- Bitcoin is up 7.96% in the past week.

- Market fundamentals suggested that Bitcoin could experience a market correction soon.

As expected, Bitcoin [BTC] has had a strong October. Although the month started on a low note, the crypto has made significant gains that exceed its previous losses.

Since the low of $58867, BTC has surged to reach the July level of $69,000.

At the time of writing, Bitcoin was even trading at $69028. This marked a 7.96% increase over the past week, with the crypto gaining 9.52% on the monthly charts.

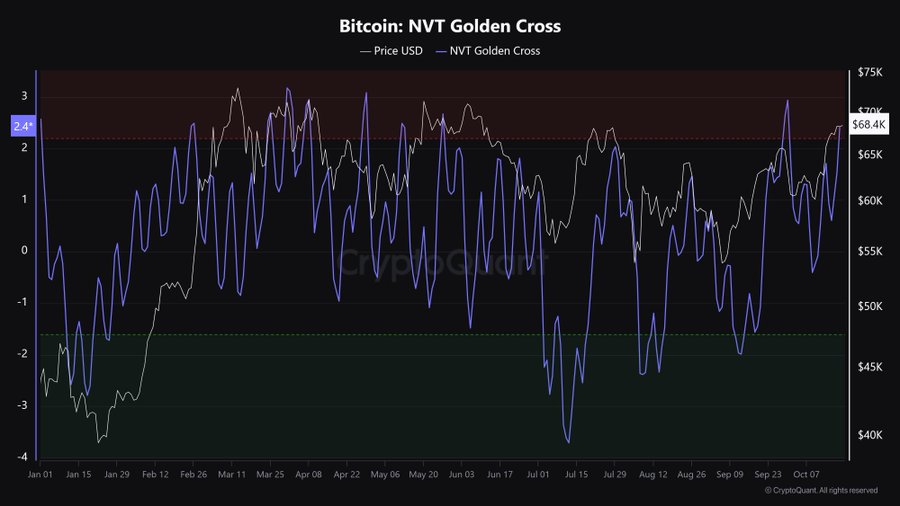

The recent upturn has made analysts optimistic and pessimistic in equal measure. For example, CryptoQuant analyst Burak Kesmeci suggested that Bitcoin could see a market correction, citing the NVT gold cross.

Market sentiment

In his analysis, Kesmeci stated that Bitcoin’s NVT Golden Cross has entered a “hot zone” in the short term.

Source:

According to him, the market will eventually undergo a correction before an uptrend resumes.

For the uninitiated, the NVT Golden Cross hitting the ‘hot zone’ suggests that BTC is currently trading higher than what the network activity warrants.

So it has become overvalued relative to the amount of value transferred to the blockchain.

This indicates a potential overbought situation where price growth is not supported by the fundamental usage of the network.

These conditions often precede a price correction, where the market adjusts and brings the price back in line with network fundamentals.

Based on this analogy, Bitcoin will experience a pullback in the short term.

What the BTC charts say

As Kesmeci has noted, current fundamentals do not support a sustained rally and could fall to meet demand.

The question therefore is: how sustainable is the current rally, and what do market indicators suggest?

Source: CryptoQuant

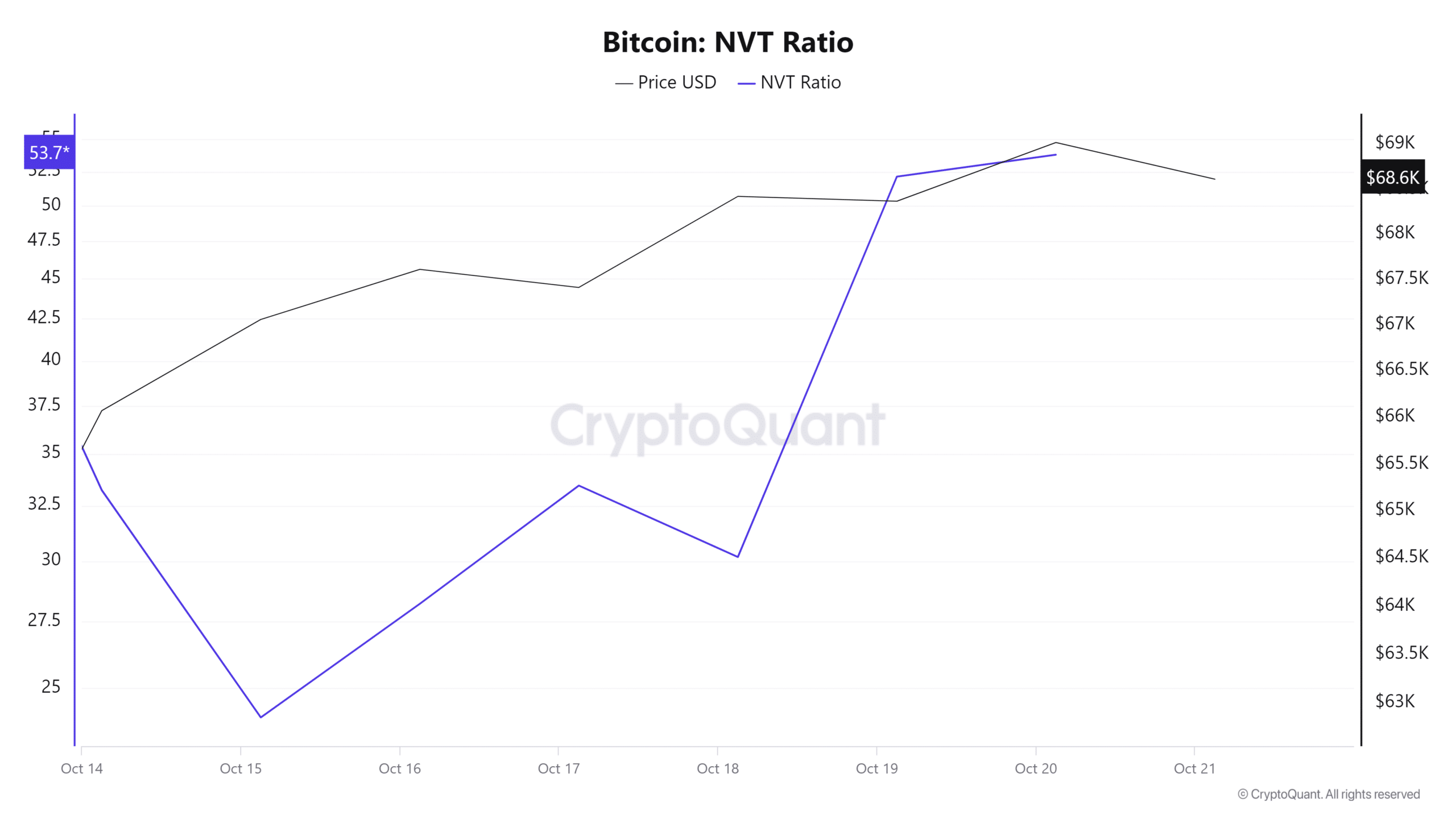

The first indicator to take into account is Bitcoin’s NVT ratio, which measures the network value against the transaction.

According to CryptoQuant, the NVT ratio has increased over the past week. This increase implies that BTC is overvalued compared to actual utility and network activity, making prices unsustainably high.

Source: CryptoQuant

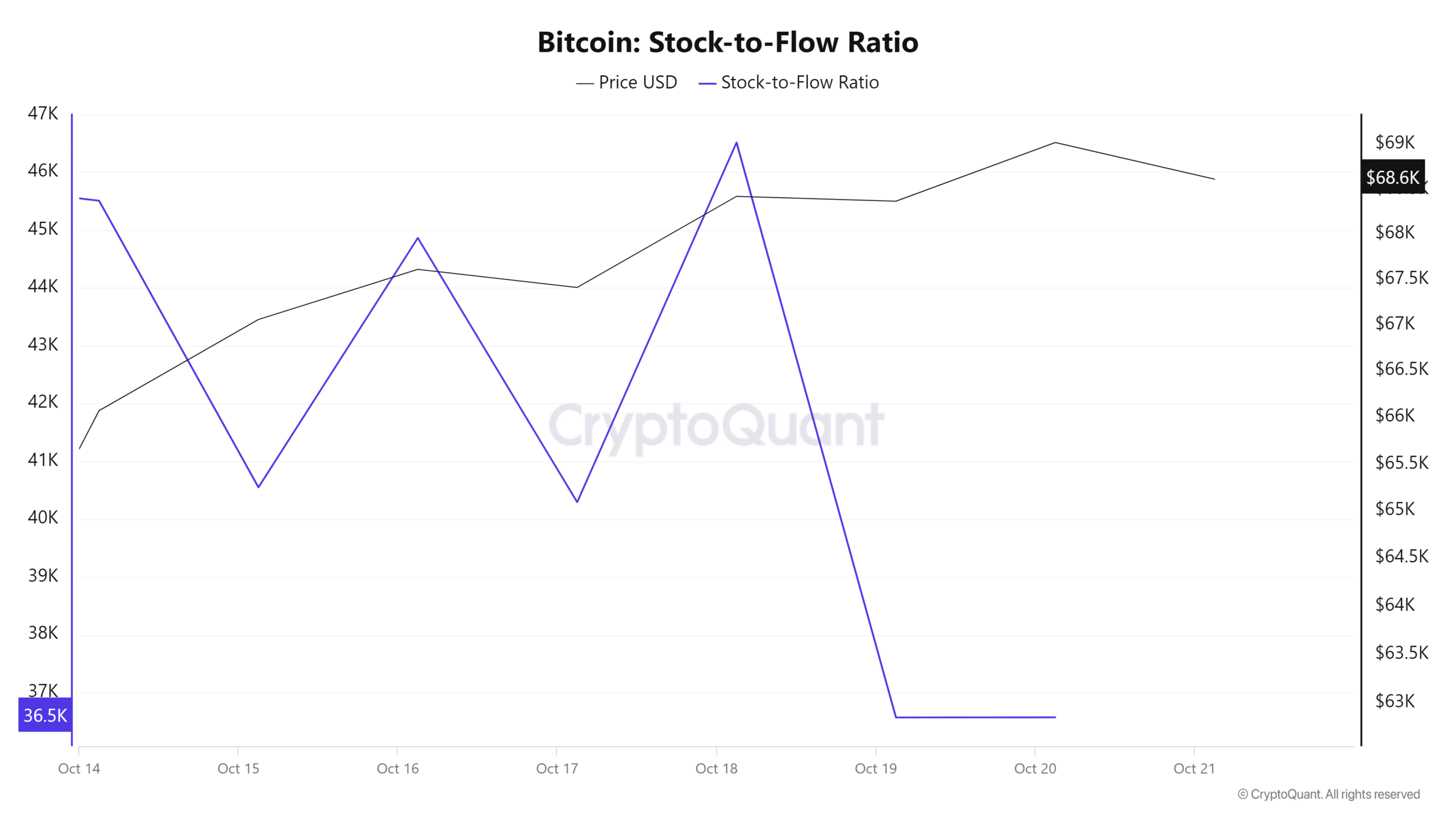

Furthermore, Bitcoin’s Stock-to-Flow Ratio has fallen over the past week, indicating an increase in supply. The increased availability of BTC tends to turn the market into bearish, especially if demand does not grow.

Source: Santiment

Finally, Bitcoin’s price-DAA divergence has remained negative over the past week. This indicates that there is an unsustainable price increase.

When the Price DAA is negative, it suggests that the current rally is driven by speculation or short-term demand.

Read Bitcoin’s [BTC] Price forecast 2024 – 2025

Simply put, even though BTC has risen to a recent high, market fundamentals suggest a correction is imminent. As such, the current rally is mainly driven by speculation and not supported by demand.

A correction will see Bitcoin fall towards the support level of $65872.