The beginning of the disappointment that the NFT blue chip project brought

Azuki, one of the most solid blue-chip projects in the NFT bear market, announced the debut of a new series of Azuki Elementals, which sparked the interest of many investors, surpassing the animated promotional video, which lasted more than a minute expectations.

The Azuki Elementals are the third addition to Azuki’s fast-growing cosmos, following Azuki’s Genesis collection and Beanz. Elementals consist of 20,000 NFTs and span four different domains (Lightning, Earth, Water, and Fire). During the project’s recent Vegas event, the first 10,000 Azuki Tokens were dropped to Azuki holders. The rest were auctioned off in an Elementals auction.

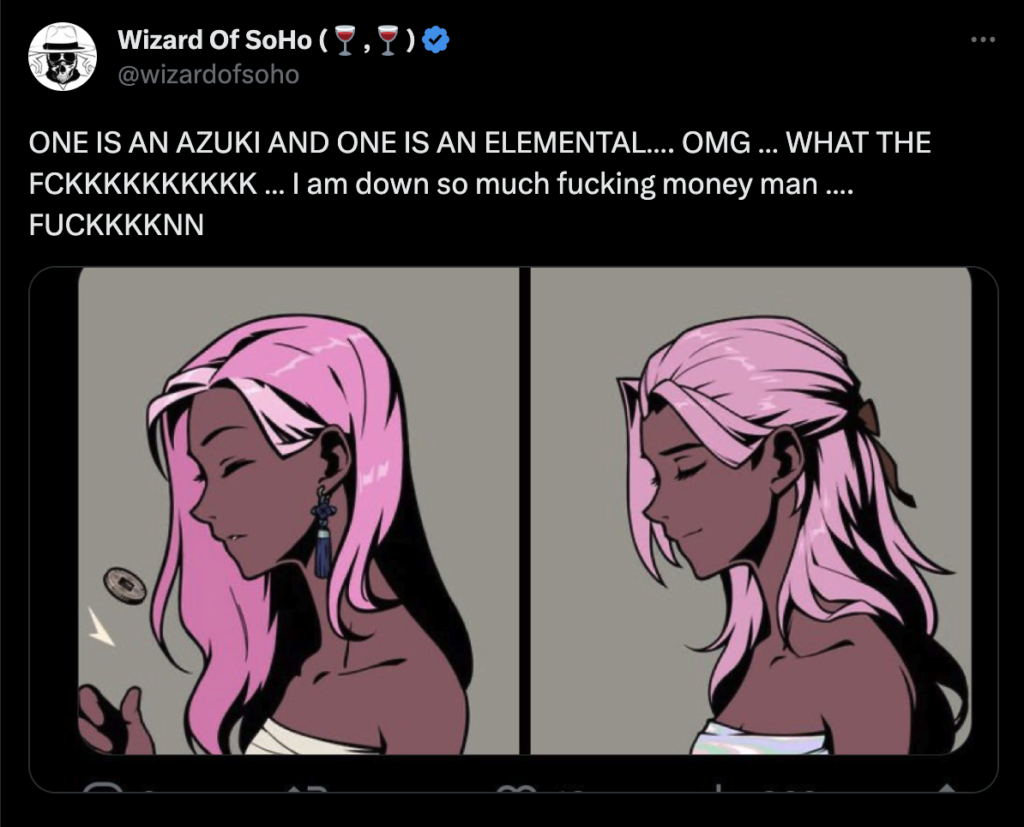

When it comes to the NFT market, there are many projects that keep producing new series, but most of them cannot avoid word of mouth, and Azuki is no exception. The holders found that Azuki Elementals is a large-scale rollover scene of the buyer presentation, which deviates too much from the promotional video showing the card’s formal launch. Azuki Elementals openly plagiarized its own course work, which is quite similar to the old Azuki and the new NFT. Don’t say this is a new project, say it’s Azuki’s extra problem.

The coin provoked a wide range of reactions, with many (mainly Azuki holders) ecstatic about their successful coin experience, while others were frustrated that despite arriving on time, they were unable to get their hands on a coin. There was no restriction on hitting presale Azukis, allowing many people to hit more than 10, with one person able to hit an amazing 332 Elementals. Nevertheless, many Beanz holders failed to hit.

Elementals arranged three rounds of sales and sold them all in 15 minutes, netting $38 million for the team. Nevertheless, when Elementals’ NFT art photo was announced, buyers found it very similar to the Azuki series, sparking outrage in the community. The floor price of the Elementals series quickly dropped from the original 2 ETH to a low of 1.32 ETH; the Azuki series was also affected, leading to the price drop.

On June 29, on-chain experts discovered that Azuki had moved 20,000 ETH (approximately $37 million) to Coinbase Prime from the sale of the Elementals series.

Azuki’s answer

Azuki is the first, while Elementals are the second. The art styles of the two groups are identical. At first they mistook them for the same series. If you like this kind of art, make one and use it as your social avatar; no one will be able to determine if you are wearing Azuki or Elementals. Yet their prices are diametrically opposed.

The former has a presale price of 17 ETH, while the latter has an initial floor price of 2 ETH. This significantly reduced Azuki’s value, and when Elementals appeared, it caused a sell-off and price collapse. This eroded the owners’ trust in the community.

In response to criticism from the community, the official Azuki tweet said that the team has tried to use the original Azuki column as the heart of their universe’s functioning, but this has not conveyed well to the community. Azuki holders will always receive top priority and over-allocation in future prizes, airdrops and experiences based on their status.

On Elementals’ casting this time around, Azuki said it was influenced by NBA Top Shot and combined AI/social media components, aiming to provide everyone with a live social experience that creates a sense of immersion, though they confess they failed . on a certain moment. At the same time, the team intended that the airdrop would give everyone a chance to acquire unusual NFTs, but they made a mistake in assigning appropriate weights to the ranks, which overcomplicated the mechanics.

During this discussion, according to multiple community members, Azuki also recommended several corrective steps and future plans, including holding a community vote to change the art of Elementals, including replacing the original solid color background of Elementals. To make it stand out more, it has been changed to a new floating background.

Later, the “Collector System” will be implemented, and the rights and interests granted by this new system will be determined by the different series, NFT rarity and possession. There are criteria such as time and badges, and the seller’s behavior affects the points earned (even if they are redeemed).

Azuki believes that IP/Web3 technology can disrupt the animation business and collaborates with talented animators to create animation. There will be participatory experiences such as leveraging NPC encounters to mint tokens or collectibles, and the entire production process will be entirely self-funded. The team and holders have full control over and benefit from the animation, with all proceeds going back to the Azuki project.

At the same time, green beans will be used in animations, but they cannot be sold and can only be obtained by OG Azuki holders; the Beanz series has its own roadmap and the team will research community content and create some short animations.

Several people have made fascinating connections between Yuga and Azuki, comparing BAYC to Azuki, Elementals to MAYC, and Beanz to BAKC. Yuga and Azuki have both firmly established themselves as blue-chip projects with a plethora of collections within their own ecosystems. While such analogies make sense given the structural similarities, they often miss the individual personalities and goals of these ventures.

Conclusion

Despite these parallels, the Azuki team has been unequivocal in establishing its own identity and agenda. They claim that their purpose and aspirations are clearly their own, rather than a copy of previous ventures. Azuki’s previous mints and major events have always been performed to a high standard.

But it’s not all terrible news. Big news came in the form of an Azuki anime series, which is currently being produced as short films. The team sees this as an opportunity to use decentralized IP and Web3 technologies to disrupt the anime business. The anime is being self-funded and the crew is exploring ways for OG Azuki owners to license their NFTs for inclusion in the series.

DISCLAIMER: The information on this website is intended as general market commentary and does not constitute investment advice. We recommend that you do your own research before investing.