- BTC surpassed $70,000 and hit a four-month high, driven in part by a liquidity grab.

- BTC was only 3.5% away from its ATH, but there was still a roadblock to clear.

Bitcoin [BTC] breached the psychological level of $70K and rose to a four-month high of $71.5K. The rebound took the ‘Upbtober’ gain to 11%, effectively breaking out of the multi-month consolidation margin since March.

Why has Bitcoin risen?

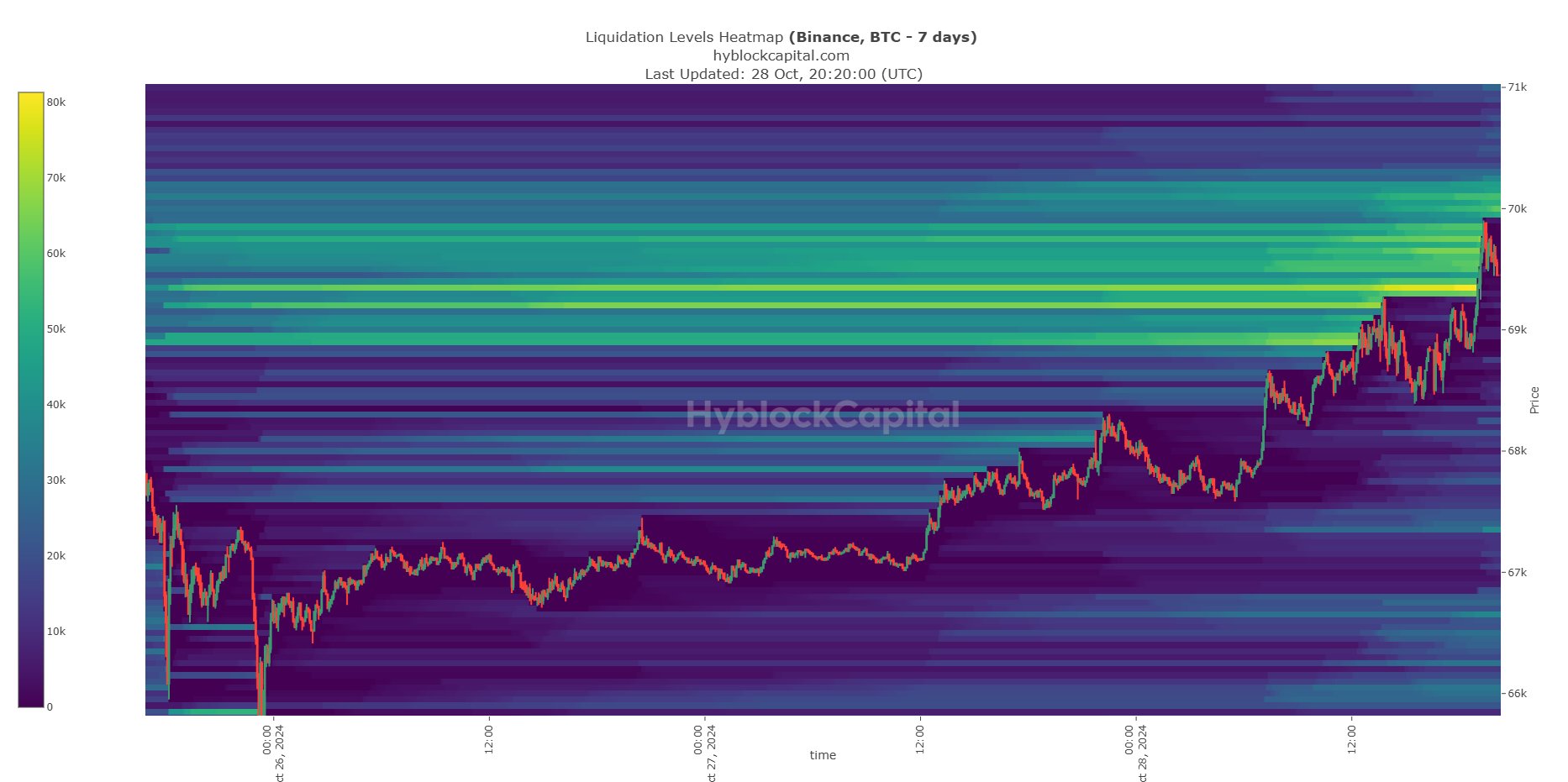

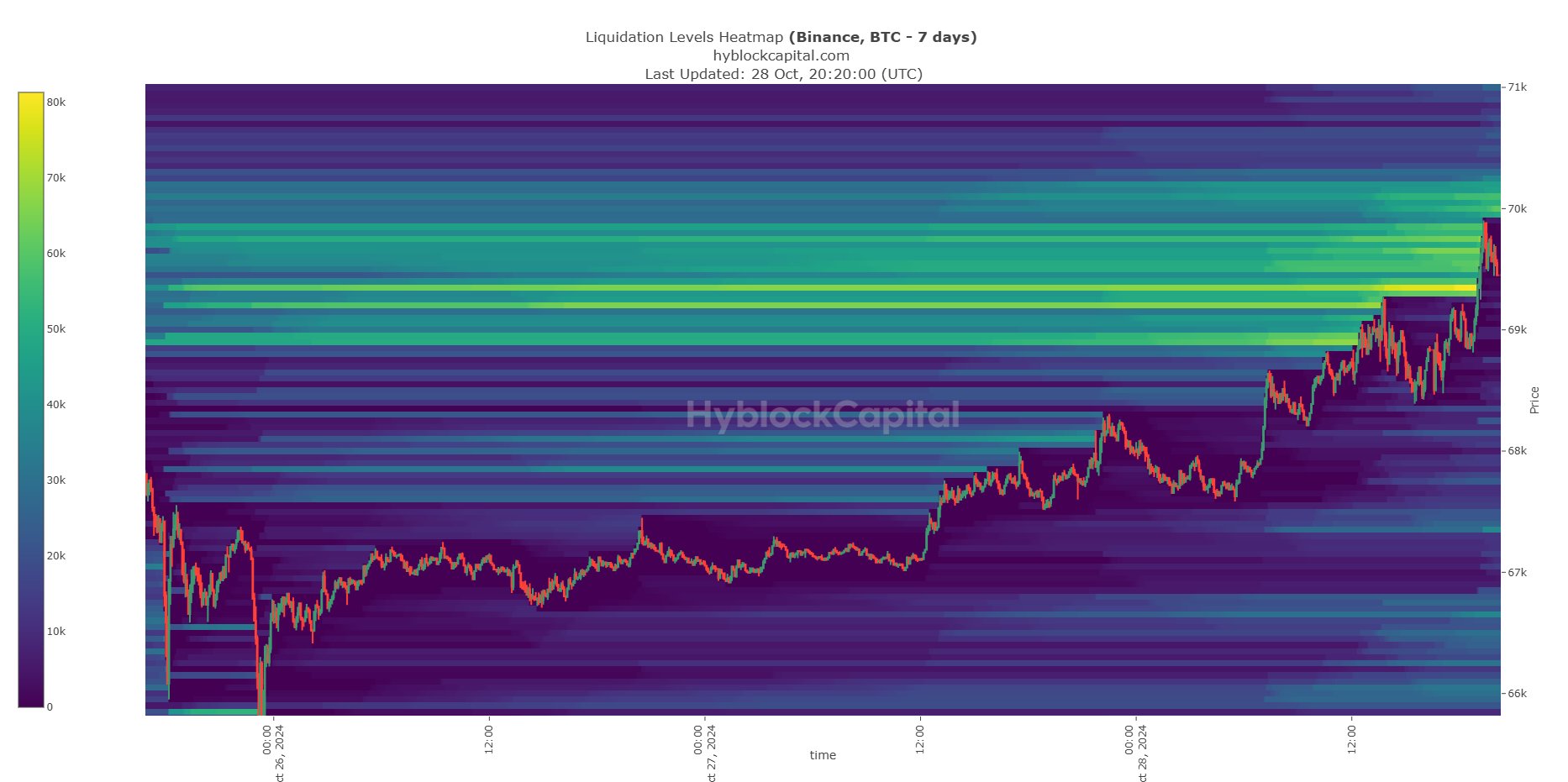

A liquidity grab drove some of the pump above $70,000. There were significant liquidity clusters (short positions) between $69.4K and $70K noted by BTC analyst and trader CrypNeuvo.

For context, price action typically follows these liquidation levels (bright yellow), largely influenced by market maker moves. Therefore, the $70,000 cluster acted as a magnet for the recent upswing, liquidating significant short positions of $70,000.

Source: Hyblock

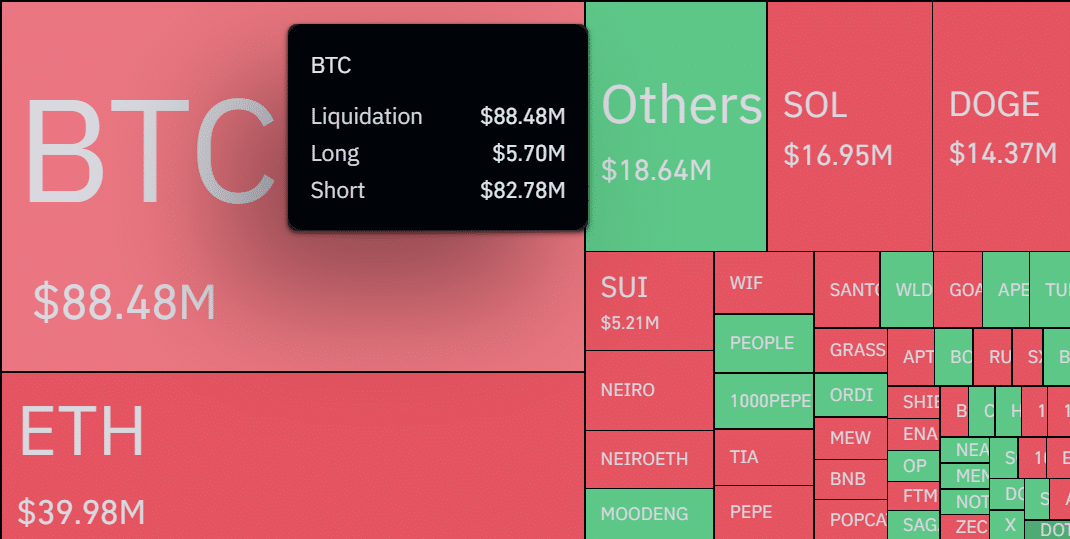

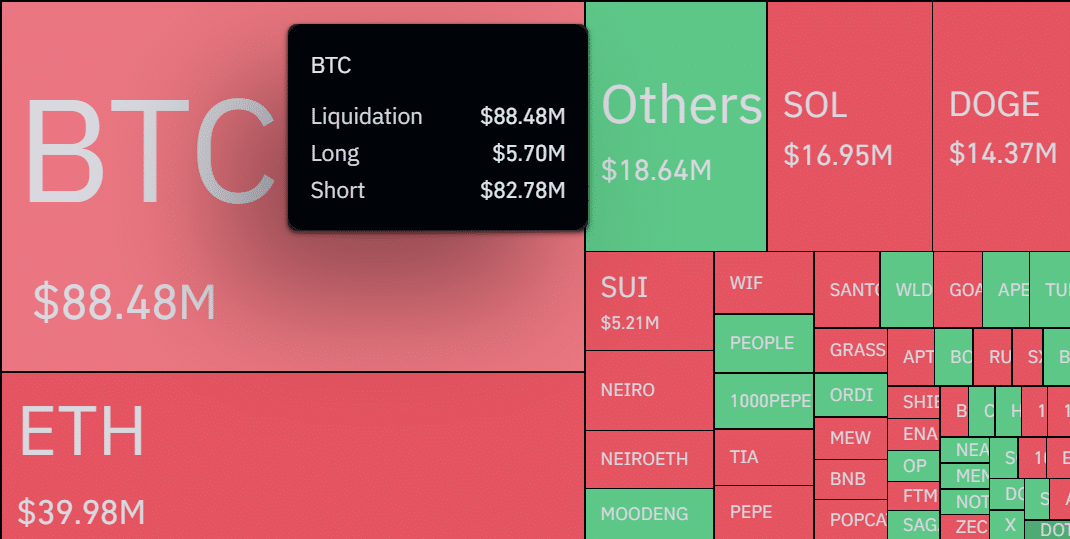

Over $80 million short film stretches

According to Coinglass data, positions of $88 million were liquidated after BTC rose above the psychological level of $70,000.

Speculators betting on a likely $70,000 price rejection (short positions) suffered the most, with nearly $83 million in losses in the past 24 hours.

Source: Coinglass

By extension, this also indicated strong bullish sentiment as the market waits American elections results next week.

As the chances of Trump winning the US election increased according to prediction sites, Bitfinex analysts believed that US elections would be a ‘perfect storm for BTC.’ The analysts declared,

“The convergence of election uncertainty, the ‘Trump trade’ narrative and favorable seasonality in the fourth quarter is creating a perfect storm for Bitcoin, promising an exciting period regardless of noisy price moves heading into the election in two weeks.”

Analyst Peter Brandt shared a similar projection and believed the move above $70,000 could herald the long-awaited parabolic rally post-halving.

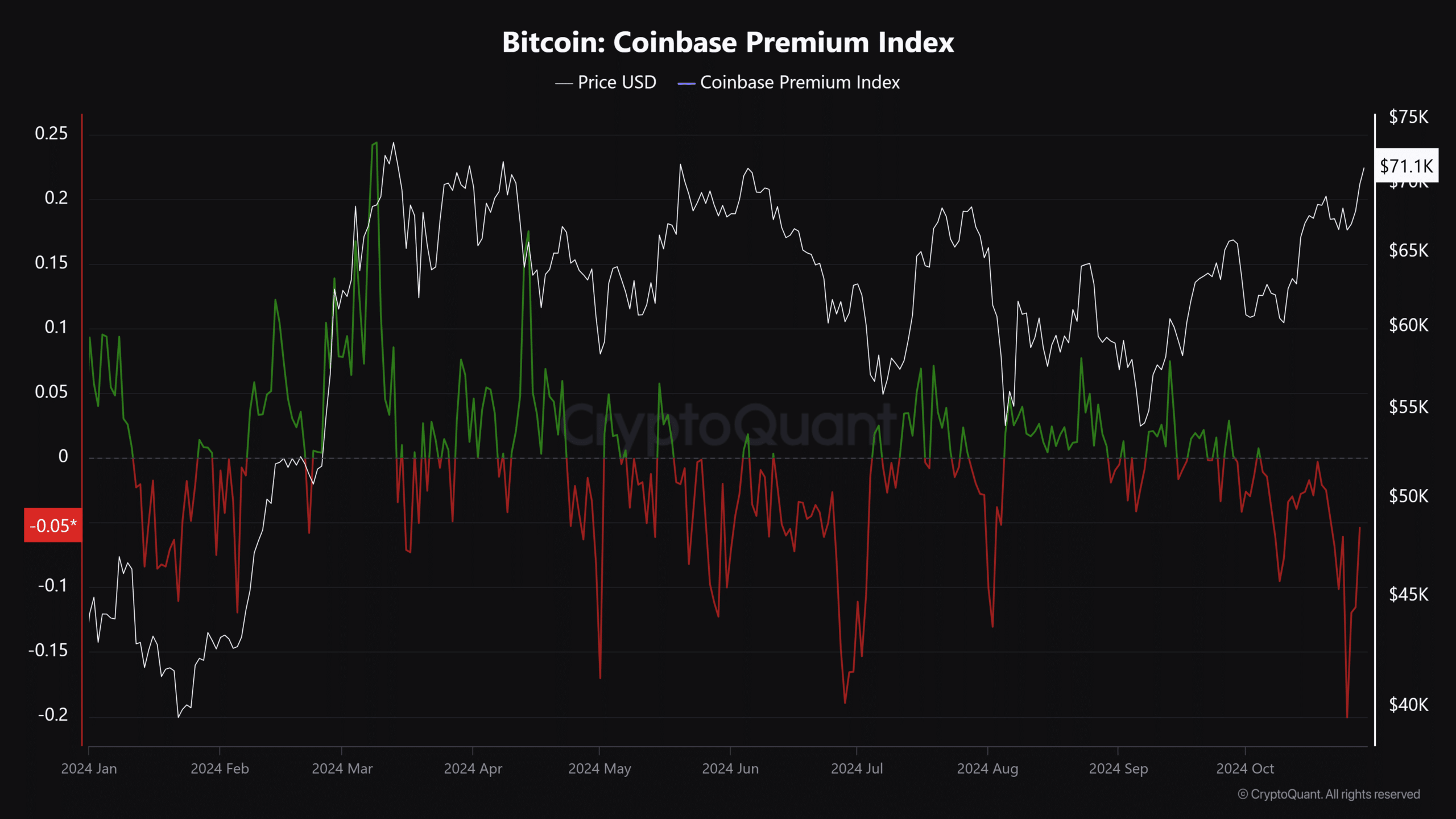

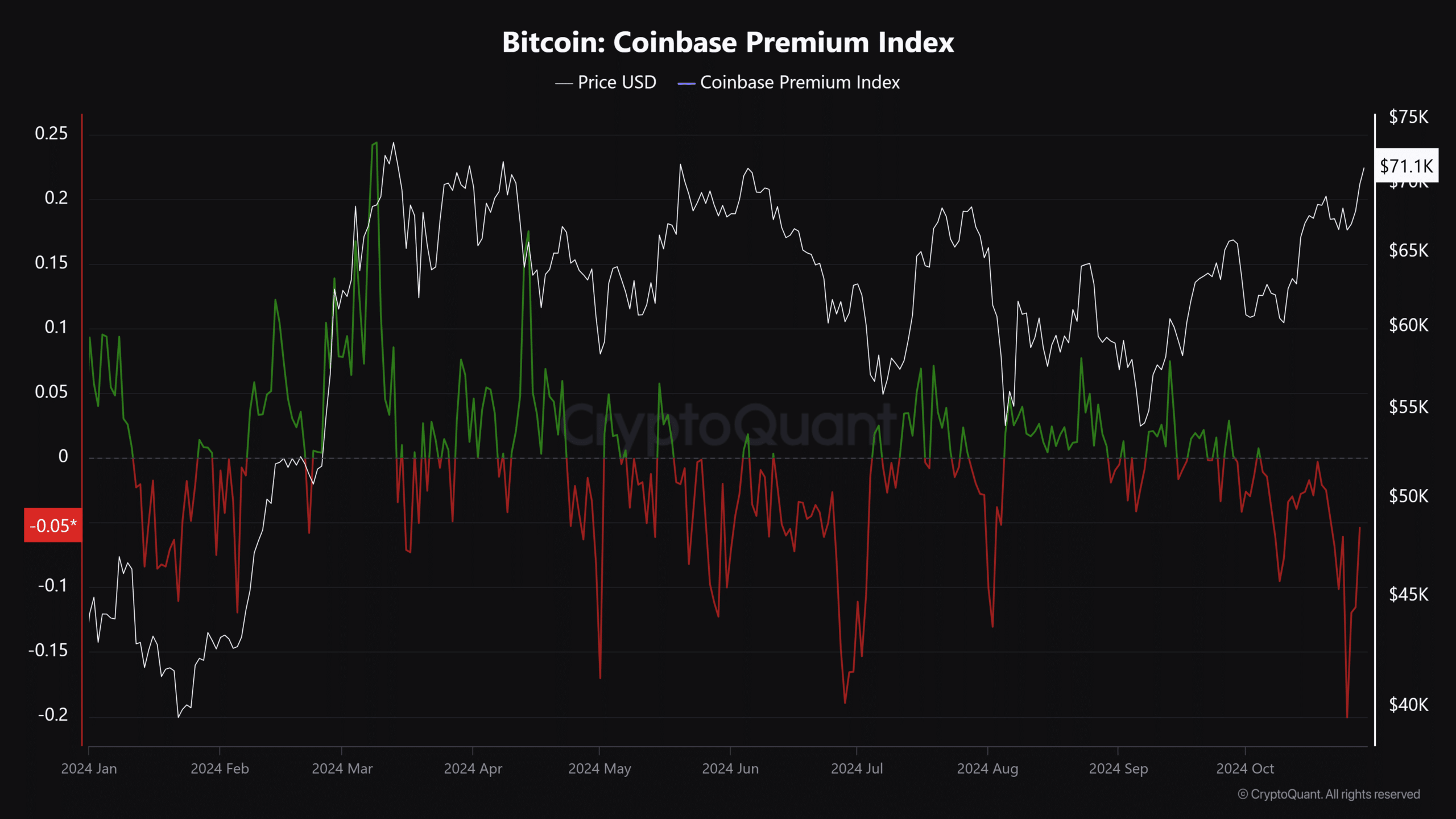

That said, there was renewed demand from US investors as BTC soared, as evidenced by the reversal of the Coinbase Premium Index.

Source: CryptoQuant

In most cases, strong US demand (green) always coincides with a sustainable recovery for BTC.

While the recent improvement was great for BTC, the weak value meant that investor interest was still relatively low compared to March when BTC hit a new all-time high.

Read Bitcoin’s [BTC] Price forecast 2024–2025

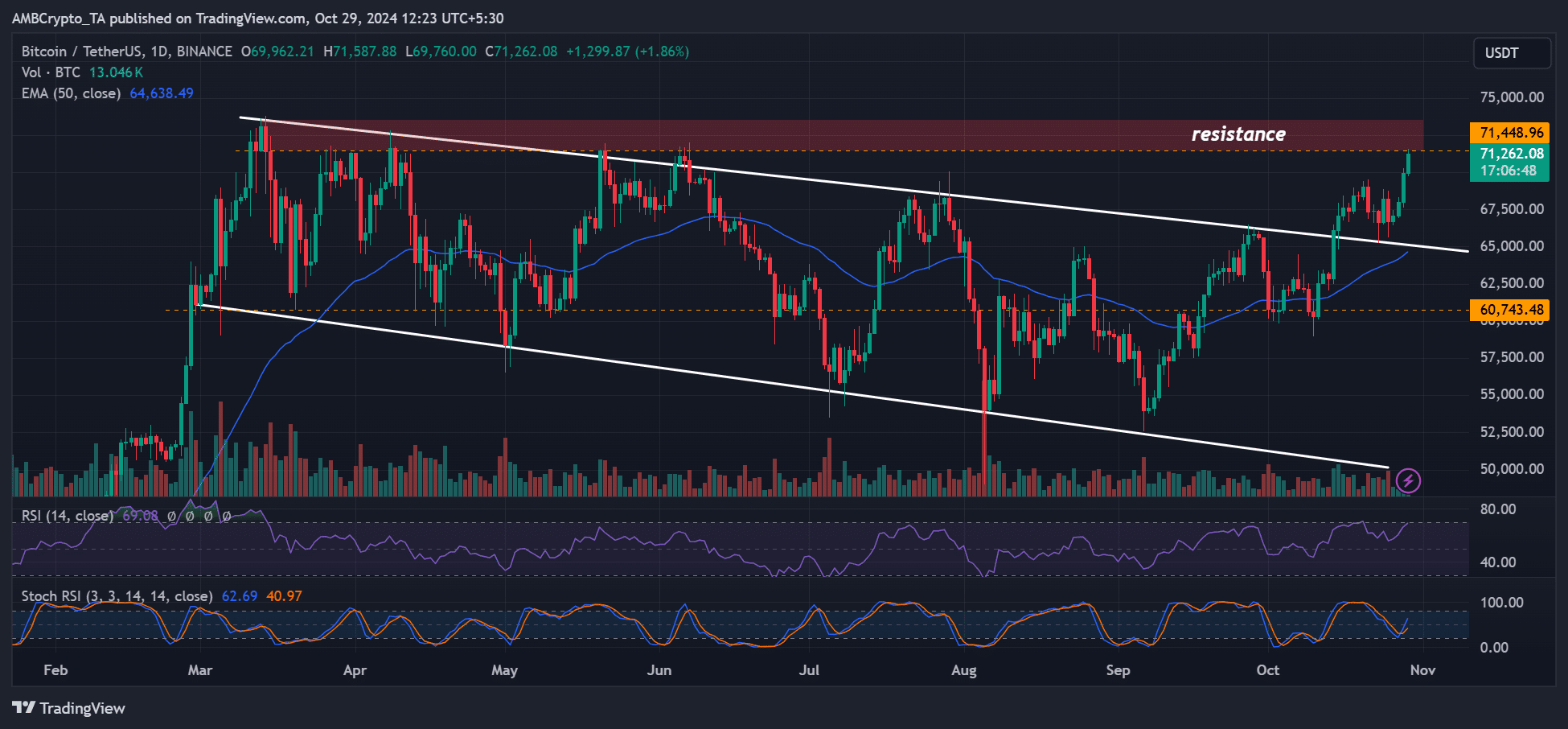

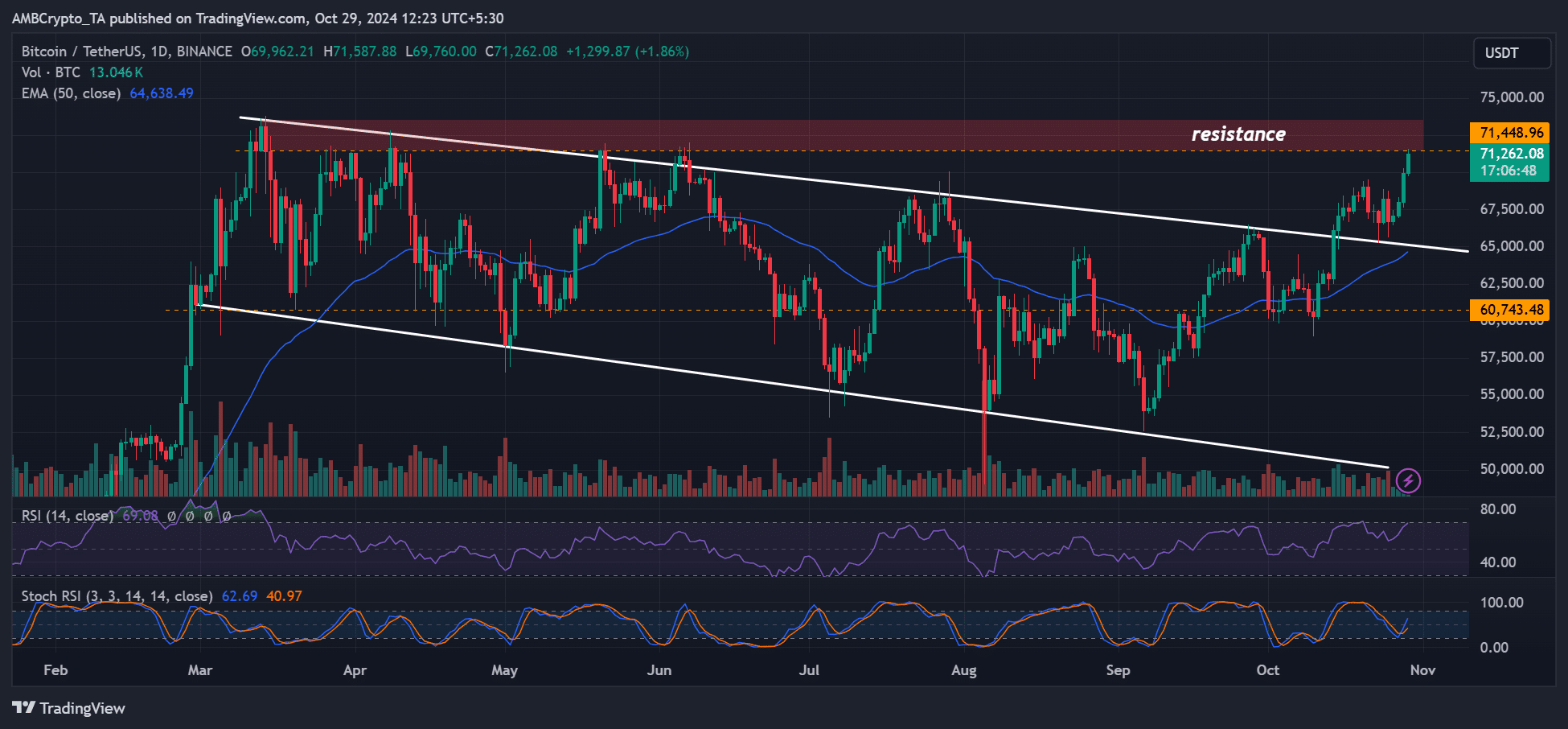

On the daily price chart, BTC was in a bullish market structure. It was just 3.5% off its ATH and could soon see a price discovery.

However, it encountered resistance and a bearish order block (red) formed at the March ATH. To continue the short-term uptrend, BTC needed to clear the $71K-$73K roadblock.

Source: BTC/USDT, TradingView