BNB Chain TVL is up 2%, NFT trading volume is up 283%, but on-chain activity and network revenue are declining.

Recent data shows that the BNB chain has seen notable changes across several metrics in the third quarter of 2024, despite market challenges. The chain saw a modest increase in Total Value Locked (TVL) and a significant increase in NFT trading activity.

However, network revenues and overall on-chain activity declined compared to the previous quarter.

BNB DeFi and Staking see modest gains

BNB Smart Chain’s DeFi TVL, measured in USD, increased 2% quarter-over-quarter, from $4.74 billion in the second quarter to $4.85 billion in the third quarter. Despite this growth, BNB Smart Chain dropped to fourth place in the TVL rankings, overtaken by Solana.

Meanwhile, BNB-denominated TVL remained stable at BNB8.3 million, indicating consistent capital inflows. Venus Finance maintained its position as the leading protocol for TVL, up 13% quarter-over-quarter to $1.79 billion. However, loans on Venus fell significantly, by 36%, to $454 million.

BNB DeFi TVL

Strike activity also grew, by total BNB has deployed increased by 7% to 32.4 million BNB. ListaDAO’s liquid staking solution, slisBNB, continued to dominate, although staked volumes fell 2% quarter-over-quarter to 406,200 slisBNB.

In a major development, the YieldNest protocol has introduced a re-staking feature, allowing users to convert slisBNB to ynBNB for further staking. This move is intended to increase the liquidity of the ecosystem.

Turnover of the BNB chain is declining

BNB Chain’s revenue, which reflects the total fees collected by the network, fell in the third quarter. Revenue for the quarter totaled $34.9 million, down 28% from $48.4 million in the second quarter.

Sales expressed in BNB also fell, by 22% quarter on quarter. In the third quarter, sales amounted to 63,500 BNB, compared to 81,300 BNB in the previous quarter.

NFT activity is rising

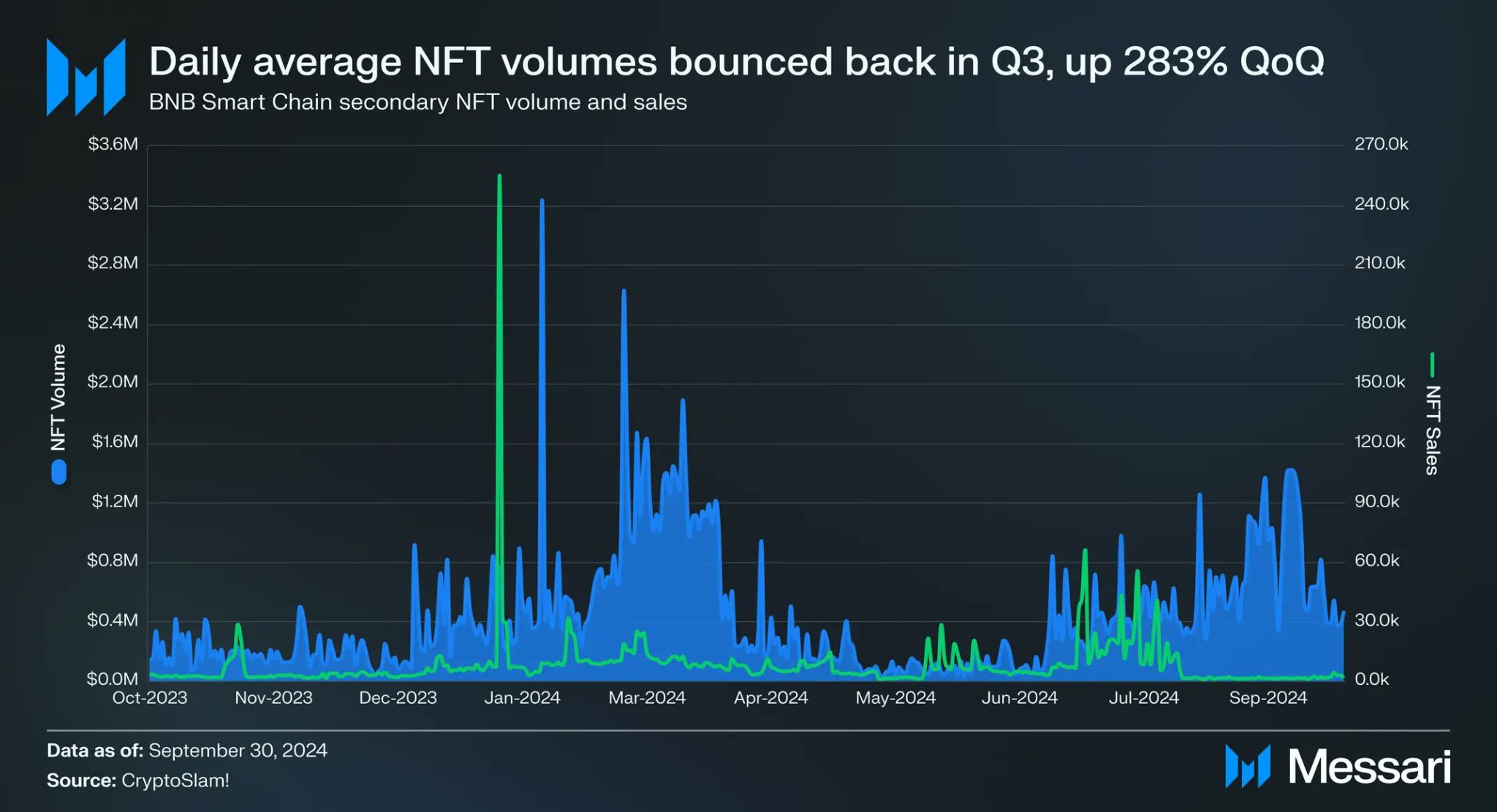

On the NFT front, BNB Chain saw a significant recovery after a quiet second quarter, with average daily trading volume rising 283% to $600,400 in the third quarter. Average daily sales also increased by 47% to 8,900.

BNB NFT volumes

However, the number of unique daily buyers fell 53% to 2,300, suggesting that recent NFT activity has been driven by larger transactions from a smaller group of high-quality traders.

Activity on the chain and gas-free initiative

Despite the positive momentum in some areas, BNB Smart Chain‘s on-chain activity slowed. The average number of daily transactions fell 8% quarter-on-quarter to 3.4 million, while the number of active daily addresses fell 19% to 868,300.

Stablecoin transactions remained a strong point, with USDT leading the way in active addresses, averaging 294,000 daily – an 8% quarter-over-quarter growth. PancakeSwap remained the second most active protocol, with 94,600 daily addresses.

Amid these trends, BNB Chain launched its “Gas-Free Carnival” to improve stablecoin usage. This initiative offers gas-free transfers for USDT, USDC and FDUSD, powered by Bitget Wallet and SafePal. Additionally, free withdrawals and free bridging options through Celer cBridge are intended to improve user experience and drive adoption.