Este Artículo También Está Disponible and Español.

In an escalation of the global economic friction, the imposed rates of President Trump have roasted financial markets this week, so that both shares, bitcoin and cryptocurrencies are cut. Still a new one memo From Bitwise Asset Management suggests that this headwind could ultimately push Bitcoin to new heights – without whether the strategy of Trump succeeds or fails.

At the start of the week, the cryptomarkt witnessed a serious sale. Bitcoin fell by around 5%, while Ethereum and XRP respectively even sharper losses members – 17%and 18%. The immediate catalyst was Trump by Trump of a rate of 25% for most import from Canada and Mexico, as well as a rate of 10% on China. In retaliation, those trading partners themselves announced countermeasures.

Related lecture

The US dollar reacted by jumping more than 1% against important currencies. That, combined with the ongoing weekend illiquidity in crypto -markets, led to a wave of forced liquidations such as lever traders sold in the Downdraft. According to Bitwise Chief Investment Officer Matt Hougan, no less than $ 10 billion in lifting tree positions was wiped out in what he described as “the greatest liquidation event in the history of Crypto.”

Despite the dramatic price action, the head of Bitwise Alpha Strategies, Jeffrey Park, remains optimistic about Bitcoin’s process. He points to two leading ideas that form his bullish thesis: the ‘Triffin dilemma’ and the broader goal of President Trump to restructure American trading dynamics.

The Triffin -Dilemma emphasizes the conflict between a currency that serves as a worldwide reserve – the consistent demand and overvaluation – and the need to lead on persistent trade shortages to deliver sufficient currency abroad. Although this status enables the US to borrow cheaply, it also exerts sustainable pressure on domestic production and export.

“Trump wants to get rid of the negatives, but retains the positive points,” Park explains, suggesting that rates can be a negotiating instrument to force other countries to the table – from the 1985 Plaza Accord, that the dollar in coordination with Others have devalued large economies.

The two scenarios: Bitcoin wins, Fiat loses

Park argues that Bitcoin benefits under two different results of Trump’s current trade policy:

Scenario 1: Trump manages to weaken the dollar (while the rates keeps low)

If Trump a multilateral agreement can maneuver-akin to a ‘plaza accord 2.0’ to reduce the overvaluation of the dollar without stimulating long-term interest rates, the risky appetite among American investors could rise. In this environment, a non-sovereign assets such as Bitcoin, free of capital controls and dilution would probably attract extra inflow. In the meantime, other countries that are struggling with the fall -out of a weaker dollar can use tax and monetary stimulans to support their economies, which may lead to more capital to alternative assets such as Bitcoin.

Related lecture

“If Trump can bully his way to the position, there is no actively positioned better than Bitcoin. Lower rates will cause the risky appetite of American investors, which means that prices are high. Abroad, countries will be confronted with weakened economies and will turn to a classical economic stimulus to compensate, which leads to higher Bitcoin prices, ”says Park.

Scenario 2: A long -term trade war and massive money prints

If Trump fails to secure a broad deal and draws up the trade war, the global economic weakness would almost certainly invite an extensive monetary stimulus of central banks. Historically, such large -scale liquidity injections have been Bullish for Bitcoin, because investors are looking for deflatoire and decentralized assets isolated by the central bank’s policy

“And what if he fails? What if we get a continuing rate war instead? Our image of high conviction is that the resulting economic weakness will lead to printing money on a scale that is larger than we have ever seen. And historically, such a stimulus has been extremely good for Bitcoin, “says Park …

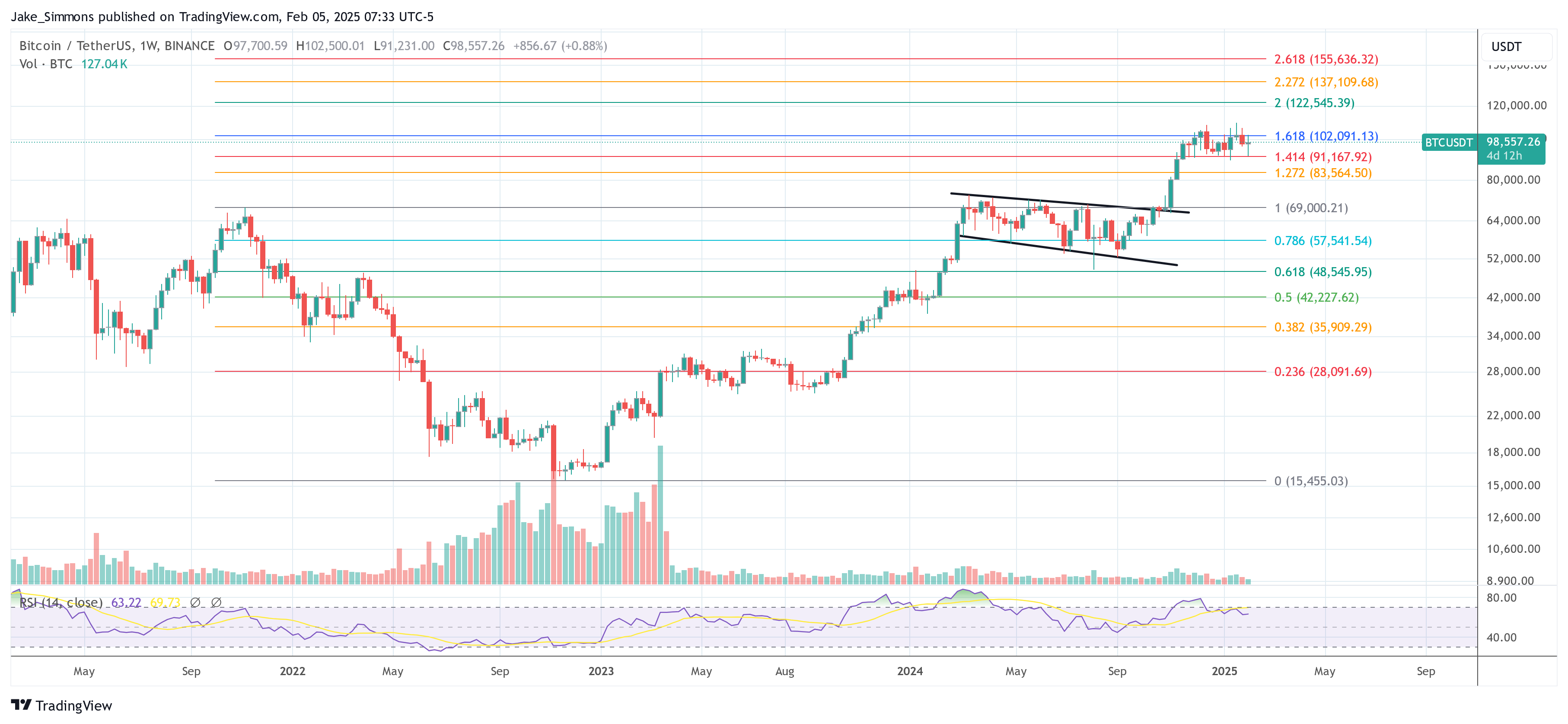

At the time of the press, BTC traded at $ 98,557.

Featured image made with dall.e, graph of tradingview.com