- Experts have outlined several factors that point to BTC’s potential for a long-term rally.

- The prevailing data indicates an impending price drop before an upward move occurs.

After a recent plunge to the $58,000 region, Bitcoin [BTC] has suffered a loss of 1.33% in the past month. Short-term analysis predicts further declines as trading progresses.

Despite these fluctuations, some analysts remain optimistic and view the current downturn as a short-term setback. They maintain a positive long-term outlook for the cryptocurrency.

Bitcoin shows promising long-term potential

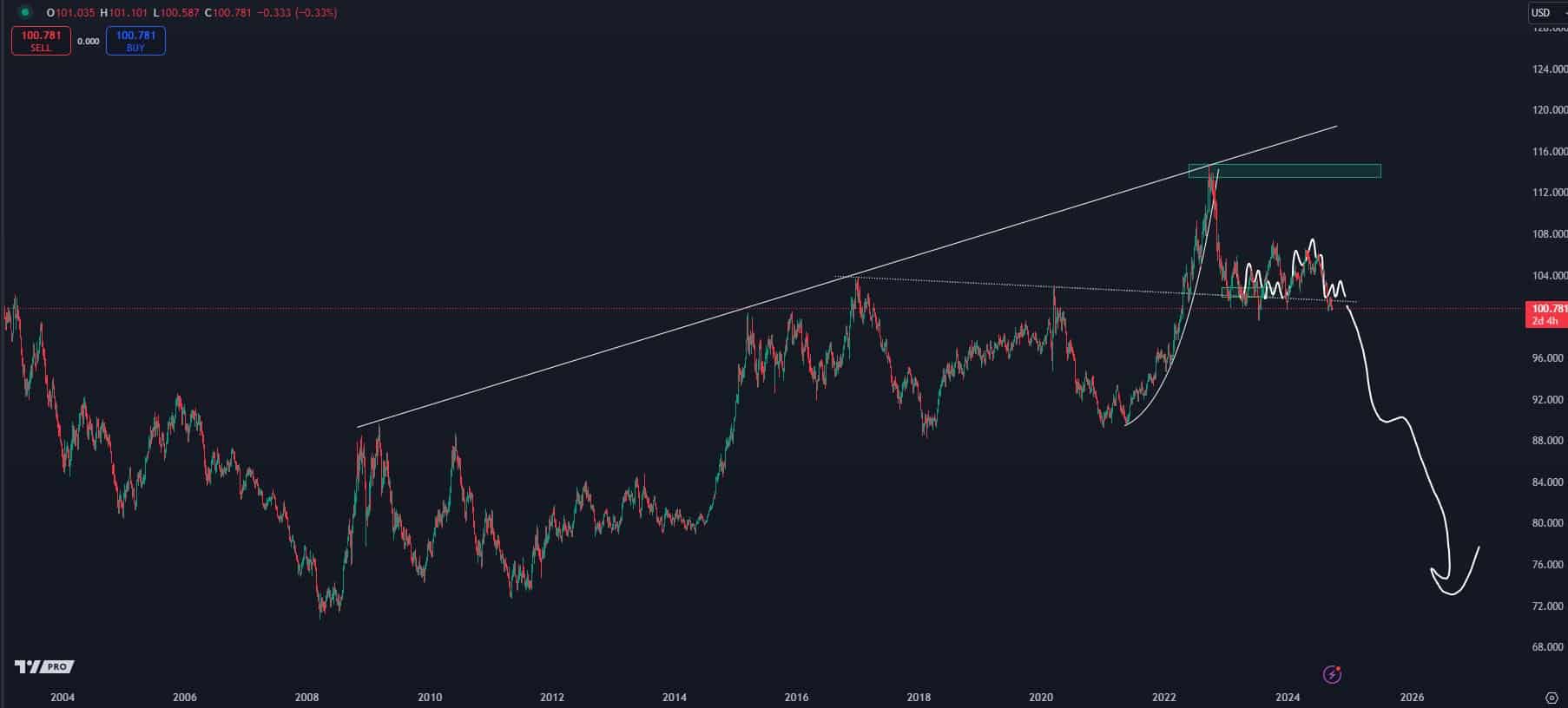

Analyst Mr. Crypto marked that BTC is currently forming a bullish flag pattern, similar to its positioning in 2023, which preceded a new all-time high.

If this pattern holds, BTC is expected to experience a major surge, potentially reaching a new all-time high.

Source:

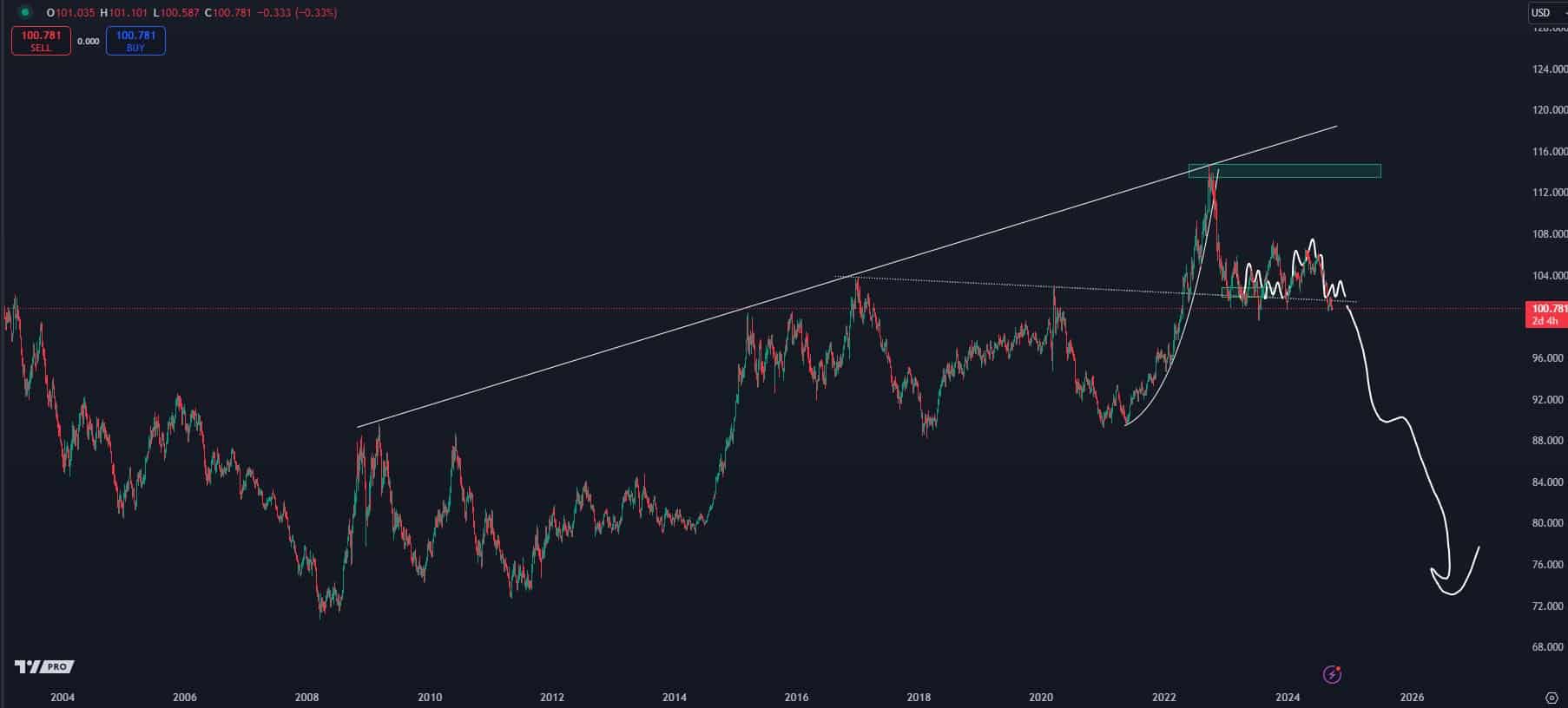

Another analyst Crypto Kaleo, who has checked BTC’s movement against the DXY (US Dollar Index) for over 19 months shows that the correlation is consistent. The DXY chart tracks the value of the US dollar against a basket of foreign currencies.

Kaleo predicts a decline in the DXY, which is expected to catalyze a Bitcoin rally as these charts typically move inversely. Such a development could take BTC to the next level.

Source:

Despite this optimistic outlook, AMBCrypto has noted that some traders and investors are currently choosing to sell in the short term.

Traders are retreating from BTC

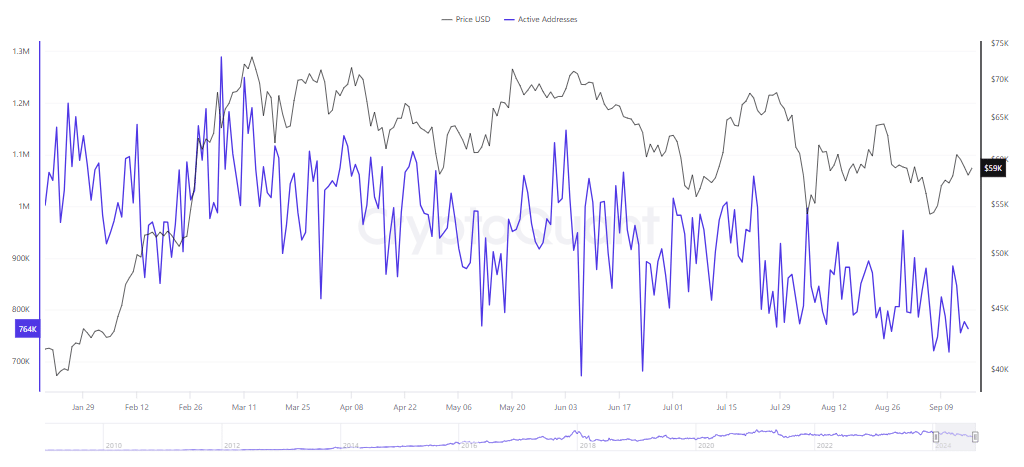

Traders are showing reduced interest in BTC, evidenced by a noticeable decline in trading activity.

Current data shows a decline in the number of active BTC addresses – from 885,329 to 764,033 – indicating bearish sentiment among participants.

Source: CryptoQuant

Furthermore, there has been a noticeable increase in the supply of BTC exchanges, which represents the total number of assets available on various exchanges.

Available BTC has increased to 2.58 million, which could potentially lead to a price drop if not accompanied by corresponding interest from buyers.

Such trends indicate a possible short-term decline in BTC prices unless there are changes in the market situation.

The bears are still there

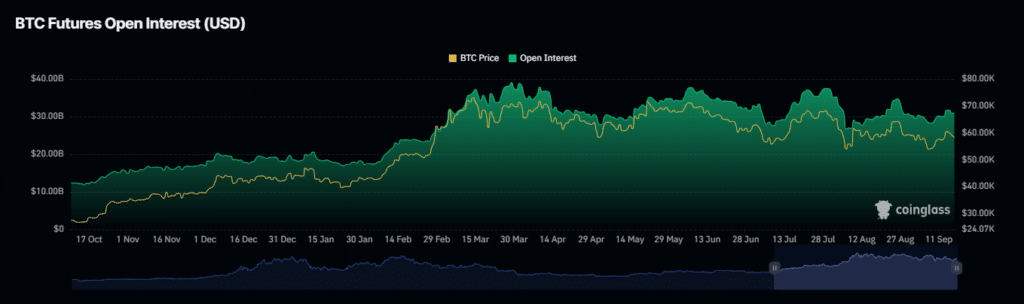

A more bearish short-term outlook for BTC is emerging, as evidenced by recent liquidation data Mint glass reveals unfavorable results for traders anticipating a rise. At the time of publication, long positions worth more than $23.96 million have been forcibly liquidated.

Liquidation data contains details of the forced closure of trading positions, which is triggered when traders fail to meet margin requirements or when their trades move substantially against them.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024-25

Additionally, open interest – a measure of investor interest in an asset – fell 0.44%, as reported by Coinglass.

If these trends continue, a continued decline in both metrics could further depress BTC prices in the near term.