- Bitcoin is on a bearish trajectory in the short term.

- Liquidity pools could pull the price towards $63,000 in the coming days.

Bitcoin [BTC] Miners saw a big drop in their profit margins when the price fell to $49,000 two weeks ago. This led to capitulation of miners and a greater outflow of miners.

The spike in the hash rate and the difficulty of mining put the smaller miners in a difficult situation.

The technical analysis and liquidation heatmap indicated that a BTC recovery would face a huge hurdle above the psychological resistance of $60,000. Do the bulls have enough ammunition to break this barrier?

The momentum could shift to the bulls

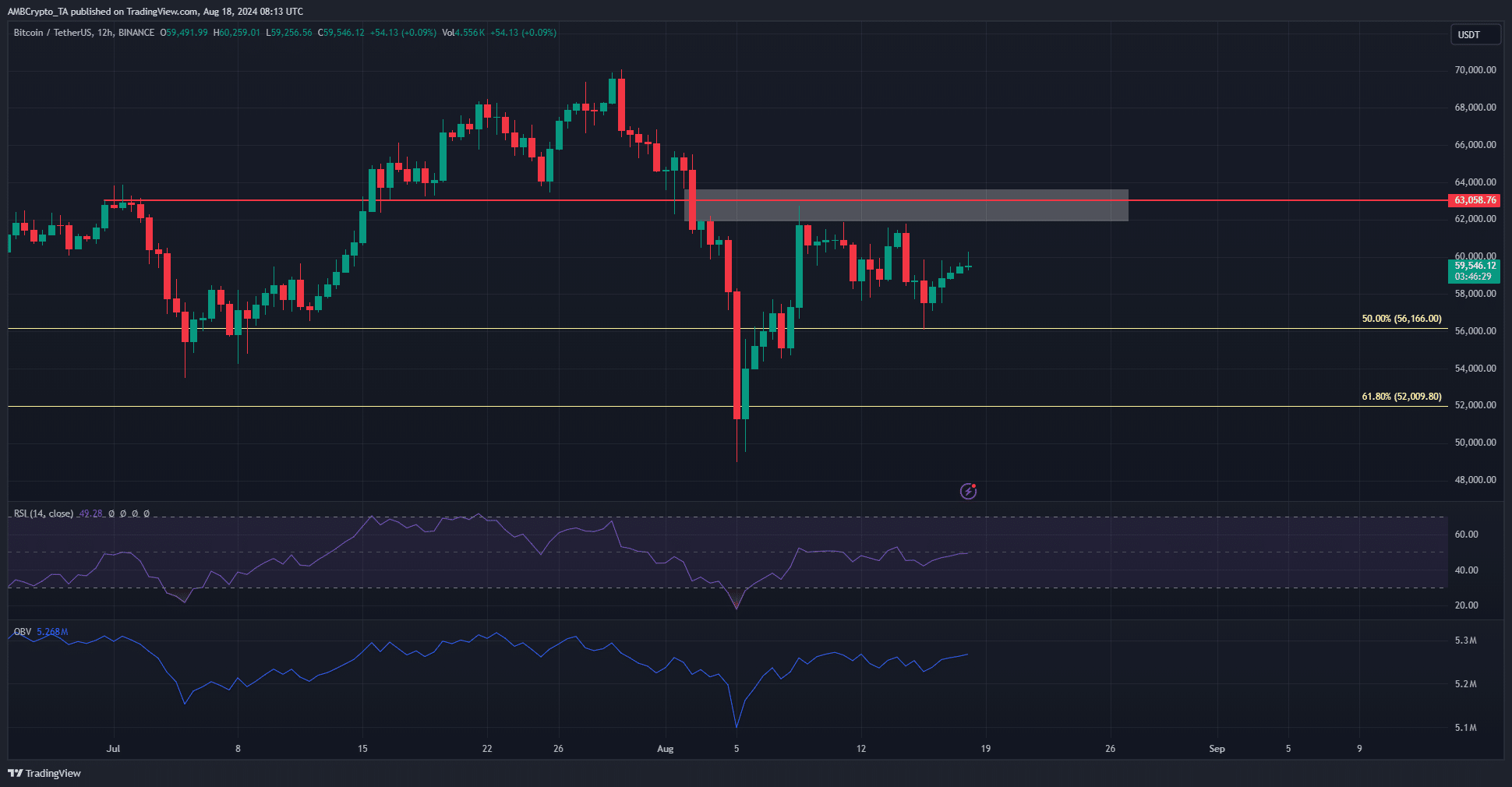

Source: BTC/USDT on TradingView

The RSI on the 12-hour chart has reached the neutral 50 level over the past week. The $61.5k region has consistently rejected the price over this period.

At the time of writing, it looked like the RSI was trying to get above 50 again.

The OBV has also climbed higher over the past two days. This indicated that demand could be enough to push BTC to the $63,000 mark. However, an imbalance and a resistance level coincided there.

Bitcoin bulls will have a hard time fighting the sellers, but they have one factor that could help.

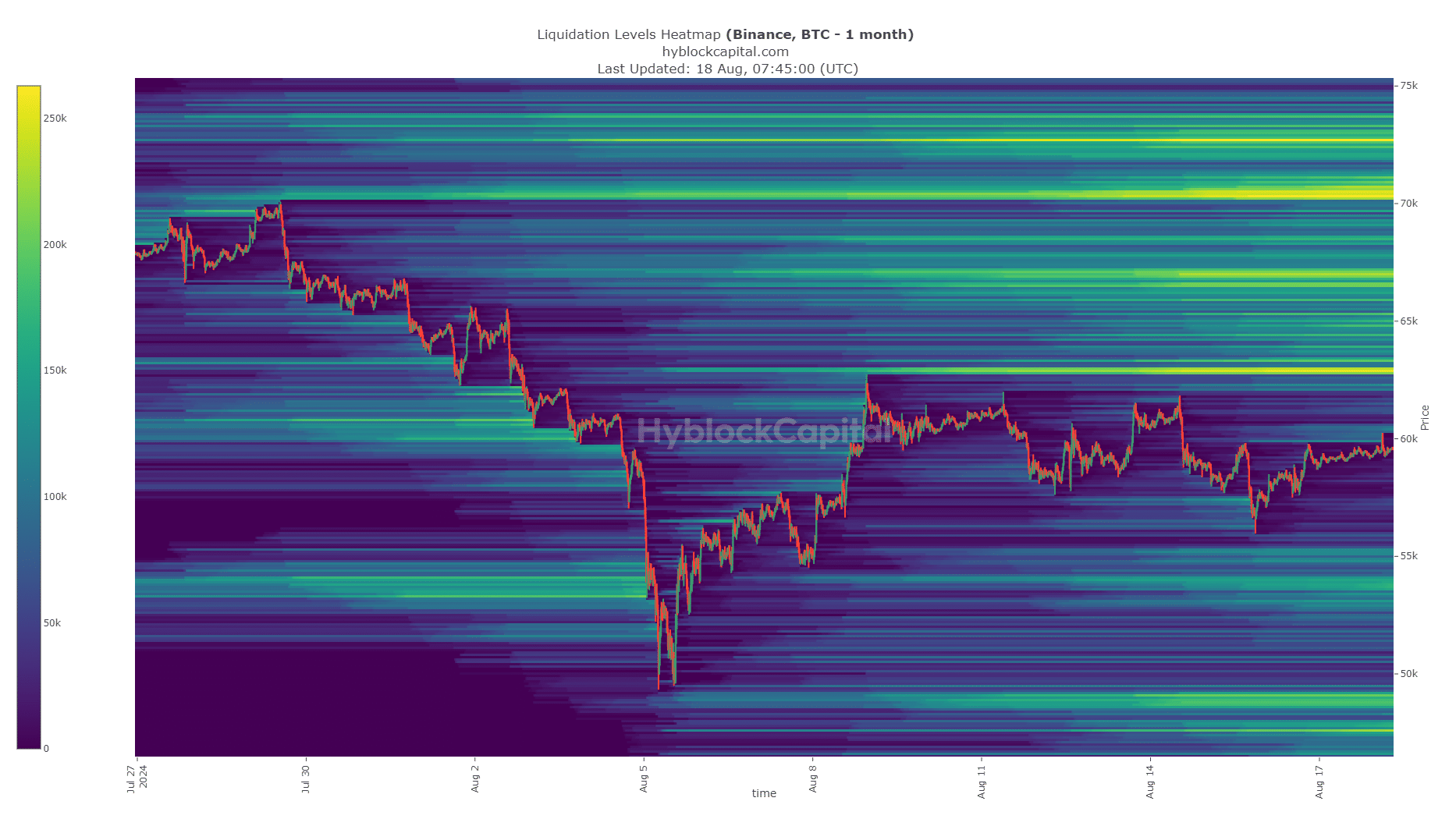

Magnetic zones favor the BTC bulls in the short term

The liquidation heatmap showed a high concentration of liquidation levels at $63k and $67.1k.

The proximity and density of the $63,000 liquidity cluster could allow Bitcoin to jump higher to conquer the region before a pullback occurs.

Read Bitcoin’s [BTC] Price forecast 2024-25

Liquidity above $65k was also a magnetic zone, and a move to $67.1k cannot be discounted.

However, traders should remember that BTC has a bearish market structure on the weekly chart and needs a move past $69.5k to change this situation.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer