David Lawant, head of research at FalconX, a prime digital asset brokerage offering trading, financing and custody for leading financial institutions, recently announced analysis on X (formerly Twitter) about the evolving role of Bitcoin halvings in market dynamics. This analysis challenges the traditional view that halvings have a direct and significant impact on the price of Bitcoin. Instead, it highlights a broader economic and strategic context that could more profoundly influence investor perception and market behavior.

The diminishing impact of the miner on the Bitcoin price

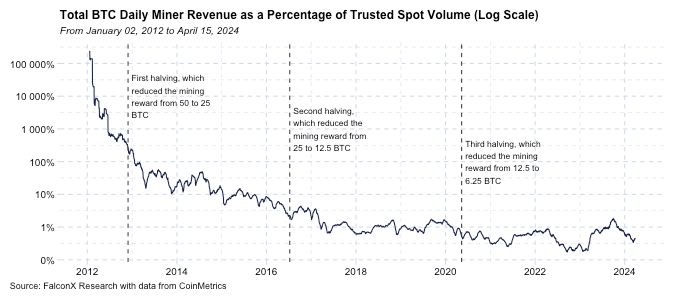

Lawant begins by addressing the changing impact of Bitcoin miners on market prices. He presents a detailed chart comparing total mining revenue to Bitcoin spot traded volume from 2012, clearly indicating the dates of the three previous halvings. This data shows a significant shift: “The most crucial chart for understanding halving dynamics is the chart below, not the price chart. It illustrates the share of total mining revenue compared to BTC spot trading volume since 2012, with the three halving dates highlighted.”

In 2012, total mining revenues were a multiple of daily traded volume, highlighting a time when miners’ decisions to sell could have significant consequences for the market. In 2016, this figure was still a notable double-digit percentage of daily volume, but has since declined. Lawant emphasizes: “While miners remain an integral part of the Bitcoin ecosystem, their influence on price formation has diminished significantly.”

He explains that this reduction is partly due to the increasing diversification of Bitcoin holders and the increasing sophistication of financial instruments within the cryptocurrency market. Furthermore, not all mining revenues are immediately affected by halving events. Miners can choose to hold their rewards instead of selling, which affects the direct impact of reduced block rewards on supply.

Lawant links the timing of halvings to broader economic cycles, and suggests that halvings do not occur in isolation, but alongside significant monetary policy changes. This juxtaposition increases the narrative impact of halvings, as they underscore Bitcoin’s characteristics of scarcity and decentralization during periods when traditional monetary systems are under pressure.

“Bitcoin halving events usually occur during crucial turning points in monetary policy, so the story just fits too perfectly to assume they can’t influence prices,” Lawant notes. This explanation suggests a psychological and strategic dimension in which the perceived value of Bitcoin’s scarcity becomes clearer.

The analysis then shifts to the macroeconomic environment that influences Bitcoin’s appeal. Lawant points to the 2020 discussion by investor Paul Tudor Jones, who labeled the economic environment as “the great monetary inflation,” a period marked by aggressive monetary expansion by central banks. Lawant argues: “I would argue that this was a more important factor in the 2020-2021 bull run than the direct impact of the halving,” noting that macroeconomic factors may have had a more substantial impact on Bitcoin’s price than the halving. yourself.

Future prospects: macroeconomics over mechanics

Looking to the future, Lawant speculates that as the world enters a new phase of economic uncertainty and potential monetary reforms, macroeconomic factors will increasingly dictate Bitcoin’s price movements rather than the mechanical aspects of halvings.

“Now, in 2024, concerns are centered around the aftermath of fiscal/monetary policies that have been in place for decades but are being turbocharged in a world that is very different from four years ago. […] We may be entering a new part of this macroeconomic cycle, and macro is becoming an increasingly important factor in BTC price action,” he concludes.

This perspective suggests that while the direct price impact of Bitcoin halvings may diminish, the broader economic context is likely to emphasize Bitcoin’s fundamental properties – immutability and a fixed supply ceiling – as crucial anchors for its value proposition in a rapidly evolving economic landscape.

At the time of writing, BTC was trading at $62,873.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.