- Bitcoin has a bearish structure on the weekly chart.

- The recent losses could be reversed next week, but it is unclear whether the bulls can push prices above $69,000.

Bitcoin [BTC] on Thursday, July 25, prices fell another 2.2% and the daily trading session is not over yet. Since Monday, Bitcoin is down 5.84%. The breakout past $60,000 was considered significant, but it looked like the price could head there again.

While Bitcoin doesn’t need a reason or news event for prices to move one way or another, the recent losses have a plausible reason. So why did Bitcoin fall today?

The liquidation levels indicate that BTC could move towards $69,000 next week

In a message on X (formerly Twitter) crypto analyst CrypNuevo has made a prediction that Bitcoin prices would fall towards $64.5k. This was due to the liquidity pool in this area in the lower time frames.

It was likely that prices would gravitate towards it, and his prediction has been correct so far. At the time of writing, BTC exchanged hands for $64.2k. He also predicted that the stock would rise towards $68.9k.

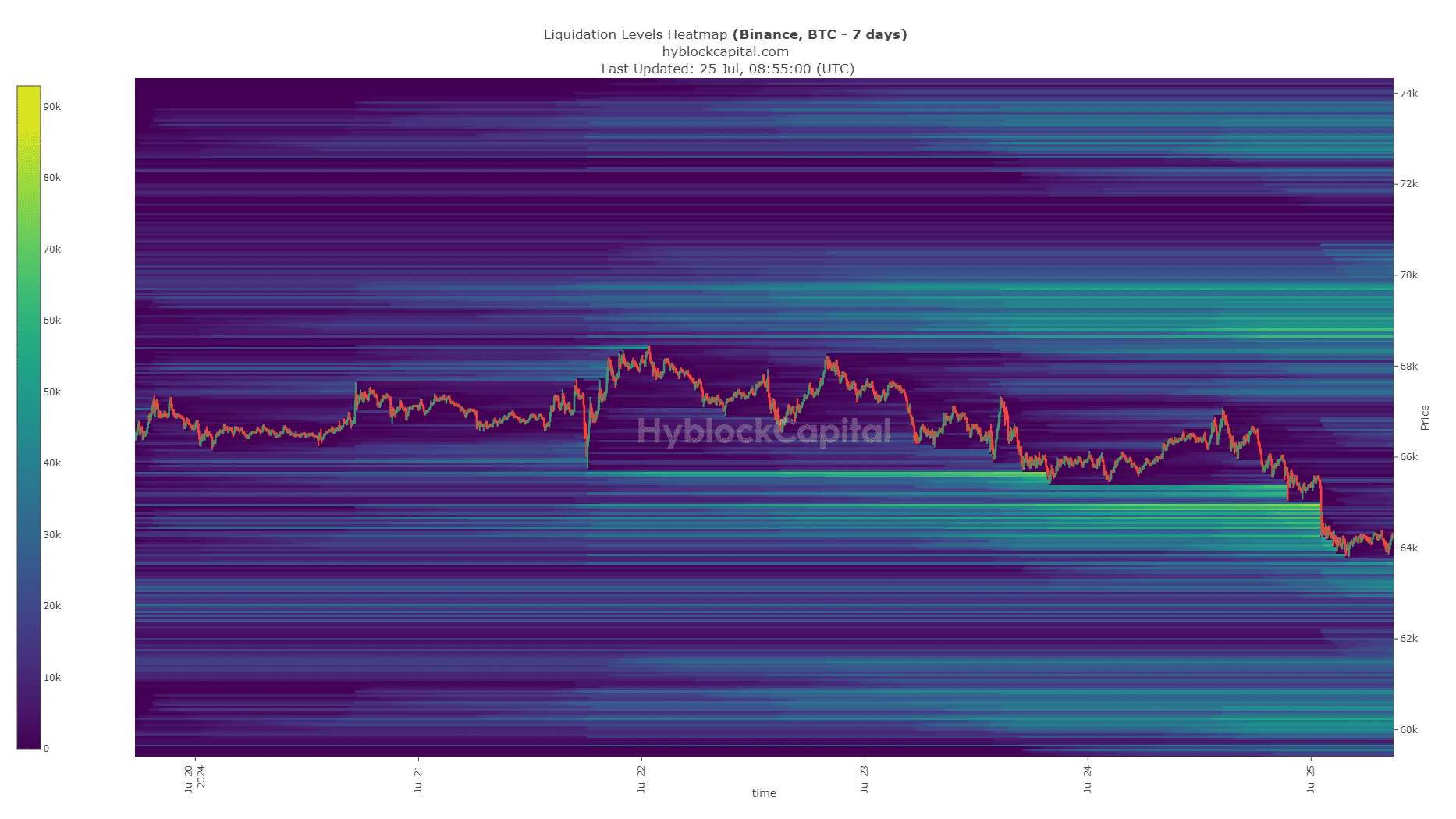

AMBCrypto looked at the 7-day liquidation heatmap and found that the $64k-$64.8k zone was a cluster of liquidation levels.

As the analyst had noted on Sunday, July 21, a return to these levels in search of liquidity was feasible.

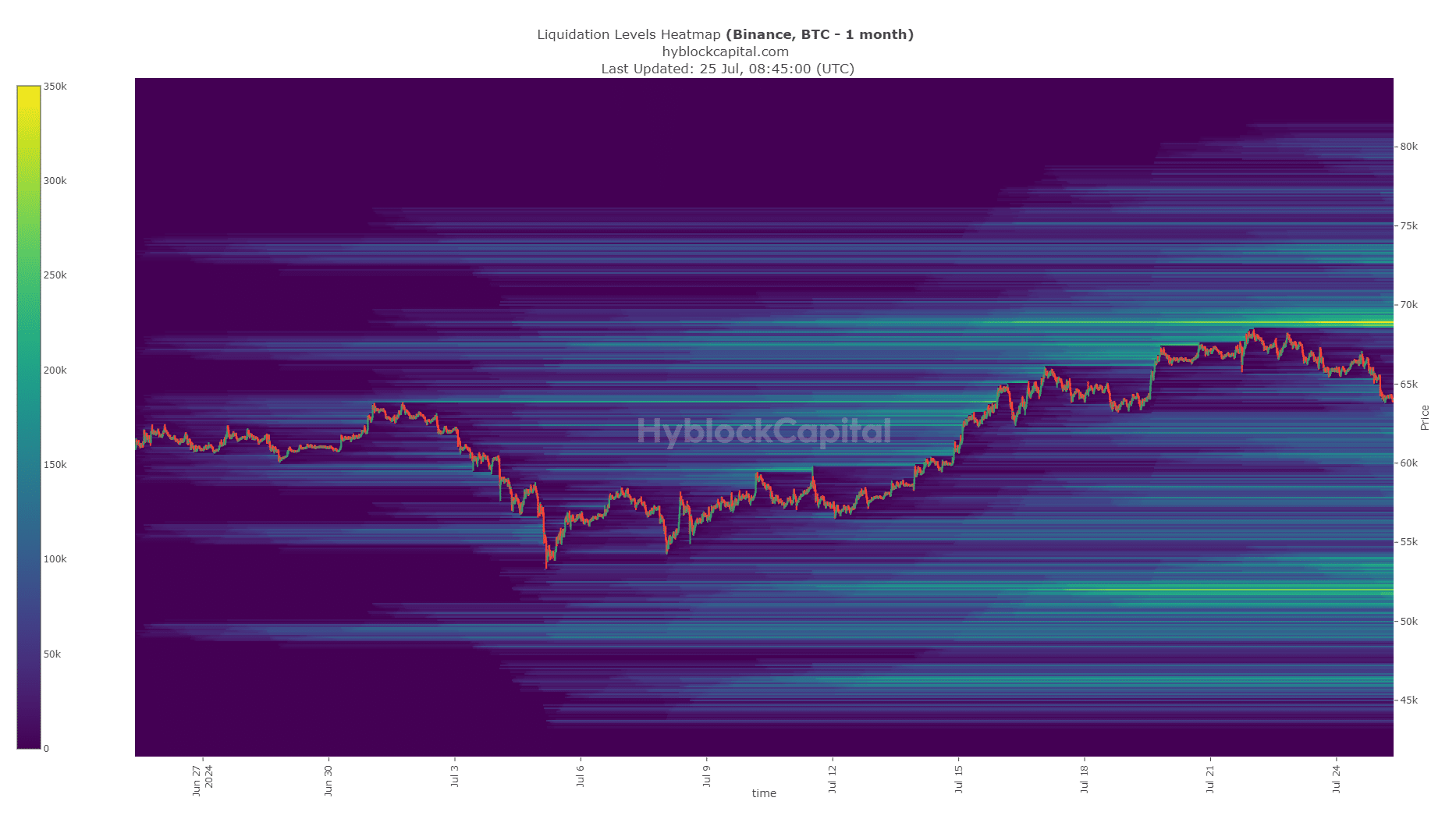

While that helps explain why Bitcoin is falling in value today, AMBCrypto looked at the 1-month chart to understand where prices might go next. To the north, the $69k level was bright with liquidation levels and this is likely to pick up prices.

Worryingly, the $52,000 and $46,000 levels also saw some liquidation levels. These levels could become closer in the coming days, making it more likely that BTC will test them.

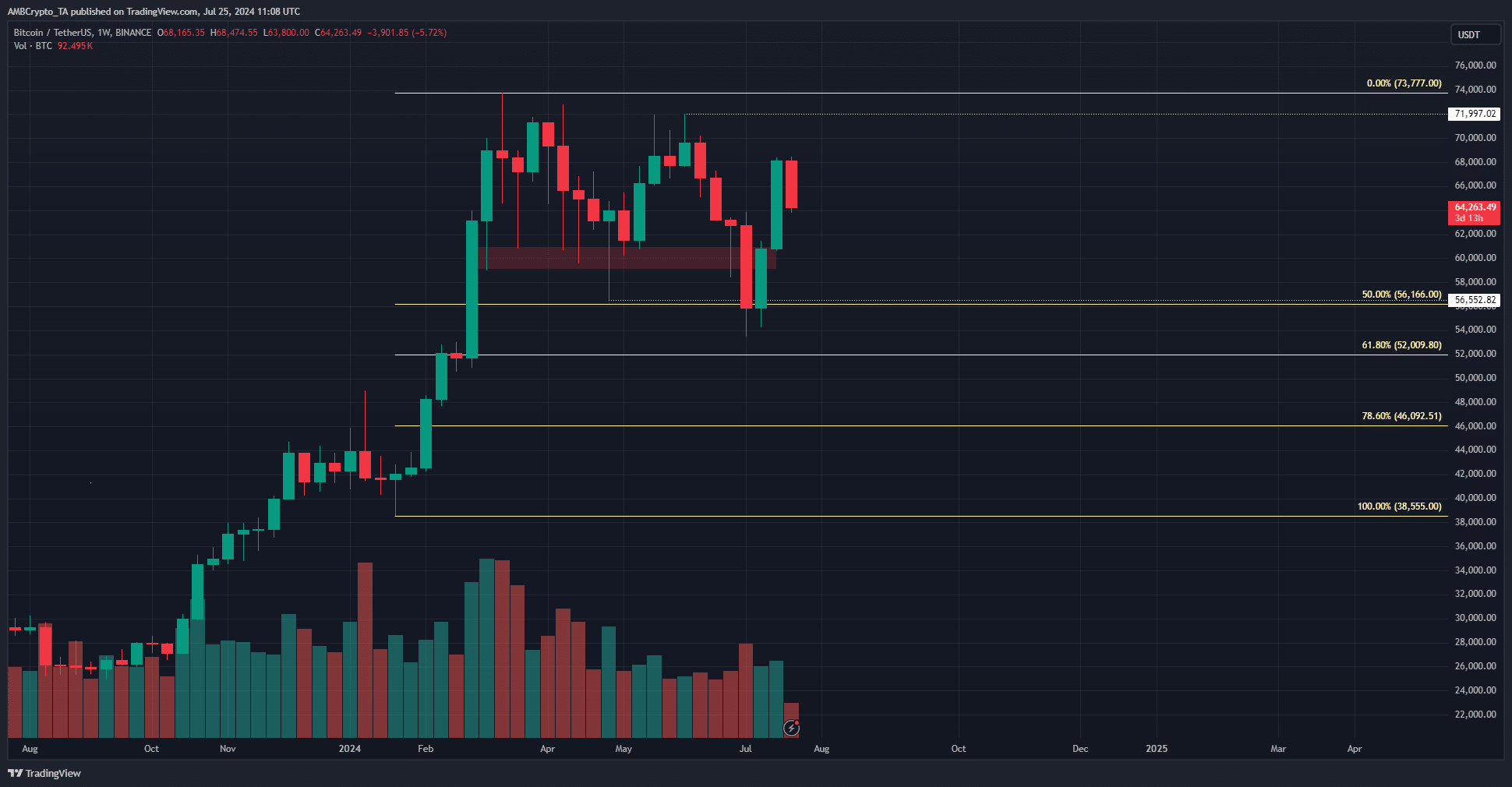

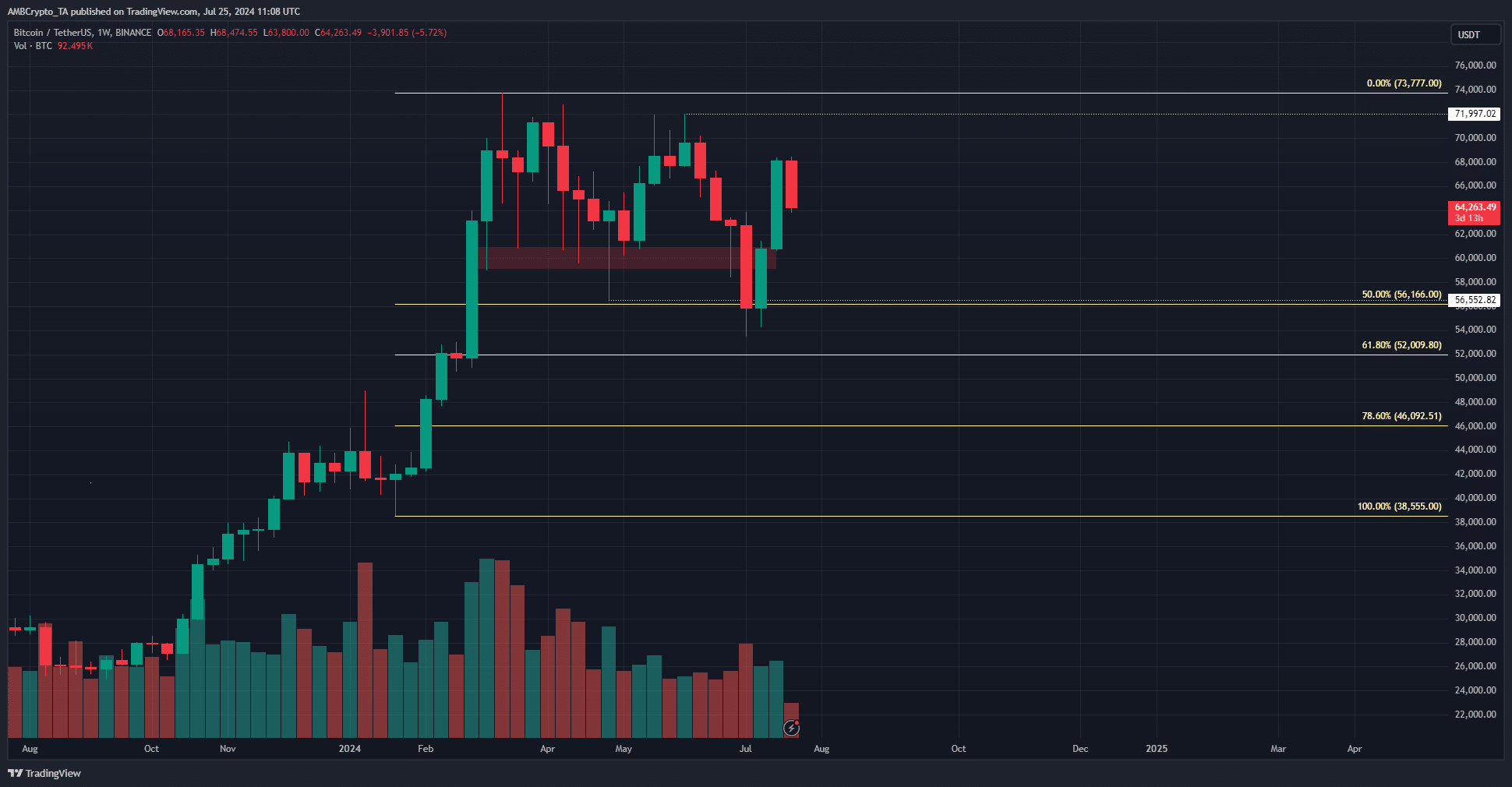

The weekly chart indicates a continuation

Source: BTC/USDT on TradingView

In a message on X, Trader Mayne, a popular crypto trader, pointed out that the weekly structure was still bearish. It turned bearish after April’s higher low of $56.5k was broken in early July.

Read Bitcoin’s [BTC] Price forecast 2024-25

Meanwhile, the local high at $72k was neither visited nor broken within the one-week time frame, indicating a bearish swing may be in play. This could be bad news for long-term owners.

The Fibonacci retracement levels showed that the $52,000 and $46,000 levels, which were also liquidity pools, were the 61.8% and 78.6% retracement levels.