- Cardano fell by more than 9% in the past 24 hours.

- Indicators pointed to a continued price decline.

After a huge price increase in the last 24 hours, Cardanos [ADA] price registered a decline. Blockchain development activity followed a similar trend.

Cardano’s weekly development

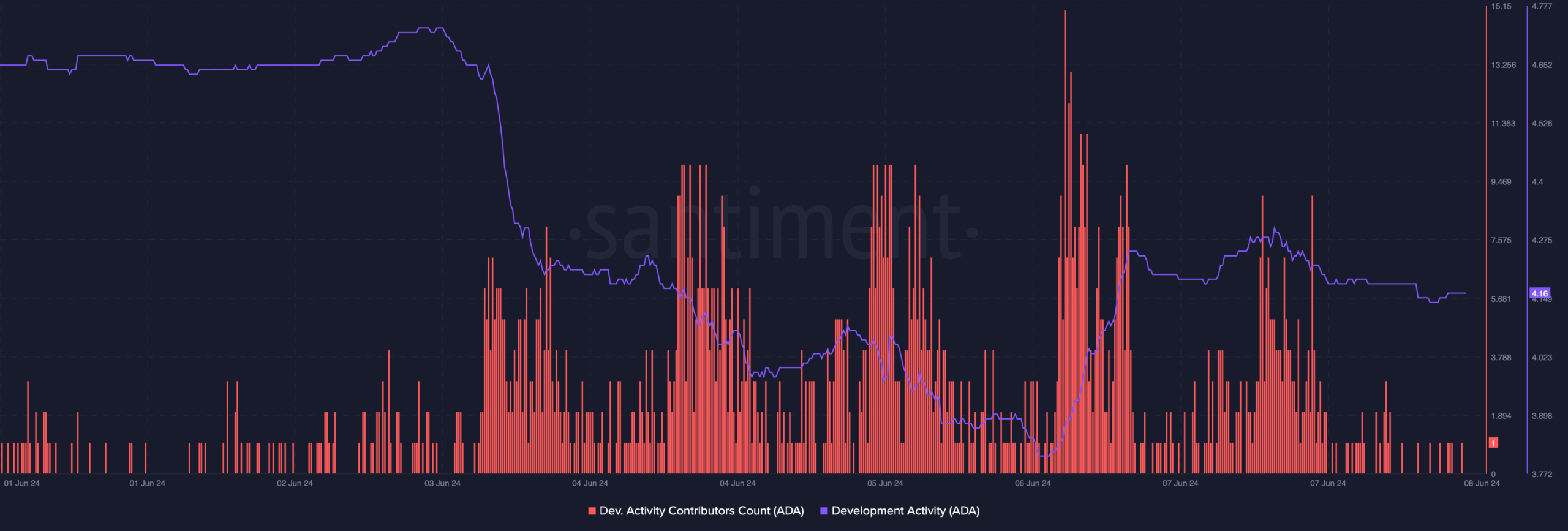

AMBCrypto’s analysis of Santiment’s data showed that the number of ADA developer activity contributors remained high last week. However, development activity declined.

Source: Santiment

In addition, Input Output Global reported its weekly development report, highlighting the work of various Cardano teams.

According to the report, the Lace team has released v.1.12, which is packed with improvements and a major new feature that allows users to choose fiat currency to fund their wallet through this service.

This week, the Plutus team released version 1.29.0.0 of the Plutus Libraries, while the Mithril team continued to implement the certification of Cardano transactions in Mithril networks.

The report also mentioned the updated statistics of the Cardano blockchain. Cardano’s total number of transactions exceeded 91 million, while the number of native tokens also exceeded 10 million.

Moreover, 171 projects have been launched on the blockchain so far.

ADA turns bearish

As developers worked on multiple projects, ADA became volatile.

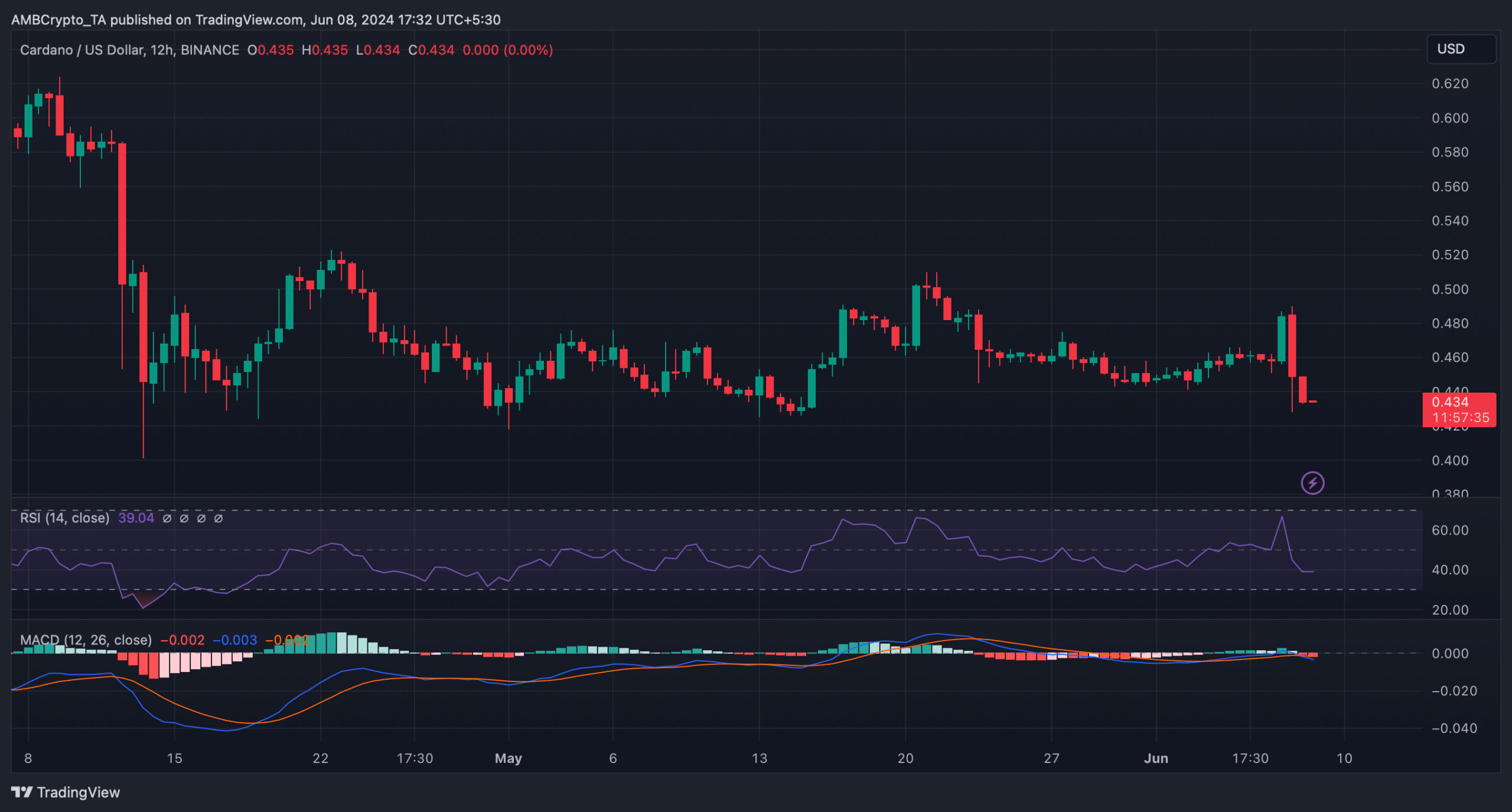

The price of the token rose and reached $0.487 on June 8, but the trend did not hold. Soon after, the bears took over and pushed the price of the token down.

According to CoinMarketCapADA is down more than 9% in the last 24 hours.

At the time of writing, the token was trading at $0.4354 with a market cap of over $14 billion, making it the 10th largest crypto.

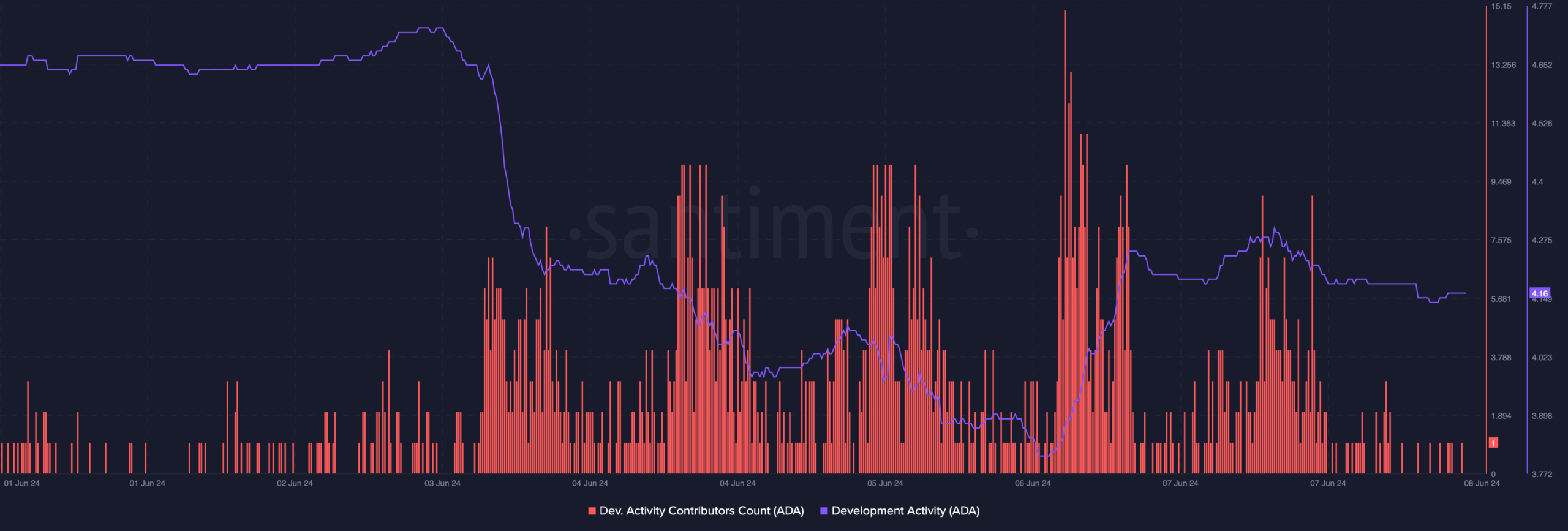

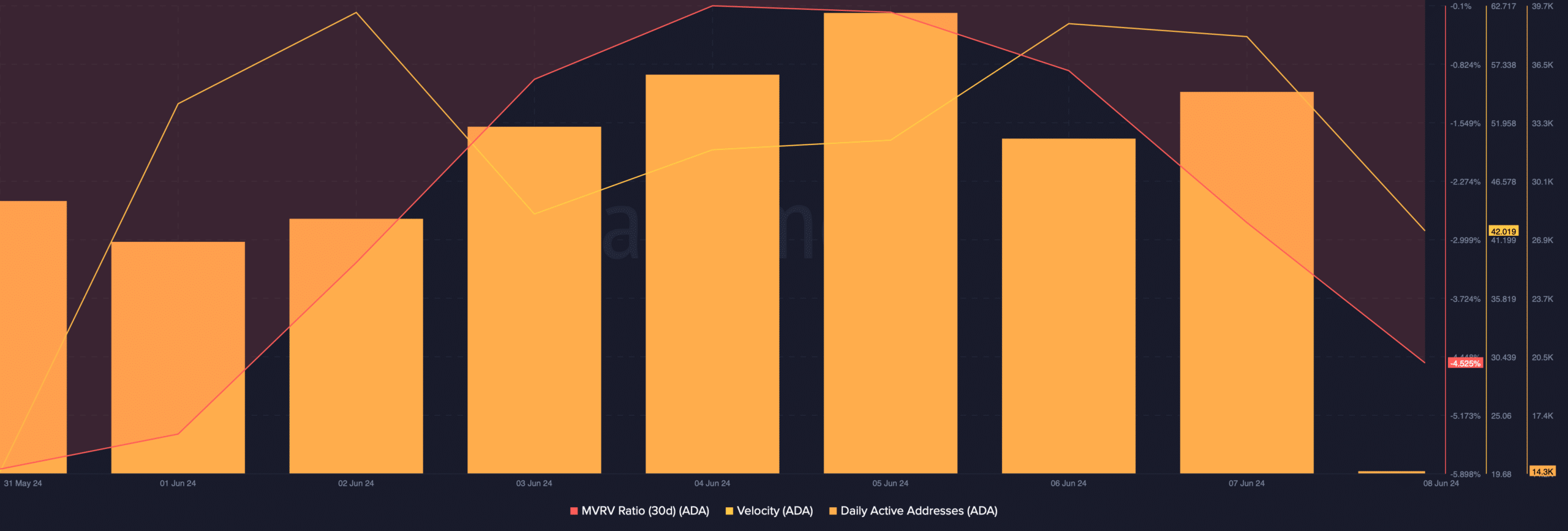

AMBCrypto then analyzed how the metrics were affected by the price correction. According to our analysis of Santiment’s data, Cardano’s MVRV ratio fell as a result of the price drop.

The rate also dropped on June 7, meaning ADA was used less frequently on transactions within a given time frame.

Nevertheless, blockchain network activity remained high as the number of daily active addresses increased.

Source: Santiment

Is your portfolio green? look at the ADA Profit Calculator

AMBCrypto then analyzed ADA’s daily chart to see if the indicators pointed to a price increase. Our analysis showed that the MACD showed a bearish crossover.

The Relative Strength Index (RSI) also recorded a sharp decline, indicating that the chances of a further downtrend were high.

Source: TradingView