- Bitcoin, Ethereum and Solana dropped significantly on the price charts

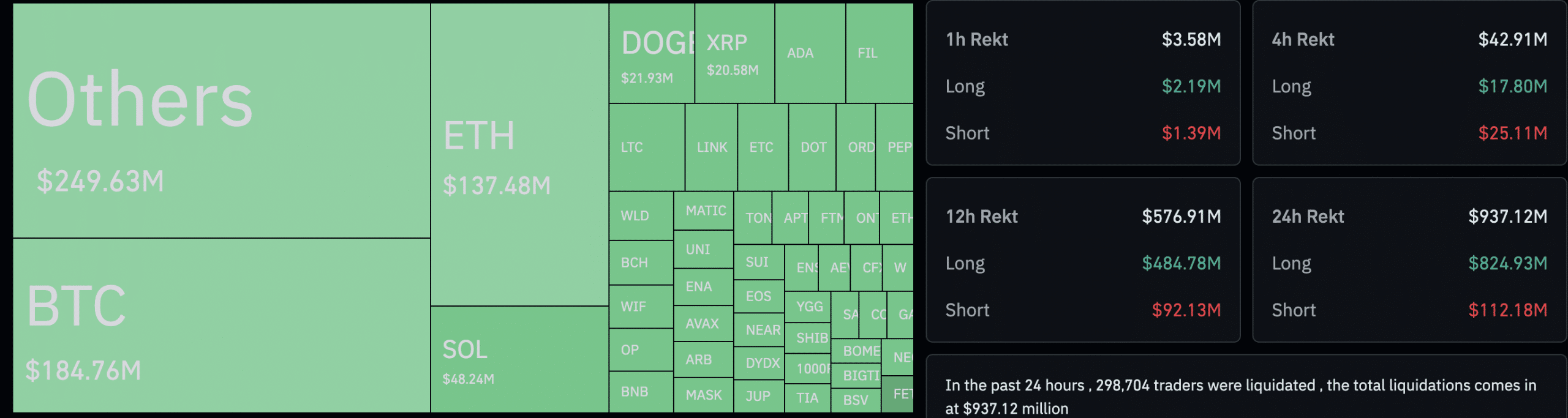

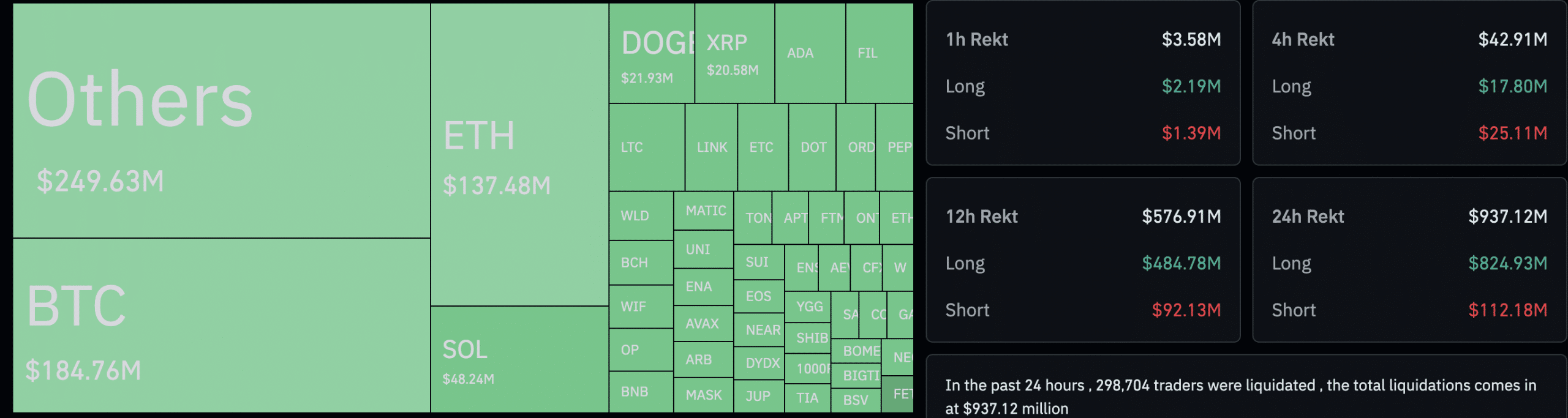

- Nearly $1 billion worth of positions have been liquidated in the past 24 hours

After a price increase last week, Bitcoin [BTC] registered a significant correction in the last 24 hours. During the said period, the cryptocurrency’s price fell by 4.95%, with BTC trading at $67,829.94 at the time of writing. Bitcoin fell as traditional markets tumbled due to the geopolitical uncertainty surrounding Iran’s possible attack on Israel. Accordingly, both the S&P500 and Nasdaq fell, while the value of traditional safe havens such as gold rose.

The drop in Bitcoin’s price had a cascading effect, causing other cryptocurrencies on the charts to drop in value as well.

Another bites the dust

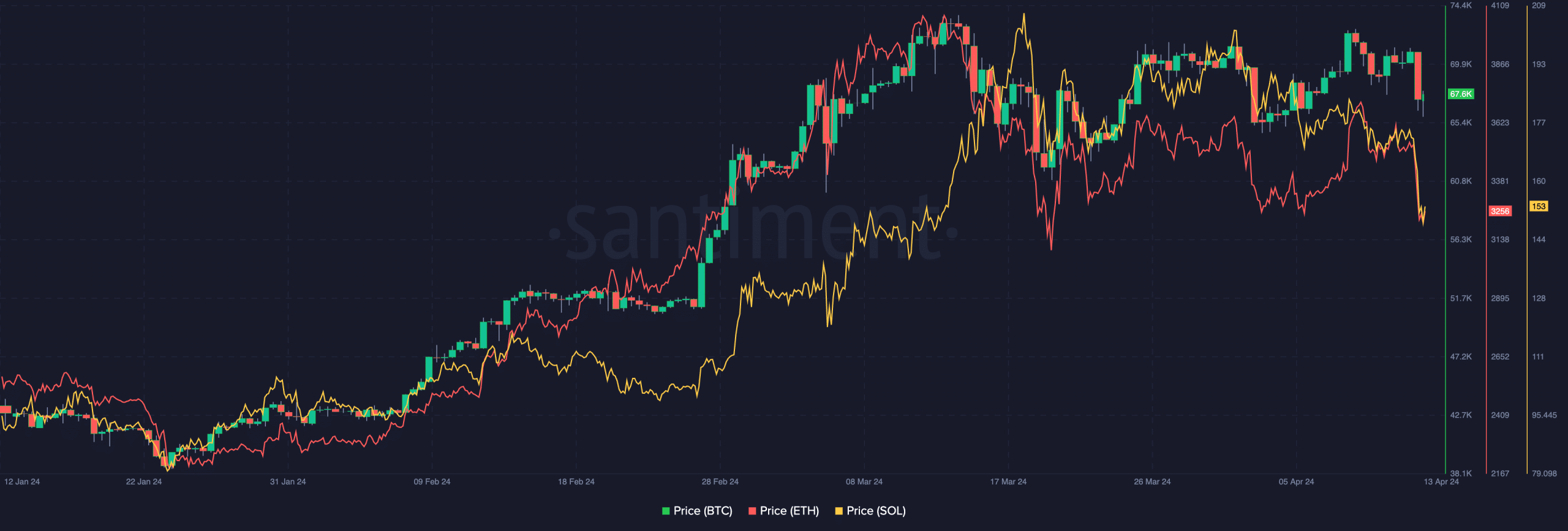

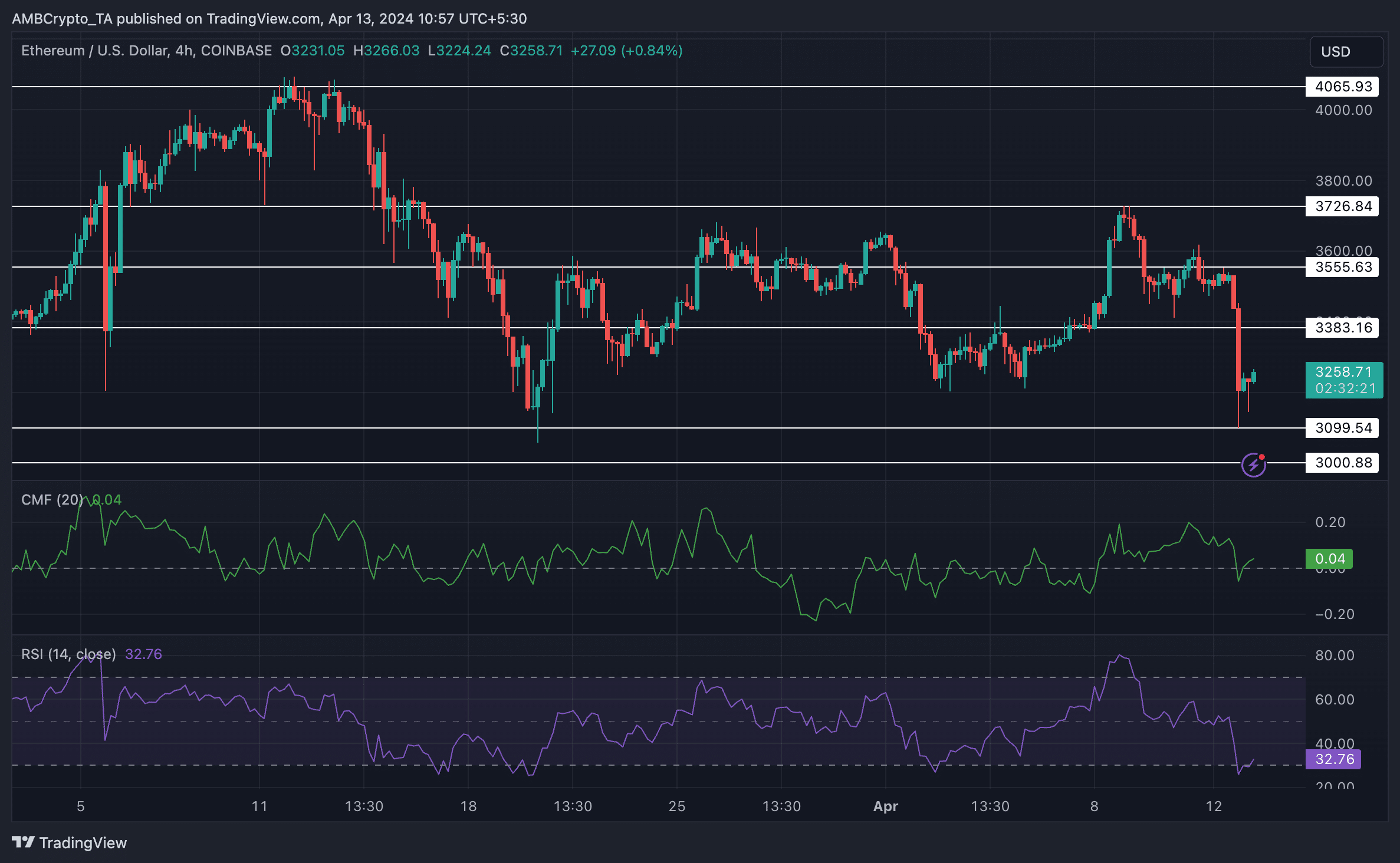

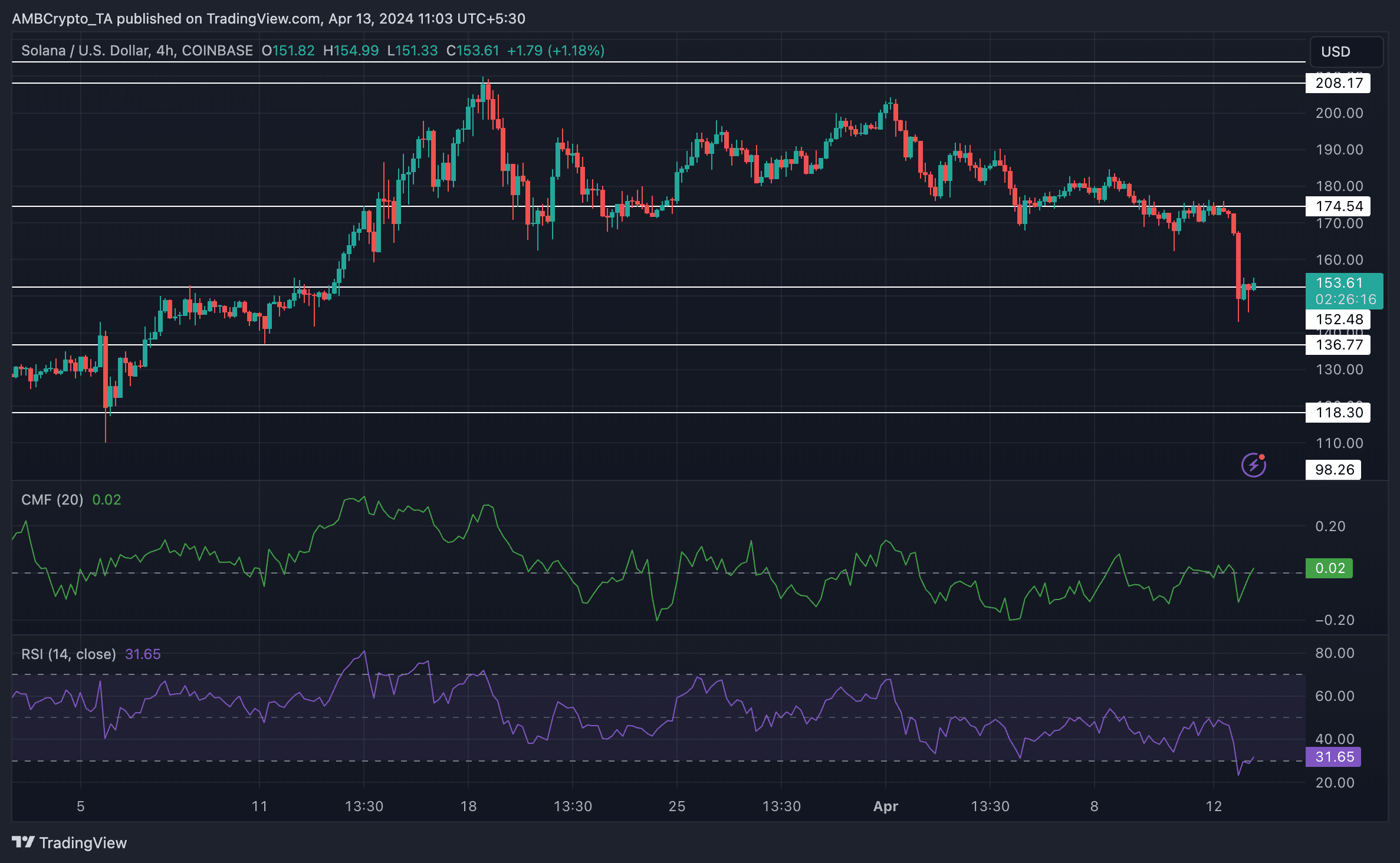

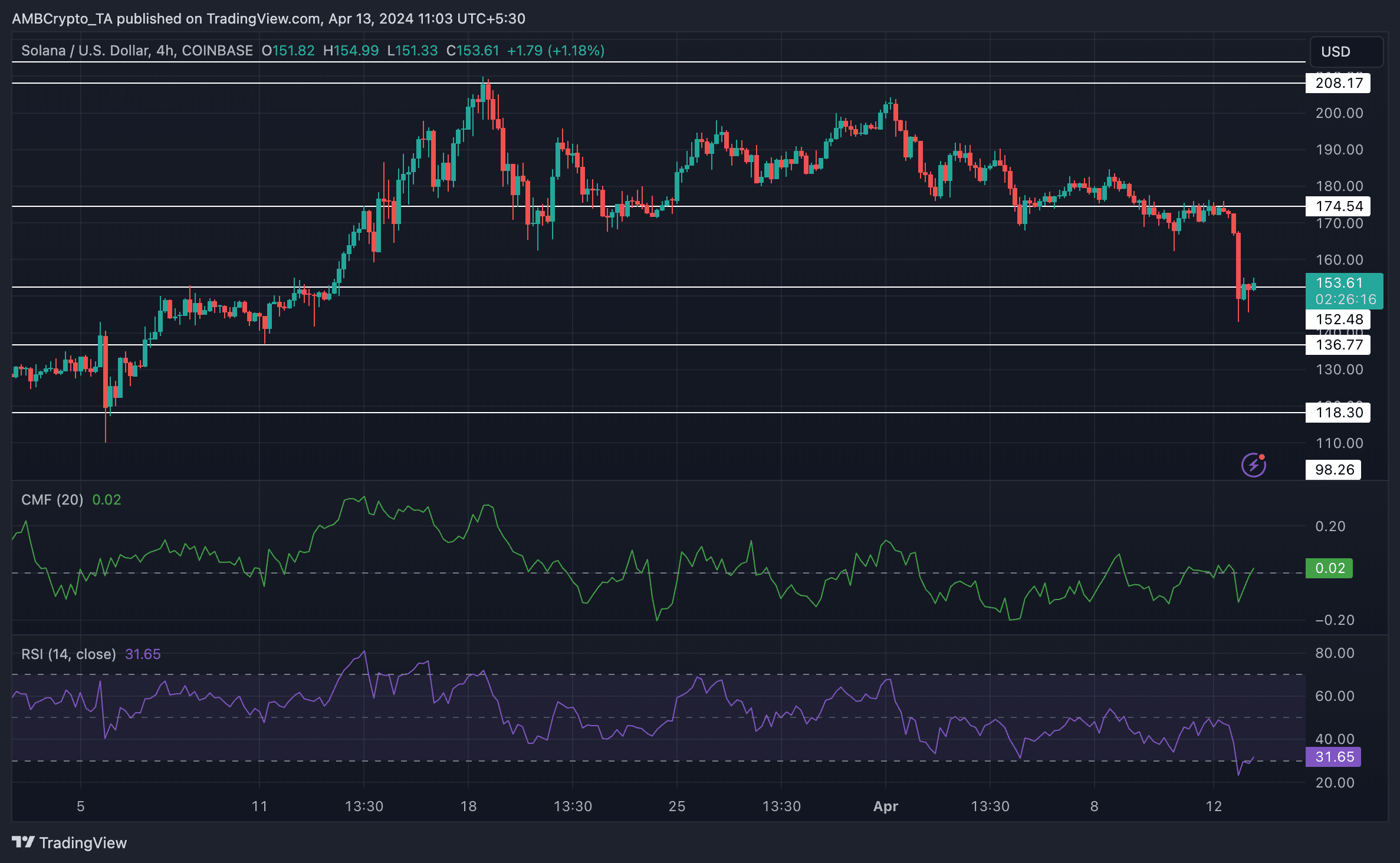

Due to its high correlation with Bitcoin, Ethereum [ETH] and Solana [SOL]’s prices also fell dramatically and suffered a worse fate. SOL fell 11.93% in the last 24 hours and ETH fell 8.33% in the same period. Thanks to the same, both SOL and ETH broke past their previously established higher lows, disrupting their ongoing bullish trend on the charts.

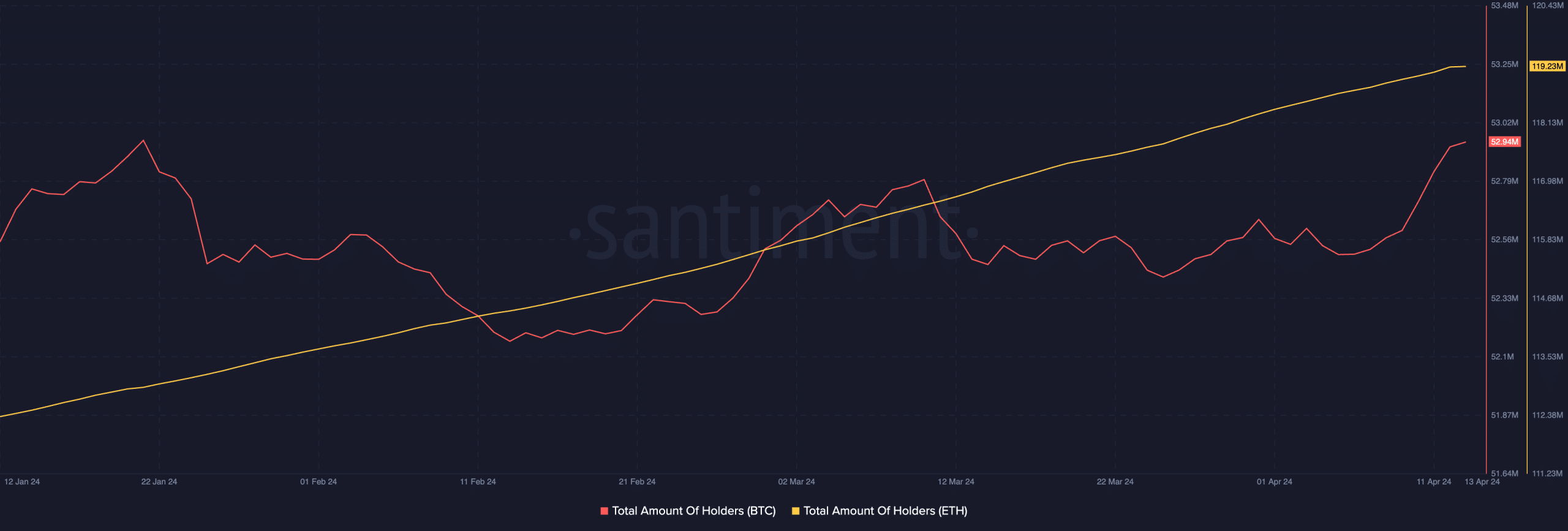

Source: Santiment

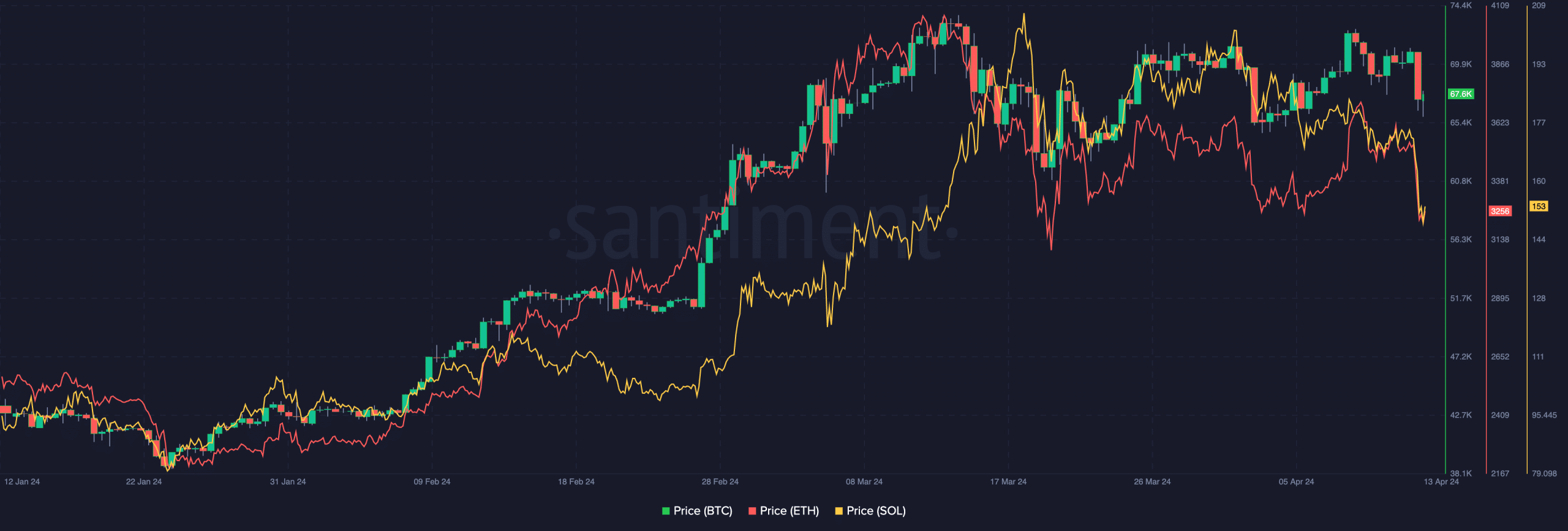

During this drawdown, the price of ETH even fell to $3099. However, after testing this level, it managed to rise back up to $3256.96 at the time of writing.

Previously, Ethereum had tested this level on March 20. If Ethereum follows a similar trajectory in the future, it could reach the $3384 level soon.

Source: trading view

Solana followed a similar path. Although the correction was quite recent, Solana’s price movement since April 1 indicated a possible price decline. Since the beginning of the month, SOL showed multiple lower lows and lower highs, indicative of a bearish trend.

A massive resurgence of bullish momentum would be required for both ETH and SOL to recover.

Source: trading view

Are whales to blame?

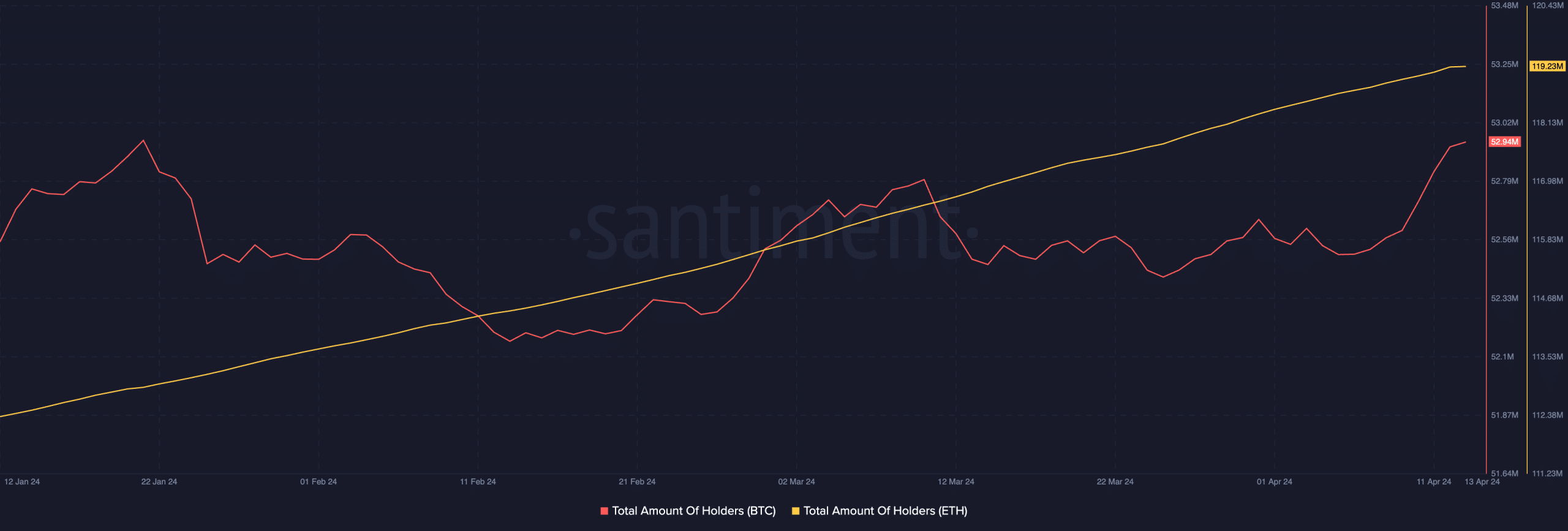

However, despite these price corrections, interest in BTC and ETH remains high. In fact, AMBCrypto’s analysis of Santiment’s data showed that the number of addresses holding BTC and ETH has grown significantly in recent weeks.

This indicated that the recent price decline could have been caused by the behavior of some whales who indulged in profit taking.

Source: Santiment

How do traders survive?

In the past 24 hours, $947 million worth of positions have been liquidated. Of this, $824.94 million consisted of long positions. Traders who were bullish on BTC, ETH and SOL lost the most money. However, at this point it is still too early to tell which direction BTC will take, especially with the halving just on the horizon.

Source: Coinglass