- During the bear market, both retail and institutional investors increased their accumulation.

- In the near term, things could turn bullish as some indicators favored buyers.

After hitting an all-time high of over $67.00o at the end of November 2021, Bitcoins [BTC] the price has remained under the influence of bears. In fact, this is the longest bear market in Bitcoin history, having lasted well over 490 days.

Read Bitcoins [BTC] Price Prediction 2023-24

While there were multiple reasons that caused this, it should be noted that the bear market may not end anytime soon. It could require a trigger for BTC to exit the bear market and record massive growth.

A never-ending bear market for Bitcoin

Bitcoin goes through cycles. These cycles have a period of expansion, major correction, accumulation and re-expansion. However, not every cycle is the same length. Michaël van de Popp, founder and CEO of MN Trading, pointed this out in his recent tweet.

The longest bear market in history for #Bitcoin

It may feel like a ghost town in crypto. It may feel like there won’t even be a bull cycle anymore and I understand why these thoughts are there.

But why?

People base their decisions on history. 👇… pic.twitter.com/Ljtv9wmw12

— Michael van de Poppe (@CryptoMichNL) August 27, 2023

The current bear market is similar in some ways to that of 2015. A period of sideways action generally reduces interest in assets. This was revealed by a look at Bitcoin’s on-chain data.

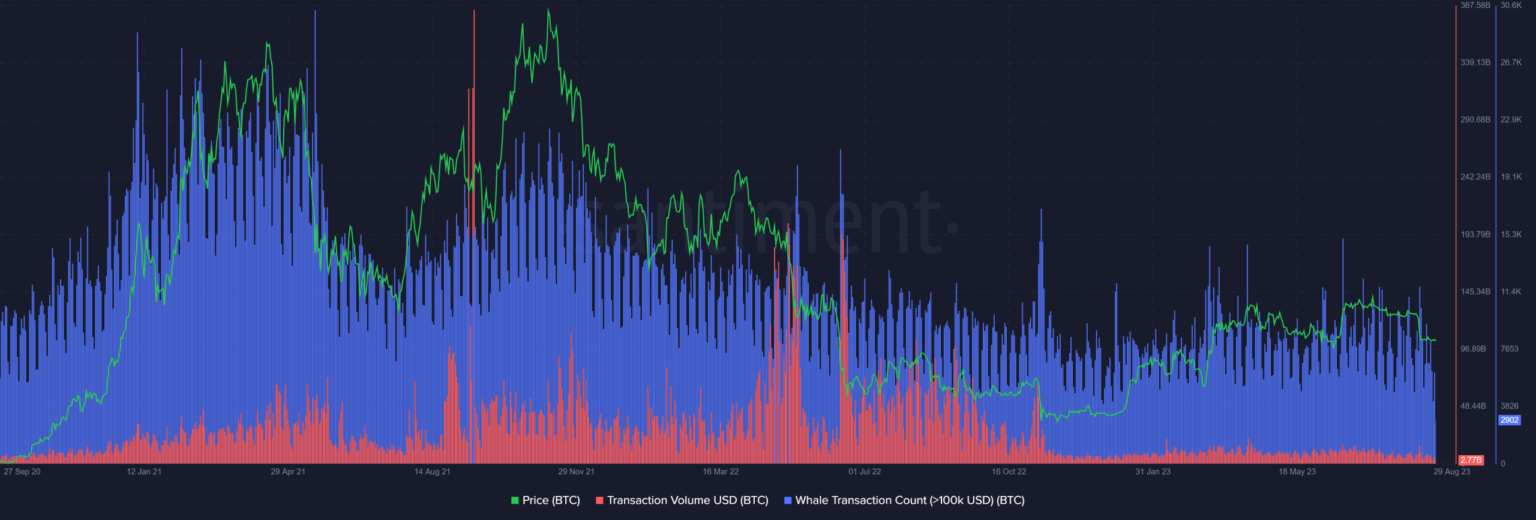

During the bear market, the numbers of whale trades have dropped, just like that BTC‘s transaction volume.

Source: Sentiment

However, while the price has remained low, Bitcoin adoption is on the rise. Black Rock, for example recently became the second largest shareholder of the four largest Bitcoin mining companies.

Not only that, but also if reported previously, MicroStrategies announced an additional purchase of 467 bitcoins, increasing the company’s assets under management to 152,800 units.

While BTC’s price action continued to be bearish, the supply on the exchanges plummeted and the supply off the exchanges increased. In addition, the total number of BTC holders also increased consistently, reflecting the increased accumulation.

This clearly indicated an increased acceptance of BTC not only by institutional investors, but also by retail investors.

Source: Sentiment

However, if marginal price movements are not taken into account, investors may have to wait longer for BTC to reach new highs. Possibly the upcoming halving of Bitcoin in 2024 could act as a trigger.

During the last halving in May 2020, it took a few months for the coin to start its bull rally. So, if history is to be believed, the next BTC bull rally may not be imminent.

Is your wallet green? look at the BTC Profit Calculator

Do you have something in store in the short term?

In the short term, however BTC‘s price may see an increase as some market indicators have been bullish. For example, both Bitcoin’s Relative Strength Index (RSI) and Money Flow Index (MFI) were in oversold zones, which could increase buying pressure.

In addition, the MACD showed the possibility of a bullish crossover, increasing the likelihood of price movement north in the coming days. At the time of writing, BTC was trade at $25,957.73 with a market cap of over $505 billion.

Source: TradingView