- Bitcoin miners chose to mine Kaspa to offset their losses.

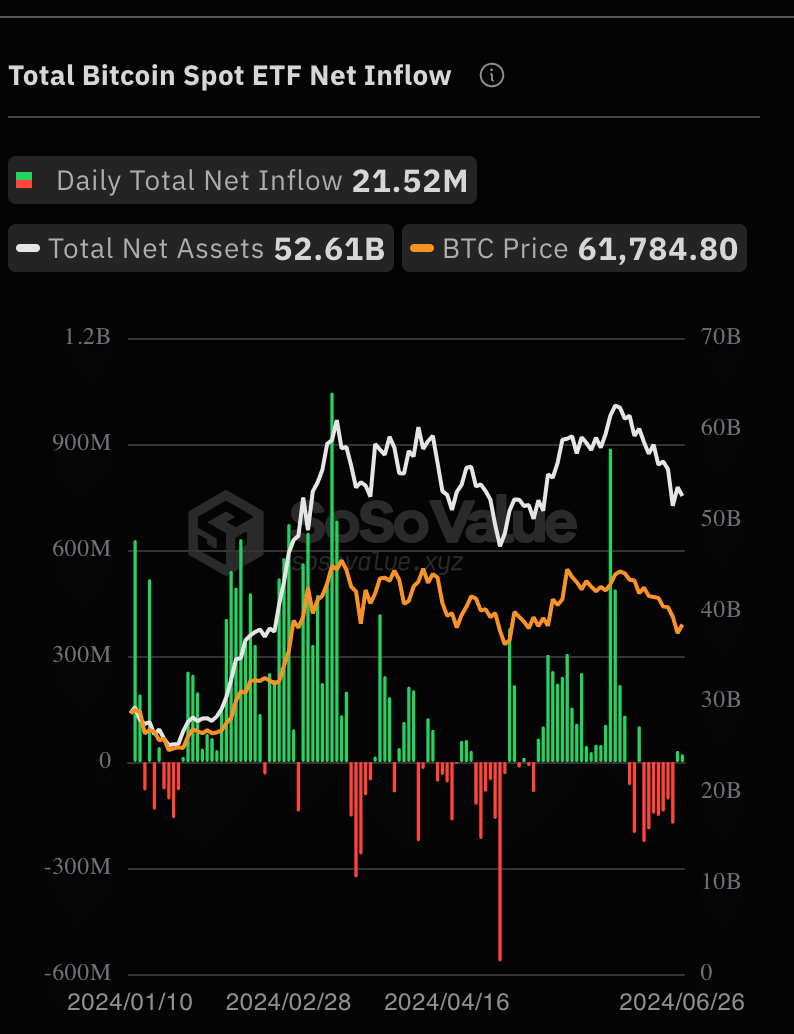

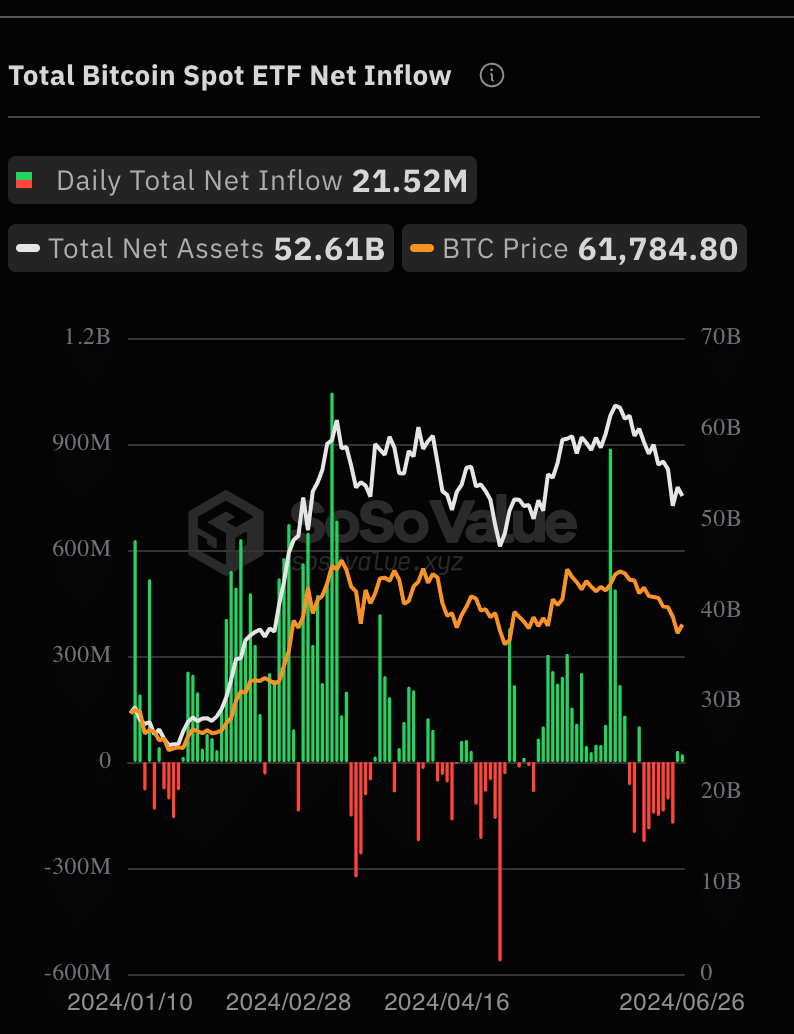

- General interest in ETFs remained high, despite falling prices.

Bitcoins [BTC] The recent price drop has put miners in a state of FUD (fear, uncertainty and doubt).

Miners find new ways

As a result, many Bitcoin miners have decided to diversify their income streams and offset a drop in Bitcoin production.

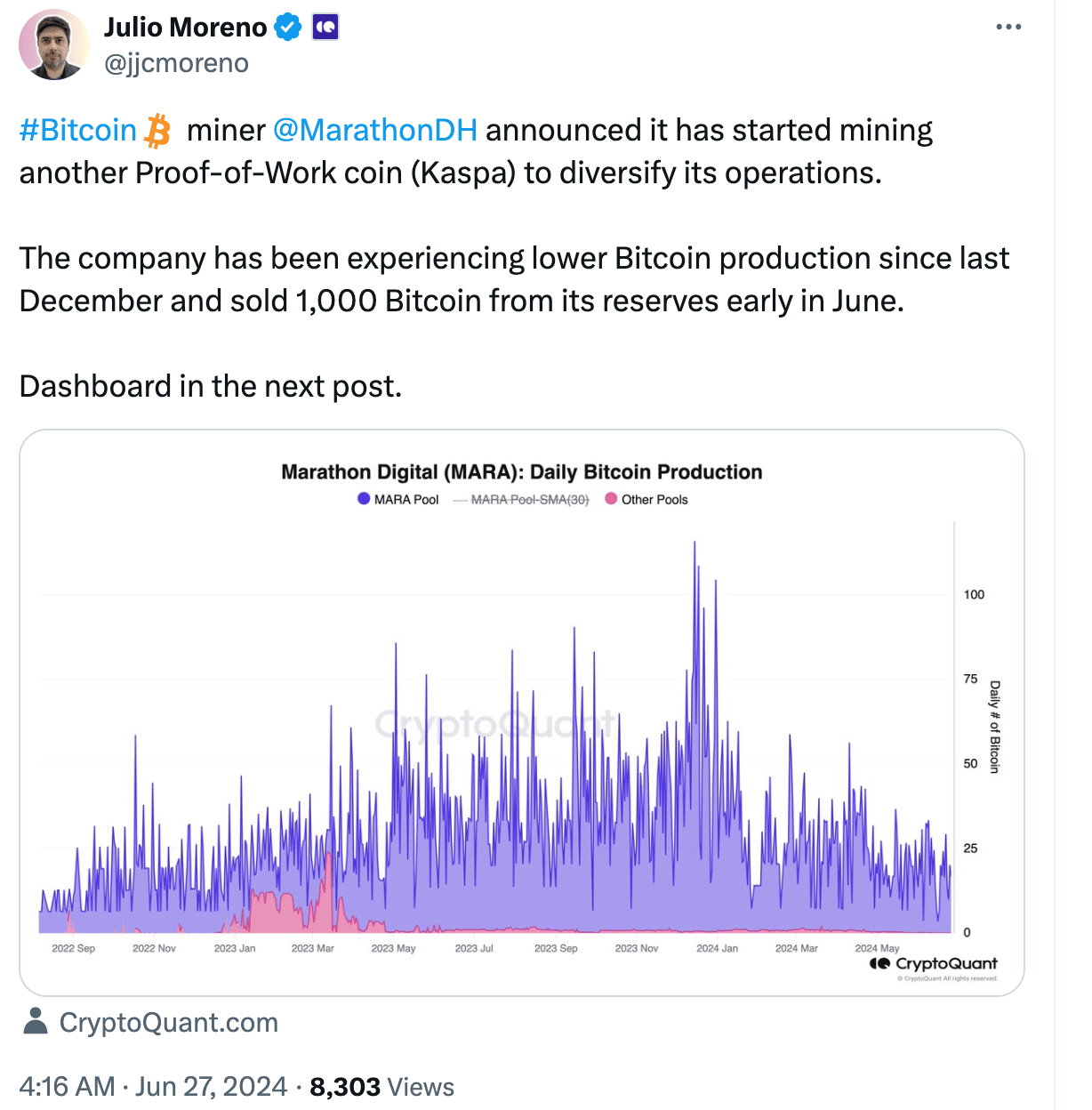

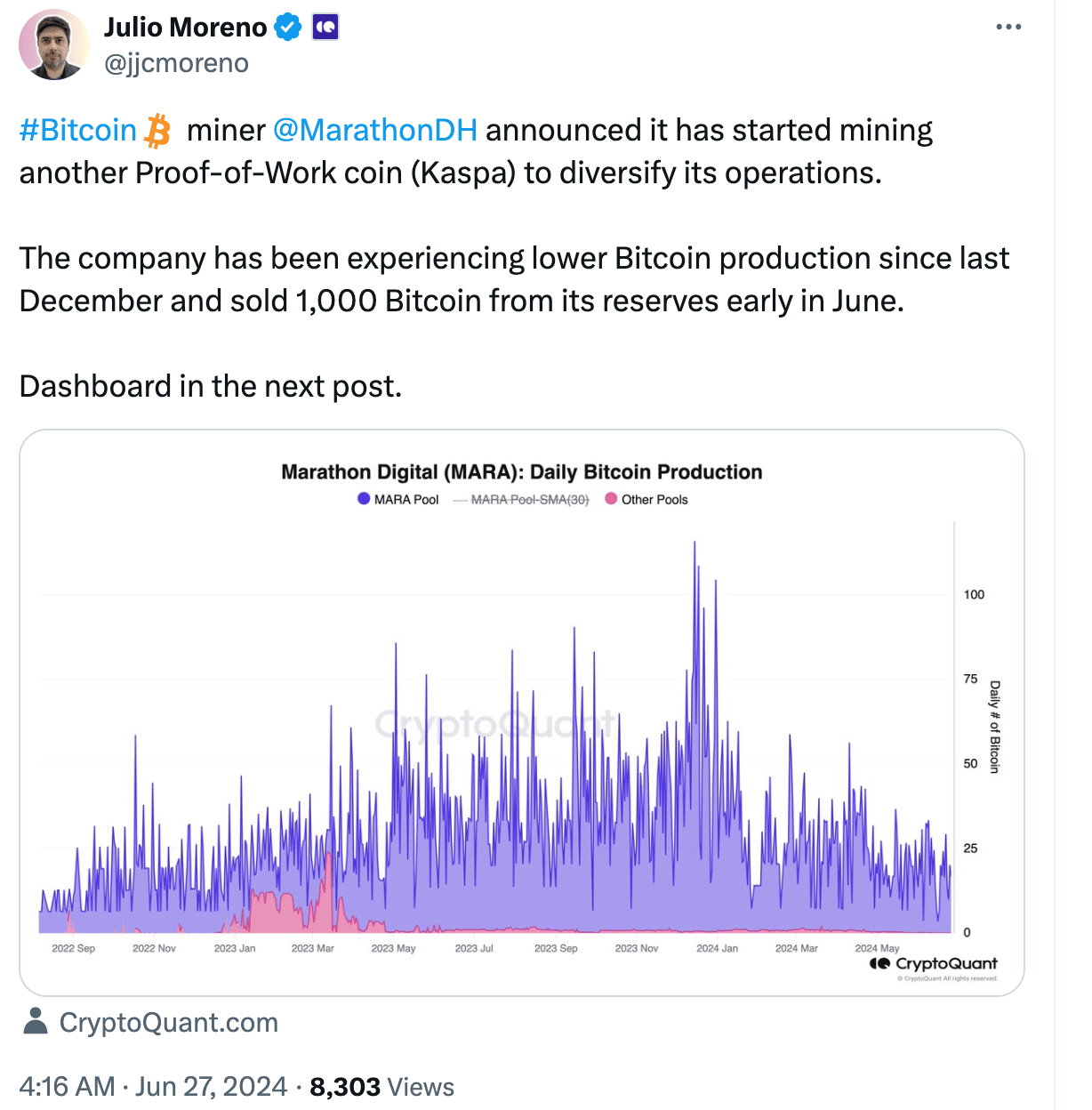

Major Bitcoin mining company Marathon Digital Holdings (MarathonDH) has started mining Kaspa, another Proof-of-Work cryptocurrency.

MarathonDH has been experiencing lower Bitcoin production since December 2023, culminating in the company selling 1,000 Bitcoin from its reserves in early June.

Kaspa, with its faster block times and potentially higher block rewards compared to Bitcoin, offered an attractive option for MarathonDH to increase its profitability.

If other major miners follow suit and start mining Kaspa to diversify, there could be an increase in selling pressure in the Bitcoin market, potentially driving the price down in the short term.

Source:

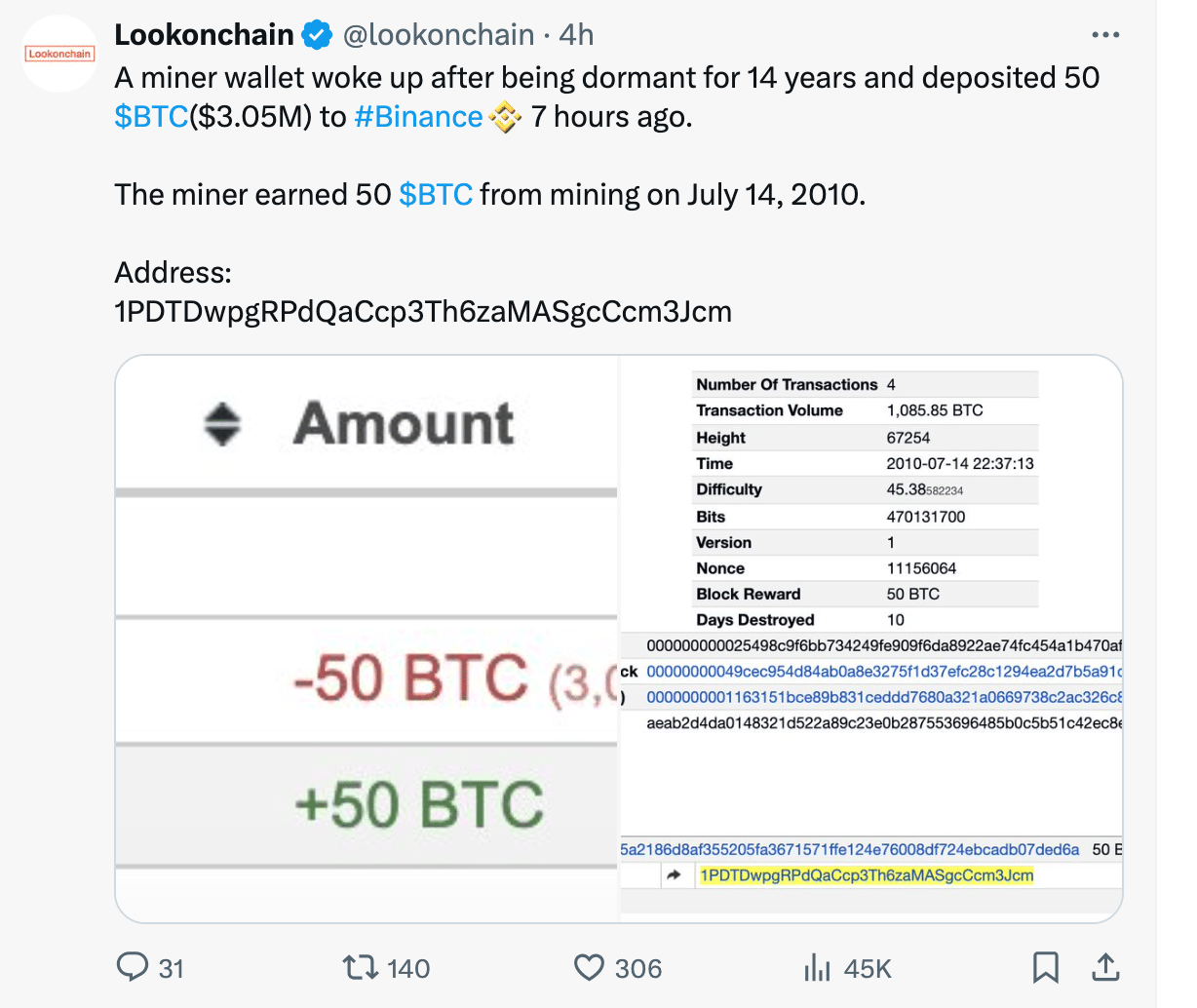

A dormant miner address, inactive for a whopping 14 years, woke up and transferred 50 BTC to a Binance [BNB] deposit address.

This miner earned these 50 BTC by mining on July 14, 2010, a time when the price of each Bitcoin was just $0.05.

The reawakening of this wallet and its transfer to Binance could indicate potential selling pressure on the Bitcoin market in the near future, which could further impact the price.

Source:

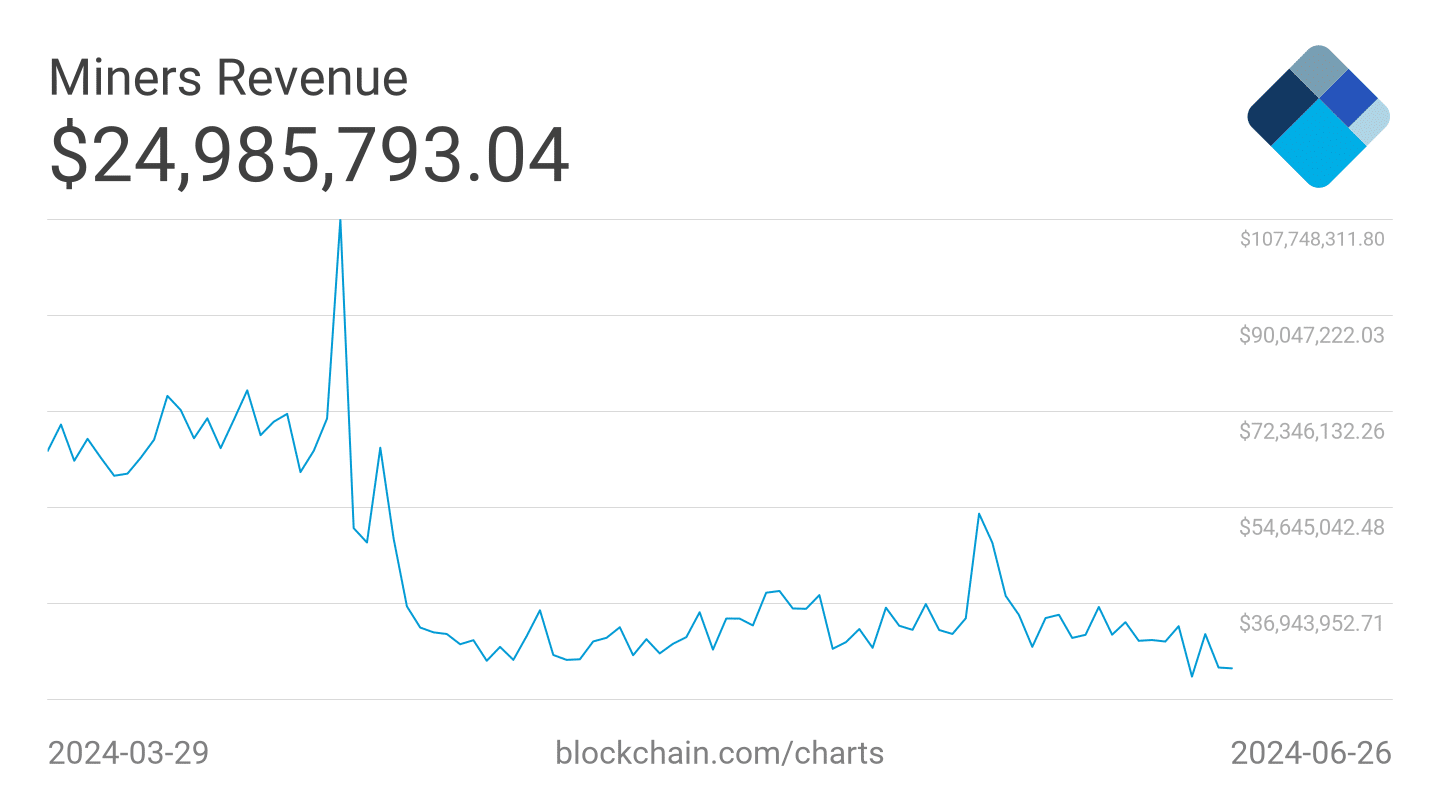

Adding to the problem, the daily revenue generated by these miners had been significantly depleted in recent days. Since June 7, miners’ earnings have fallen from $54 million to $24 million.

If miners fail to see an increase in revenue, they would be forced to sell their assets to remain profitable, which could cause further damage to the price of BTC.

Source: Blockchain.com

Interest in ETFs grew

Although the miners’ condition does not look positive, interest in BTC ETFs could help sustain Bitcoin’s price under immense selling pressure.

SoSo Value’s data showed that at the time of writing, Bitcoin spot ETFs saw investor interest on June 26, with net inflows of approximately $21.4 million. This comes after a period of outflow.

Two leading funds, Grayscale Bitcoin Trust (GBTC) and Fidelity Bitcoin ETF (FBTC), were the main beneficiaries.

Read Bitcoin’s [BTC] Price forecast 2023-24

GBTC raked in $4.33 million, while FBTC raked in a more significant $18.61 million in one day.

Notably, FBTC’s total net inflows have reached a staggering $9.185 billion, solidifying FBTC’s position as a major player in the Bitcoin ETF landscape.

Source: Sosowaarde

![While Bitcoin Miners Move to Kaspa [KAS]will BTC fall even further?](https://bitcoinplatform.com/wp-content/uploads/2024/06/BTC-miners-1-1000x600.webp)