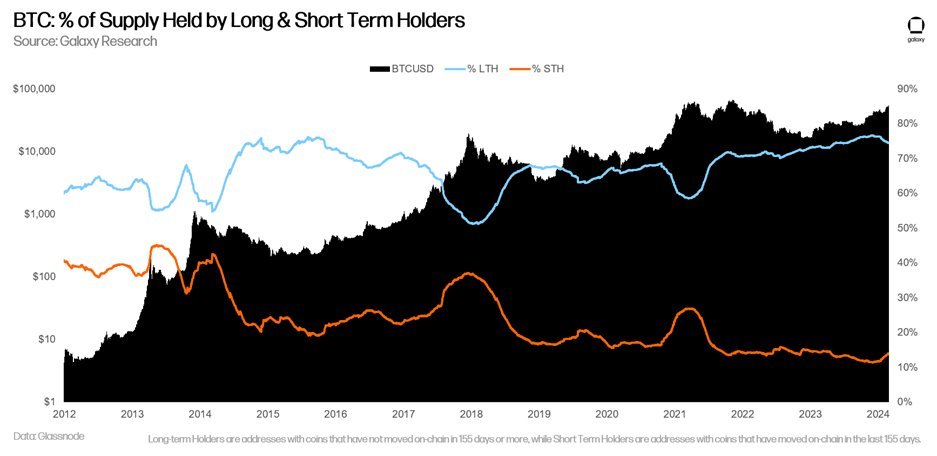

A key aspect of Thorn’s analysis is the unwavering strength of Bitcoin’s long-term holding base, which he estimates holds about 75% of the total BTC supply. “Long-term holders are still largely holding up,” Thorn notes, highlighting the community’s resilience and confidence in Bitcoin’s long-term value proposition. This demographic, characterized by their “diamond hands,” plays a crucial role in stabilizing the market and buffering against the volatility that often defines the crypto space.

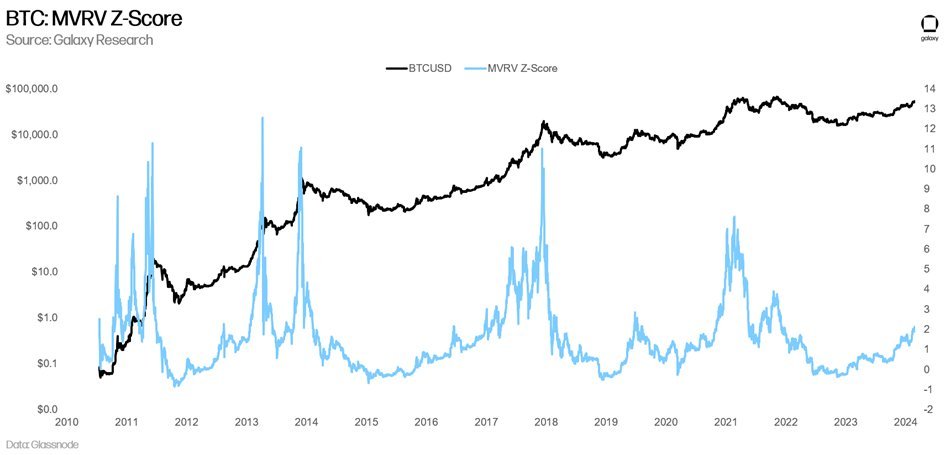

Thorn further discusses the analytical tools and statistics that provide insight into Bitcoin market behavior. He introduces the MVRV Z-Score, a new approach to understanding the cyclicality of Bitcoin’s price action by comparing its market value to its realized value. This metric provides insight into the perceived overvaluation or undervaluation of Bitcoin at a given point in time. Currently the MVRV Z-Score is close to 2, while at previous cycle tops the metric peaked at 8 (in 2021) or even above 12 (in previous halving cycles).

By addressing the speculation surrounding the acceleration of the Bitcoin cycle, Thorn allays concerns that the market is peaking prematurely. He argues against the idea that we are “accelerating the ‘cycle,’” instead arguing that the arrival of Bitcoin ETFs in the United States represents a transformative shift with far-reaching consequences. “This time it’s different,” claims Thorn, pointing to the ETFs’ disruption of traditional Bitcoin price cycles and their impact on investor behavior and intra-crypto dynamics.

The Spot Bitcoin ETF Effect

Thorn underlined the transformative impact of Bitcoin ETFs, stating that we are only at the beginning of a significant shift in the way Bitcoin is approached and invested in, particularly by the institutional sector. “Despite the incredible volumes and flows, there is plenty of reason to believe that the Bitcoin ETF story is just beginning,” he said, pointing to the untapped potential within the asset management industry.

In their October 2023 report entitled ‘Sizing the Market for the Bitcoin ETF’, Galaxy laid out a compelling case for the future growth of Bitcoin ETFs. The report highlights that asset managers and financial advisors represent the most significant net new entry market for these vehicles, providing a previously unavailable opportunity to allocate client capital to BTC exposure.

The size of this untapped market is significant. According to Galaxy’s research, there is approximately $40 trillion in assets under management (AUM) across banks and broker/dealers that have yet to activate access to spot BTC ETFs. This includes $27.1 trillion managed by broker-dealers, $11.9 trillion by banks and $9.3 trillion by registered investment advisors, for a total US Wealth Management AUM of $48.3 trillion as of October 2023. This data underscores the huge potential for Bitcoin ETFs to make inroads. deeper into the financial ecosystem, catalyzing a new wave of investment flows into Bitcoin.

Thorn further speculated about the upcoming round of post-ETF launch 13F filings in April, suggesting that these filings could reveal significant Bitcoin allocations from some of the biggest names in the investing world. “In April we will also receive the first round of post-ETF launch 13F filings, and (just guessing here…) we will likely see some big names assigned to Bitcoin,” Thorn expects. This development, he said, could create a feedback loop in which new platforms and investments cause higher prices, which in turn attracts more investments.

The implications of this feedback loop are profound. As more asset management platforms begin to offer access to Bitcoin ETFs, the influx of new capital could have a significant impact on BTC’s price dynamics, liquidity, and overall market structure. This transition represents a key moment in Bitcoin’s maturation as an asset class, transitioning from a speculative investment to a staple of diversified portfolios managed by financial advisors and asset managers.

We are still early

Thorn’s optimism extends beyond immediate market indicators to the broader implications of Bitcoin’s integration into the financial mainstream. He expects a new all-time high for Bitcoin in the near term, fueled by a combination of factors including ETF momentum, the increasing acceptance of BTC as a legitimate asset class, and the anticipatory buzz around the upcoming halving. “All this is to say: my answer to that burning question: where are we in the cycle? – is that we haven’t even begun to reach the heights this is likely to reach,” he concludes.

Thorn’s analysis culminates in a bullish forecast for Bitcoin. As the community stands on the eve of the fourth BTC halving, Thorn’s insights provide a compelling vision of a market poised for unprecedented growth, driven by a confluence of technological innovation, regulatory evolution, and shifting global economic currents. “Bitcoin is prime time now, and while it may be hard to believe, things are just starting to get exciting,” declares Thorn, capturing the essence of a market on the cusp of a new era.

At the time of writing, BTC was trading at $62,065.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.