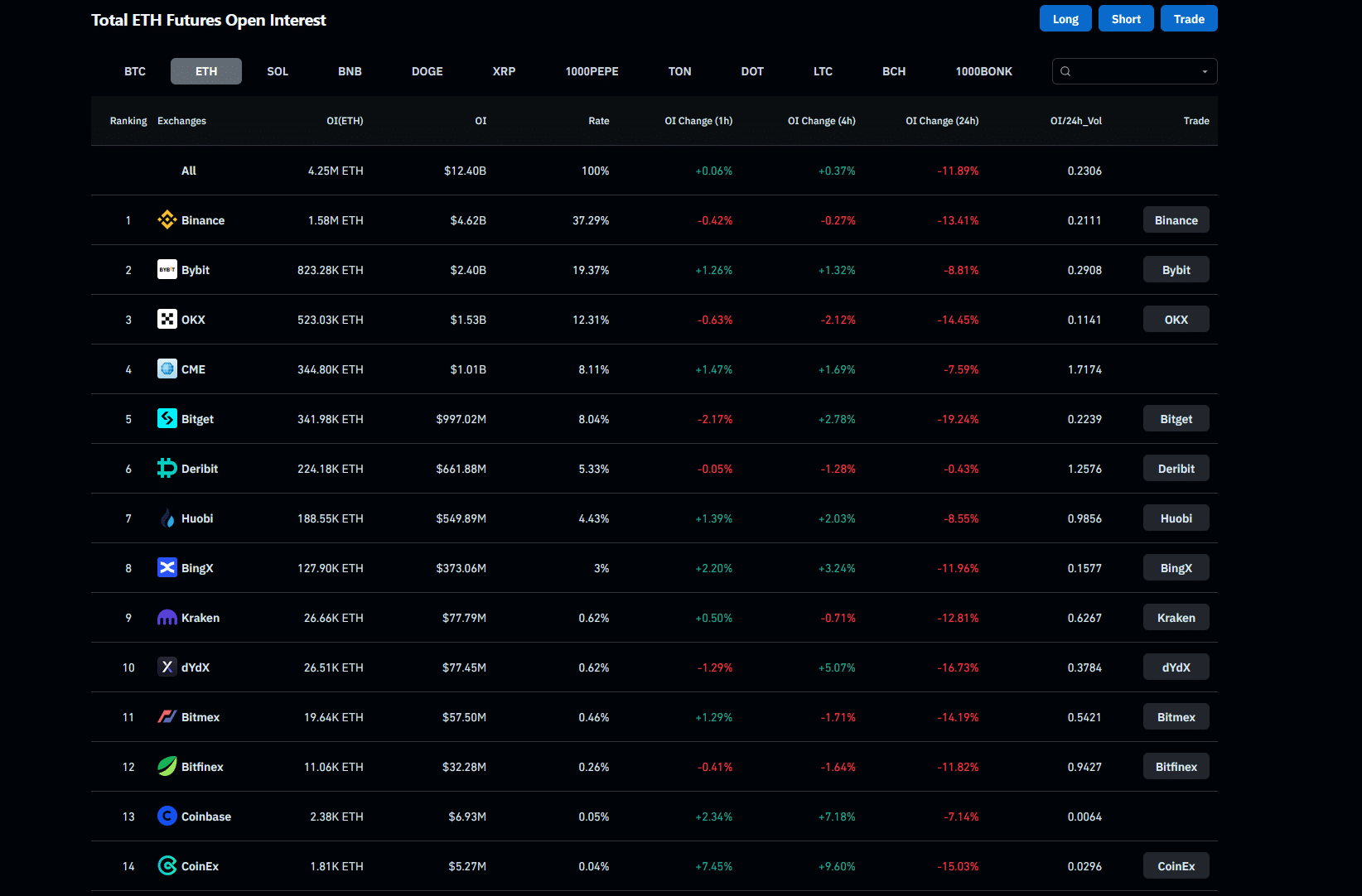

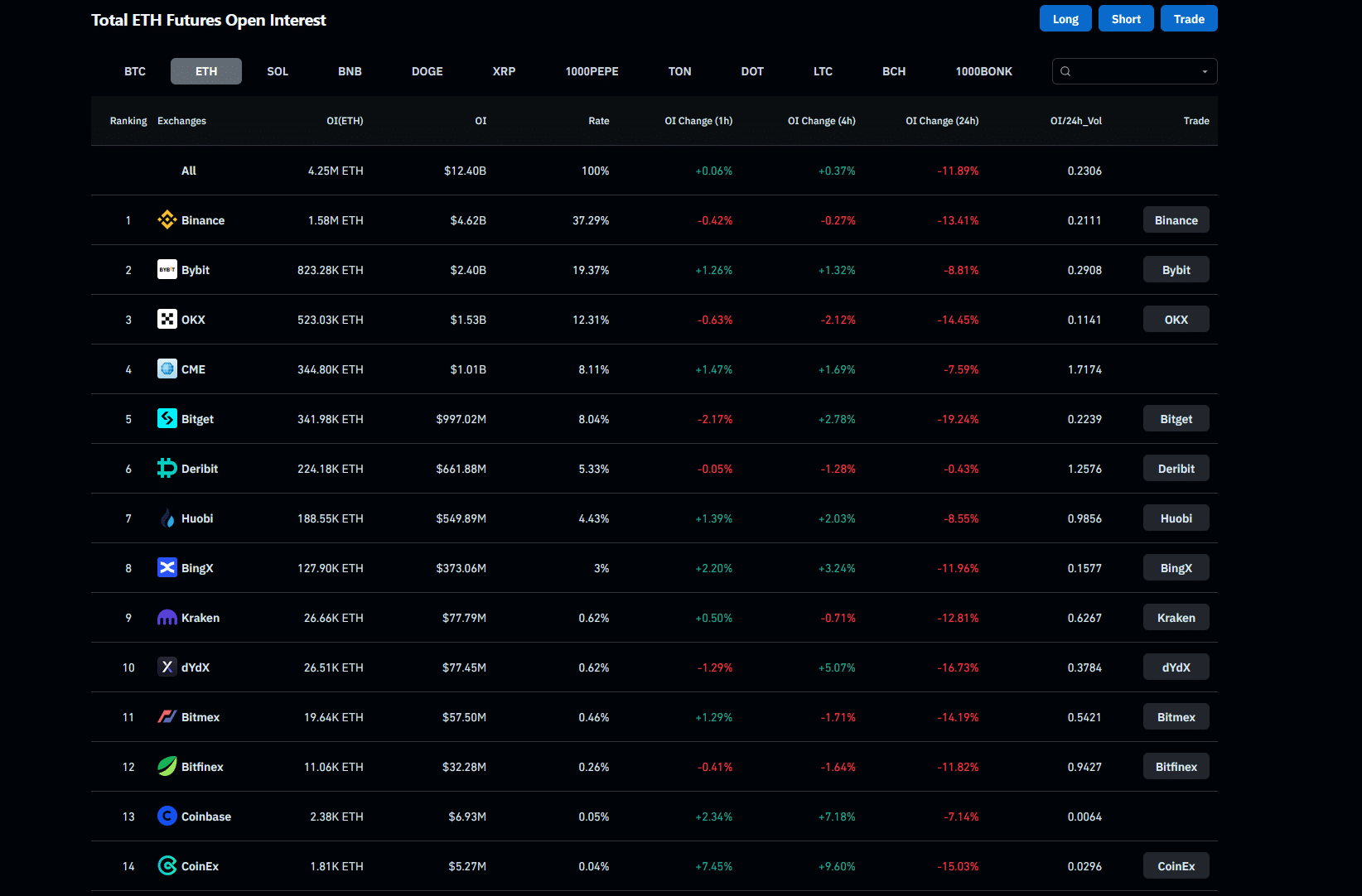

Meanwhile, total open interest (OI) for ETH Futures on the major exchanges also fell by almost 12% in the aforementioned period – a sign that funds are exiting the market.

Source: Coinglass

Finally, Ethereum’s CME OI also fell 7.59%, confirming bearish investor sentiment across the board.

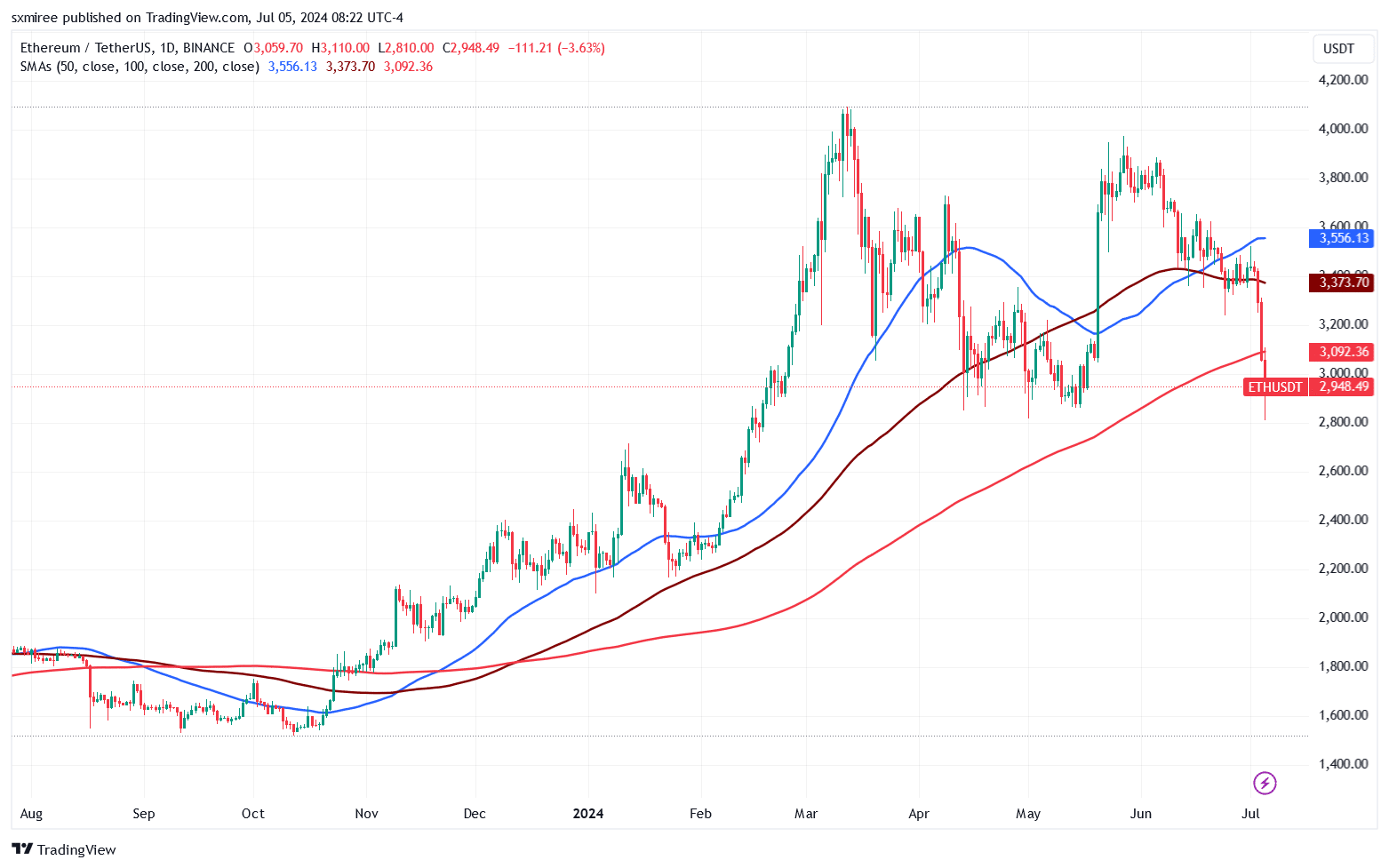

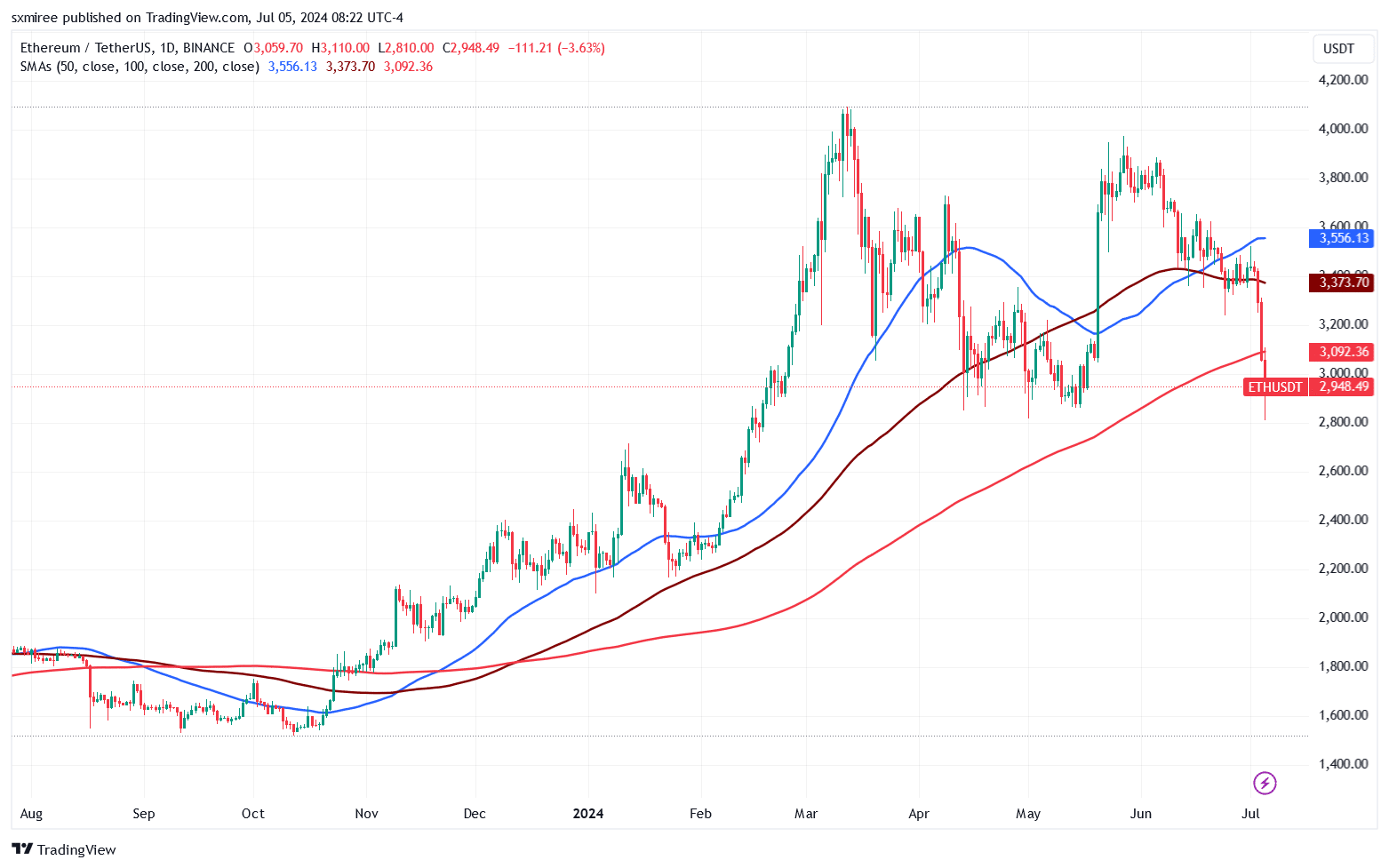

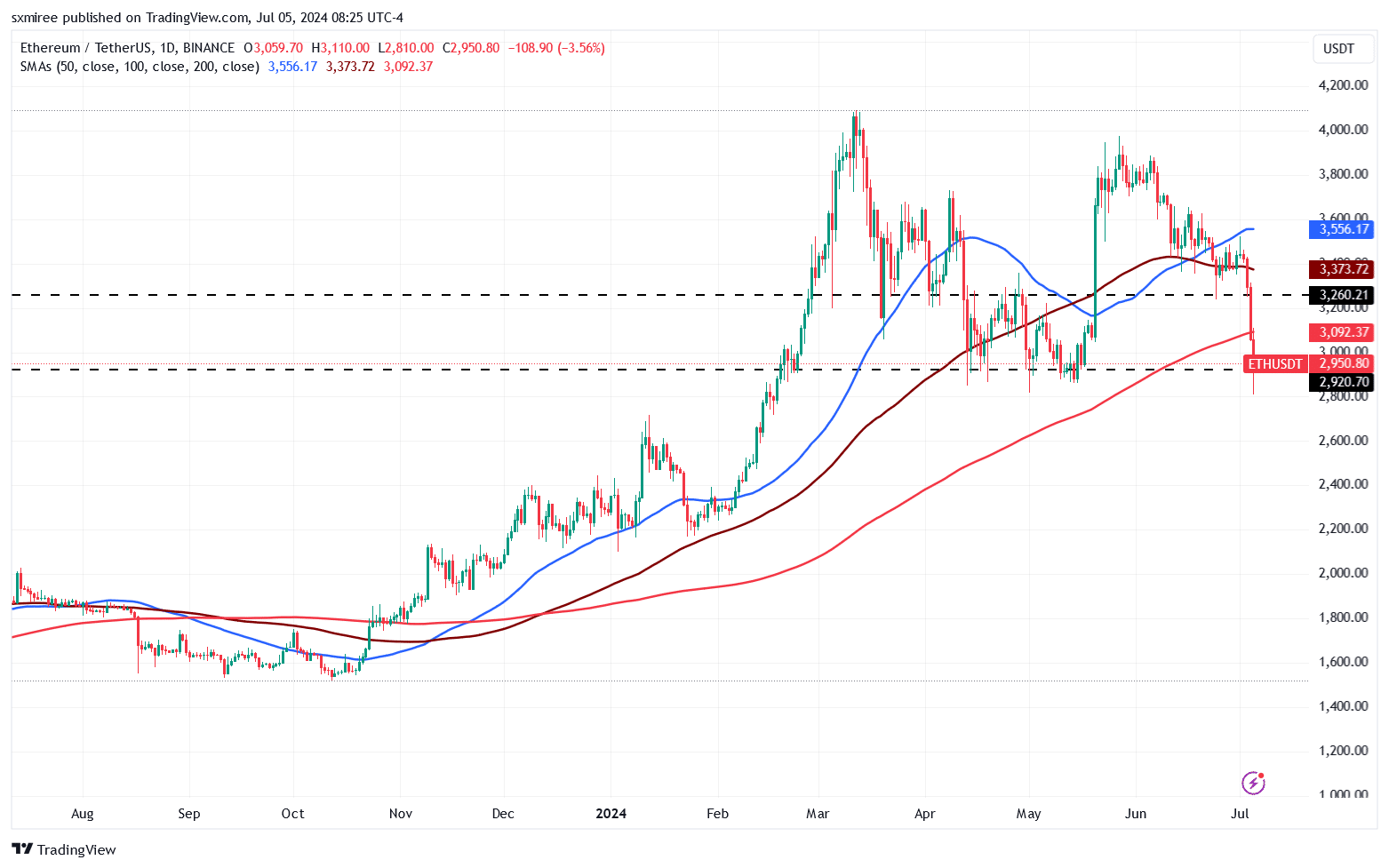

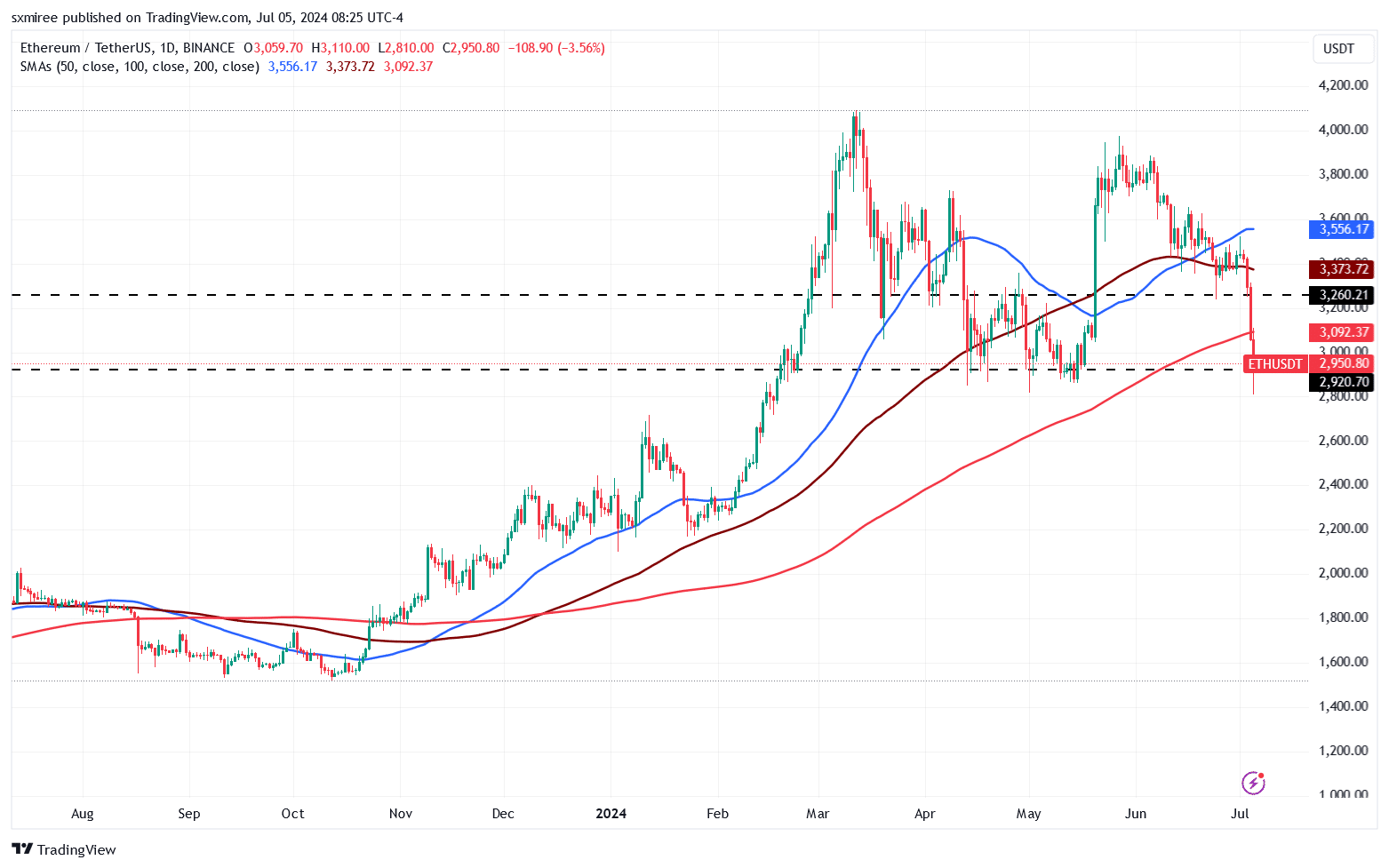

ETH/USDT technical analysis

ETH/USDT losses, now stretching into a fourth day, have put pressure on the pair. This pushed the pair above key support levels at the height of the recession. The price of ETH fell below the 50, 100, and 200 simple moving averages on the daily chart.

Source: TradingView

The last time ETH/USDT fell below all three trendlines on the daily time frame was in August 2023. At the time, the crypto market saw losses due to reports of the sale of Bitcoin holdings by Elon Musk’s SpaceX.

ETH was last spotted at $2,920, which is 40% below its all-time high according to CoinMarketCap. Ethereum’s subdued performance this week has also reinforced the bearish outlook in the near term.

Source: TradingView

The ETH/USDT pair is now positioned to face resistance around the $3,200 level, which it previously struggled with between mid-April and mid-June.